Summer Stocker Outlook for 2022

Author(s): Greg Halich and Kenny Burdine

Published: March 31st, 2022

Shareable PDF

Driving through the Commonwealth it is clear that spring has arrived and we are seeing signs of pastures growing. Stocker operators are starting to place calves on pasture, which typically pushes calf prices to their seasonal highs. As of late March, calf prices have increased by more than $20 per cwt from their lows last fall. At the time of this writing (March 25th), fall 2022 CME© feeder cattle futures were trading in the low-$180’s per cwt, more than $15 per cwt higher than the April contract. Simply put, the futures market is suggesting that the price of heavy feeders between spring and fall should increase substantially, which should be reflected in strong calf prices this spring.

The purpose of this article is to assess the likely profitability of summer stocker programs for 2022 and establish target purchase prices for calves based on a range of return levels. While it is impossible to predict where feeder cattle markets will end up this fall, producers need to estimate this and not rely on the current price (March) for 750-850 lb feeder calves. The fall CME© feeder cattle futures price (adjusted for basis) is the best way to estimate likely feeder cattle prices for fall. Grazing costs including pasture costs, veterinary and health expenses, hauling, commission, etc. are estimated and subtracted from the expected value of the fall feeders. Once this has been done, a better assessment can be made of what can be paid for stocker cattle this spring in order to build in an acceptable return to management, capital, and risk.

Key assumptions for the stocker analysis are as follows: 1) Graze steers April 1 to October 1 (183 days), 1.5 lb/day gain (no grain feeding), 2% death loss, and 5% interest on the calf. The interest rate used in this analysis may seem high for producers who are self-financed or have very low interest rates, but is likely pretty close for those going through traditional lenders. Given these assumptions, sale weights would be 775 lbs and 875 lbs for 500 lb and 600 lb purchased calves, respectively. Using a $183 CME© futures contract price for October 2022 to estimate sale price, a 775 steer is estimated to sell for $1.74/b and an 875 steer is estimated to sell for $1.70/lb. This estimate uses a -$10 per cwt basis for an 800 lb steer and a $4 per cwt price slide. This basis estimate put the estimated Kentucky price $2-3 per 100 wt lower than previous years to account for increased transportation costs getting these cattle to the Great Plains feedlots. These sale prices are also based on the assumption that cattle are sold in lots of 40 or more head. Stocker operators who typically sell in smaller lots should adjust their expected sale prices downward accordingly.

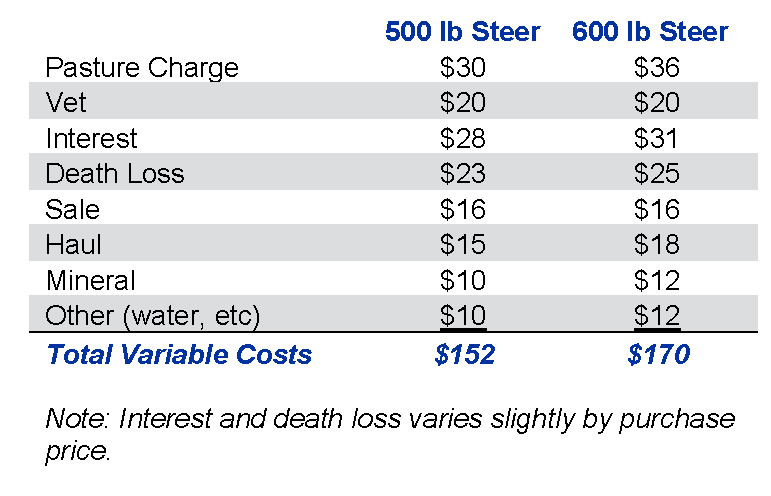

Estimated costs for carrying the 500 and 600 lb steers are shown in Table 1. Stocking rates of 1.0 acre per 500 lb steer and 1.2 acres per 600 lb steer were assumed in arriving at these charges. Most of these are self-explanatory except the pasture charge, which accounts for variable costs such as bush-hogging, fertilizer, seeding clovers, etc., and is considered a bare-bones scenario. Sale expenses (commission) are based on the assumption that cattle will be sold in larger groups and producers will pay the lower corresponding commission rate. However, producers who sell feeders in smaller groups will pay higher commission rates which could exceed $50 per head based on the revenue assumptions of this analysis. Any of these costs could be much higher in certain situations, so producers should adjust accordingly.

Table 1: Expected Variable Costs 2022

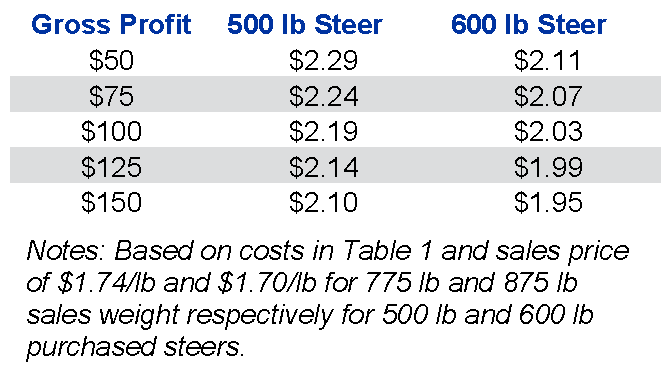

Target purchase prices were estimated for both sizes of steers and adjusted so that gross returns over variable costs ranged from $50-$150 per head. This gives a reasonable range of possible purchase prices for each sized calf this spring. Results are shown in Table 2. For 500 lb steers, target purchase prices ranged from $2.10 to $2.29 per lb. For 600 lb steers, target purchase prices ranged from $1.95 to $2.11 per lb. When targeting a $100 per head gross profit, breakeven purchase prices were $2.19/lb for 500 lb steers and $2.03/lb for 600 lb steers.

As an example of exactly how this works for a 500 lb steer targeting a $100 gross profit:

775 lbs steer x $1.74 (expected sale price) $1,348

Total Variable Costs - $152

Profit Target - $100

Target Purchase Cost $1096

Target Purchase Price = $1096 / 500 lbs = $2.19 / lb

Table 2: Target Purchase Prices for Various Gross Profits 2022

For heifers, sale price for heavy feeders will be lower than comparably sized steers and they will not generally gain as well. In this analysis, we assumed the price discount for these heifers is $12 per hundredweight lower than the same weight steers and we assumed heifers would gain 10% slower than steers. With these assumptions, purchase prices would have to be $0.25/lb lower for 500 lb heifers and $0.22 lower for 600 lb heifers compared to the steer prices found in Table 2. Thus when targeting a $100 per head gross profit, breakeven purchase prices were $1.94/lb for 500 lb heifers and $1.81/lb for 600 lb heifers.

Your cost structure may be different from that presented in Table 1, and if so, simply shift the targeted gross profit up or down to account for this. If your costs are $25 higher per calf, then you would shift each targeted profit down by one row: For example, you would use the $125 gross profit to estimate a $100 gross profit if your costs were $25 higher. Another way to evaluate this is that a $1 increase in costs would decrease the targeted purchase price by $0.20 per cwt for 500 lb steers and $0.17 per cwt for 600 lb steers.

It is important to note that the gross profits in Table 2 do not account for labor or investments in land, equipment, fencing, and other facilities (fixed costs). Thus, in the long-run, these target profits need to be high enough to justify labor and investment, as well as a management return. Typically, by the time this article is written in late-March, calf prices are approaching levels that would place returns on the lower end of the range analyzed. However, current calf prices are well below many of the target purchase prices estimated in this analysis given fall CME© futures prices. This is all the more reason that stocker operators should carefully think through their budgets and make rational purchasing decisions.

There is a tendency for calf prices to reach their seasonal price peak when grass really starts growing in early spring. There is little reason to think this won’t happen in 2022, which will result in tighter expected margins for stocker cattle placed in the upcoming weeks. However, two unique factors are at play in 2022 that are worth discussion. First, there is an unusually large difference between the current prices for heavy feeder cattle and what the fall board is suggesting for late summer and fall prices. Some stocker operators may be bidding less aggressively if they are planning their programs based on current heavy feeder prices, rather than future’s based fall expectations. Secondly, higher feed prices are likely discouraging feedlots from placing light calves on feed right now. This would result in less competition in calf markets, which may be keeping calf prices somewhat at bay. While there is no way to know for sure what the next few weeks will bring, there could be significant opportunities for stocker operators to place calves at a favorable margin this spring.

Finally, the placement of calves into stocker programs represents a significant cost and there is always a great deal of uncertainty about fall sale price. For this reason, stocker operators should also consider risk management strategies as they place calves into grazing programs. Hedging, through the sale of futures contracts, provides solid downside risk protection, but will subject the producer to margin calls if cattle prices increase. Entering a cash forward contract or offering cattle through internet sales with delayed delivery will reduce or eliminate price uncertainty, but will also limit marketing flexibility should weather conditions necessitate sale at a different time. Finally, strategies such as put options and Livestock Risk Protection (LRP) Insurance offer a less aggressive strategy that provides downside price protection (at a price), but more ability to capitalize on rising prices. And, the subsidy levels for LRP insurance have increased substantially over the last couple of year, making LRP much more attractive. Regardless of what makes the most sense for the individual producer, time spent considering price risk management is likely time well spent in these volatile markets. The best way to ensure profitability is to budget carefully and to manage downside price risk.

Greg Halich is an Associate Extension Professor in Farm Management Economics for both grain and cattle production and can be reached at Greg.Halich@uky.edu or 859-257-8841. Kenny Burdine is an Associate Extension Professor in Livestock Marketing and Management and can be reached at kburdine@uky.edu or 859-257-7273.

Recommended Citation Format:

Halich, G. and K. Burdine. "Summer Stocker Outlook for 2022." Economic and Policy Update (22):3, Department of Agricultural Economics, University of Kentucky, March 31st, 2022.

Author(s) Contact Information:

Greg Halich | Associate Extension Professor | greg.halich@uky.edu

Kenny Burdine | Associate Extension Professor | kburdine@uky.edu

Recent Extension Articles

Maximizing Value: 2022 Spring Application of Broiler Litter for Grain Crop Production

Jordan Shockley | March 31st, 2022

One of the many decisions producers have to make before planting is in regard to their nutrient management plan. Broiler litter provides a great opportunity as a complete fertilizer and is being produced and used throughout the state in grain production. However, the value of broiler litter can vary greatly depending on the management practices, nutrient content of the litter, soil test data and commercial fertilizer prices.

Pre and Post-COVID Analysis of Select Spring Crops at the Auction

Savannah Columbia | March 31st, 2022

Spring is on the horizon in Kentucky. Many specialty crop growers have already begun thinking about which fruits and vegetables to cultivate and the ideal market channels in which to sell. There are many market channels available to producers – an important market channel for both Kentucky and many of our growers is the produce auction. While growers do not receive the same price premium at the auction compared to an urban farmer’s market, there are reasons the auction is a viable market channel.