U.S. Ag Exports/Trade Policy Update as of June 2022

Author(s): Will Snell

Published: June 30th, 2022

Shareable PDF

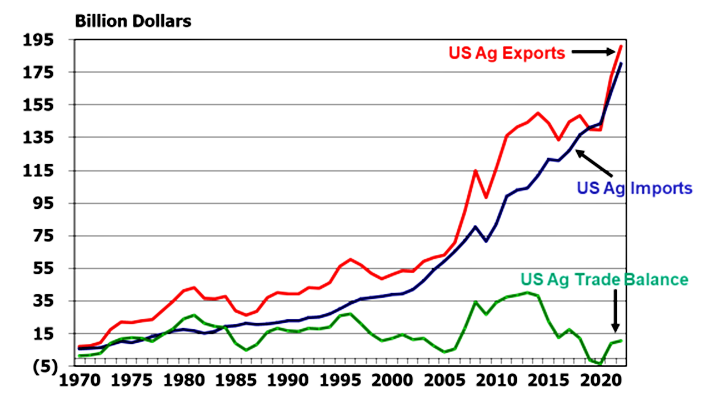

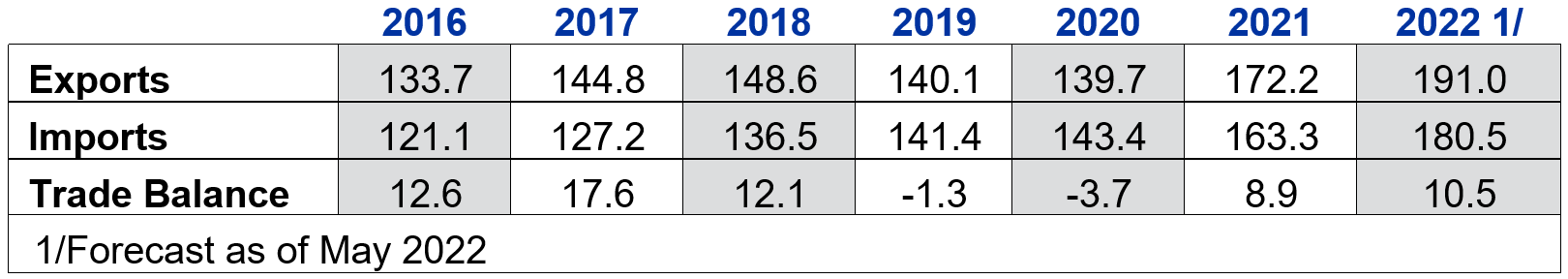

USDA recently updated their trade forecast for FY 2022 projecting a record-high U.S. ag export level totaling $191 billion, 11% higher than last year’s record high and 35% above the 2016-2020 average. Gains in U.S. ag trade are occurring despite a slowing global economy and a higher-valued U.S. dollar. However, the historic high export values for FY 2022 are in response to higher commodity prices as export volumes are projected to be lower for most agricultural commodities/products. Tight global ag supplies caused by various weather events, supply chain challenges, and trade interruptions caused by the war in Ukraine are major factors contributing to significantly higher commodity prices and export values.

Figure 1: U.S. Ag Exports, Imports, and Trade Balance

Source: ERS/USDA, for Year Ending on September 30th

Table 1: U.S. Agricultural Trade, Fiscal Years (FY) 2016-2022, year ending September 30th

Source: Economic Research Service/USDA

The U.S. exported $10 billion worth of soybeans in the first four months of the 2022 calendar year, up 20% in value and setting a new record for January-April shipments. U.S. corn exports, so far in 2022, are up 5% in value, with wheat up 17%, but both are down by more than 10% in volume.

On the livestock side, U.S. beef exports have been exceptionally strong in 2022 (up 38% in volume and 5% in quantity) while pork exports have slumped (down 18% in value and 20% in quantity). U.S. dairy and poultry exports are up by more than 20% in value during the first four months of 2022 but have posted negligible gains in quantity reflecting the effects of much higher export prices. Also important for Kentucky, the 2022 trade data to date indicates significant export gains for forest products (+14%) and distilled spirits (+22%) with the latter likely benefitting from the elimination of EU tariffs late last year.

China is expected to remain the largest foreign buyer of U.S. agriculture with exports forecast to total a record $36 billion (18.8% of the total) in FY 2022. Mexico and Canada, our next two largest foreign buyers, are projected to boost purchases of U.S. ag exports by more than 20% in the current fiscal year.

U.S. agricultural imports are projected at $180.5 billion for FY 2022, up 10% from the previous year. Overall, the U.S. ag trade balance is expected to grow in FY2022 to $10.5 billion, after U.S. agriculture experienced modest trade deficits in FY 2019 and FY 2020 – the first time since the 1950s.

Trade Policy

The Biden administration’s trade policy agenda is certainly different from previous administrations which focused primarily on tariff reductions and more traditional trade policy tools to improve market access for U.S. products. While acknowledging the importance of these trade-enhancing instruments, the Biden administration is more focused on addressing issues impacting workers and the environment among trade partners, bolstering supply chains, and addressing other non-tariff trade barriers such as sanitary and phytosanitary barriers to create a more sustainable trade environment. U.S. farm/commodity organizations typically agree that addressing these trade barriers is important, but they have been disappointed that the Biden administration has not actively pursued free trade agreements that reduce tariffs and directly improve market access for U.S. agricultural exports. Recognizing the potential adoption and benefits of free trade agreements, U.S. Trade Representative Katherine Tai earlier this year described free trade agreements as a 20th century tool, implying that today’s trade policy needs to be flexible to address changing political, economic, and social issues. Furthermore, the Biden administration so far has not elected to pursue Trade Promotion Authority which yields Congressional guidance to the executive branch in pursuing free trade agreements and shaping the nation’s trade policy.

A lot of attention within the U.S. agriculture community in recent years has focused on markets within the Indo-Pacific Region, given its expanding population and income base. Former President Barack Obama brokered the Trans-Pacific Partnership (TPP) with 11 Pacific Rim countries that was backed by U.S. agriculture, but former President Donald Trump followed his campaign promise by pulling the U.S. out of this agreement in 2017. The remaining nations eventually agreed upon a revised agreement called the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). Many within U.S. agriculture would support the Biden administration to actively pursue joining the CPTPP but instead last month, the Biden administration announced Indo-Pacific Economic Framework or IPEF which includes (among other items) non-tariff-related efforts to enhance trade competition among partners by improving supply chains, supporting trade technologies (including digital commerce), addressing environmental and labor standards, and curbing tax evasion and corruption. The IPEF consists of the United States and 12 other countries (Australia, Brunei, India, Indonesia, Japan, South Korea, Malaysia, New Zealand, Philippines, Singapore, Thailand, and Vietnam), comprising 40% of the global economy. Collectively these nations typically account for one-quarter of U.S. ag exports with optimism among U.S. ag trade organizations of additional export gains for U.S. livestock, dairy, and grains if various non-tariff barriers are removed.

Taiwan, the United States’ sixth-largest ag export market, despite relatively high ag import tariffs, was not a part of the IPEF, but earlier this month, the Biden administration announced trade negotiations are occurring between these two nations which, similar to the IDEF, focuses only on non-tariff barriers.

In addition, the Biden administration recently updated beef quality safeguards on U.S. beef entering Japan – the United States’ second-largest beef export market – as a part of the U.S. Japanese Trade Agreement signed in 2019. The administration claims this change will “allow U.S. exporters to meet Japan’s growing demand for high-quality beef and reduce the probability that Japan will impose higher tariffs in the future.”

As far as China, the Biden administration has not indicated efforts to secure a “Phase II” trade agreement with China, but instead has adopted a “New Approach to the U.S. – China Trade Relationship. While this “approach” does call for continued enforcement of the Phase I agreement, it focusses on various non-market trade practices by the Chinese government that the Biden administration claims distort competition, limits market access, and encompasses predatory practices in trade and technology.

In reality, the direction of future trade policy is very uncertain as markets and governments adjust to a changing world that has been rocked by a global pandemic, supply chain disruptions, and a serious military conflict in Ukraine that has impacted economies worldwide. Given the emerging efforts of nations and multinational companies to reduce the carbon footprint of global trading, goals to increase local/domestic food production, and the potential adoption of additional protectionistic trade policies by some nations, will global ag trade opportunities within agriculture be diminished, or will this new global environment continue to create new and expanding markets for U.S. farmers ag/food companies?

Recommended Citation Format:

Snell, W. “U.S. Ag Exports/Trade Policy Update as of June 2022." Economic and Policy Update (22):6, Department of Agricultural Economics, University of Kentucky, June 30th, 2022.

Author(s) Contact Information:

Will Snell | Extension Professor | wsnell@uky.edu

Recent Extension Articles

High Path Avian Influenza Update and the On-Farm Financial Impacts from an Outbreak

Jordan Shockley | June 30th, 2022

In 2014/15, the U.S. poultry industry experienced one of the most significant animal health emergencies due to high pathogenic avian influenza (HPAI), also known as “bird flu.” Federal expenditures to control the outbreak and pay poultry growers for lost birds exceeded $1 billion. Unfortunately, the poultry industry is experiencing another outbreak challenging the scale of 2014/15.

Circle of Concern and Circle of Influence

Steve Isaacs | June 30th, 2022

Much of our discussion is on items of concern, like prices and input supply problems, certainly important, but largely beyond our individual influence. Is it important? Sure. Is it something we can influence? No. Do we have to manage around it? Yes. While an individual cannot manage the price, they can monitor and manage use and efficiency. While an individual cannot manage a supply chain interruption, they can anticipate and plan to accommodate disruptions and delays.