Coronavirus Food Assistance Program (2.0)

Author(s): Will Snell and Kenny Burdine

Published: September 23rd, 2020

Shareable PDF

USDA has announced a second round of Coronavirus Food Assistance Program (CFAP) payments for farmers impacted by COVID-19. For complete details on eligible commodities, payment rates/methodologies, and sign-up, visit USDA’s CFAP website at www.farmers.gov/cfap. Plus, check out USDA’s Fact Sheet on CFAP 2.0.

Summary information important to Kentucky agriculture includes the following:

- CFAP 2.0 will total up to nearly $14 billion nationally, which will be in addition to the funds received from the first round of CFAP payments. This new round will include new calculation methods/payment rates and some new commodities including tobacco, hemp, wheat, and goats.

- Enrollment will start on Monday, September 21st at local FSA offices, with the application process similar to the first round of CFAP payments, including self-certification.

- Deadline for signup will be Dec 11, 2020

- CFAP 2.0 payments will be based on three different categories:

- “price trigger” commodities – experienced a 5% or greater national price decline in comparison to the average prices for the week of January 13-17, 2020, and July 27-31, 2020.

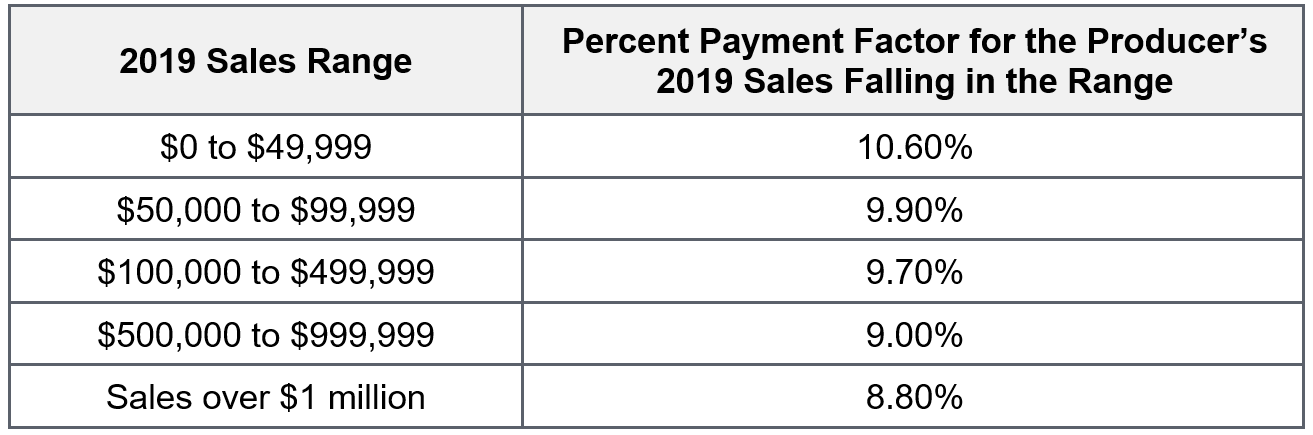

- “sales” commodities – payment calculations will use a sales-based approach where producers are paid based on five payment gradations associated with their 2019 sales.

- “flat rate” commodities – do not meet the 5% or greater national price decline trigger or do not have data available to calculate a price change.

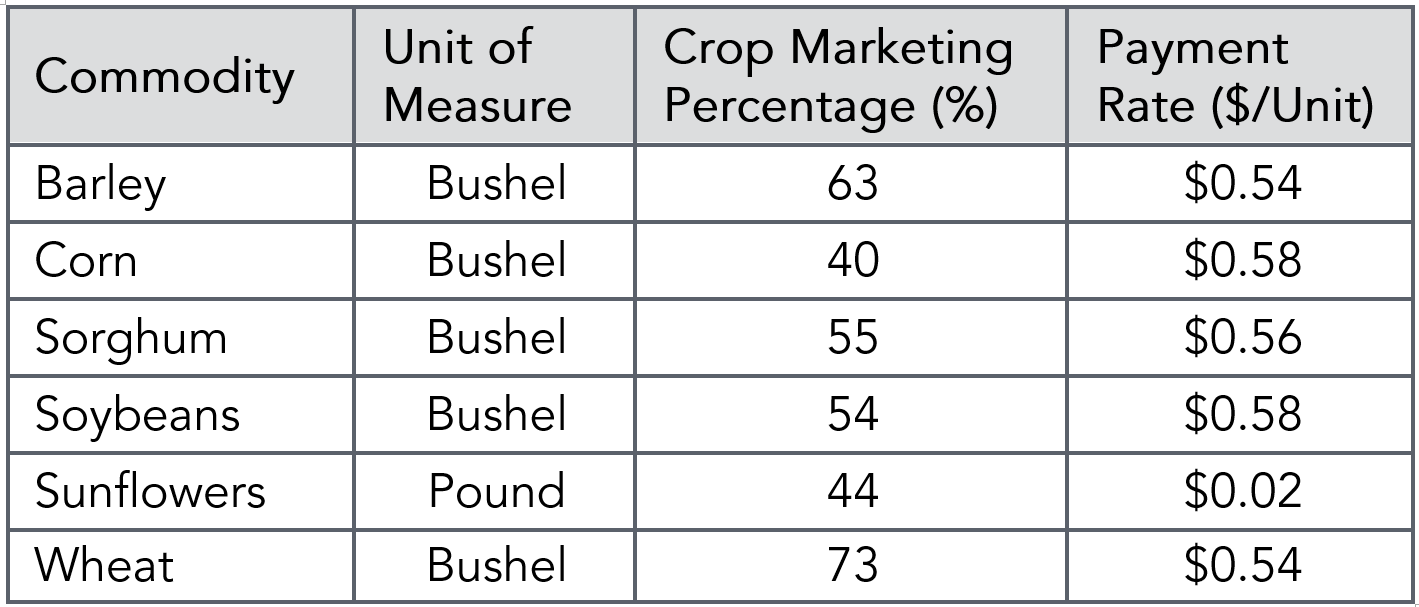

- For corn, soybeans, wheat, barley, sorghum, among other row crops whose payment eligibility is based on the price trigger outlined above:

- payments will be based on the greater of the 2020 planted acres multiplied by $15 per acre; or the eligible acres multiplied by a nationwide crop marketing percentage, multiplied by a crop-specific payment rate, and then by the producer’s weighted 2020 Actual Production History (APH) approved yield.

- If an APH isn’t available, the CFAP yield will be 85% of the benchmark yield used for the Agriculture Risk Coverage-County (ARC-CO) program option.

- Payment rates among row crops will be the following:

- For more details on row crop payments under CFAP 2.0, click here.

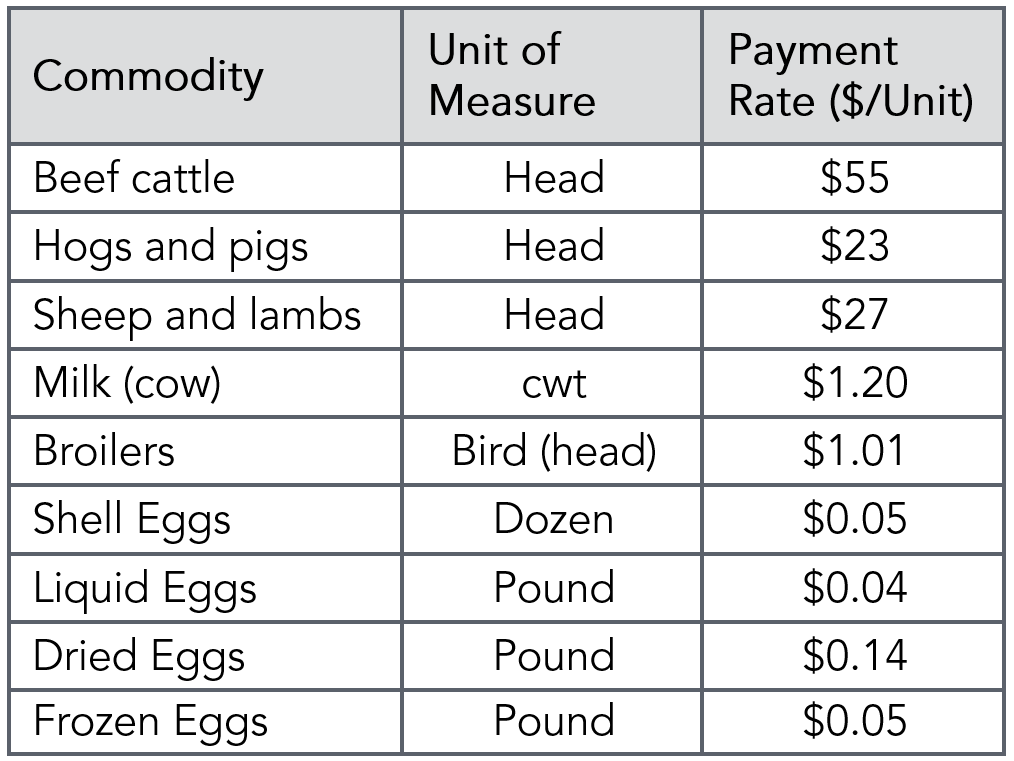

- Livestock payments are based on both price changes and sales levels:

- Beef cattle, pigs/hogs, and lamb/sheep payments will be based on the maximum owned inventory of eligible livestock, excluding breeding stock, on a date selected by the producer between April 16 and Aug. 31.

- Dairy payments will be based on actual production from April 1 to Aug. 31 and an estimate by the FSA of production from Sept. 1 to Dec. 31. The production estimate for Sept. 1 to Dec 31 will be made by multiplying the average daily production from April 1 to Aug 31, by 122.

- Broiler payments will be equal to 75% of 2019 production and multiplied by $1.01 per bird. Payments for producers who began producing in 2020 will be based on 2020 production as of the application date. Contract growers are ineligible for CFAP 2.0.

- Egg payments will also be based on 75% of the farm’s 2019 production and multiplied by different payment rate for shell, liquid, dried, and frozen eggs.

- Payment rates for livestock will be the following:

- Tobacco, and other specialty enterprises such as aquaculture, nursery crops, floriculture, specialty livestock such as goats, and certain fruits/vegetables will be paid based on their 2019 sales. Payments will be a percentage of 2019 sales with that percentage decreasing at higher 2019 sales levels (see table below).

For specific details on tobacco payments under CFAP 2.0 click here. For aquaculture, click here. For nursery crops and floriculture, click here. For other specialty crops, click here. For specialty livestock, click here.

- “Flat rate” commodities will include hemp, alfalfa, and canola (among other crops), with payments being a flat $15/acre rate based on the eligible acres from the 2020 crop.

Author(s) Contact Information:

Will Snell | Extension Professor | wsnell@uky.edu

Kenny Burdine | Associate Extension Professor | kburdine@uky.edu

Recent Extension Articles

Coronavirus Food Assistance Program (CFAP) Update

May 27th, 2020

USDA has announced details of the Coronavirus Food Assistance Program (CFAP) designed to compensate farmers who have suffered losses due to COVID-19. On April 17, 2020, U.S. Secretary of Agriculture Sonny Perdue announced the CFAP which evolved from funding provided in the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the Families First Coronavirus Response Act (FFCRA), and other existing USDA funds.

Specialty Crop COVID-19 Response Project

September 28th, 2020

During this moment of simultaneous disruption and rapid innovation, our project supports LRFS communities of practice by documenting and disseminating innovations and best practices developed on the ground and drawing on LRFS thought leaders to frame research on COVID-19 relate shifts to LRFS markets with the aim of supporting long term resilience.