Grain Profitability Outlook 2022

Author(s): Greg Halich

Published: March 31st, 2022

Shareable PDF

The grain markets had already been climbing before Russia invaded Ukraine on February 24th. Since then, prices have been on a tear, particularly for wheat and corn. Current prices for 2022 new-crop delivery are around $6.50/bu for corn, $15/bu for soybeans, and $10/bu for wheat in Kentucky (3/25/22). This is an increase of around $2.25/bu for corn, $4/bu for soybeans, and $4.50/bu for wheat compared to what these prices were expected one year ago.

Tempering the increased revenue from higher grain prices are steep increases in fertilizer and fuel prices. Fertilizer prices have been rising steadily since last winter and we now have prices that are at all-time highs. Since January we have seen increases of $1000/ton for anhydrous, $400/ton for DAP, and $450/ton for potash. This article will evaluate the combined effect of the increases in both commodity and input costs, and estimate profitability for the 2022 crop.

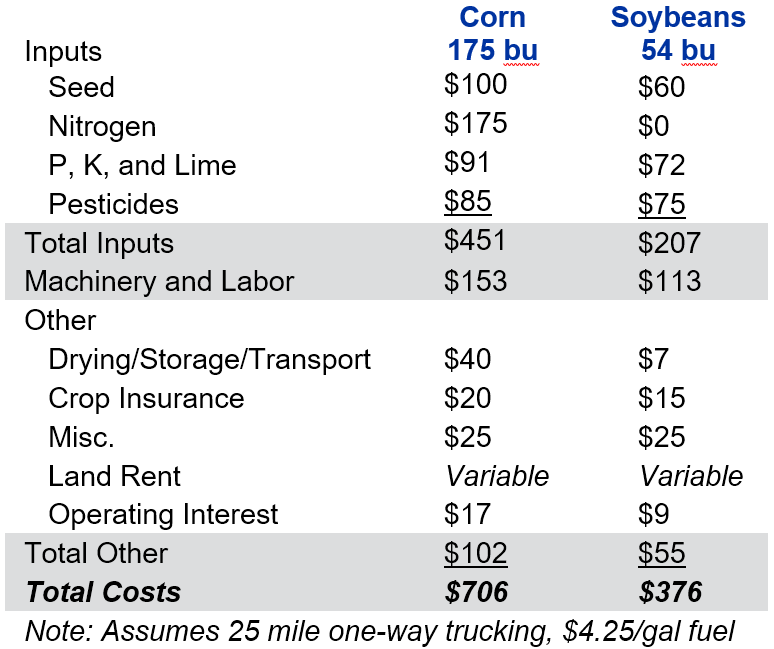

Costs for an efficient Western Kentucky farm are estimated in Table 1 on soil that averages 175 bushels of corn and 54 bushels of soybeans per acre. Machinery and labor costs include depreciation and overhead costs, as well as an opportunity cost for operator labor. Fuel costs are based on $4.25/gallon diesel and 25-mile one-way trucking to the elevator.

Table 1: Expected Variable Costs 2022

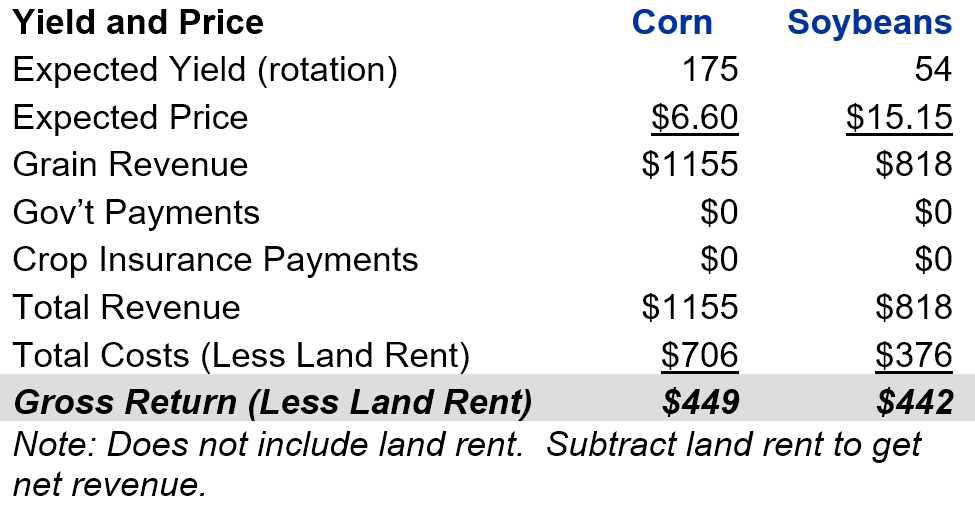

Corn and soybean prices used in this analysis are based on forward contracting prices (as of late March) for an average of 2022 fall and winter delivery: $15.15/bu for soybeans and $6.60/bu for corn. Table 2 shows the expected gross return (does not include land rent) given the costs in Table 1 and expected commodity prices and yields.

Table 2: Summary Gross Return West Kentucky 2022 (per acre)

The expected gross profit for this productivity soil is $449/acre for corn and $442/acre for soybeans. Assuming a 50-50 rotation the average gross return would be $446/acre. The net return would be calculated by subtracting out the land rent. In Western Kentucky, much of the ground with this type of productivity is being rented for $150-225/acre. As an example, if we use a $200 land rent, the net return (return to management and risk) would be a $246/acre.

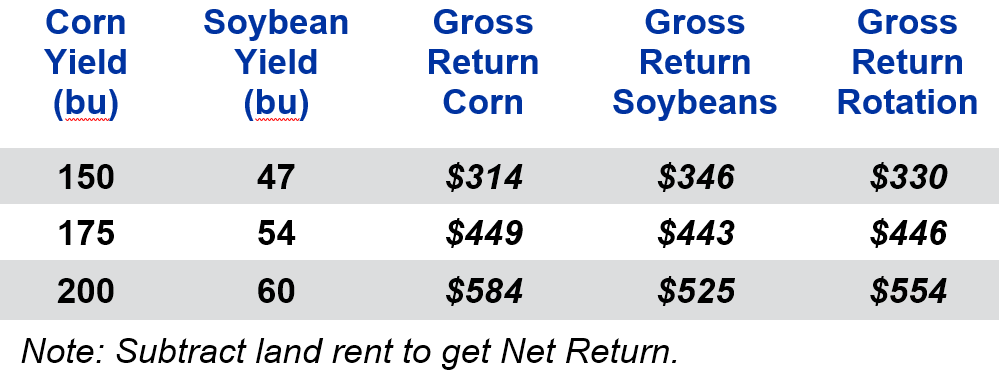

Table 3 shows a summary of the estimated gross returns for various soil productivities. Think of these yields as the long-run expected yields for a particular farm, not year-to-year variability. Costs are adjusted to account for different expected yields. The biggest change in costs is for trucking which adjusts on a 1-1 basis, but other costs such as fertilizer are adjusted at a lower rate. Looking at Table 3, it is easy to see how quickly gross profitability changes with expected yield.

Table 3: West Kentucky 2022 (per acre)

$15.15 Soybeans (elevator) $6.60 Corn (elevator)

$0.92-N, $0.56-P, $0.69-K

Observations

1) Potential profitability looks incredible for 2022, even after accounting for the unprecedented increases in input costs. I have heard farmers this winter claim they did not think they would not be able to make a profit this upcoming year. My guess is that they either did not have a very sharp pencil (possibly no pencil at all), or they were trying to temper profit expectations to keep landlords from raising rents in the upcoming year. We have not seen these magnitudes in gross returns since the peak of the ethanol boom. A grain farmer that can’t make a significant profit in 2022 will either have terrible yields in conjunction with no crop insurance or doesn’t have a pulse.

2) Wheat has seen the most dramatic price increases in the last month due to the war between two of the largest wheat exporters (Russia is still calling this a “special operation”). For those lucky Kentucky farms that planted wheat last fall, they should see even better returns than shown in Table 3 compared to full-season soybeans. Wheat yields vary across the state, but with current market conditions, gross returns are likely to be $50-200 higher on mid-level soil productivity wheat ground, and $150-250 higher on high-level soil productivity wheat ground.

3) Central Kentucky has a slightly higher cost structure due to its use of urea as the primary nitrogen source and longer trucking distances to key markets on average. Thus gross returns in this region are likely to be $10-50 per acre lower than those shown in Table 3.

4) Corn profitability has increased more rapidly than soybean in the last month. Up to that point, soybean returns held a significant advantage over corn returns on most ground in Kentucky. The previous year was the same, so with current markets, the new pricing dynamics are providing an opportunity to get back into rotation on those farms that have deviated from their normal rotation. This, of course, assumes they can change out seed orders which may be a problem in many situations this close to spring planting.

Marketing

Remember the old adage “a bird-in-the-hand is worth two in the bush”. If you haven’t marketed much of your 2022 crop now would be a good time to start getting serious about it. While most farmers are reluctant to market very much of their future crop this far out, the current prices offered for the 2022 new crops are screaming for attention, and at least worth considering given the major shift in market conditions. Remember the other old adage: what the market giveth, the market can taketh.

Figure 1: July 2022 Wheat Futures (3/24/22)

Don’t believe my numbers? I appreciate skepticism. The corn-soybean budgets can be used to come up with your own estimates.

Recommended Citation Format:

Halich, G. "Grain Profitability Outlook 2022." Economic and Policy Update (22):3, Department of Agricultural Economics, University of Kentucky, March 31st, 2022.

Author(s) Contact Information:

Greg Halich | Associate Extension Professor | greg.halich@uky.edu

Recent Extension Articles

Pre and Post-COVID Analysis of Select Spring Crops at the Auction

Savannah Columbia | March 31st, 2022

Spring is on the horizon in Kentucky. Many specialty crop growers have already begun thinking about which fruits and vegetables to cultivate and the ideal market channels in which to sell. There are many market channels available to producers – an important market channel for both Kentucky and many of our growers is the produce auction. While growers do not receive the same price premium at the auction compared to an urban farmer’s market, there are reasons the auction is a viable market channel.

Summer Stocker Outlook for 2022

Greg Halich and Kenny Burdine | March 31st, 2022

Driving through the Commonwealth it is clear that spring has arrived and we are seeing signs of pastures growing. Stocker operators are starting to place calves on pasture, which typically pushes calf prices to their seasonal highs. As of late March, calf prices have increased by more than $20 per cwt from their lows last fall. Simply put, the futures market is suggesting that the price of heavy feeders between spring and fall should increase substantially, which should be reflected in strong calf prices this spring.