Bookkeeping Tips for Multi-entity Operations

Author(s): Suzy Martin

Published: October 28th, 2021

Shareable PDF

There are multiple reasons a farming operation might separate its business into multiple entities. It might be for transition and estate purposes, liability reasons, tax issues, etc. Ideally, these kinds of decisions involve input from everyone that is part of the “team.” Meaning owners, the attorney, tax advisor, management, lender, heirs, etc. Basically, anyone that might be impacted by such decisions. If an operation is part of a program like Kentucky Farm Business Management, not only can they be advised about the pros and cons of multi-entity structures but can also be educated about the importance of following through with the changes new business structures bring. In other words, if a business decides to set up these entities they must also be willing to “dot the i’s and cross the t’s” to ensure the reasons for them are not invalidated.

For example, let’s say a farming operation sets up a new entity for the semis and grain trailers. Their goal is to limit liability in case of an accident. That’s all well and good but to actually get the limited liability that is being sought, the business needs to function as a completely separate business. This means that all insurance, loans, titles, etc. need to be in the name of the trucking company. All of the drivers need to be employees of the business and are paid for the hours spent trucking. If you have employees that truck and farm you might even have to pay them from different companies based on the work they have done. A trucking business would not qualify for the agriculture exemption, so any wages paid to employees through the business are subject to unemployment taxes. Non-agriculture businesses file a quarterly Form 941 to report federal payroll taxes versus an annual Form 943. Workman’s compensation insurance would also need to be purchased. The trucking business would need to charge the farming operation a fair and reasonable rate to truck the grain. The operations would need to ensure they don’t mix the expenses between the companies.

Another common example is to have the land in one entity and the farming operation in another. Again, they need to operate as completely separate businesses. The land improvements, property taxes, land loan payments, etc. need to be paid out of the land company. Also, deeds need to have the appropriate verbiage to match. The farming operation would need to pay a fair and reasonable rent to the land company. This would also include any buildings on the property as they are usually part of the real estate. The Farm Service Agency (FSA) would need to be aware of the setup for their records.

There are other bookkeeping issues in multi-entity operations. One is the transfer of money between the entities. When the money gets transferred the income or expense account used should mirror the account that was used in the corresponding entity. Continuing the example above, if the farming entity pays rent to the land-owning entity then the transaction would be recorded as a rental expense in the former and rental income in the latter. If the companies are simply transferring money between accounts, then in both entities the transaction would need to be put in a non-taxable account. The bottom line is that you cannot call an item an expense in one company without claiming it as income in the other. All entities need to have their own set of records and their own checking account. Finally, the entity that secures the loan should be the entity that makes the loan payments.

This is the time of year that clients will make decisions to change up their business structure in preparation for a January 1st starting date. If this is something you are thinking of doing it would be beneficial to talk to your team. It’s easier to start off right than to try to correct mistakes after the fact.

Recommended Citation Format:

Martin, S. "Bookkeeping Tips for Multi-entity Operations." Economic and Policy Update (21):10, Department of Agricultural Economics, University of Kentucky, October 28th, 2021.

Author(s) Contact Information:

Suzy Martin | KFBM Area Extension Specialist | slmartin@uky.edu

Recent Extension Articles

Family Living Expenses on Kentucky Farms

October 28th, 2021

There is likely no single item in a farm business cash flow with more uncertainty and more variability than “family living expense.” We tend to live on what’s left over after paying debt and taxes. However, the Kentucky Farm Business Management program does have accurate family living data for some of the farms in their records and management program.

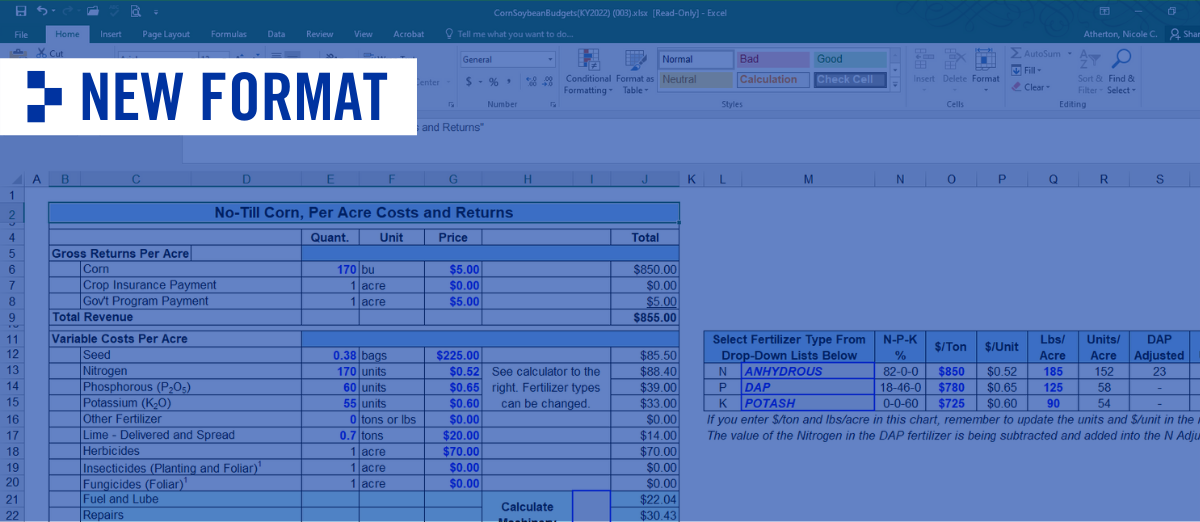

New Features to Enterprise Budgets

October 28th, 2021

Enterprise budgets are designed to help farmers estimate profitability in the current and future growing seasons, and are also used by lenders and other agricultural-related professionals. Expected year-to-year changes in profitability can help farmers make decisions related to cropping decisions.