USDA-FSA’s Livestock Indemnity Program

Author(s): Kenny Burdine

Published: August 9th, 2022

Shareable PDF

USDA’s Livestock Indemnity Program (LIP) is administered by the USDA Farm Service Agency (FSA) and is intended to help compensate producers for greater than normal levels of livestock deaths from adverse weather, disease outbreaks, and predator attacks. The program can also partially compensate producers for lost value resulting from injury. As I try to process the disastrous impact of the recent flooding in Eastern Kentucky, I felt like it might be a good time for a reminder of how the LIP program works as there is potential for producers to receive payments from this recent event.

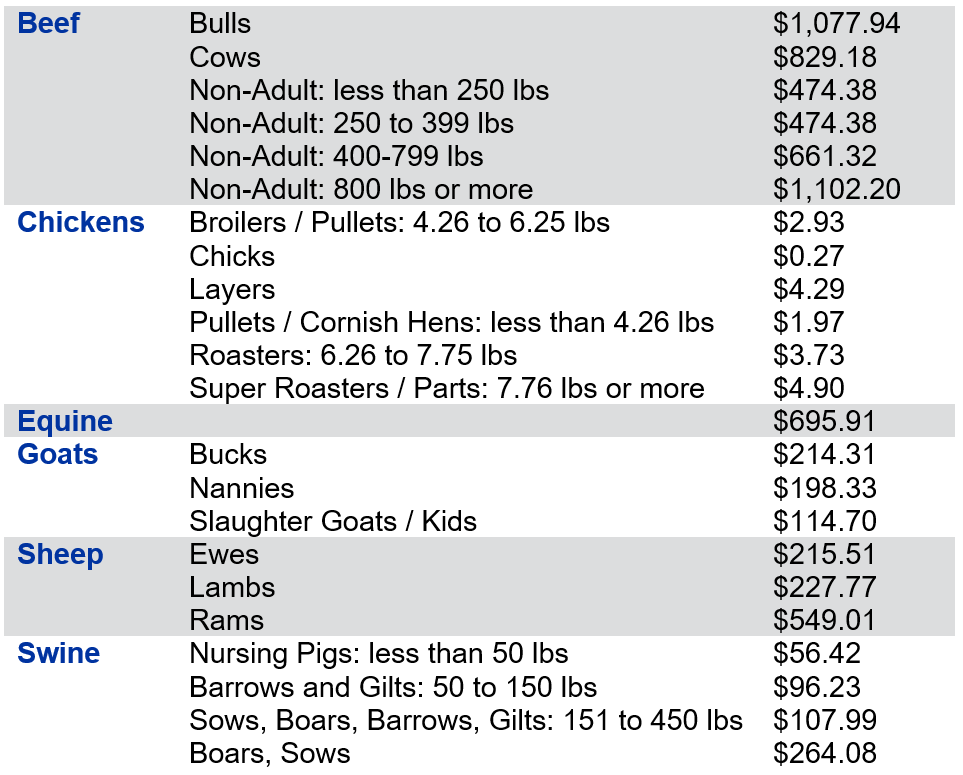

LIP payment rates for losses are set by the Secretary of Agriculture and are done so on a per head basis. The rates are updated regularly and are intended to be about 75% of the average national market value of livestock by species and type. The table below shows payment rates per head for some more common livestock categories, but other species are eligible under the program and should be investigated by producers that feel they may have qualified losses.

I will quickly walk through a simple illustration of how this might work and apply it to a cow-calf operation. Suppose a producer had 50 cows on their farm at the time of the event and lost 10 of them directly as a result of flooding. This producer may be eligible for payments on those lost cows, above what FSA considers to be a normal mortality rate. If FSA’s normal loss rate on cows were 1.5%, then normal mortality would round to 1 head for this 50 cow herd over the course of a year. In that case, the producer could potentially be eligible for a LIP payment on 9 head at the rate of $829.18 per head. If calves were lost, a similar estimate could be made for the calf crop using actual calf losses and assumed normal mortality on calves. In cases where animals were sold at a market discount as a result of injury from the event, producers may be eligible for the difference between the value they actually received at sale and the program payment rates below. In all cases, documentation is crucial to receiving payments.

Application for LIP benefits is made through local FSA offices and producers should address specific questions to that office about eligibility and documentation requirements. Producers are required to file a notice of loss within 30 calendar days of the loss and apply for payment within 60 days of the close of the calendar year in which the loss occurred. USDA-FSA recently updated their Fact Sheet on the Livestock Indemnity Program, which included a few rate increases. This publication is very useful and available to read and download.

Table 1: 2022 Livestock Indemnity Program (LIP) Payment Rates per Head

Source: FSA LIP Fact Sheet (July 2022)

Recommended Citation Format:

Burdine, K. "USDA-FSA's Livestock Indemnity Program." Economic and Policy Update (22):8, Department of Agricultural Economics, University of Kentucky, August 9th, 2022.

Author(s) Contact Information:

Kenny Burdine | Extension Professor | kburdine@uky.edu

Recent Extension Articles

Mid-Year Cattle Report Continues to Show Decreasing Cattle Inventory

Kenny Burdine | August 3rd, 2022

In late July, USDA-NASS released their mid-year estimates of U.S. cattle inventory. As expected, the report showed lower inventory across most all cattle types. All cattle and calves were estimated to be down by just under 2%, while beef cow inventory was estimated down by 2.4%.

Hay Production Cost Increases in 2022 and Management Implications

Greg Halich | July 29th, 2022

Costs for hay production have skyrocketed in 2022. Fertilizer is driving the bulk of the overall increase, followed by fuel, and then general cost increases for other categories. While we can debate the exact causes of all these increases, we have a serious situation that needs to be understood and dealt with.