Prospects for Winter Backgrounding 2022-2023

Author(s): Greg Halich and Kenny Burdine

Published: October 31st, 2022

Shareable PDF

Feeder calf prices in Kentucky showed a great deal of strength for much of 2022. In August, a 550 lb steer was selling in the low-mid $180’s per cwt on a state average basis. However, worsening drought conditions have combined with seasonal tendencies and that same weight steer calf is now selling for $15 to $20 less per cwt. Winter backgrounding profitability has a significant impact on calf prices as those winter backgrounders are competing with feedlots to purchase calves for placement in the fall. The purpose of this article is to examine potential returns to backgrounding programs for the upcoming winter.

At the time of this writing (October 24, 2022), March 2023 CME© feeder cattle futures were trading around $183 per cwt. As winter backgrounders consider purchasing calves this fall, these late winter futures prices provide market expectations for feeder cattle sale prices. With an early spring futures price of $183, and an estimated -$6 basis, an 800 lb feeder steer in Kentucky would be expected to bring around $1416 (800# @ $177 per cwt) in March. Of course, actual basis is heavily impacted by local market conditions, lot size, cattle quality, location, and numerous other factors. The -$6 basis discussed previously assumes that cattle are of relatively good quality and are sold in potload-sized groups. Producers considering winter backgrounding should make some estimate of a late winter sale price as they start to consider what can be paid for calves this fall.

The AMS Kentucky Weekly Livestock Auction Summary for the week ending on October 24th reported a state average price for 450-500 lb steers of $174.95 per cwt and a state average price for 500-550 lb steers of $166.75 per cwt. This market continues to evolve and additional costs could be incurred putting together groups of calves for placement. For the purposes of the first table, we estimated the purchase price for a 500 lb steer at $180 per cwt, or something close to $900 per head. This is pretty close to the current market for steer calves in that weight range. Larger groups of high-quality calves would likely sell for more than this, so individuals are encouraged to apply this process to the type of calves they typically buy.

We also need cost estimates on wintering those calves and selling them in the spring. While we provide an estimate for a specific winter program, costs will vary based on local conditions and the specific backgrounding program. Feed is the major cost and producers should consider all potential feeding options including commodity feeds, corn, and corn silage. For this scenario, we will consider a single program where calves are fed 1.5% of their body weight per day of a 2-way blend of corn gluten and soy hulls, and another 1.5% of their body weight per day of grass hay. While performance will vary, we will assume a rate of gain of 2.5 lbs per day, which would put on 300 lbs in approximately 120 days.

The 2-way blend is valued at $325 per ton and grass hay at $90 per ton. Health costs are assumed to be $28 per head, transportation costs are estimated to be $10 per head, and selling/marketing expenses are set at $20 per head. An interest charge of 6% is included and death loss is assumed to be 2.5% for 500 lb steers and 2.0% for 600 lb steers (discussed later in the article). These costs will vary by location and operation, so readers are encouraged to come up with their own estimates.

Several of these cost estimates are worth careful consideration. For example, we have assumed selling/marketing expenses of roughly $20 per head, which assumes that producers are paying the reduced commission rates associated with large groups. However, many producers will be selling in smaller groups and likely paying higher commission rates on a per-head basis. Vet and medicine costs are also important. We have assumed $28 per head, which is likely sufficient to include mass medication of all calves. However, this is a decision that the individual producer should make and adjust their cost estimates accordingly. With these caveats in mind, the following table shows expected returns to the program described above.

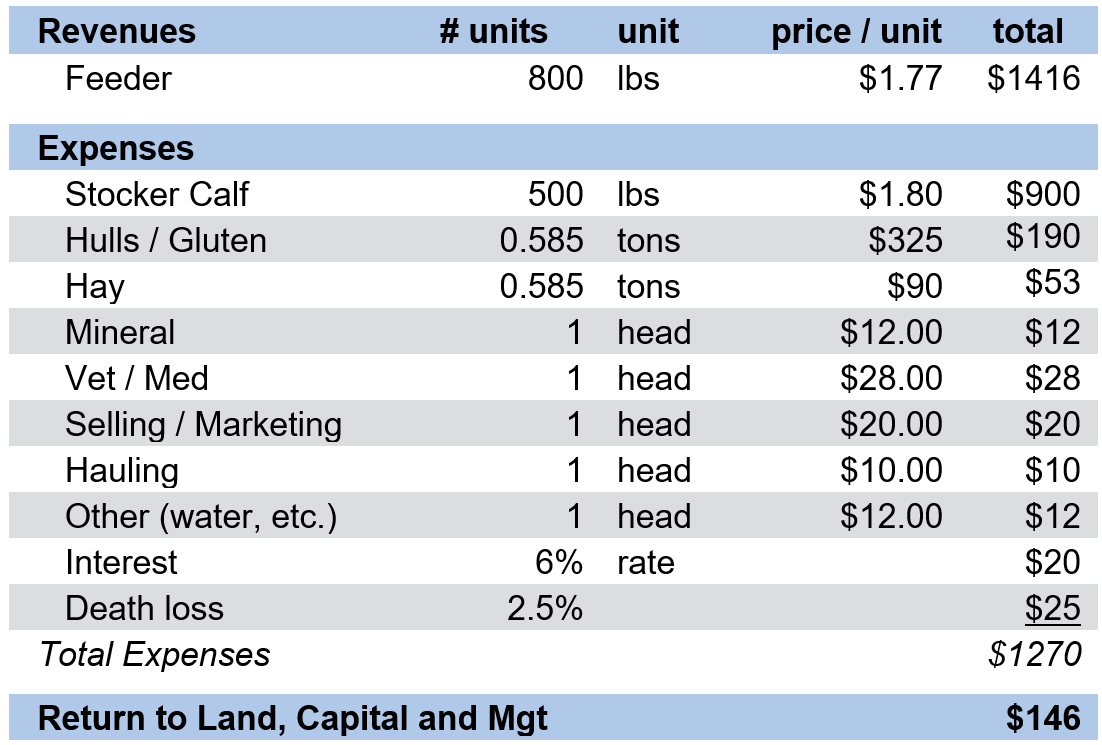

Table 1: Winter Backgrounding Budget Estimate

As can be seen in table 1, projected returns are $146 per head this winter based on the assumptions discussed previously. Producers are strongly encouraged to modify these assumptions for their individual programs to better reflect calf values and expected spring basis, as well as cost estimates and feed prices for their area. It is also worth noting that labor, depreciation, and interest on owned capital are not included in the budget, so the return shown is a return to land, capital, and management. Producers should ask themselves if that return adequately compensates them for their time, capital investment, management, and risk.

The two key assumptions made in Table 1 include the cost of the calves being placed and the expected sale value in the spring. Changes in calf placement costs will greatly impact winter backgrounding returns. For every $5 per cwt decrease in the purchase price of the calves, the return to land, capital, and management increases by $25 per head. The second assumption, the sale price for the feeder steer won’t be known with certainty until spring. Note that the assumed spring sale price in the analysis is $177 per cwt and the projected return is $146 per head. An $18 per cwt decrease in sale price would result in actual returns falling to $0. While feed price does not have as large an impact on profit as sale price, a $25/ton decrease in the price of the 2-way blend would increase expected profit by $15, and vice versa.

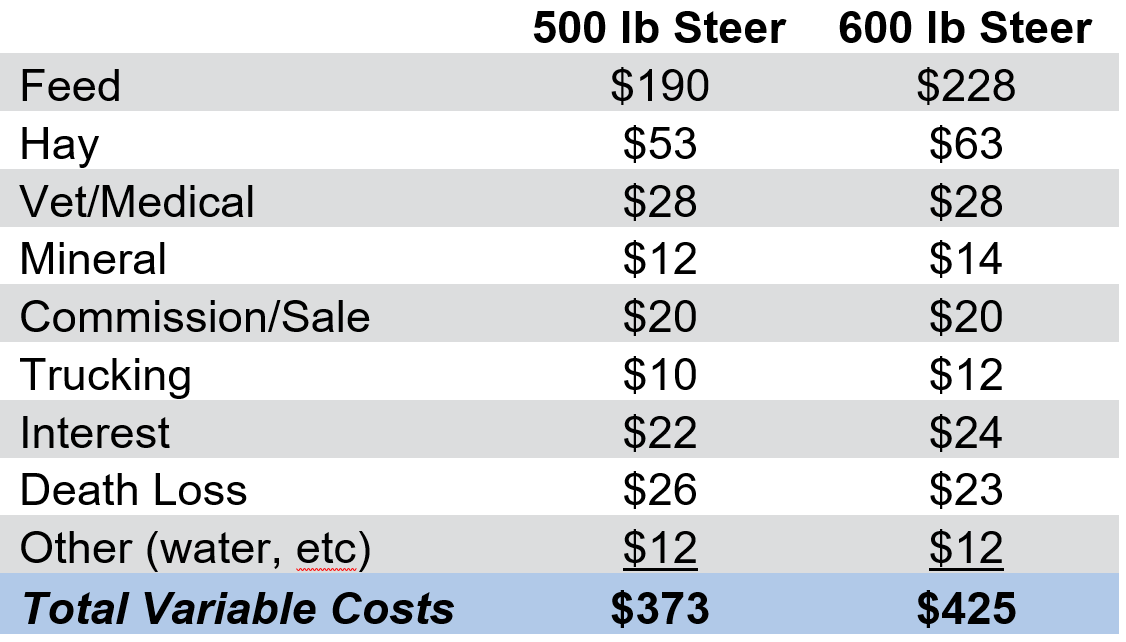

Table 2 shows a side-by-side comparison of expected costs for placement of a 500 lb steer and a 600 lb steer. The same feeding and gain assumptions are made, but feed costs are higher for the 600 lb steer due to his increased body weight. A few other costs also increase, such as mineral, transportation, and interest.

Table 2: Expected Variable Costs Fall 2022

Note: Interest and death loss vary slightly by purchase price.

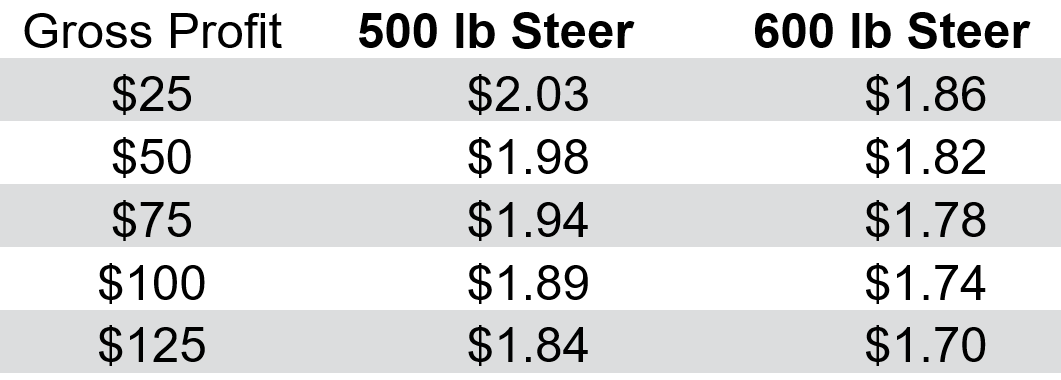

The cost estimates from table 2 are used to estimate target purchase prices for both 500 and 600 steers, given a target gross return, in table 3. A range of gross returns from $25 to $125 per head was used to create table 3, which is used to estimate a range of purchase prices. For 500 lb steers, target purchase prices ranged from $1.84 to $2.03 per lb. For 600 lb steers, target purchase prices ranged from $1.70 to $1.86 per lb. In both cases, the current calf market likely presents profit opportunities.

Here is an example of how this works for a 500 lb steer, targeting a $75 gross profit per head:

800 lb steer x $1.77 (expected sale price) $1,416

Total Variable Costs - $373

Target Profit - $75

Target Purchase Cost $968

Target Purchase Price = $968 / 500 lbs = $1.94 per lb

Table 3 can also be used to adjust target purchase prices to your cost structure. If your costs are $25 per head higher than the assumptions made in this analysis, then you would shift each targeted profit down by one row. For example, you would use the $125 gross profit to estimate a $100 gross profit if your costs were $25 higher. An alternative approach would be to spread the additional costs over the purchase weight. In that way, each $1 increase in costs, reduces target purchase price by $0.20 per cwt for a 500 lb steer and $0.17 per cwt for a 600 lb steer.

Table 3: Target Purchase Prices for Various Gross Profits Fall 2022

Notes: Based on costs in Table 1 and sales price of $1.77/lb and $1.74/lb for 800 lb and 900 lb sale weight respectively for 500 lb and 600 lb purchased steers.

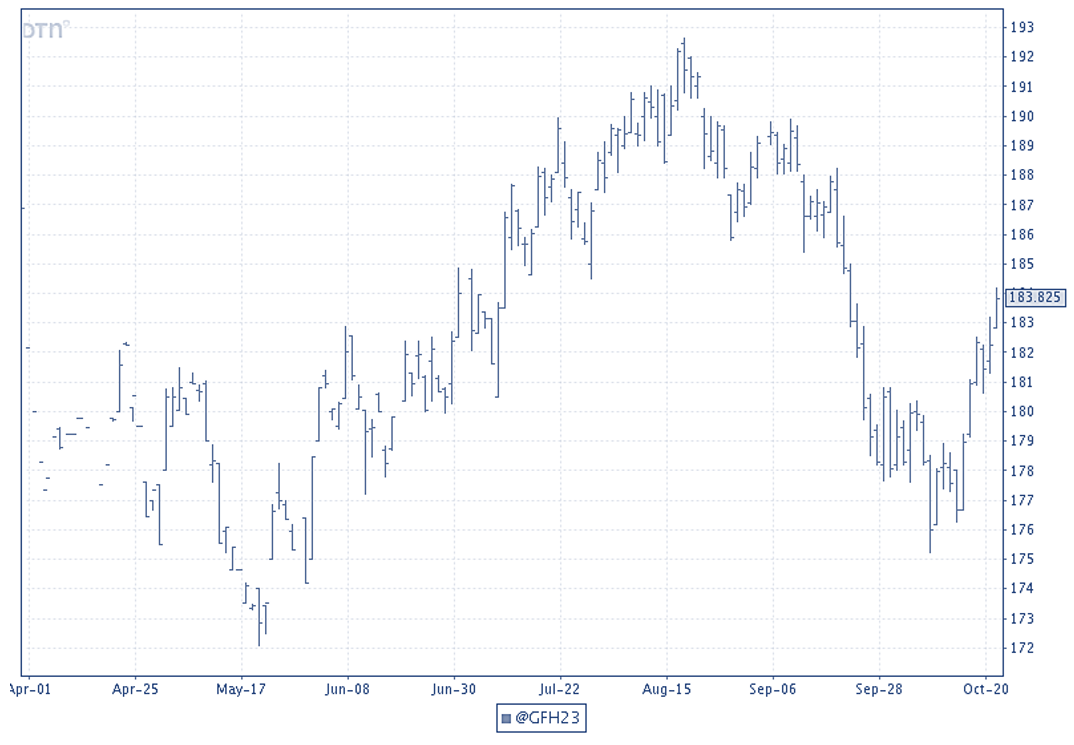

Given the assumptions of this analysis, returns to winter backgrounding have the potential to be attractive given the late-October calf market and late winter CME© Feeder Cattle Futures. However, given the importance of expected sale price on returns, winter backgrounders are encouraged to explore opportunities to manage downside price risk through contracting, futures and options, LRP insurance, and other strategies. The figure below depicts March CME© Feeder Cattle Futures from DTN over the last seven months, which has shown some volatility. Note that the March CME© Feeder Cattle Futures contract was trading in the low $190’s in mid-August, but was down in the mid $170’s earlier this month. While it does appear that the market is offering some opportunity for winter backgrounding, the last few months, as well as the last few years have provided a reminder as to how unpredictable these markets are. Therefore, some additional effort should be applied to manage downside price risk. Winter backgrounders should carefully calculate their breakeven purchase prices for calves and be opportunistic as they approach this fall.

Figure 1: March 2023 CME© Feeder Cattle Futures from DTN (close 10/24/22)

Recommended Citation Format:

Halich, G. and K. Burdine. "Prospects for Winter Backgrounding 2022-2023." Economic and Policy Update (22):10, Department of Agricultural Economics, University of Kentucky, October 31st, 2022.

Author(s) Contact Information:

Greg Halich | Associate Extension Professor | greg.halich@uky.edu

Kenny Burdine | Associate Extension Professor | kburdine@uky.edu

Recent Extension Articles

Retirement 2022

Tarrah Hardin | October 31st, 2022

With high input and equipment prices, some producers are thinking of exiting in the next few years. In order to do this, they are starting to plan now so they can manage tax liability and protect any equity they have built within their business. When it comes to retiring, having a plan to navigate all the possible issues that might come up should be number one on the producer's to-do list. Rushing through things could bring on unexpected tax liabilities as well as issues down the road.

The Auction Market for Kentucky’s Front Porch Staples: Mums and Pumpkins

Savannah Columbia | October 31st, 2022

Mums and pumpkins are staples of the Autumn season in our state. Whether they are used as a decoration or the critical piece of a pumpkin carving contest – mums and pumpkins are bought and sold through many market channels this time of year. A specific market channel they make their way through is the produce auctions in our state.