Ag Economic Situation & Outlook

2024 Economic Situation & 2025 Outlook

Our annual Ag Economic Situation & Outlook publication is a collaborative effort between the Department of Agricultural Economics Extension Faculty and the Department of Forestry and Natural Resources. This comprehensive outlook is initially presented at the Kentucky Farm Bureau Annual Meeting in Louisville, Kentucky, and is made available to the public afterward. In this year’s edition, we delve into the challenges U.S. agriculture faces in 2024, from falling commodity prices and shrinking government payments to rising input costs.

However, Kentucky’s diverse agricultural sector shows resilience, with strong performances in livestock and horticulture helping to offset downturns in grain production. This report provides valuable insights into both national and state-level trends, offering projections for 2025 and the factors that will shape the future of agriculture in Kentucky and beyond.

2024 Situation

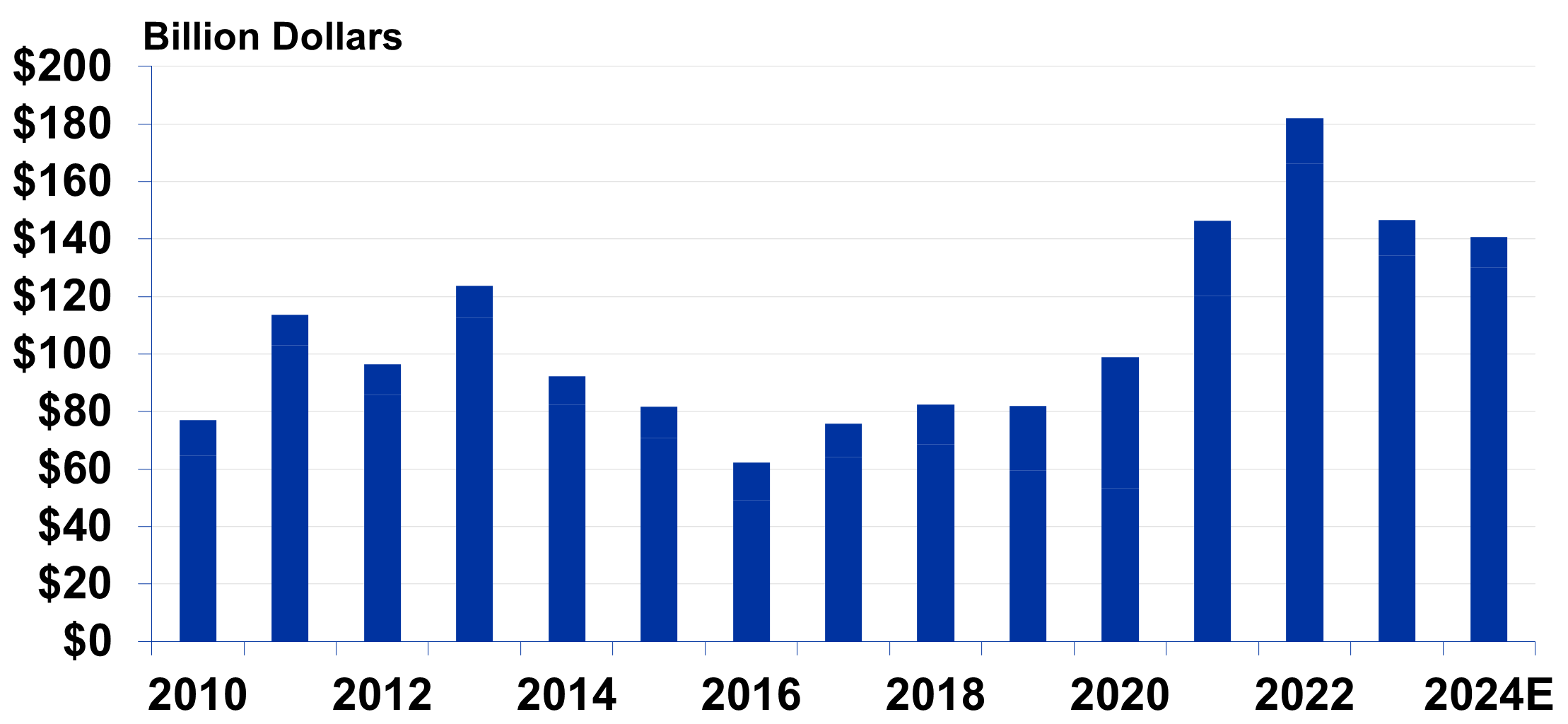

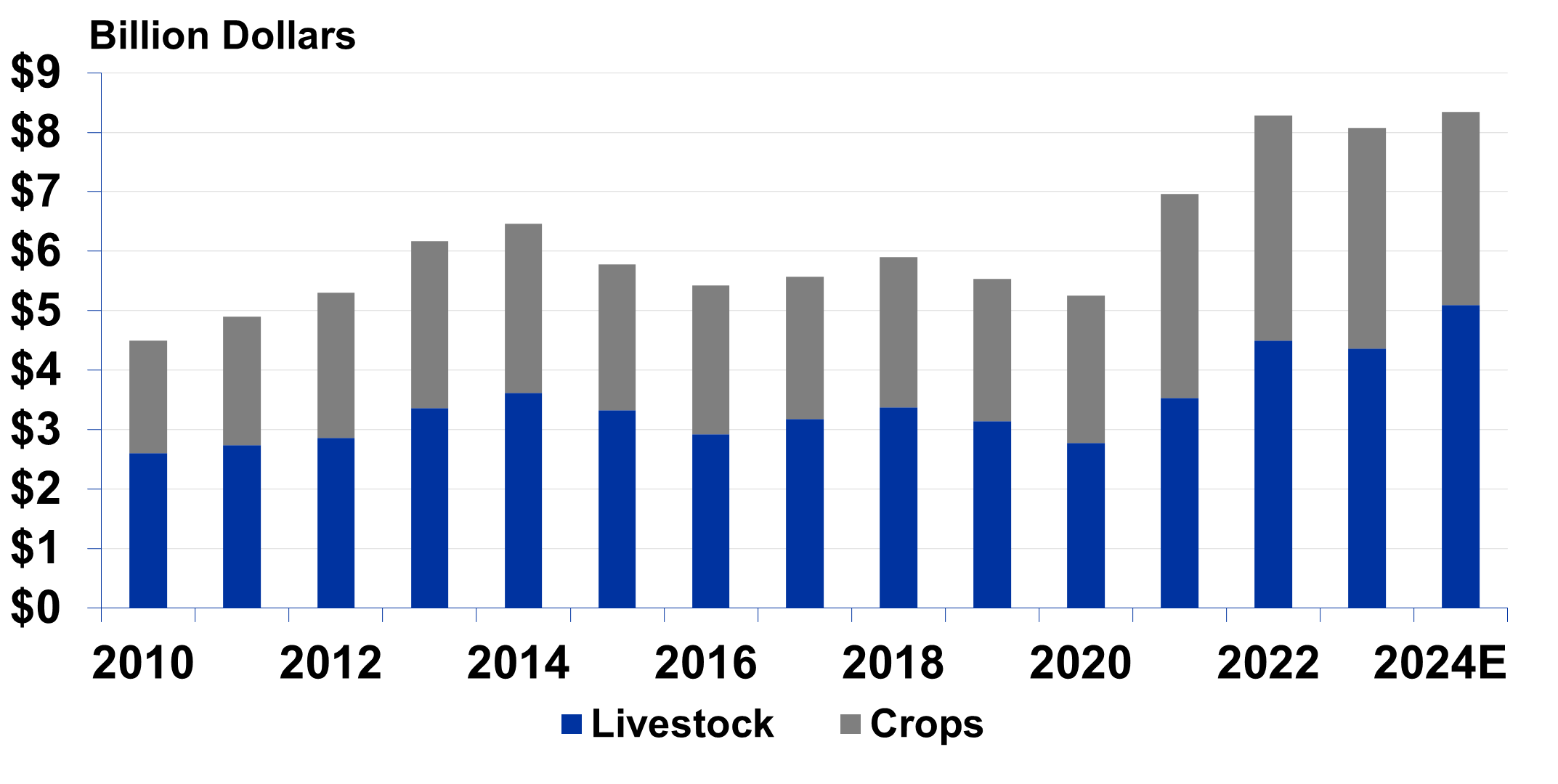

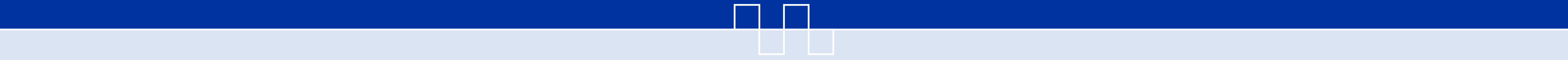

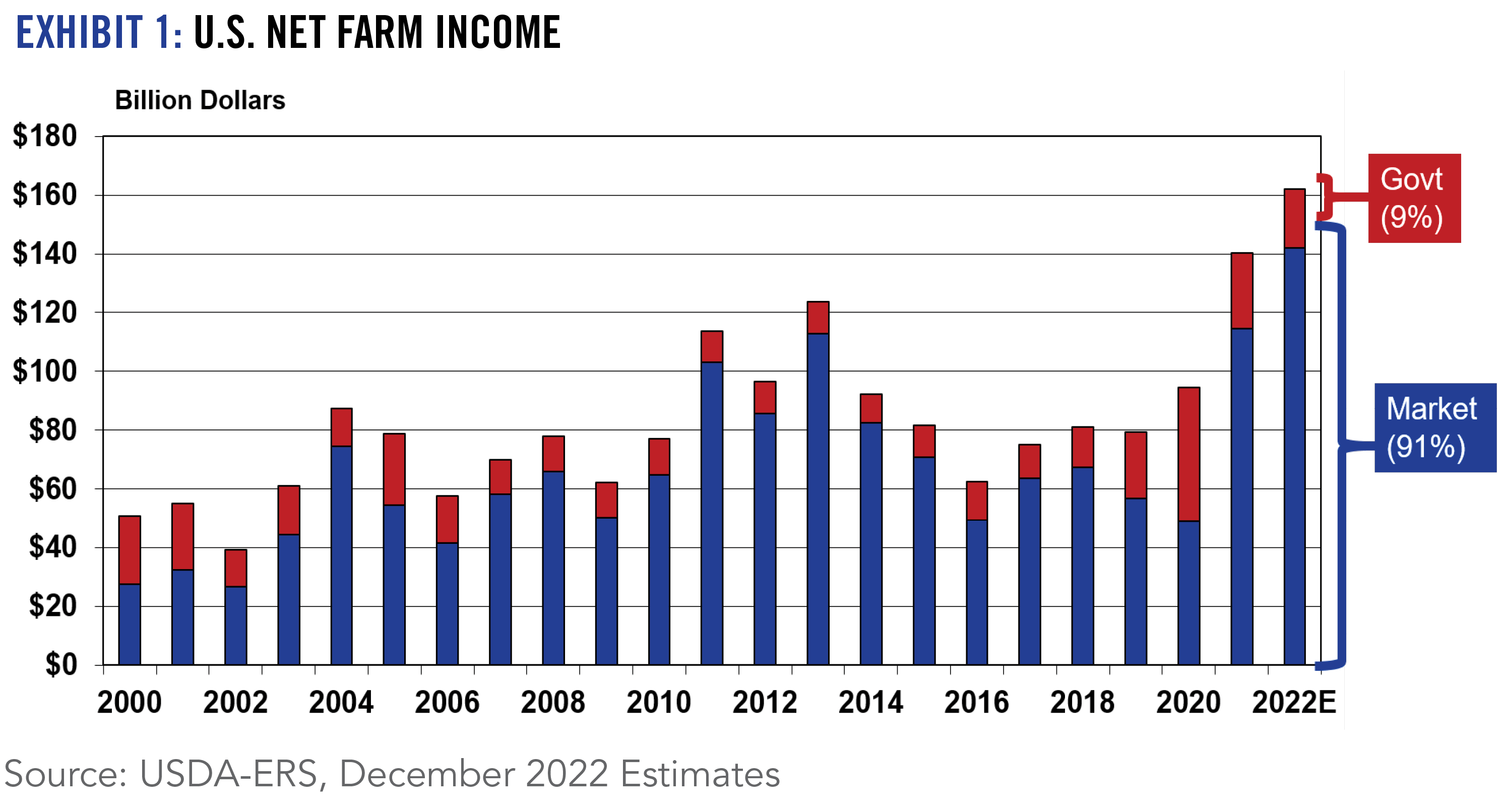

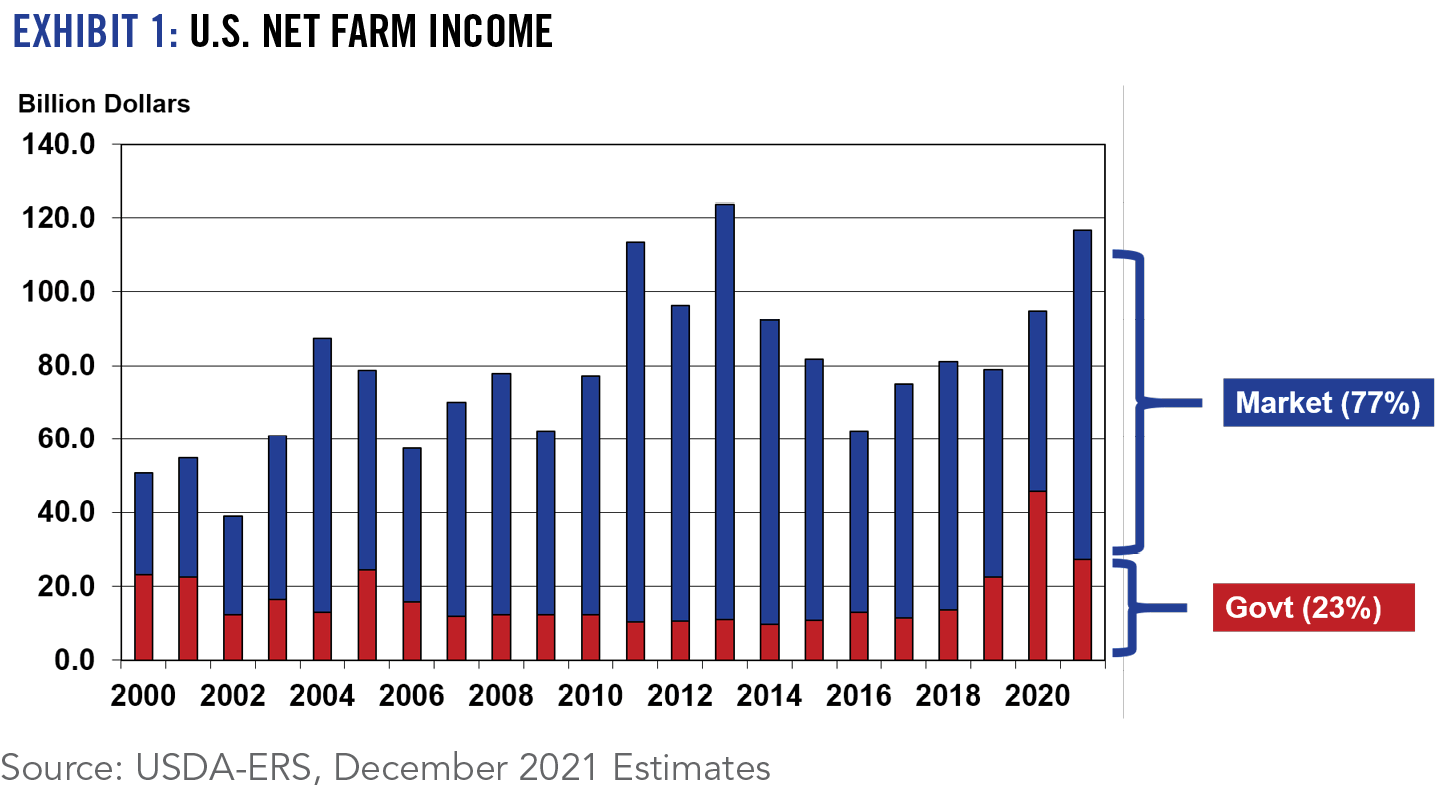

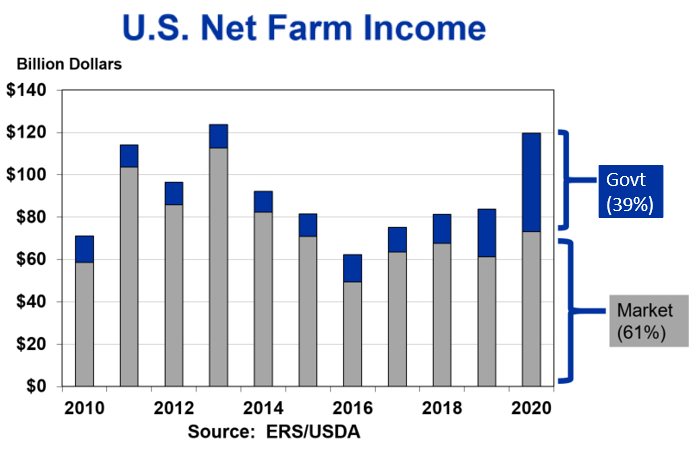

U.S. agriculture experienced another challenging year in 2024. After achieving record net farm income levels in 2021 and 2022 on the heels of strong commodity prices, exceptional crop yields, stable/declining input prices, and large government payments, U.S. net farm income fell 19.4% in 2023 and is expected to fall an additional 4.1% in 2024 according to the latest USDA estimates.

The downward trend in the U.S. farm economy this past year has slowed as growing livestock receipts (projected up 8.4% in 2024) have helped offset significantly lower crop receipts (projected down 9.2% in 2024).

Grain prices slumped in 2024 in response to large global crops and ample carryover inventories. Alternatively, beef prices are benefiting from the smallest cattle inventory in more than 60 years. The livestock sector is also being supported by higher dairy, poultry and hog prices/receipts in 2024.

Although U.S. net farm income has been declining, the current structure of the farm bill has not provided additional support as direct government payments have declined from $45.6 billion in 2020 (comprised primarily of ad hoc disaster, pandemic, and trade assistance payments) to averaging $11.4 billion over the past two years (primarily disaster and conservation funds).

Following record high export levels in 2022, the U.S. ag export value fell 11% in 2023, but has been relatively flat so far in 2024 through the first ten months. U.S. corn, beef and pork have experienced export value gains in 2024, poultry sales are relatively flat compared to last year, but soybeans exports have fallen significantly. China emerged as the largest U.S. ag export market hitting a record high $38 billion of ag purchases from the United States in 2022. However, U.S. ag trade to China has been trending downward the past two years (off 24% in 2023 and down another 19% through the first ten months of 2024) as this important ag/food importing nation is purchasing more ag/food products from South America while simultaneously attempting to boost domestic ag production. As a result. China has slipped from the top spot in 2022 to being the United States’ third largest export buyer with Canada and Mexico regaining their former status as our leading two export customers. Since the passage of the U.S.-Mexico-Canda (Trade) Agreement (USMCA) in January 2020, U.S. ag exports to these two top markets have increased by nearly 50%. Alternatively, U.S. ag exports to China have declined by nearly 25% since the two-year Phase One trade deal between the two nations ended in 2021.

In addition to falling prices, government payments, and exports, net farm income has also been plagued in recent years by input price inflation. While labor, animal replacement, and interest costs have continued to increase, U.S. farmers have benefitted from lower feed, fertilizer, and chemical expenses as they are coming off relatively high levels.

While the U.S. farm economy is trending lower, the farm balance sheet has remained relatively strong in response to strong asset values. Despite falling income and relatively high interest rates, farmland values have continued to increase in certain areas, although at a notable slower pace. Development opportunities, outside investors/buyers, and limited farmland for sale are driving the market -- not anticipated future farm income streams. Over the past five years farm debt has increased 5.8%, while average farmland values have increased by 7.5% nationally. Despite relatively strong balance sheets, shrinking working capital, along with liquidity and cash flow challenges are major concerns among a growing number of farmers in meeting short-term debt obligations. Following a tighter monetary policy by the Federal Reserve to battle inflation in 2022 and 2023, interest rates on farm operating and real estate purchases soared above 8% for the first time in nearly twenty years. Despite recent reductions in interest rates by the Fed, farm interest rates have generally remained in the 8 to 9% range.

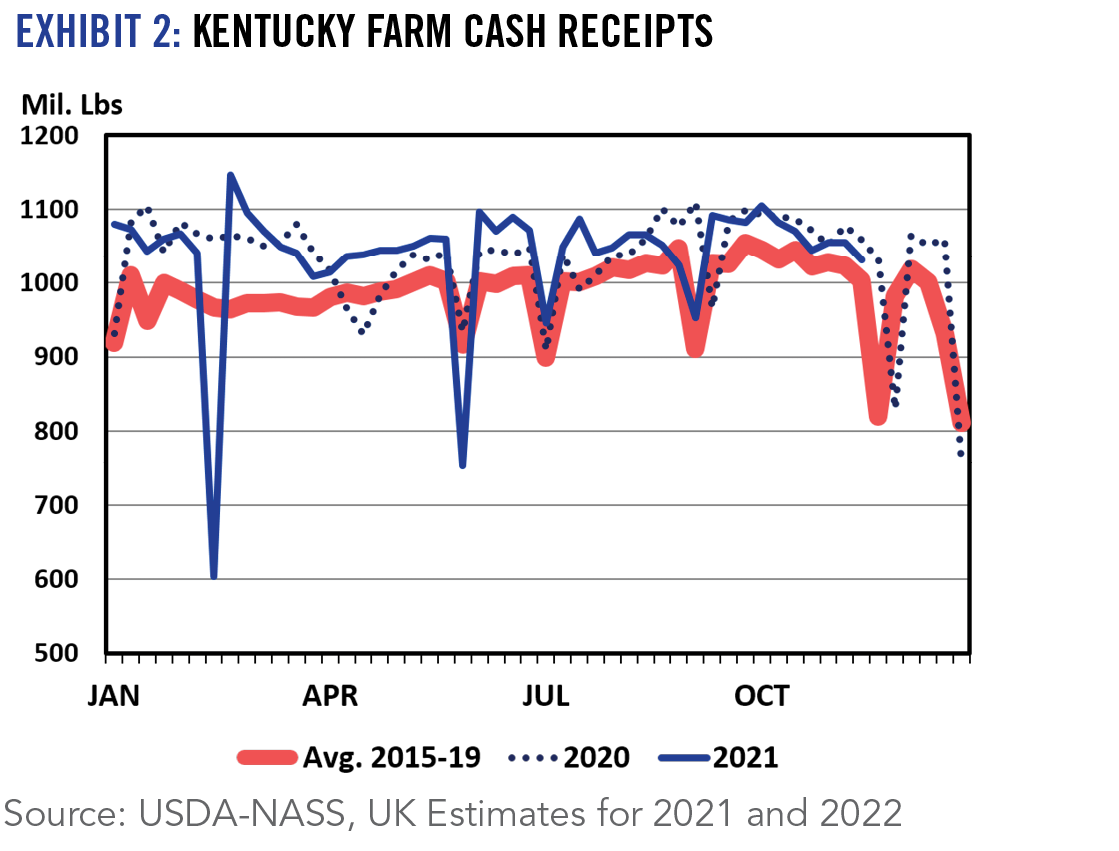

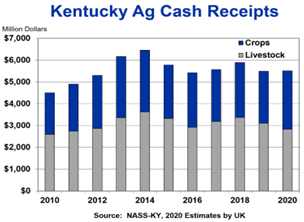

Similar to the national scene, the Kentucky farm economy has been challenged by the downturn in the overall ag economy. However, the diversity of our ag sector has enabled Kentucky agriculture to weather the storm much better than other many other states that are primarily dependent on row crop income

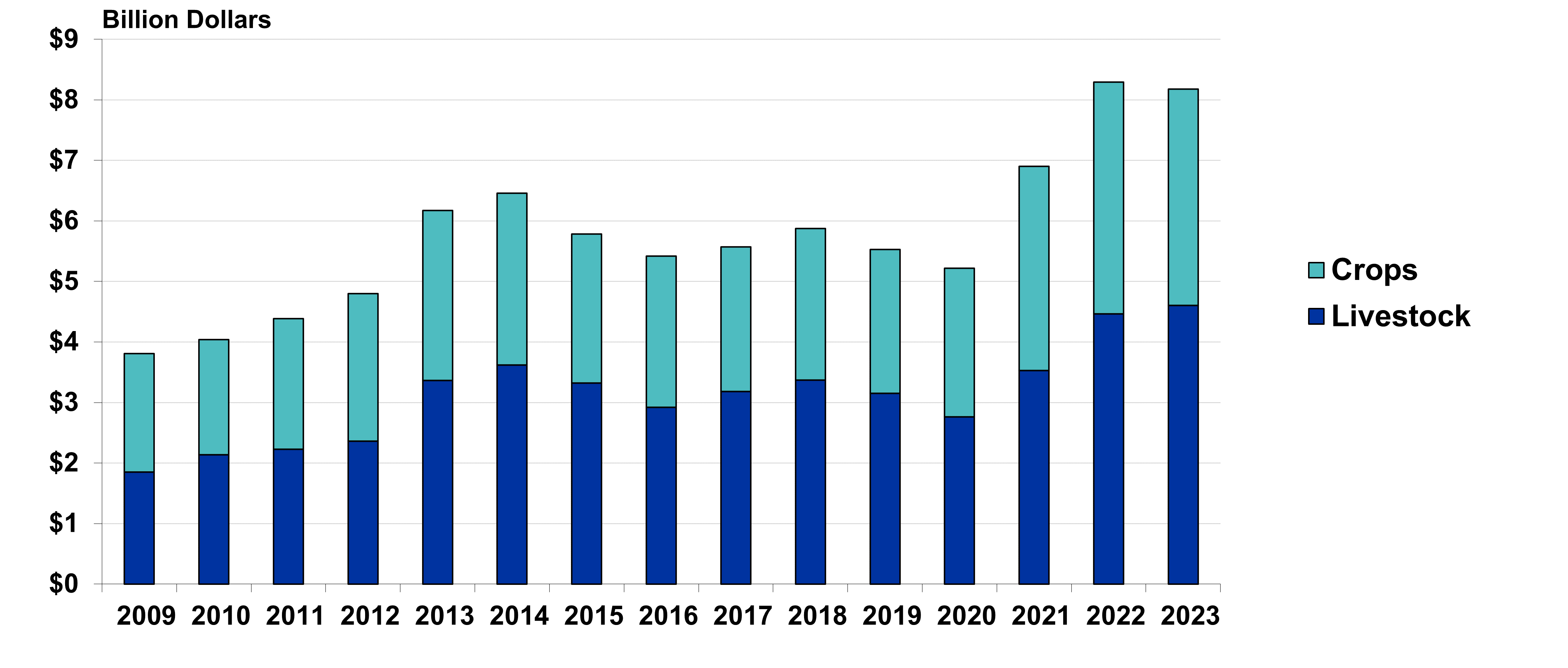

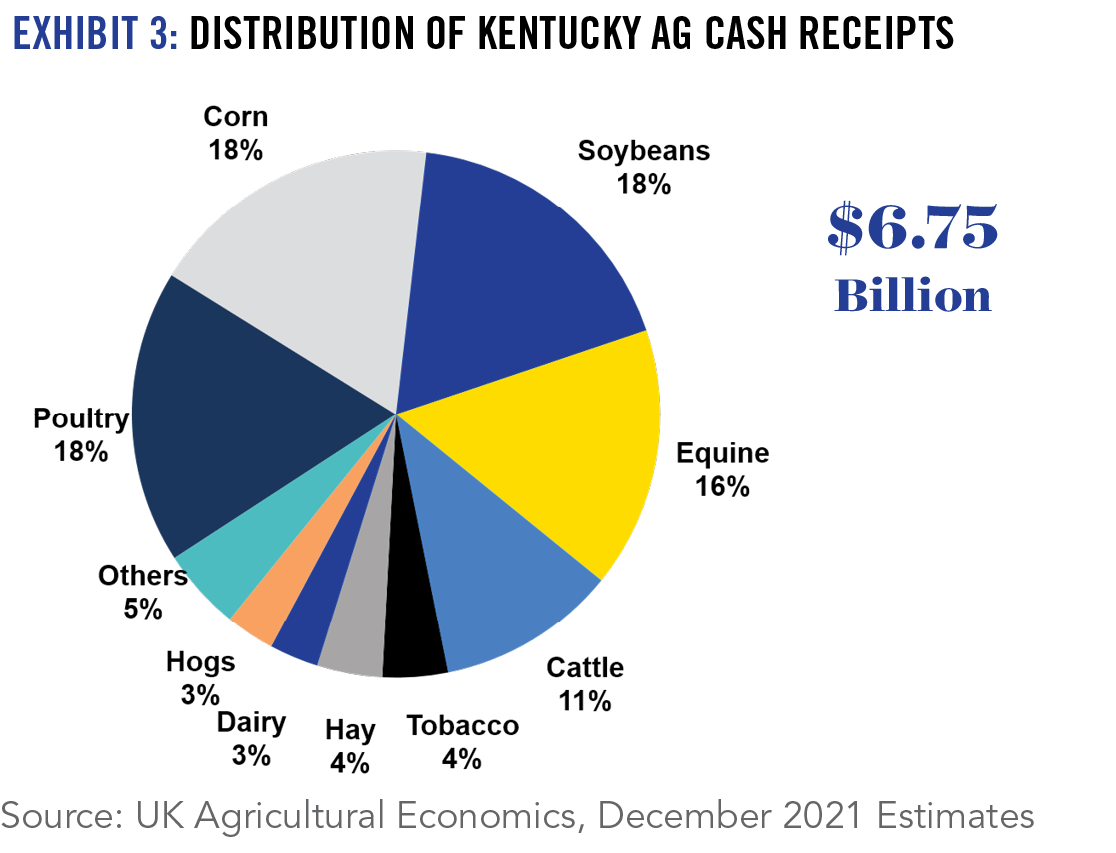

Certainly, depressed grain prices initiated a blow to Kentucky grain farmers in 2024 with mixed outcomes on grain yields across the state depending on rainfall amounts received during the growing season. Cattle prices have been the major bright spot for Kentucky agriculture in 2024, but marketing quantities have constrained additional growth in cattle income. Poultry and dairy producers have benefitted from a rebound in prices and lower feed costs. The equine market has remained relatively strong, while tobacco sales and the number of farms growing the crop continue to shrink.

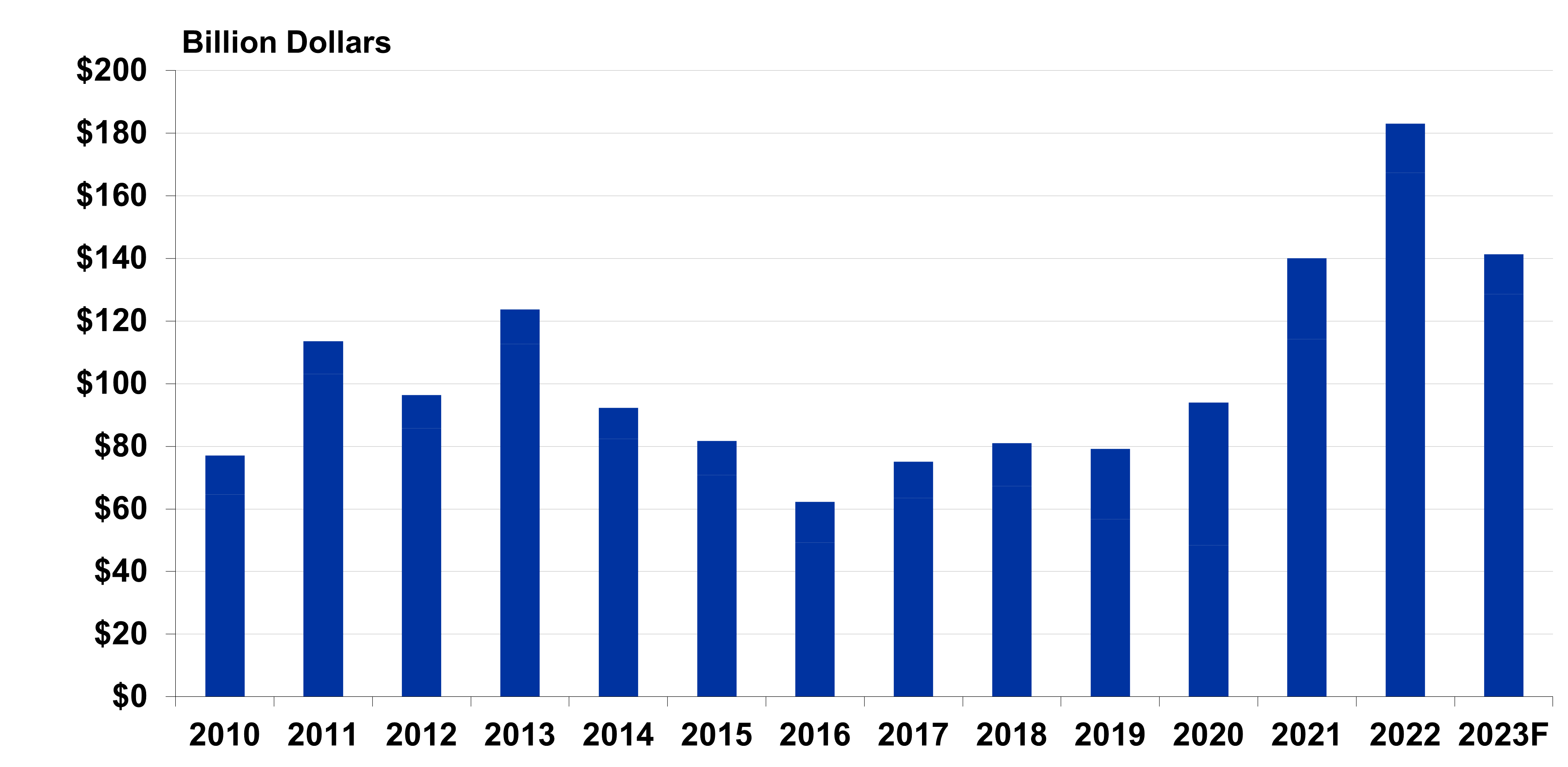

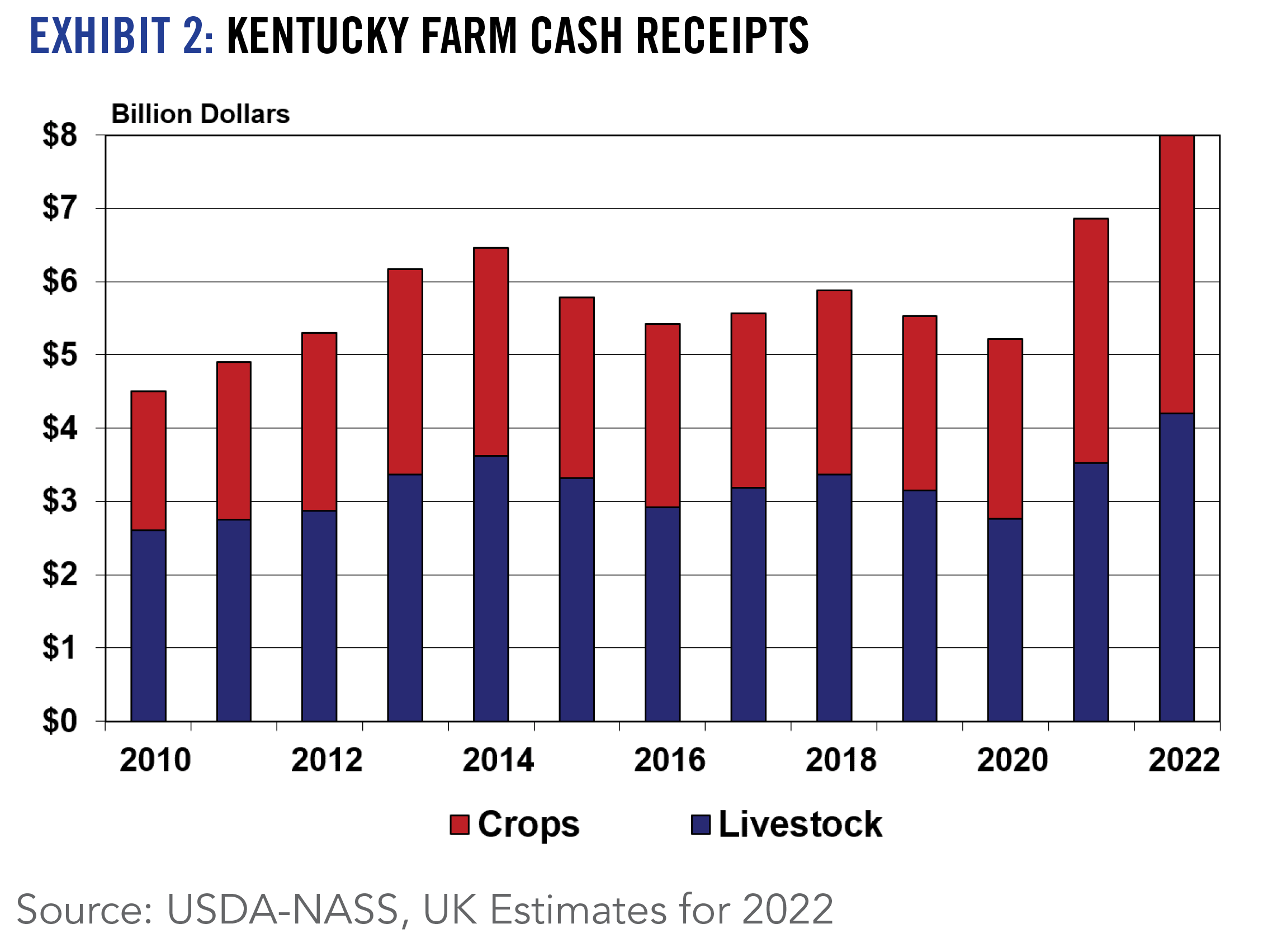

Despite slumping grain prices and weather-related challenges this past growing season, agricultural economists at the UK Martin-Gatton College of Agriculture, Food, and Environment are forecasting that Kentucky ag cash receipts may have actually increased in 2024 to near record high levels. While Kentucky crop receipts are expected to fall by 12.6% in 2024, livestock receipts are projected to increase by 16.8%. Consequently, Kentucky’s 2024 estimated ag cash receipts of $8.3 billion may challenge a similar record high level achieved in 2022. Official state ag cash receipts will be released by USDA in September 2025. Keep in mind that these data represent gross cash sales, and thus do not reflect a large and growing sale of value-added ag/food products and agritourism dollars along with forestry receipts.

Kentucky net farm income averaged $1.7 billion from 2015-2020, and more than doubled to $3.5 billion in 2021-2022, before slipping to $2.7 billion in 2023. Even with anticipated higher cash receipts, net farm income for Kentucky farmers will likely follow national trends by declining in 2024 in response to higher input costs, limited government payments and lower valued crop inventories. Nevertheless, Kentucky net farm income should hover around $2.5 billion in 2024, much lower than the 2021/2022 record levels, but still above the pre-Covid years, even after adjusting for inflation.

2025 Outlook

Kentucky farmers, especially grain farmers, will enter 2025 on a very concerning note. Grain prices are not expected to rebound, unless there is a significant global weather event depleting excess supplies. Cash remains tight and rental rates are slow to adjust to changing market conditions. Fortunately for Kentucky agriculture, current national cattle inventories will allow cattle prices to remain relatively high in 2025 as the industry awaits any signs of expansion.

While feed and fuel prices may remain at favorable levels, labor and animal replacement costs will likely remain relatively high. Interest rates could slide modestly, but interest expenses may still increase with higher rates of borrowing in response to depleted cash levels.

Markets entering 2025 remain cautious depending on a lot of heightened regulatory and farm/trade policy uncertainty as farmers and other ag businesses attempt to navigate the potential outcomes evolving from a change in the White House and Congress.

- Will our trade policy lead to a large increase in tariffs and if so, how will our competitors/customers respond?

- What about a farm bill – will one be passed? If so, what will be the structure of the farm safety net?

- What about changes in U.S. energy and immigration policies? How much, if any, will the Federal Reserve lower interest rates, amidst expected lower, but continuing stubborn inflation which could be reignited in a potential trade war? How will this impact the value of the U.S. dollar and exports?

- Will land values and balance sheets remain relatively strong?

- Will China, Mexico, and Canada remain strong export markets for U.S. agriculture. Can the U.S. further diversify its export base?

- What about outcomes for ag markets from ongoing geopolitical events Ukraine/Russia and Middle East, and perhaps others that evolve?

U.S. Net Farm Income

Source: ERS/USDA

Kentucky Farm Cash Receipts

Source: KY Ag Stats/NASS and UK Estimates for 2024 (12/5/2024)

2024 Overview

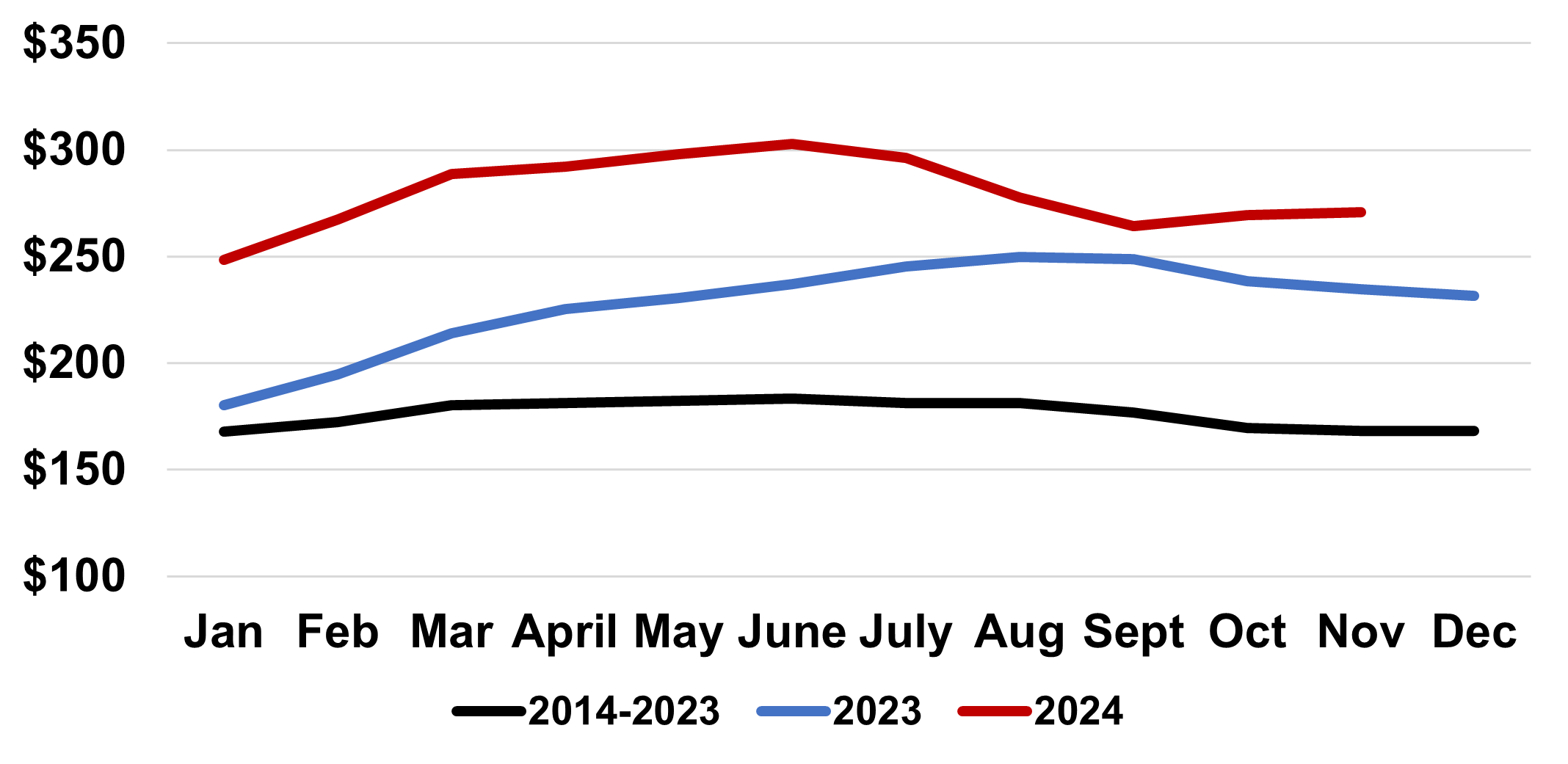

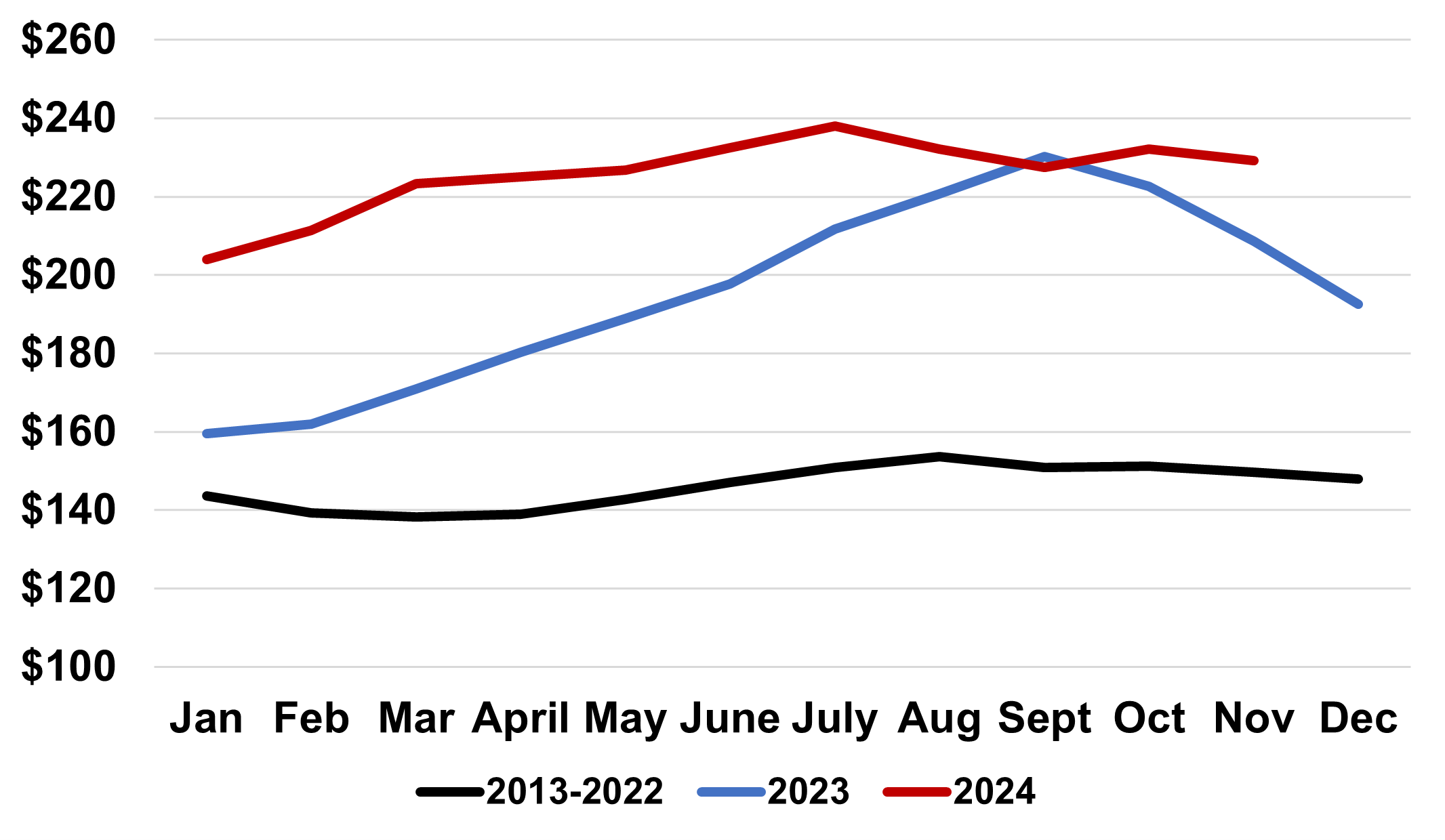

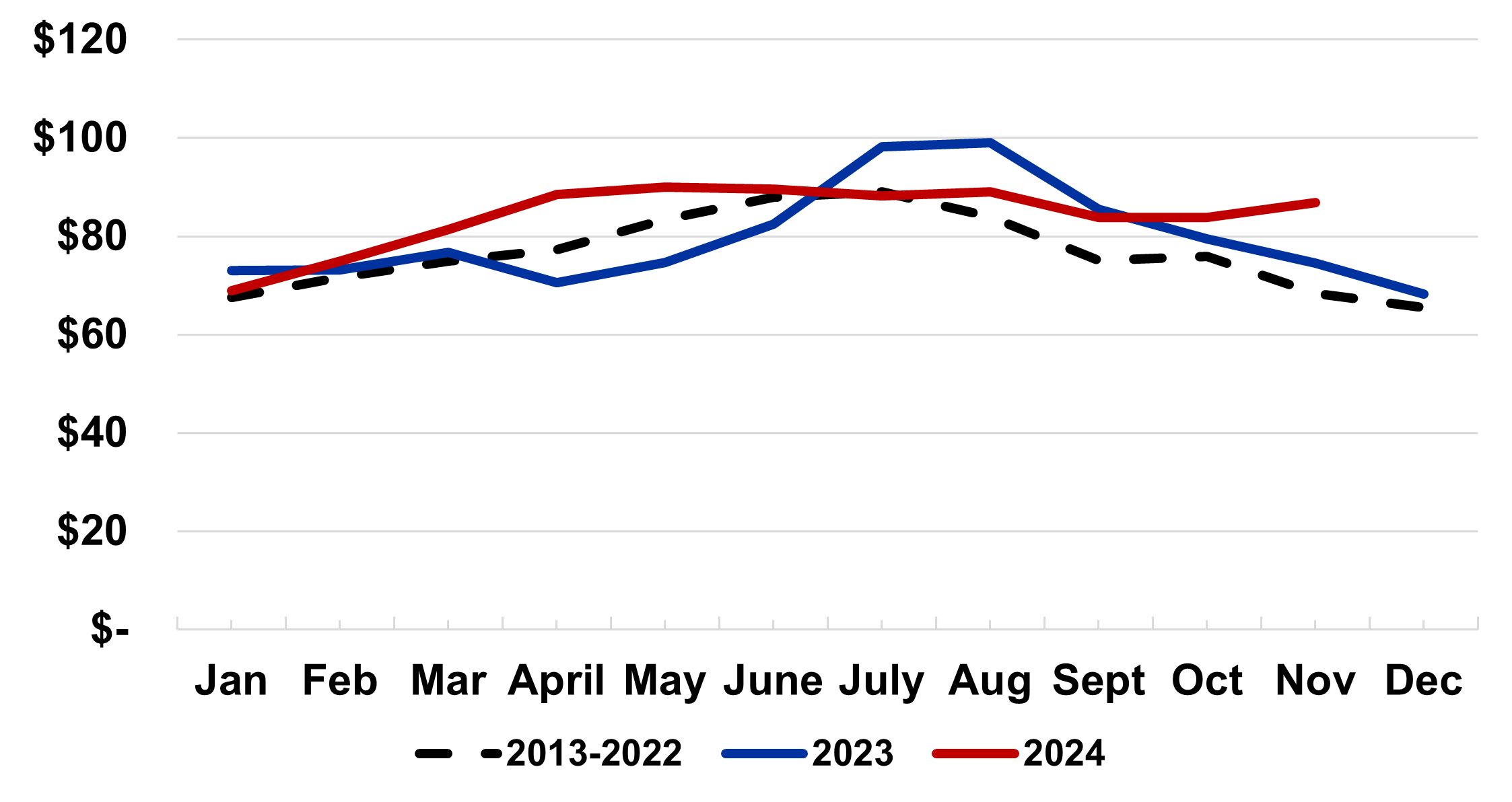

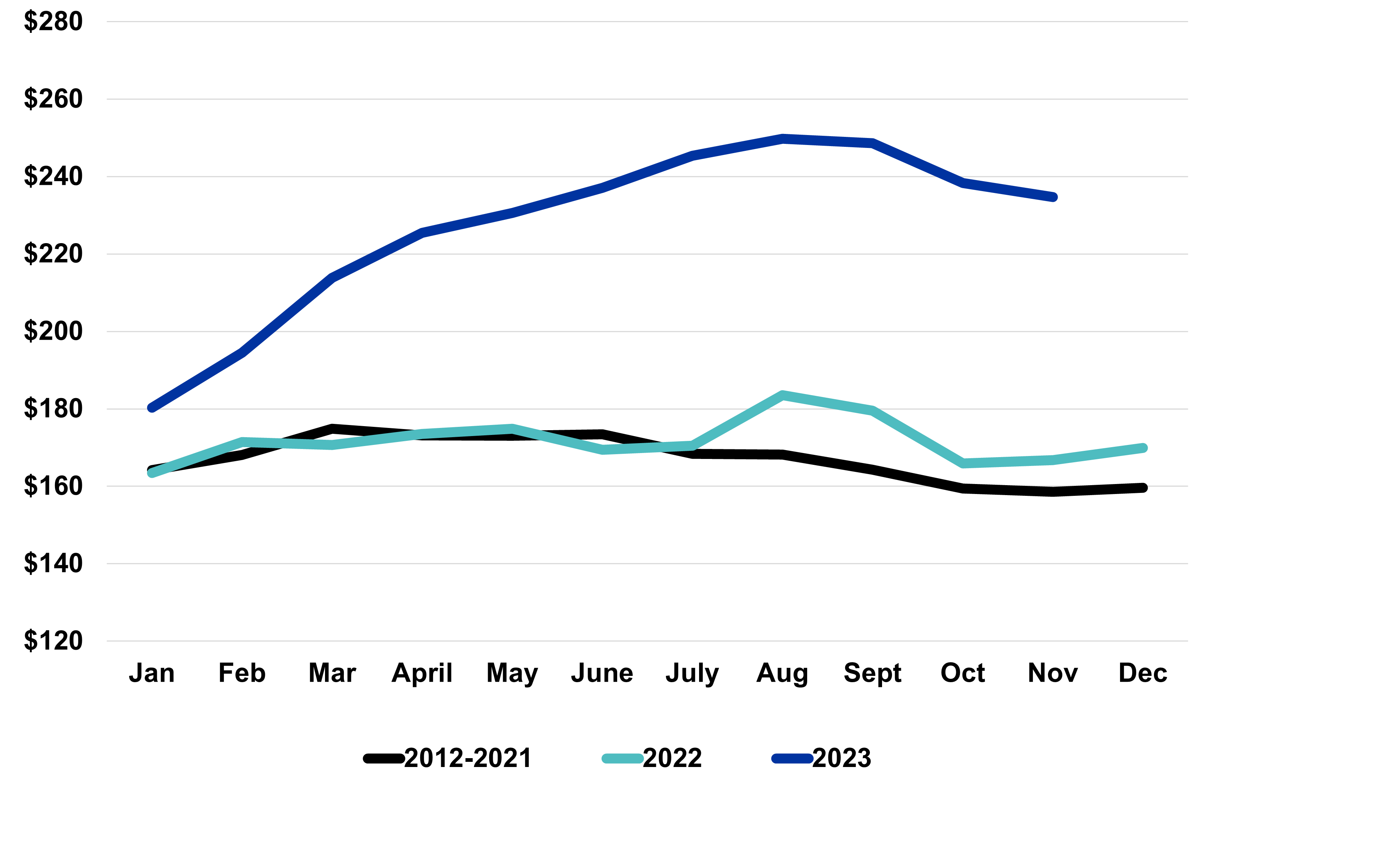

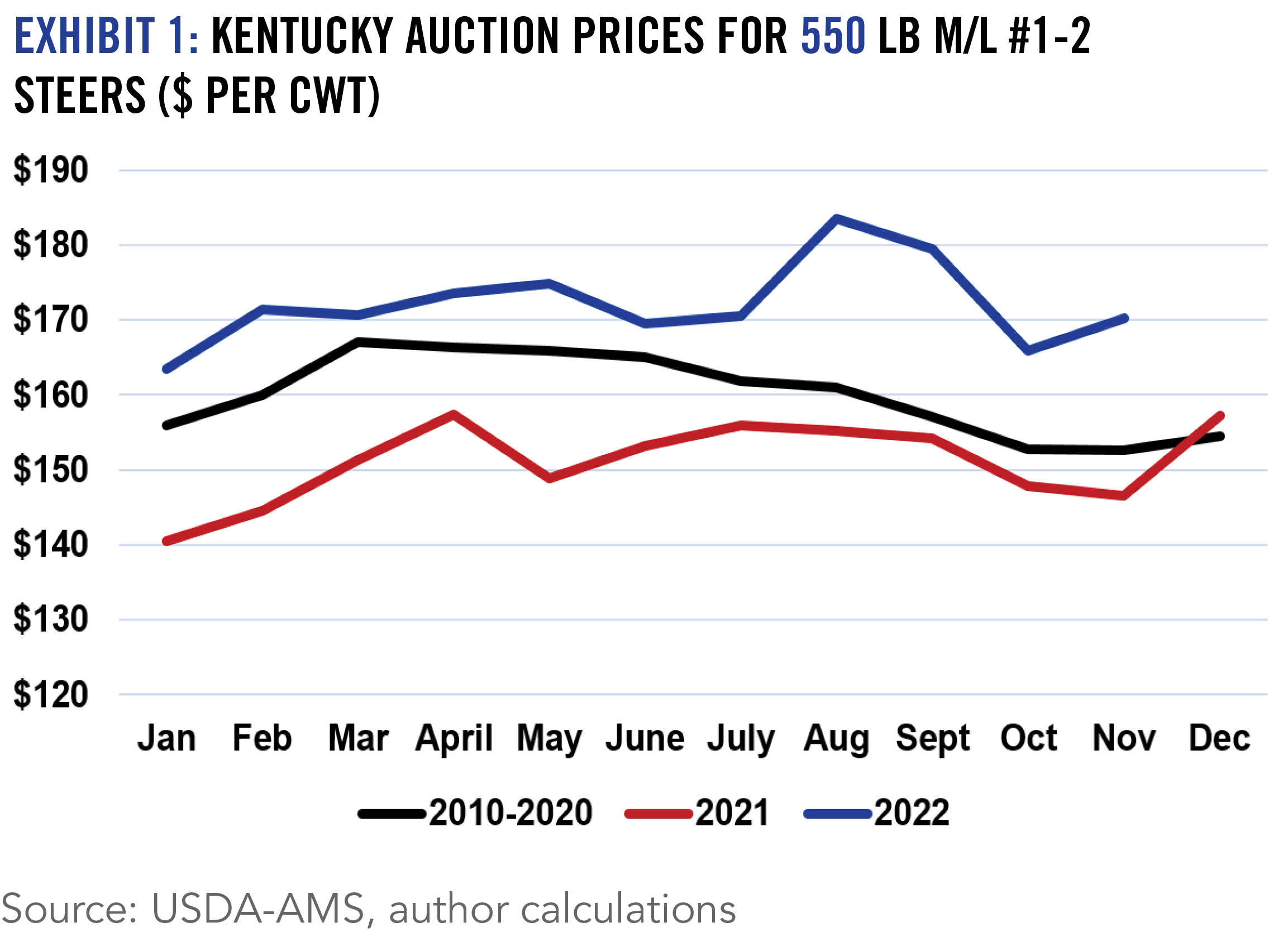

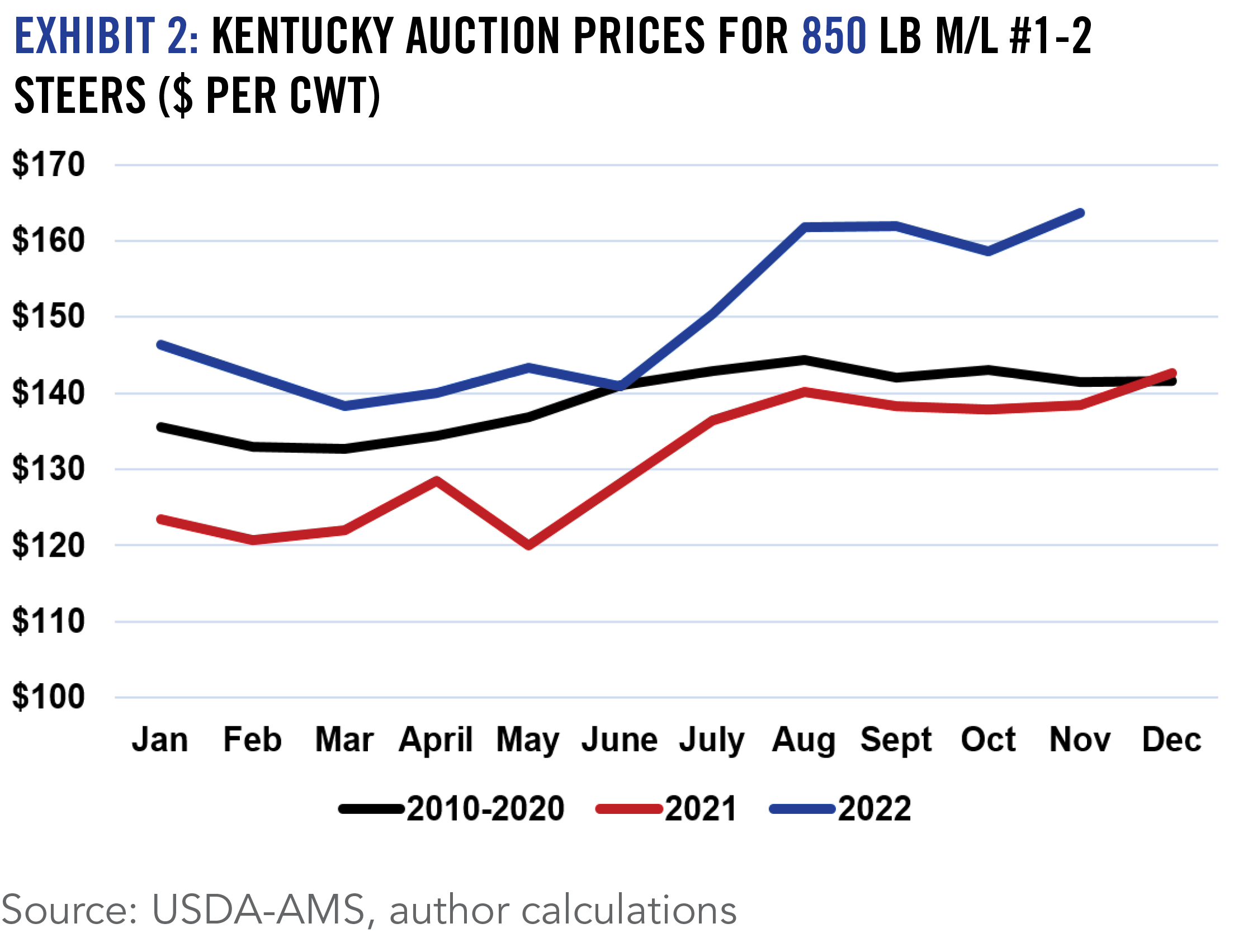

The beef cattle sector entered 2024 with beef cow inventory at a 63-year low. Tight supplies drove cattle markets during the year with calf and feeder cattle prices $30-$50 per cwt higher than 2023. Beef production was essentially unchanged from last year as cheaper feed led to longer feeding periods and higher finished weights. An increase was also seen in live cattle imports. Feeder cattle prices did pull back sharply from summer to early fall but increased counter-seasonally as we moved through fall and into winter as winter wheat grazing prospects improved. In late November, cattle markets moved higher again after New World Screwworm was found in Southern Mexico, leading to bans on the importation of live cattle originating from there.

2025 Outlook

Despite the strong calf markets, there is little indication that herd expansion has begun. A large number of factors are at play here including higher production costs, weather challenges, strong cull cow prices, and high interest rates. The beef cow herd will be smaller in 2025 than it was in 2024, which means calf supply will be even tighter. If weather cooperates and heifer retention does begin in 2025, this will only further tighten calf supplies. While there are always factors that can negatively impact markets (geopolitical concerns, inflation, etc.), the supply fundamentals are very encouraging for the next couple of years. Beef cattle producers should consider risk management strategies to protect themselves from downside risk but should also consider these markets as opportunities to invest in their operations to get where they want to be long term. For some farms, this may mean herd expansion. But for others this could mean investment in genetics, facilities, grazing systems or other things to improve efficiency and ability to add value to their cattle.

Kentucky Auction Prices, 550 lb. M/L #1-2 Steers ($ per cwt)

Source: USDA-AMS, author calculations

Kentucky Auction Prices, 850 Ib M/L #1-2 Steers ($ per cwt)

Source: USDA-AMS, author calculations

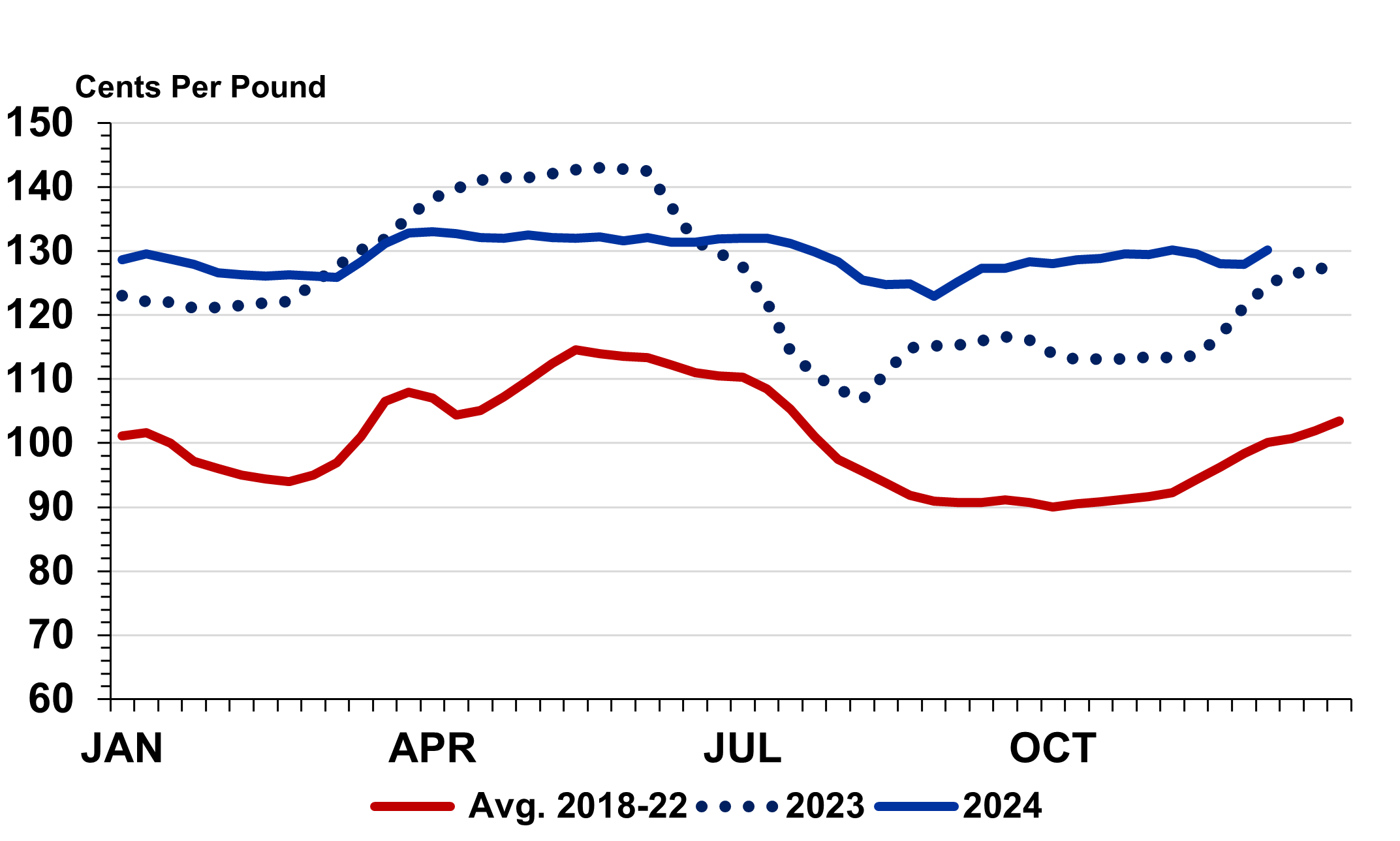

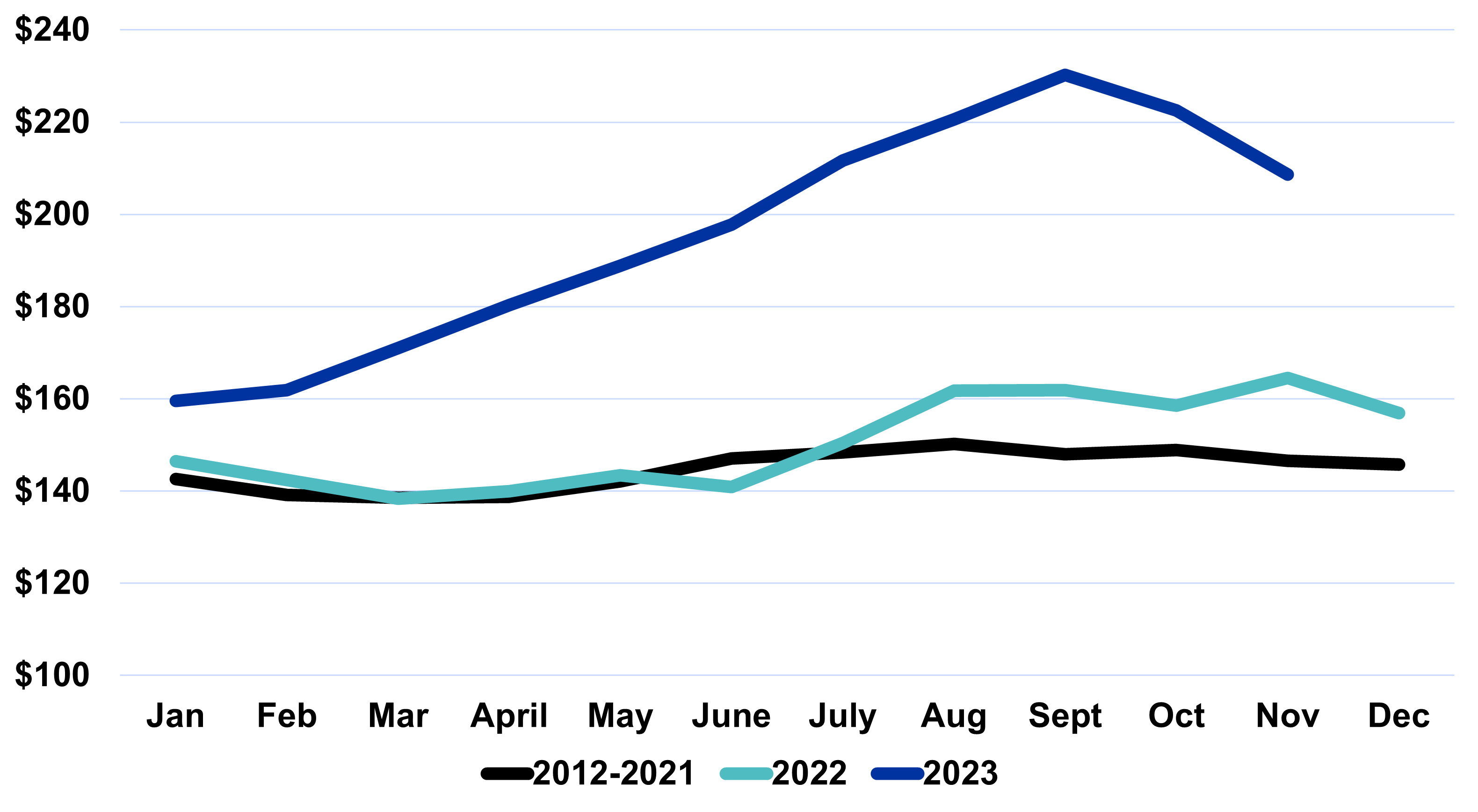

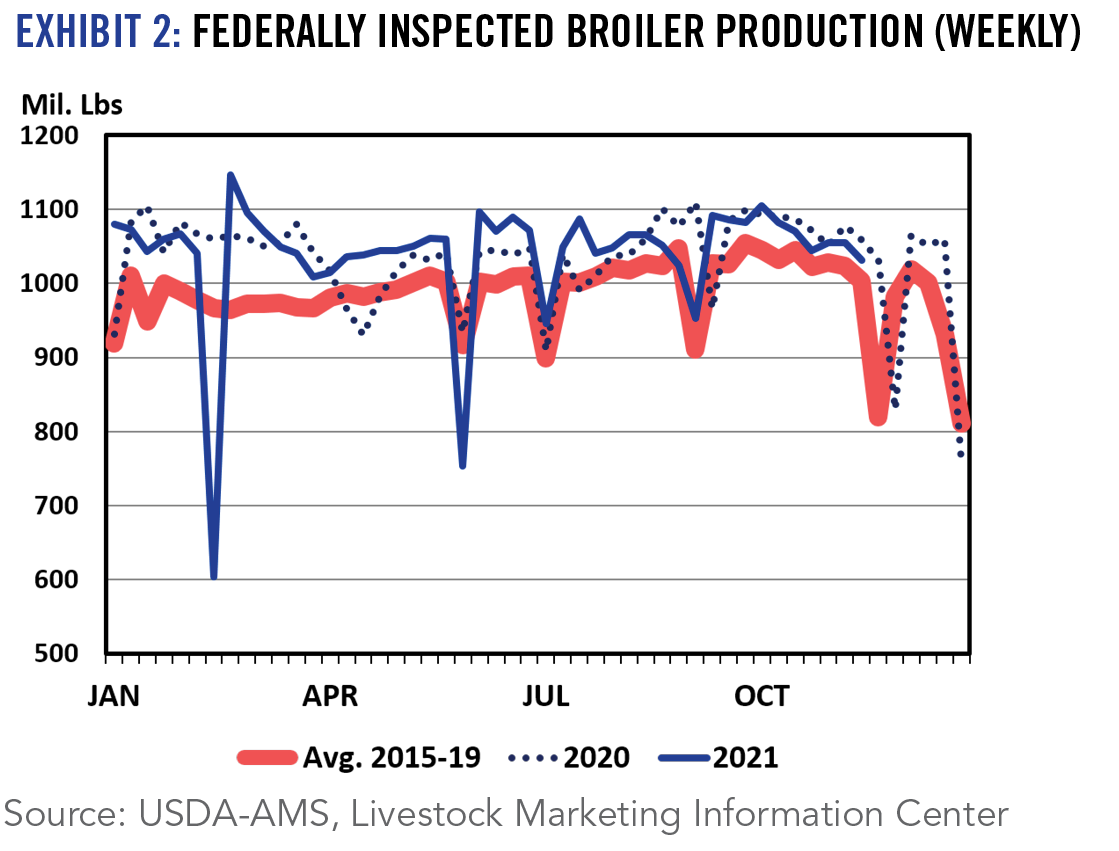

2024 Overview

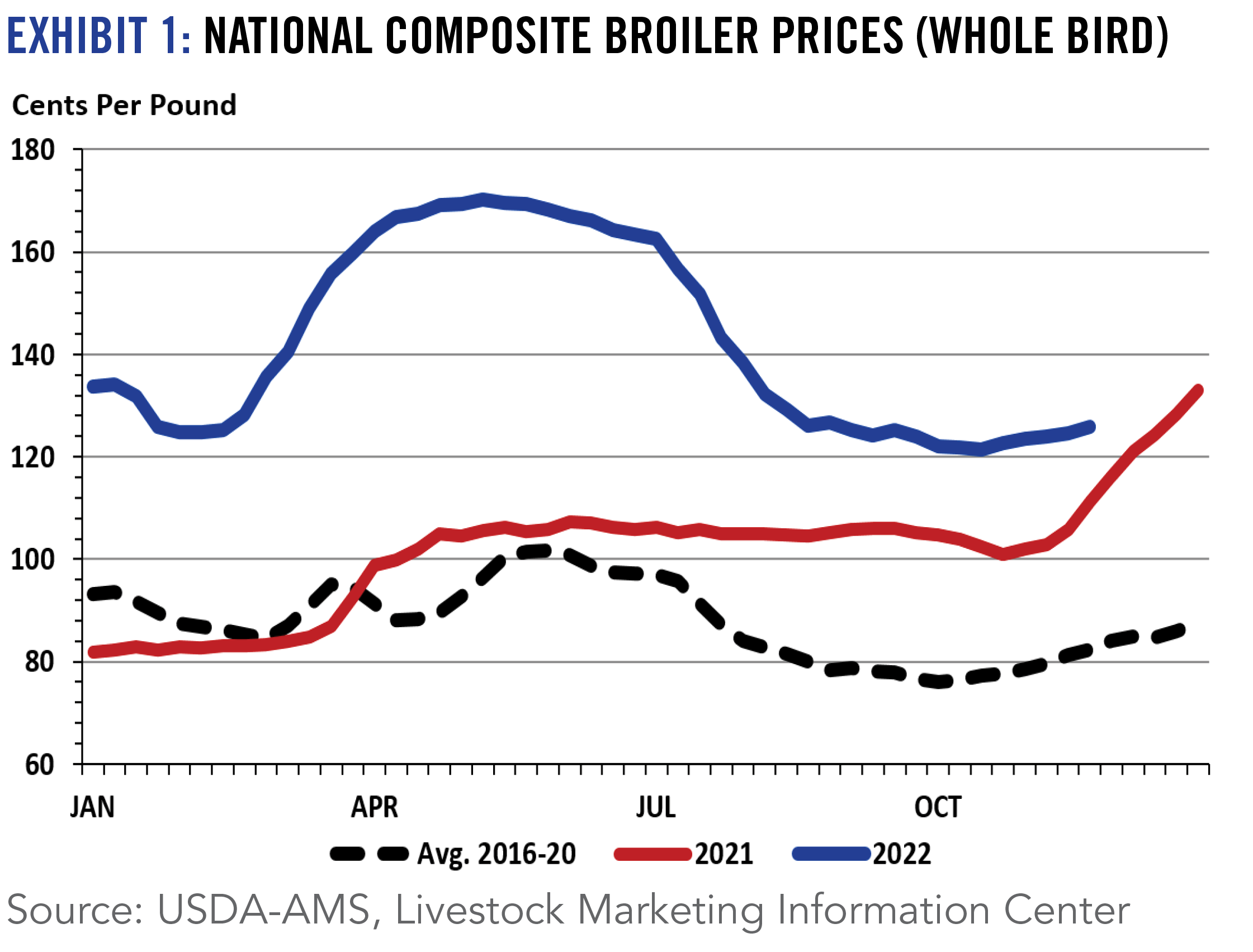

The story of 2023 was one of poultry plant closures and Avian Influenza. Fortunately, neither has dominated the discussion to the same extent in 2024. At the national level, broiler production will be up 1.5% to 2.0% for the year, while wholesale prices will be up by about 4% year-over-year. Higher production levels and stronger wholesale prices contributed to another increase in the value of broiler production in the Commonwealth. While a smaller share of the total market, egg prices were also up sharply (+72%) in 2024. Highly Pathogenic Avian Influenza hitting the layer sector was a major contributor nationally but was also lagged due to the time it takes for a layer to mature into producing eggs. Out times and operating costs continue to be a challenge for growers, but lower feed costs are positively impacting integrators.

2025 Outlook

Higher material and construction costs, combined with higher interest rates, continue to create challenges for new growers and those wishing to upgrade existing facilities. But at the same time, lower feed prices are improving profitability across the sector as a whole. This, combined with continued strength in protein values suggests that growth is again likely for 2025. While Avian Influenza cases are much less prevalent going into 2025, this always bears watching. Disease outbreaks and national disasters have proven to be the primary risk factors for the poultry sector over the last few years.

Broiler Prices, National Composite (Whole Bird), Weekly

Source: USDA-AMS, Livestock Marketing Information Center

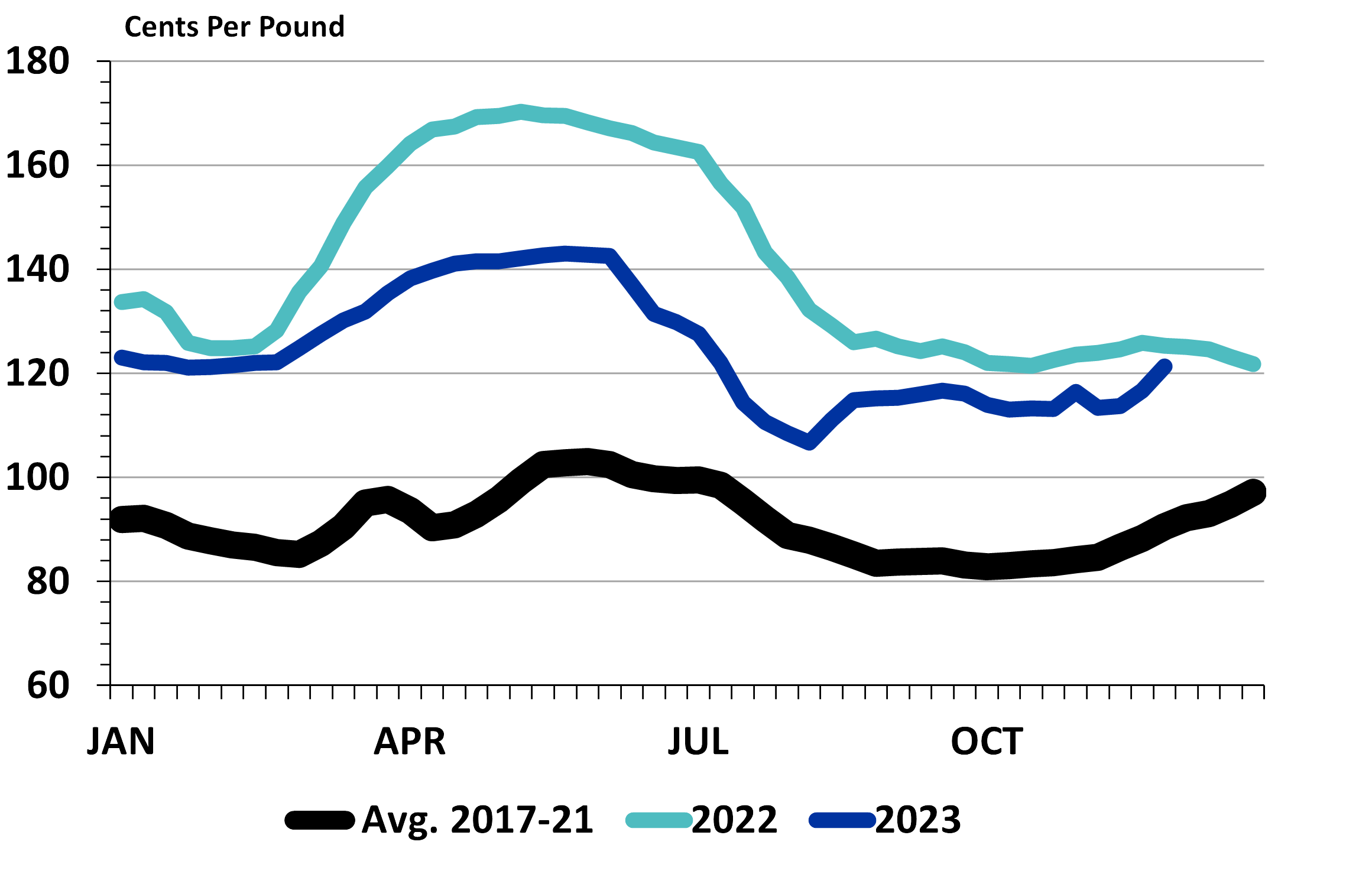

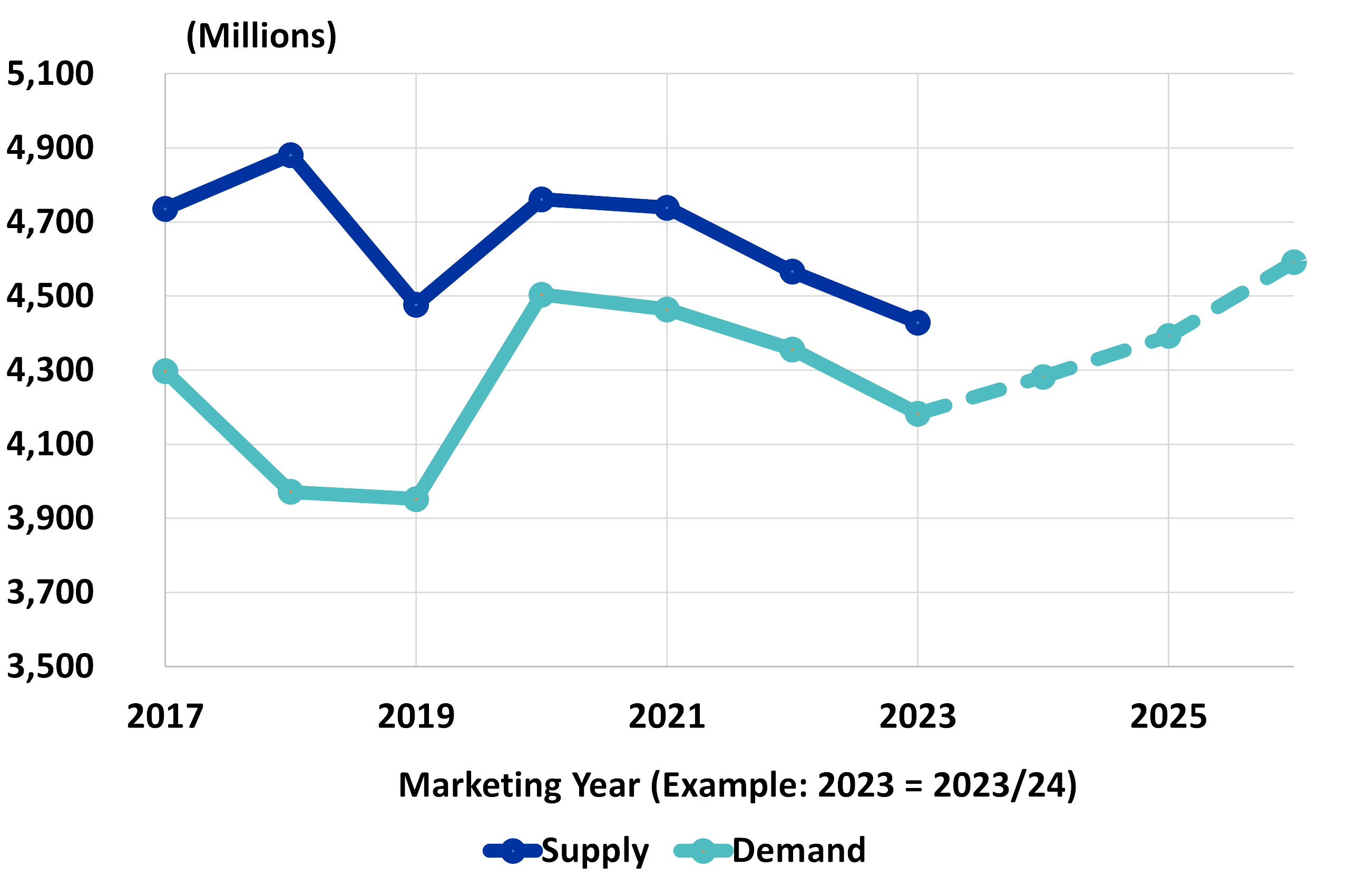

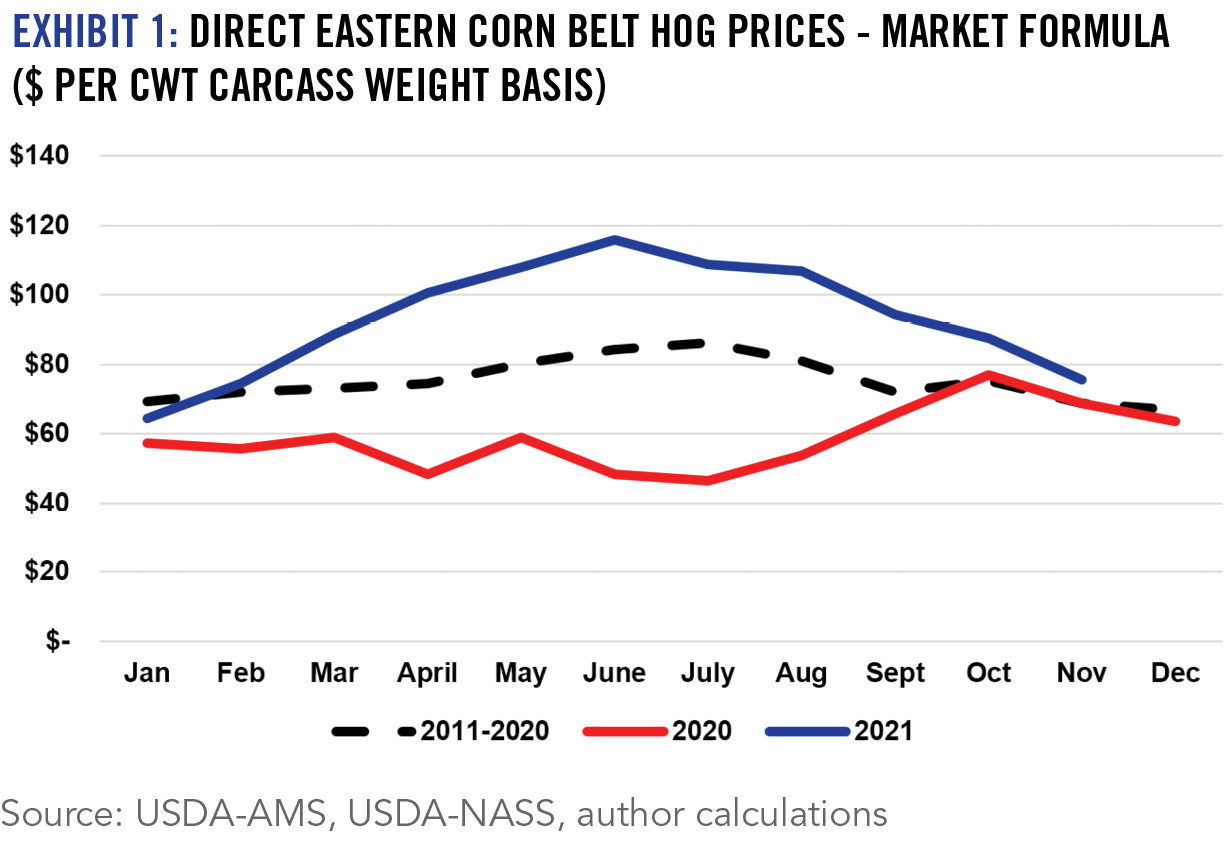

2024 Overview

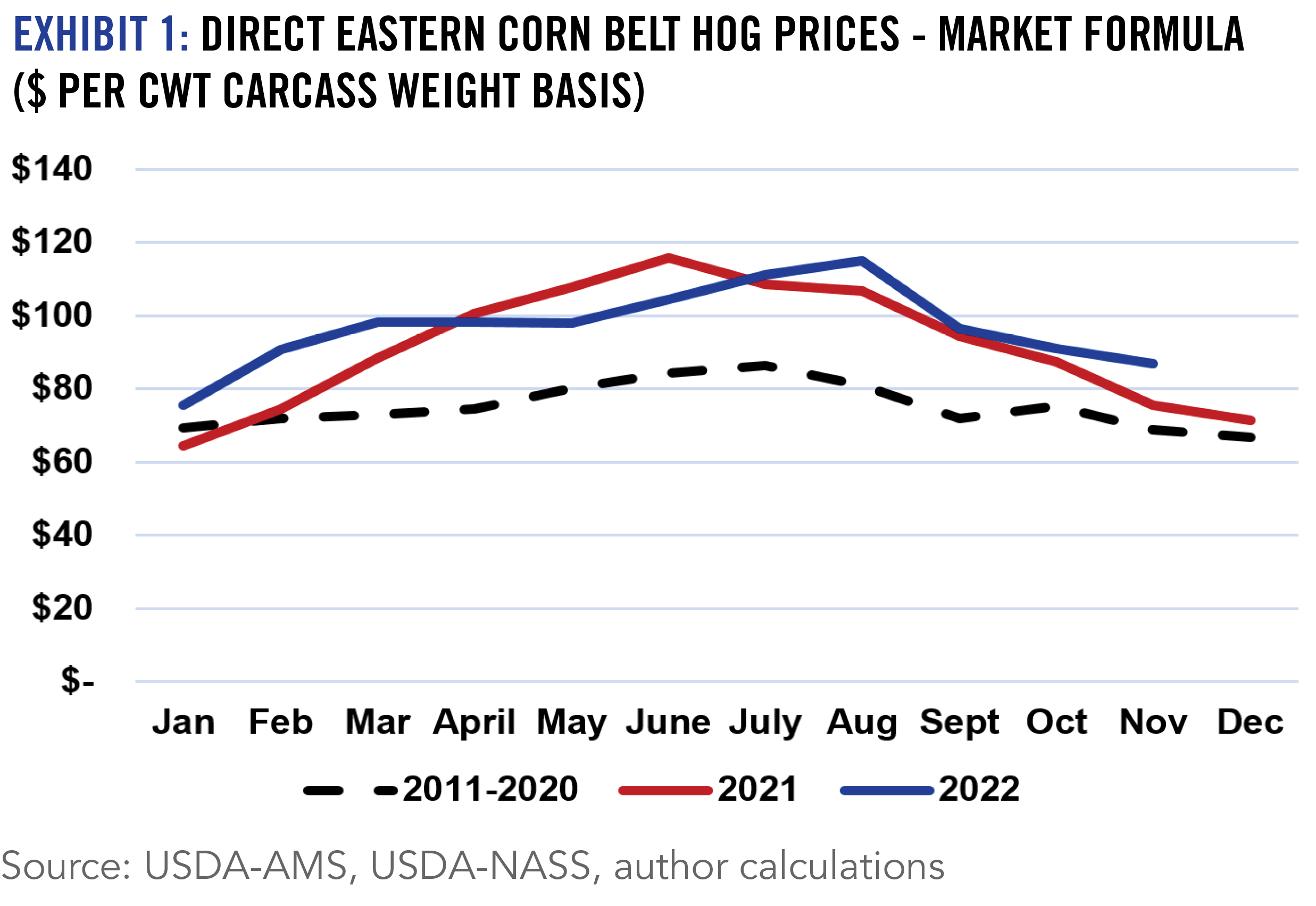

After a brutal 2023, farrow-to-finish margins showed some improvement in 2024 as hog prices increased and lower feed prices persisted. Exports have continued to be a bright spot and are on track to be up by more than 4% from the strong levels seen last year. US pork production increased by 2% during 2024 but was driven by productivity gains; breeding hog inventory has been dropping since 2020. Much like 2023, Kentucky came into 2024 with steady breeding hog inventory, but an increase in market hog numbers. Through November 2024 Eastern Cornbelt Hog prices were roughly 6% higher than 2023.

2025 Outlook

Productivity gains in the hog sector continue to impress and are likely to result in another pork production increase for 2025. Despite higher production levels, a year-over-year hog price increase is very possible next year and should be combined with continued lower feed prices. As a result, Kentucky’s independent operations should see continued margin improvement in 2025 and the same factors should lead to continued opportunities for contract integrated operations.

Direct Eastern Corn Belt Hog Prices, Market Formula ($ per cwt carcass weight basis)

Source: USDA-AMS, USDA-NASS, author calculations

2024 Overview

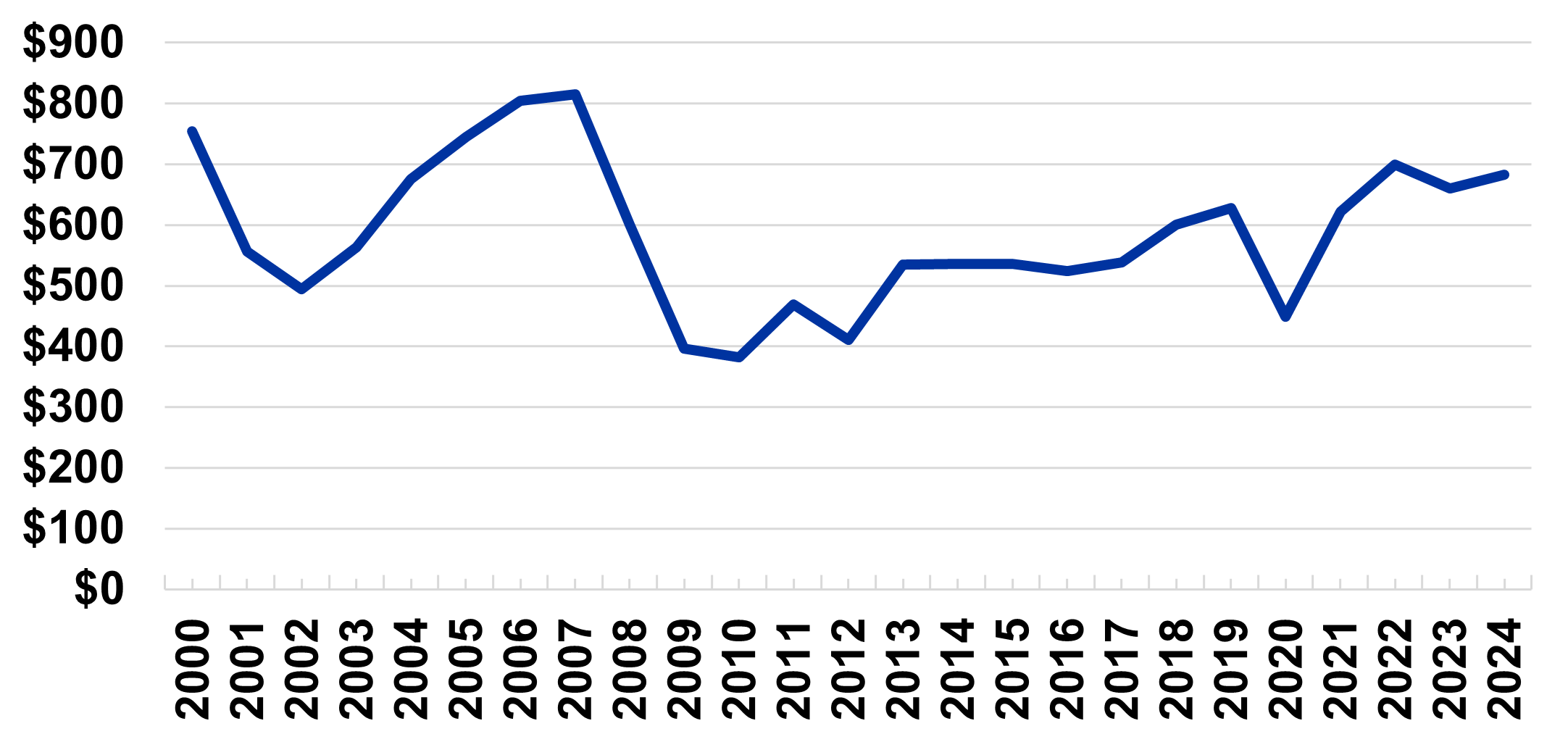

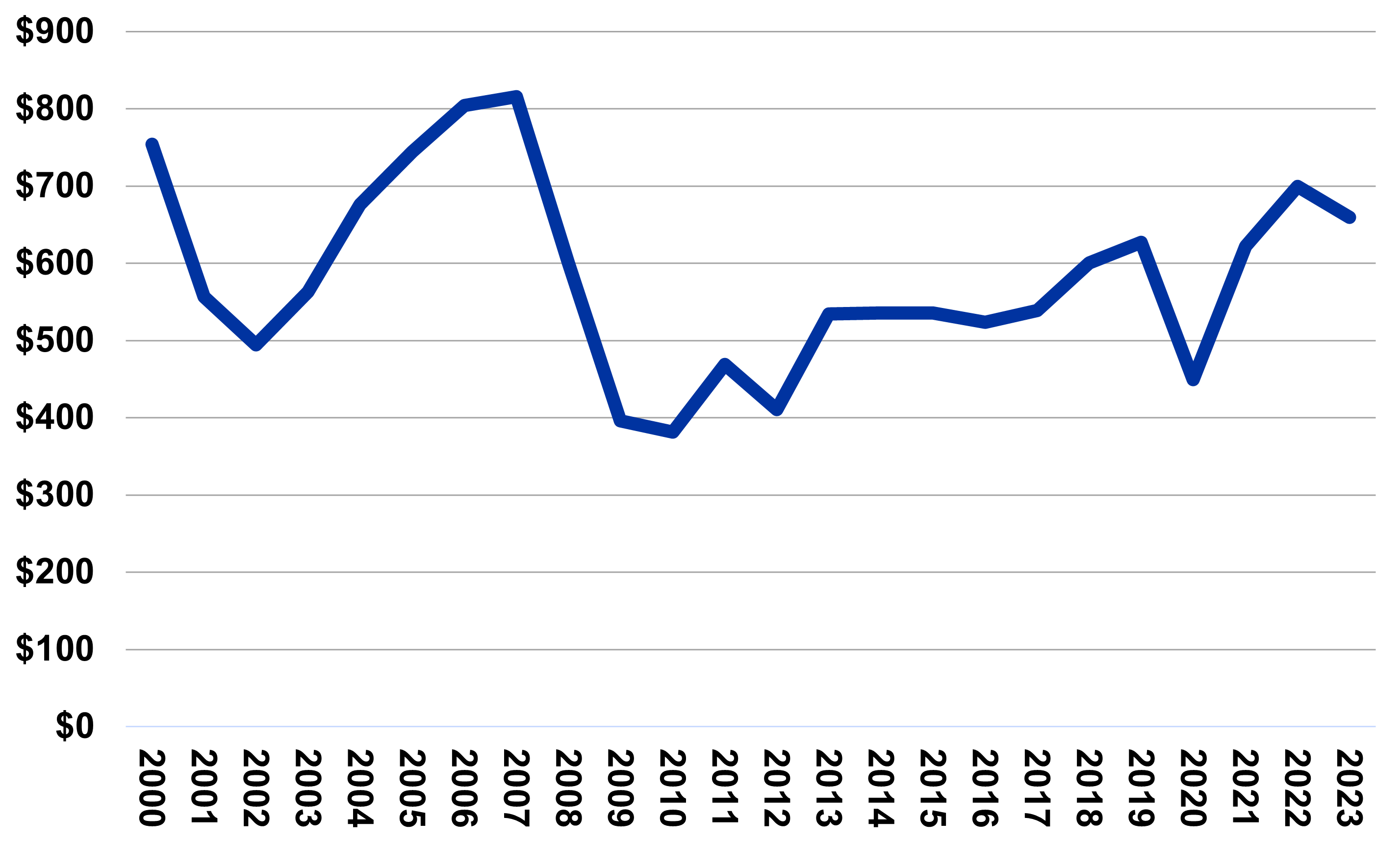

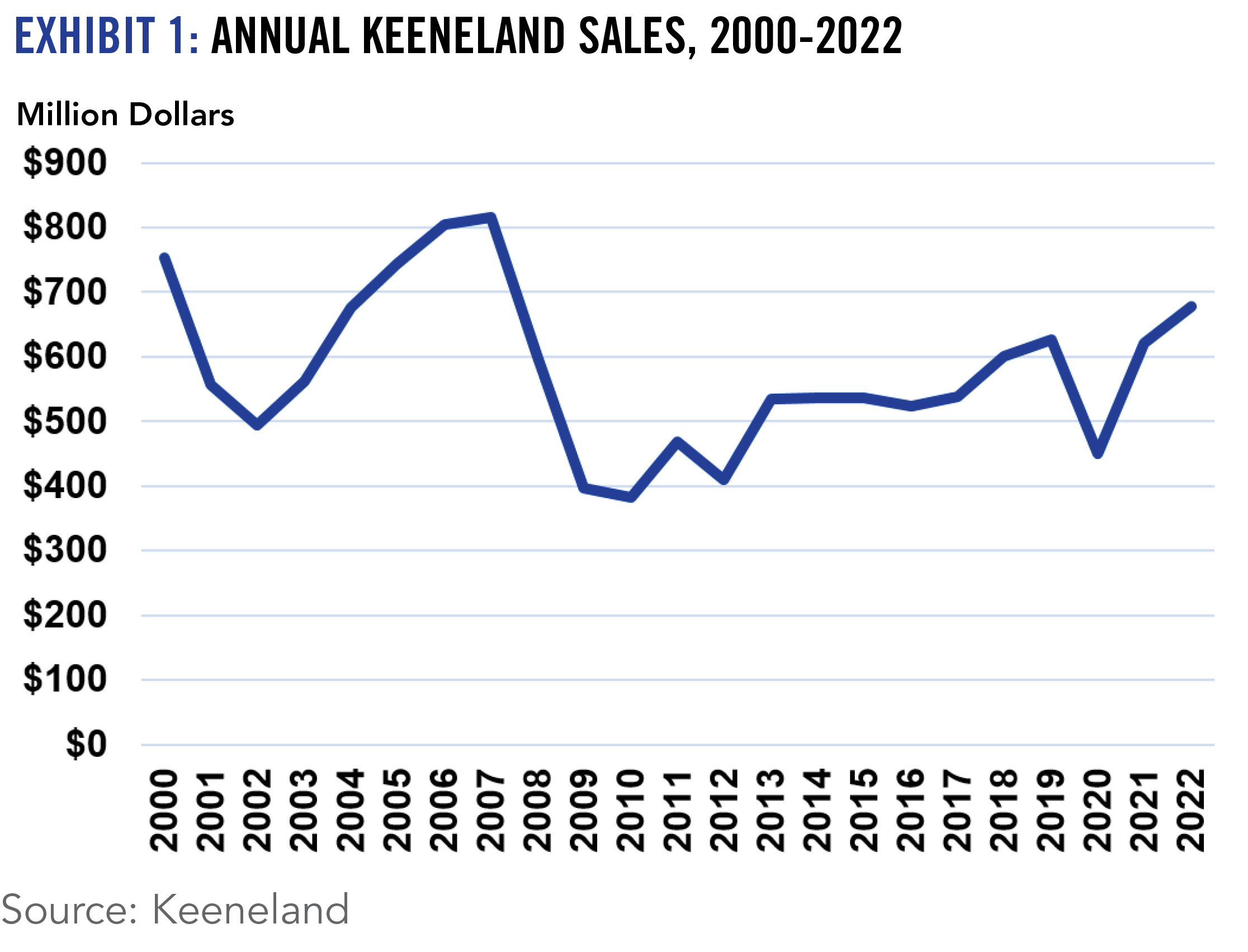

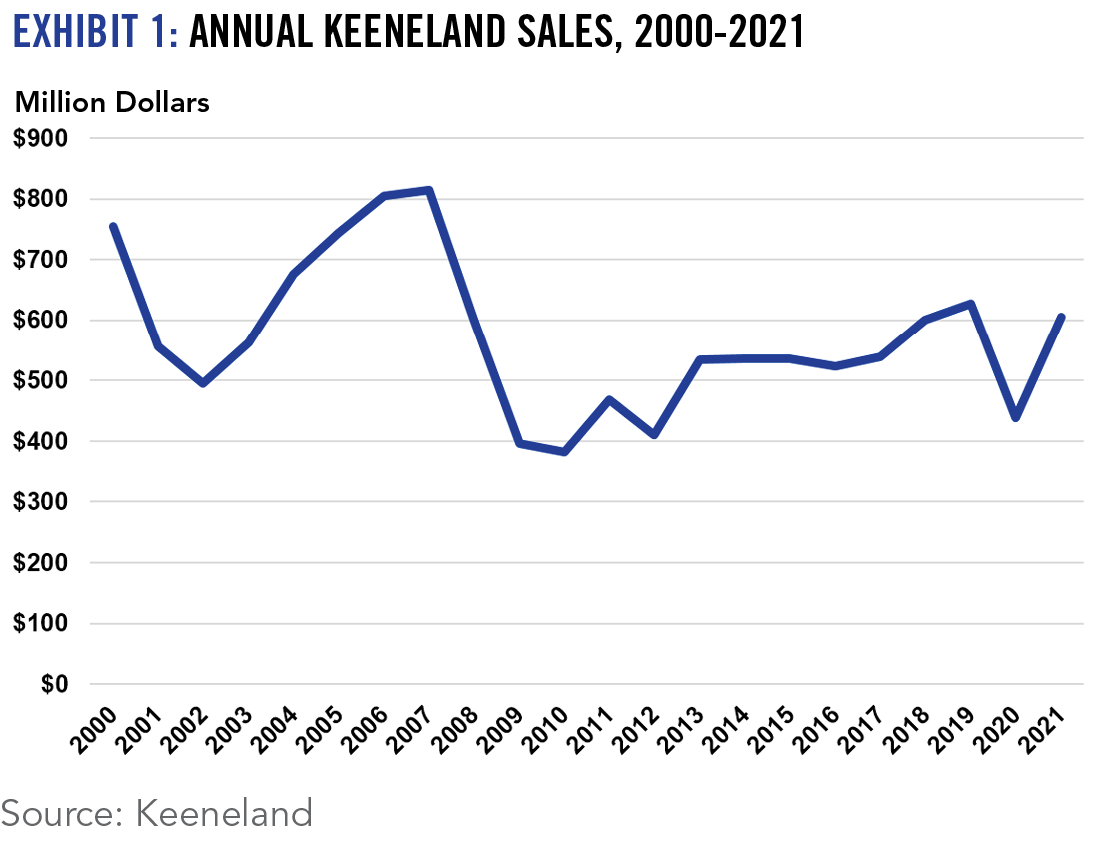

After a 6% decrease in 2023, Keeneland sales revenue increased by more than 3% during 2024. This occurred in spite of a 6% decrease in the number of horses sold through the venue. While the $682 million total was less than 2022, it was the second highest annual total since 2007. Consistent with the national trend, a 2% decrease was seen in the number of mares bred in Kentucky (The Jockey Club). This decrease in mares bred will partially offset the stronger sales and moderate the impact on equine cash receipts for the state.

2025 Outlook

Stronger sales in 2024 provide optimism for next year, as does continued gaming revenues and the associated impact on purses. Higher average sale values in 2024 may also have impacts on stud fees in 2025, which represent a significant share of equine receipts for the state. Inflationary pressures will continue to weigh on equine markets and non-racing horses may be disproportionately impacted. Still, the momentum from a relatively strong sales year, combined with the potential for stability in stud fees would suggest another increase in equine receipts is very possible

Annual Keeneland Sales: 2000 to 2024 (millions of dollars)

Source: Keeneland website

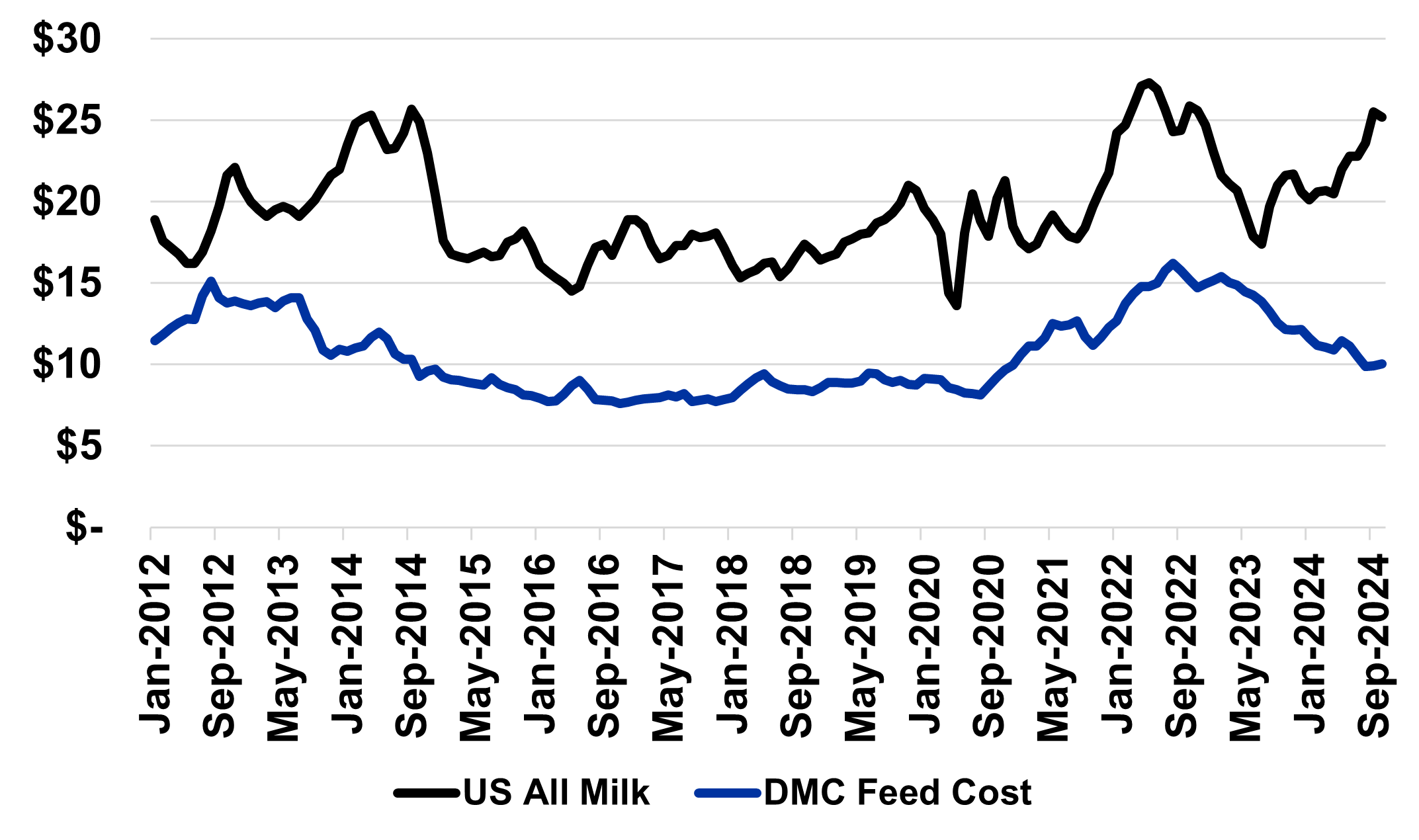

2024 Overview

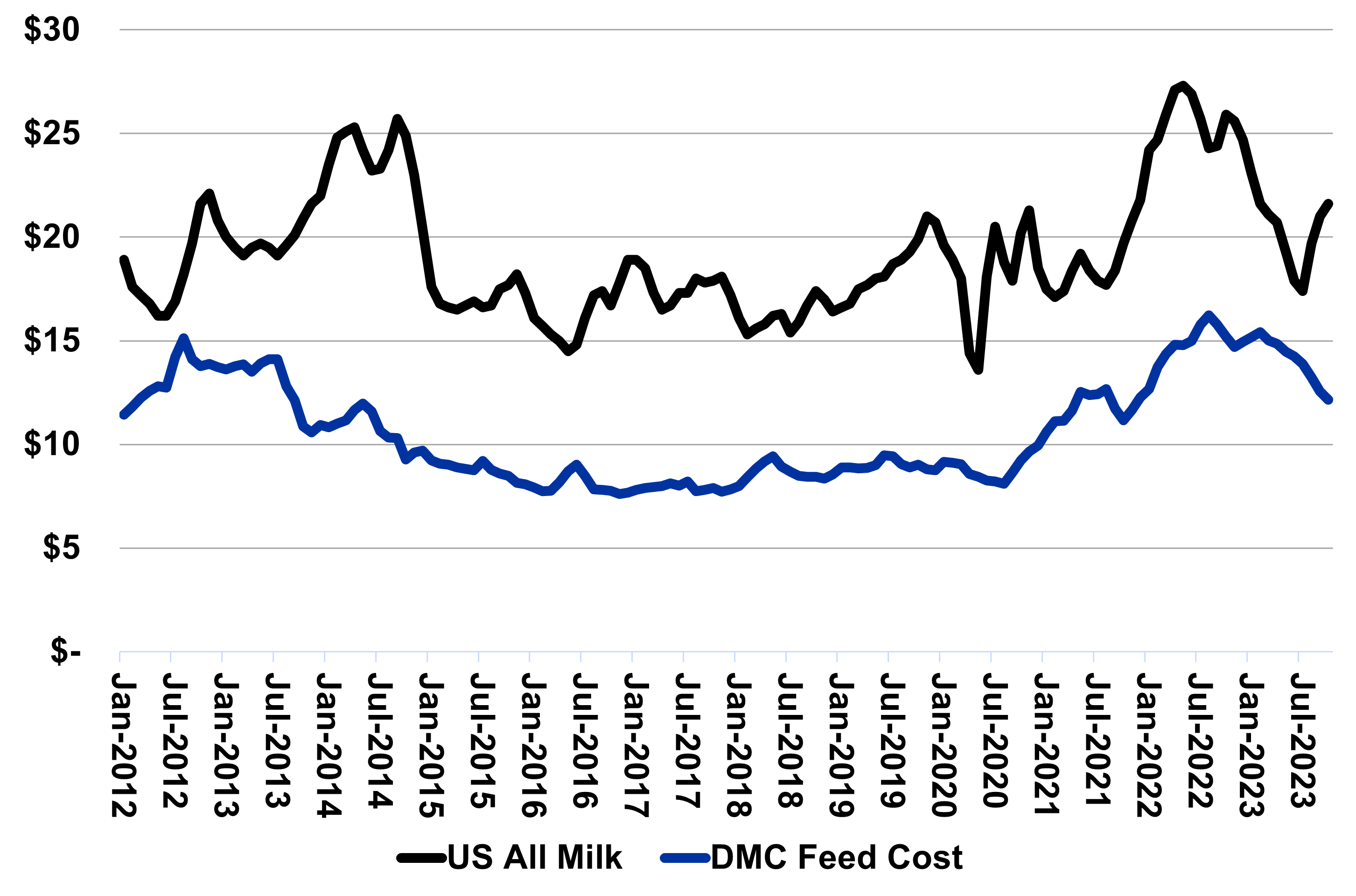

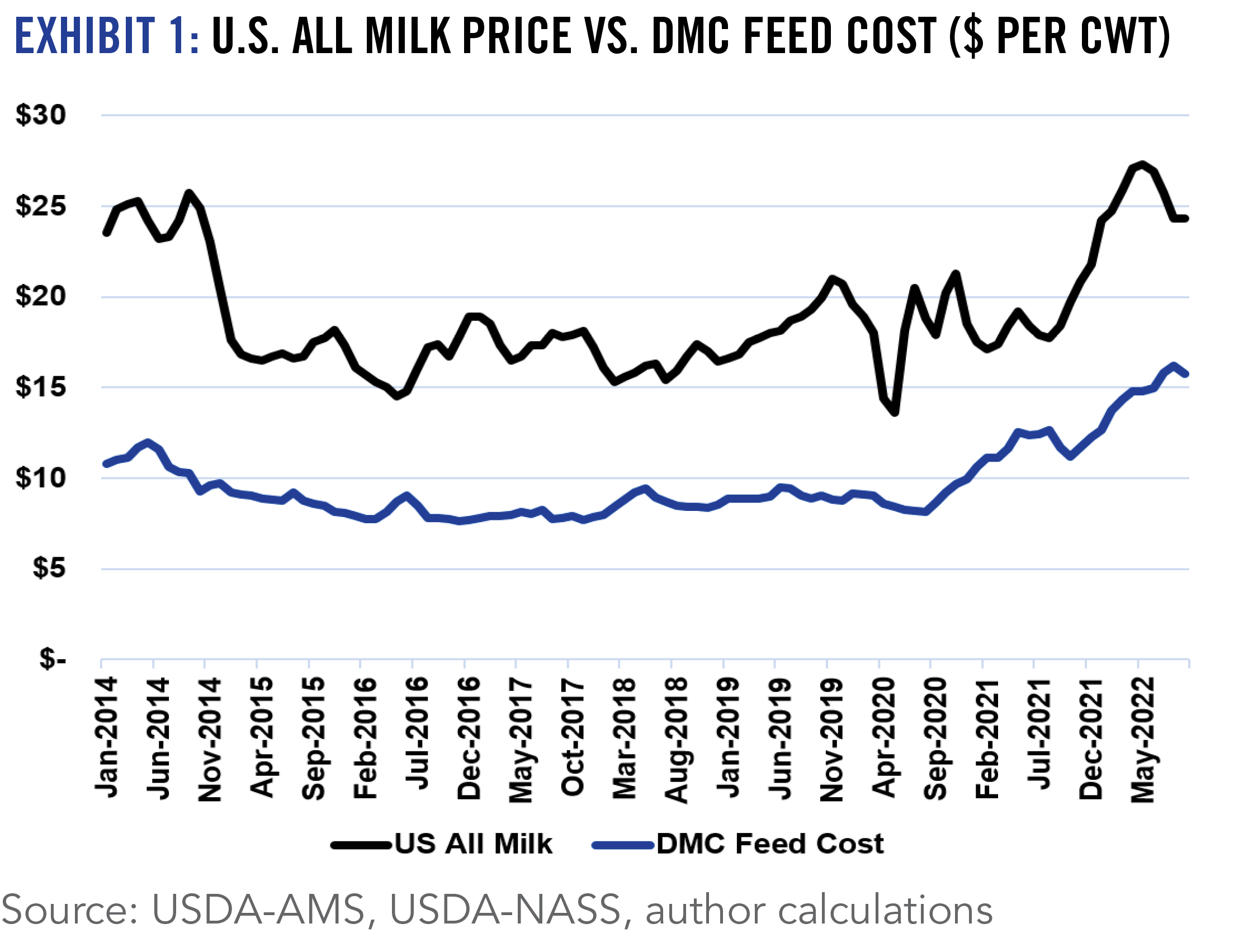

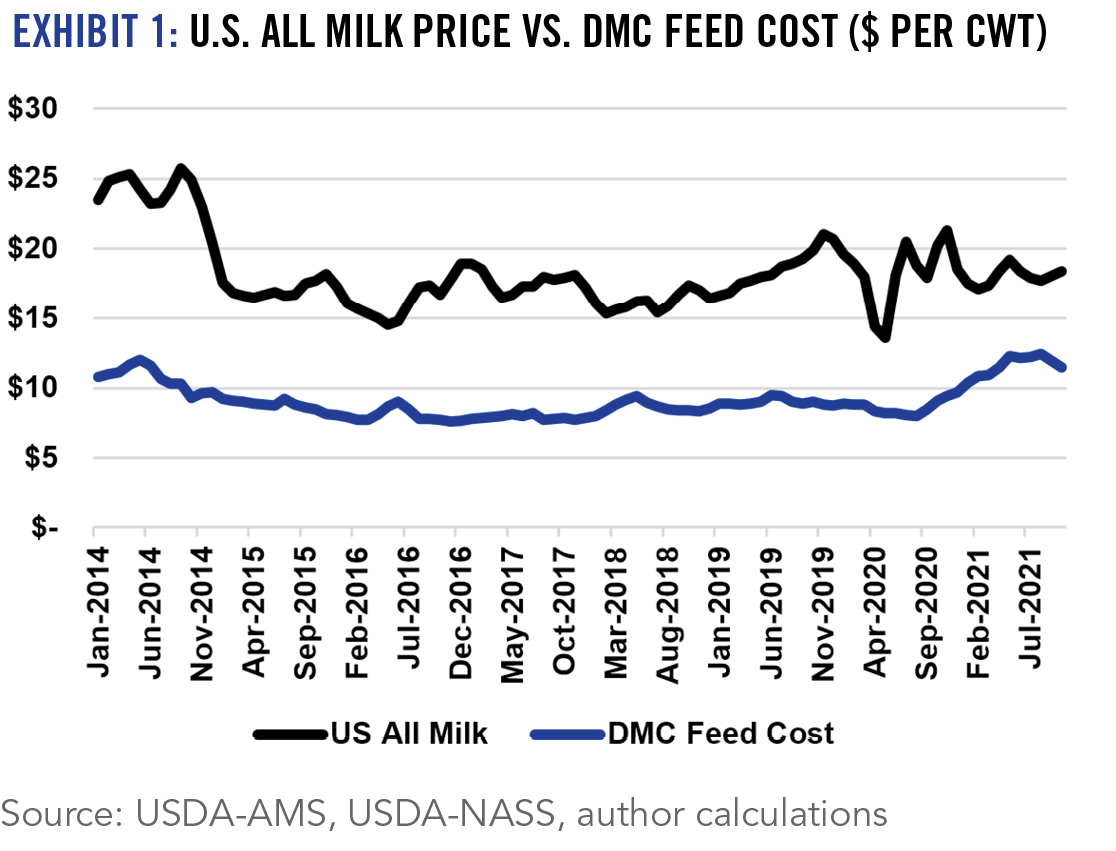

While 2023 will not be remembered fondly by dairy producers, 2024 will be considered an impressive turnaround. Dairy cow numbers were lower for much of the year and milk production was down slightly. Most dairy product values have been higher and farm-level milk prices are on track to be about $2 per cwt higher than last year. Just an importantly, feed costs are sharply lower resulting in a major improvement in returns. The Dairy Margin Coverage (DMC) margin in fall of 2024 was as high as it had been since 2014.

2025 Outlook

It is very likely that the increases in dairy cow inventory being seen by fall of 2024 will continue into 2025. This, combined with some productivity gains, should result in a slight increase in milk production next year. While it seems unlikely that 2025 prices will be at levels as high as fall of 2024, it seems just as likely they remain higher than the first half of last year. In the current feed cost environment, this likely translates into a solid year for dairy producers. The beef-on-dairy trend will continue to gain momentum and continued consolidation seems probable. Despite the generally favorable outlook, dairy producers should continue to utilize the DMC program and other risk management tools available to them.

U.S. All Milk Price vs DMC Feed Cost ($ per cwt), January 2012 to September 2024

Source: USDA-AMS, USDA-NASS, author calculations

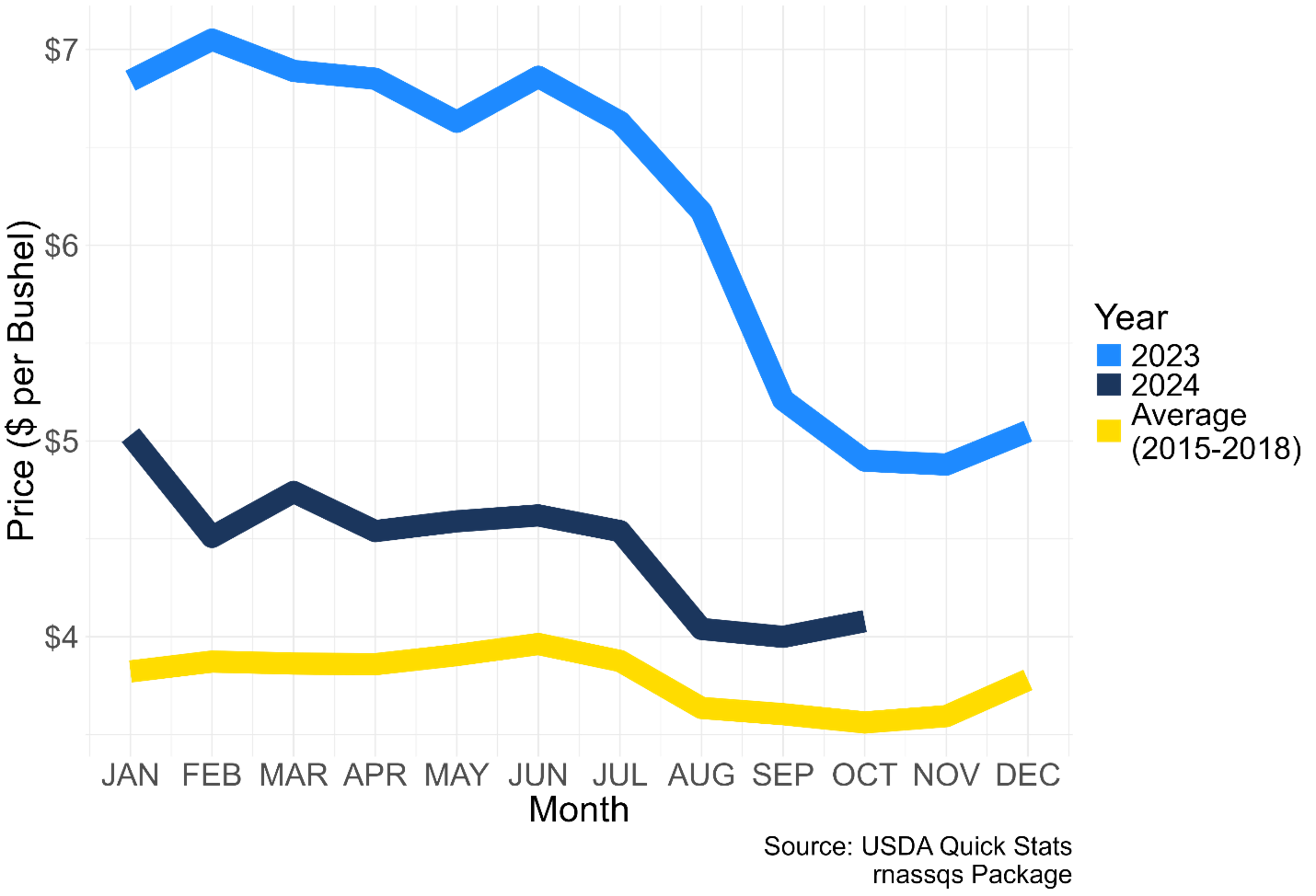

2024 Situation

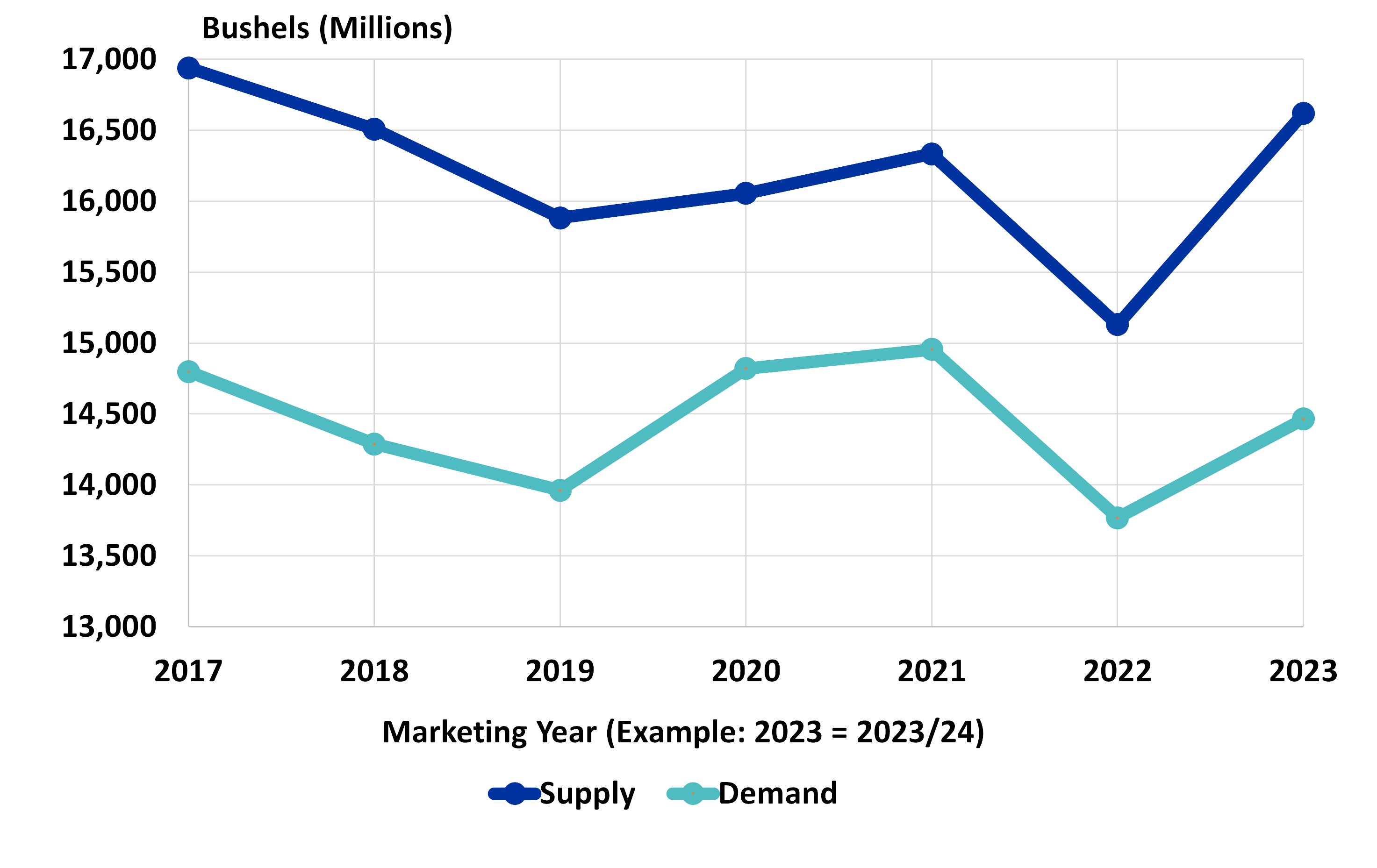

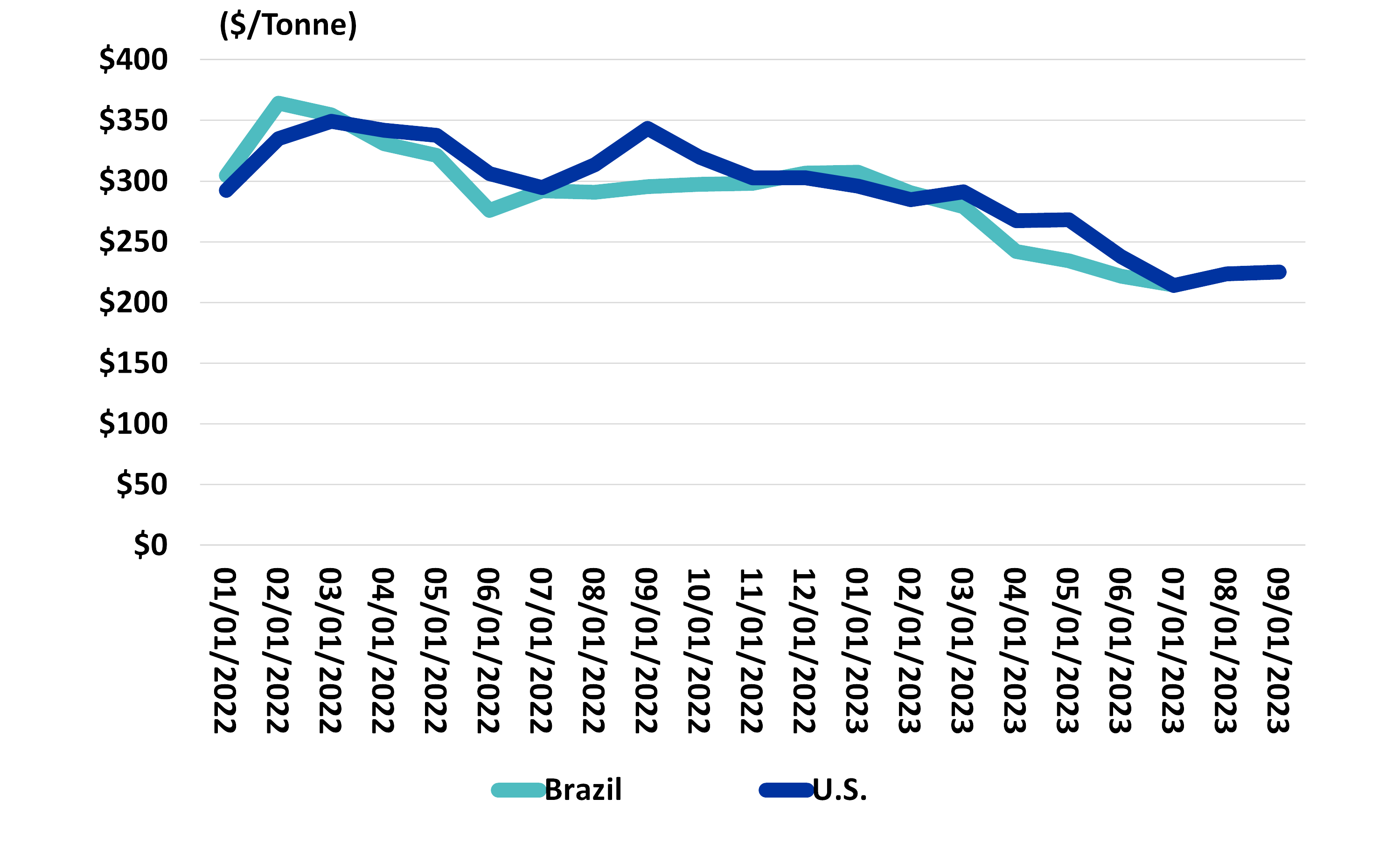

In 2024, corn prices reached their lowest inflation-adjusted level in at least the last decade, signaling one of the worst market outlooks in recent history. Central Kentucky experienced significant yield losses due to drought, although other regions managed average or better production. A near-record corn harvest elsewhere was compounded by substantial carryover from 2023, inflating supply levels and pushing down prices. Demand is expected to remain relatively constant, with ethanol production operating at capacity and no planned expansion, while a smaller cattle herd is limiting feed demand. Although exports are steady, they are insufficient to reduce large ending stocks. As a result, prices declined rapidly from $6.00/bu in late 2022 to around $4.00/bu in 2024. Current trends suggest prices may follow the 2015–2018 average, with modest increases mid-year before falling post-harvest.

2025 Outlook

In 2025, prices are expected to remain depressed with no obvious catalyst to change supply and demand dynamics. Reducing corn acreage will be essential to rebalancing the market while expanding exports could help reduce excess stocks. However, this relies heavily on stable trade relationships and favorable policies, as tariffs and geopolitical tensions remain key risks. Long-term opportunities may arise from initiatives like Sustainable Aviation Fuel, but these depend on policy support. Additionally, the ongoing conflict between Russia and Ukraine could influence global markets, with any escalation potentially driving prices up short-term via speculation.

Key Thoughts

Producers face a challenging financial outlook, with many expected to see losses ("red ink") due to persistently low prices and high supply levels. Effective marketing strategies will be critical in navigating these conditions. Pre-harvest producers are encouraged to book sales early when prices are higher while utilizing storage to capture basis returns post-harvest may offer additional value. Domestic demand remains stable but insufficient to alleviate the supply glut, emphasizing the importance of export markets. While prices are expected to follow their typical cyclical patterns—slowly rising into June or July before declining with new crop supplies—trade policies and geopolitical developments will significantly shape the market.

Kentucky Cash Corn Prices Trends by Year

2024 Situation

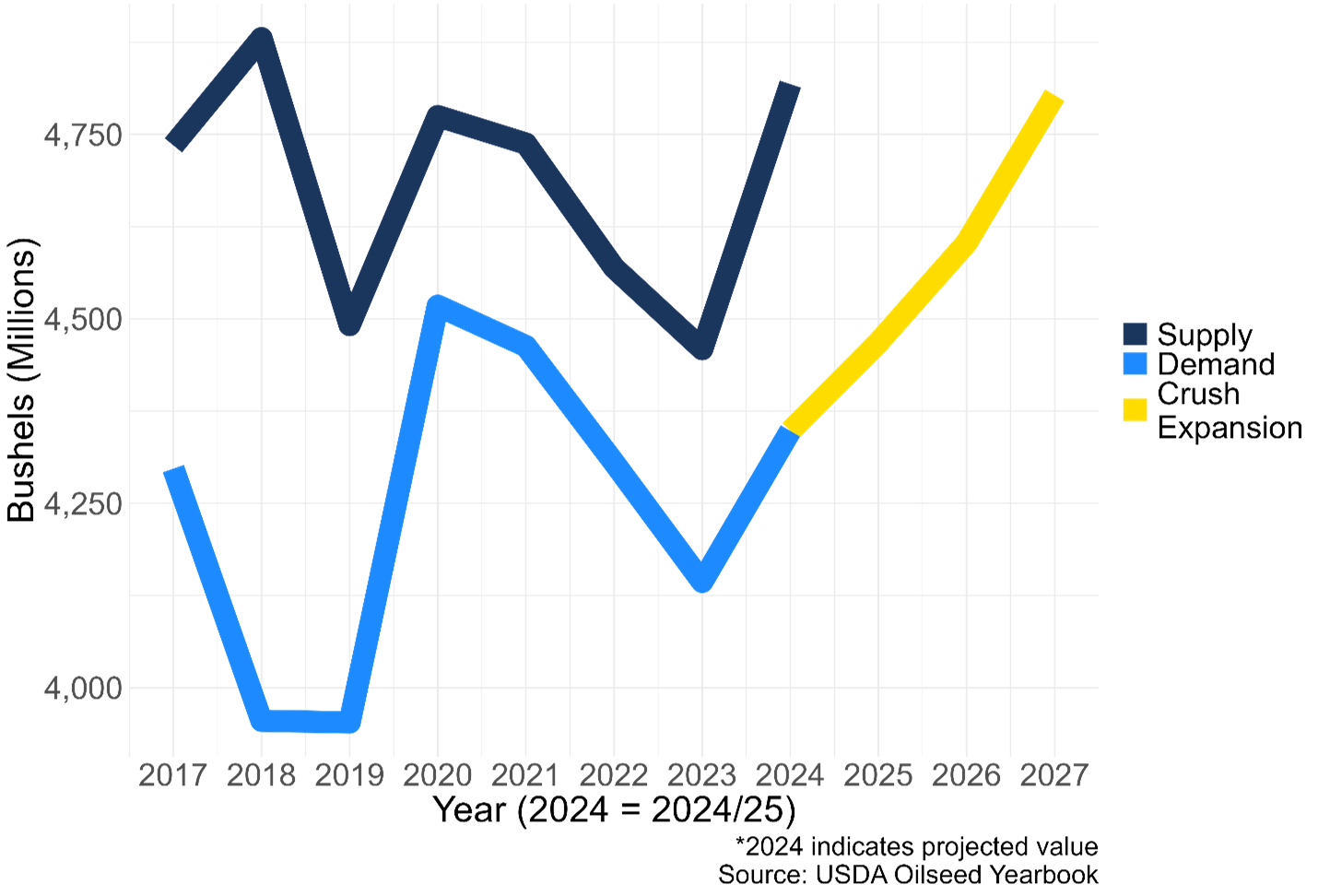

In 2024, soybean prices continued the downward trajectory from the previous year, averaging around $11.50 per bushel. This drop was primarily due to 2024 supply levels nearly matching those of 2018, a period marked by the lowest soybean prices, further exacerbated by the first Trump trade war. While demand has generally increased, driven by expanding crush capacity, the market remains oversupplied. Increased production met the expansion in crush capacity in 2024. Ending stocks suggest some leeway in the balance sheet creating a less volatile price environment.

2025 Outlook

Looking ahead to 2025, soybean prices are expected to follow trends observed in the 2010s. Prices will likely rise as the marketing year progresses, possibly influenced by Brazilian weather in February or March, before declining ahead of harvest in June or July. However, record Brazilian acreage is expected, which could stall price increases. Larger Brazilian acreage and US oversupply are expected to limit any significant price impacts in 2025. While US demand may outpace supply in 2026 if production does not follow crush expansion, the 2025 outlook remains bleak.

Key Thoughts

In the long term, the expansion of crush capacity through 2027 will likely tighten balance sheets and drive higher prices. However, these impacts depend on achieving expansion targets and meeting crush capacity. Although immediate effects on 2025 prices may be minimal, the long-term outlook suggests direct effects on soybean prices and indirect effects on corn prices. Key uncertainties include the amount of supply left on the market, acreage and production trends for 2026, and potential policy impacts from Trump trade strategies. Overall, while demand and crush capacity continue to grow, the current oversupply dampens short-term price prospects, with a more optimistic outlook for the coming years. The strategies of early marketing for delivery and utilizing storage for basis returns will again be key strategies in 2025.

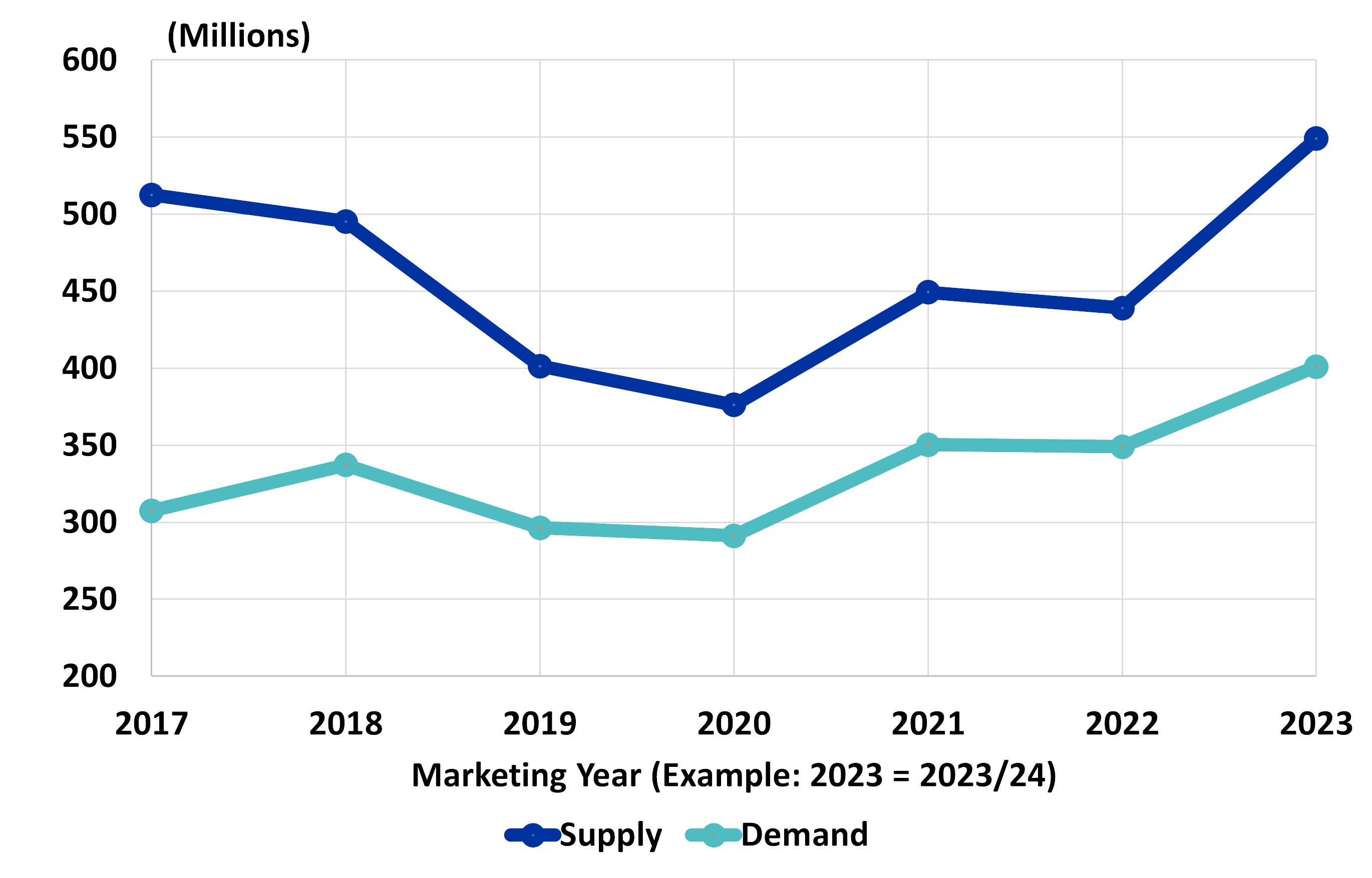

U.S. Soybean Supply and Demand by Marketing Year

2024 Situation

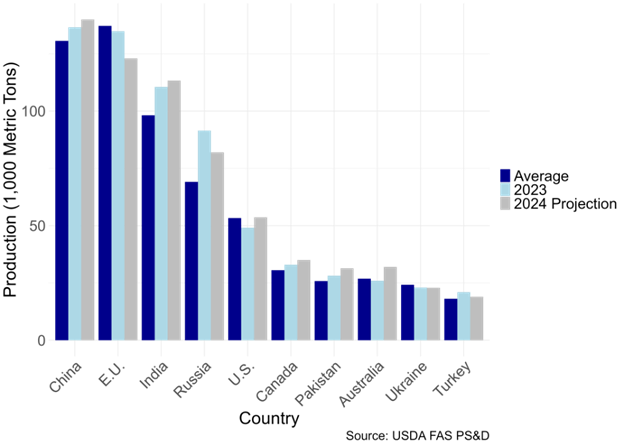

U.S. wheat supply increased in 2024, driven primarily by higher production even with reduced U.S. imports. Despite this, prices have risen since August, although it remains uncertain if a bottom has been reached. Last year’s average price was $6.50, with higher prices earlier in the year, and current harvest-time futures around $5.47/bu. Domestic demand for food use has remained steady, while seed, feed, and residual demand are flat. However, U.S. ending stocks are projected to rise, emphasizing the importance of exports.

2025 Outlook

Looking ahead to 2025, futures prices did not incentivize wheat acreage, leading to expectations of less double-crop wheat/soybean planting and reduced soft red winter wheat acreage. With a smaller expected acreage, price movements may be driven by demand, particularly in export markets, as global stocks remain tight. Wheat exports could depend on both quality and quantity, and low EU stocks and poor-quality production may present opportunities for U.S. wheat. Geopolitical uncertainties, including the Russia/Ukraine conflict, could still cause price fluctuations. While extreme swings like those in 2022 are unlikely, speculation could lead to significant volatility and pricing opportunities. Smaller U.S. wheat acreage in 2025 may contribute to supply-driven price changes as the market tries to buy wheat acres for 2026.

Key Points

- U.S. wheat supply is up, but double crop acreage is likely to decline.

- Tight world stocks and the EU facing production and quality issues may provide export opportunities for U.S. wheat.

- Geopolitical factors, particularly Russia/Ukraine, and speculative markets could drive price volatility and create short-term pricing opportunities.

Wheat Production by Country

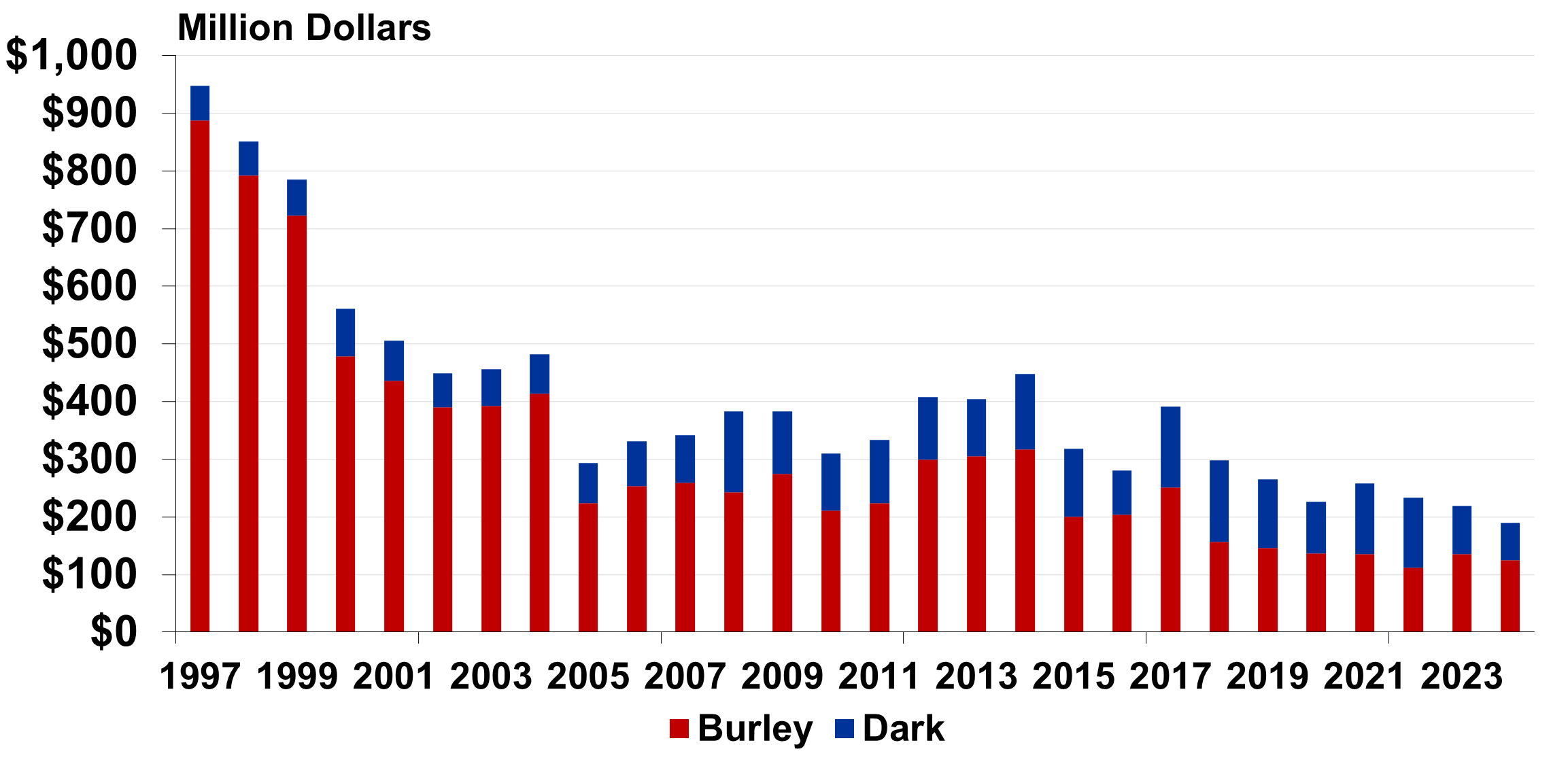

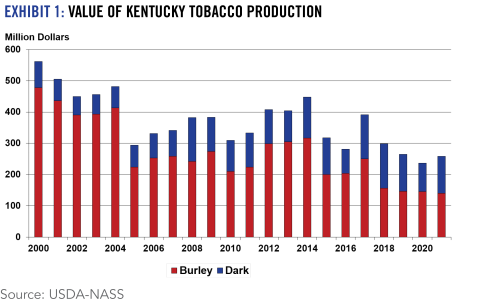

2024 Situation

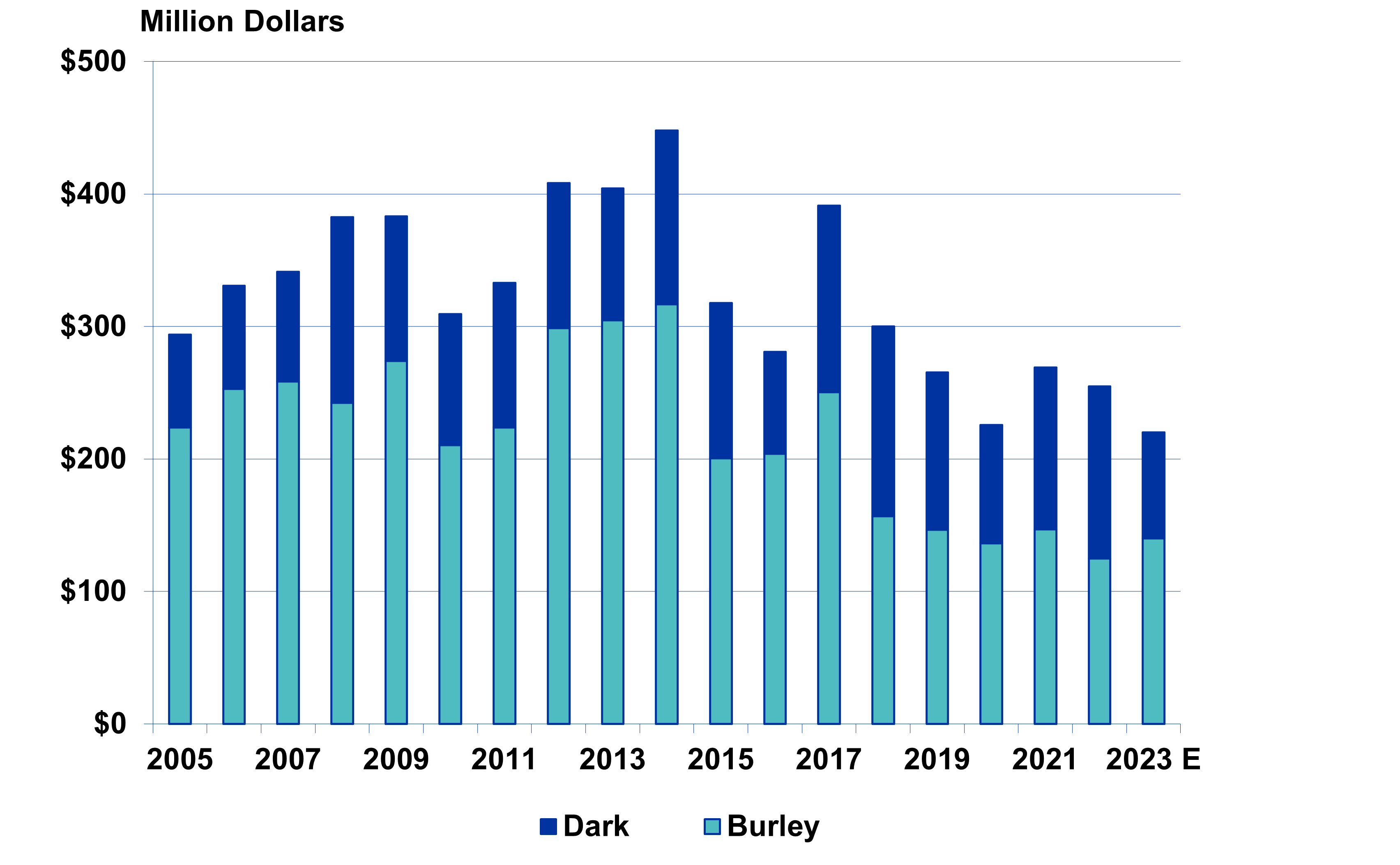

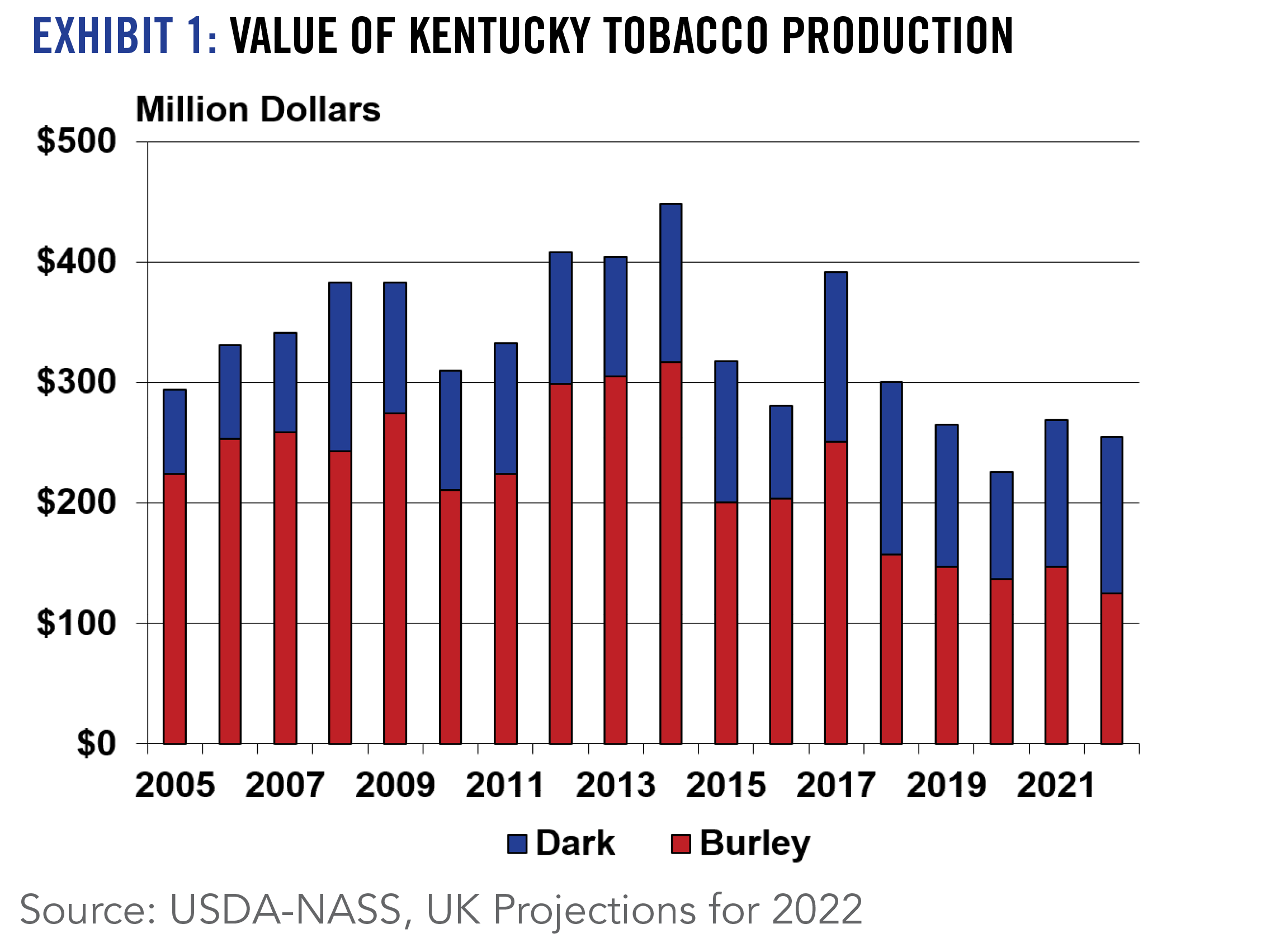

This past season has been another challenging year for tobacco farmers, ranging from extreme weather events to escalating declines in tobacco product sales. Burley supplies remain tight globally, but the supply/demand balance is not as tight as it has been in recent years given a significant decline in U.S. cigarette sales. Historically, U.S. cigarette sales have declined at a 2 to 4% annual pace, but have accelerated in recent years to falling nearly 10% annually. The U.S. dark tobacco industry continues to be plagued by the entry of nicotine pouches in the U.S. marketplace which do not contain any tobacco leaf. This market is growing at an annual 30%+ pace compared to an annual decline in snuff sales, the primary user of dark tobaccos, approaching 10%. On a positive note, the tight global supplies of burley have enabled the U.S. burley sector to experience some modest rebound in leaf exports, but coming off several years of extremely low burley export levels hovering around 10 to 15 million pounds. Given the severe decline in U.S. burley exports over the years, U.S. burley has become like the U.S, dark tobacco sector -- dependent primarily on sales of domestic tobacco products. Burley imports, while lower in 2024, continue to take a relatively high share of domestic burley use by cigarette manufacturers with volumes approaching 100 million pounds annually. U.S. burley production for this year is pegged by USDA at 55 million pounds (vs 65 million pounds in 2023), with U.S. dark fire-cured estimated to be 24 million pounds (vs 36 million pounds in 2023) and U.S. dark air-cured expected to total 11 million pounds (vs 12 million pounds in 2023). Despite the adverse weather issues, the 2024 market has generated higher leaf prices as quality and yields, in general, were better than anticipated given the challenging growing/curing conditions. However, on-going increases in labor costs and other inflated iinput expenses continue to dampen tobacco profit margins, threating additional grower attrition. And this may be the first year since 1955 that the value of tobacco production in Kentucky may have slipped below $200 million.

2025 Outlook

Looking ahead to 2025, the industry will likely continue to lose growers as profit margins remain thin based upon limited leaf price increases, yield expectations, wage rate hikes, labor challenges, and company requirements. Given anticipated declines in U.S. cigarette sales, and increased burley production overseas, total needs for U.S. burley among domestic buyers are likely to continue to fall, but individual burley grower contract volume may remain near recent levels due to grower attrition. Dark tobacco growers may not be that fortunate as smokeless tobacco manufactures continue to adjust inventories amidst slumping snuff sales.

Contract price decisions by the buyers will play a huge role in the number of growers remaining in the industry for the coming year. Continued strong cattle prices may entice some tobacco farmers to exit the industry given declining leaf needs and tightening profit margins. Alternatively, anticipated weak grain markets may encourage some farmers (especially in the dark tobacco region) to hang in there for another growing season based on labor and infrastructure availability.

Value of Kentucky Tobacco Production (1997-2024)

Source: USDA, NASS, 2024 estimate by UK

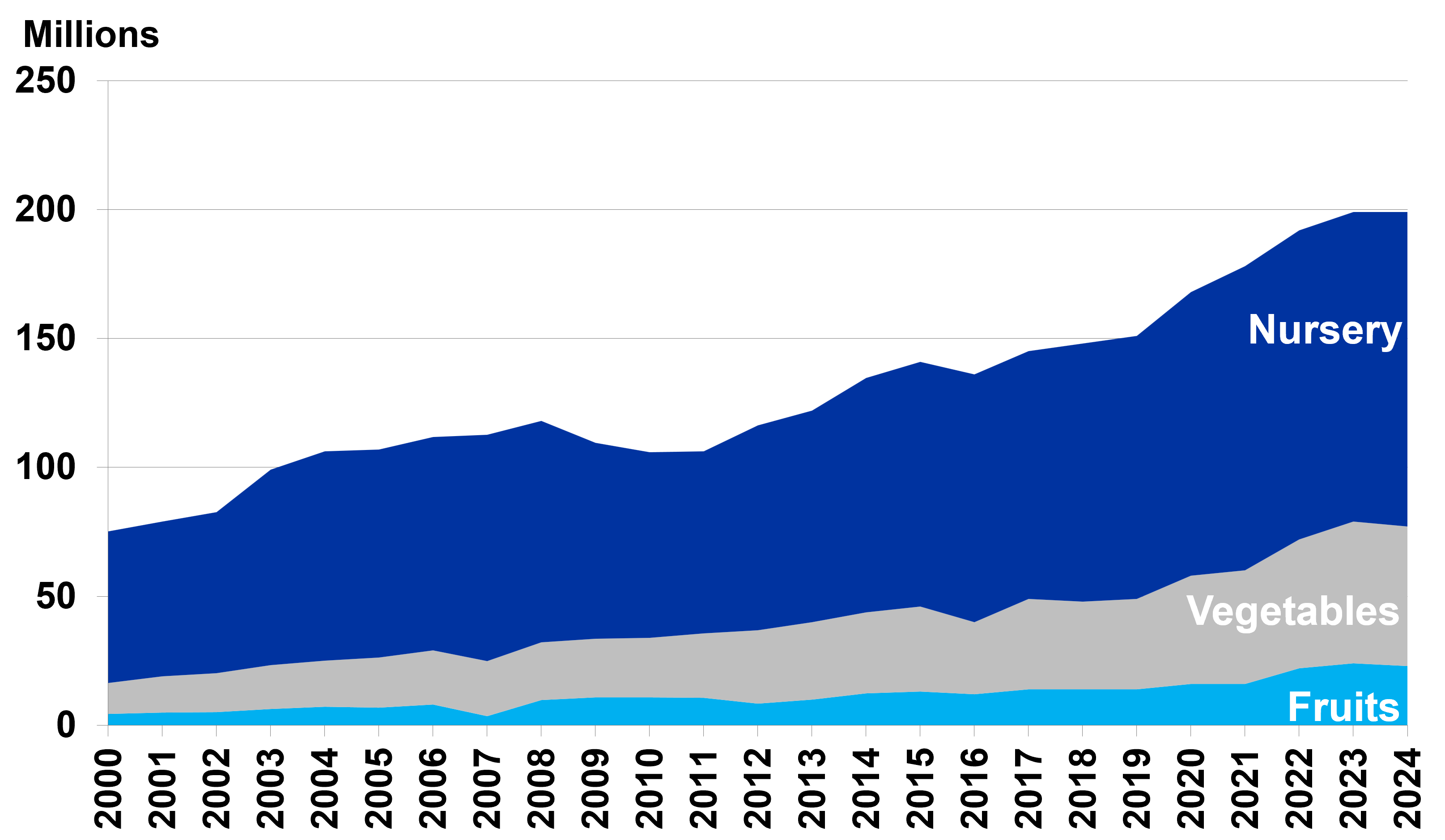

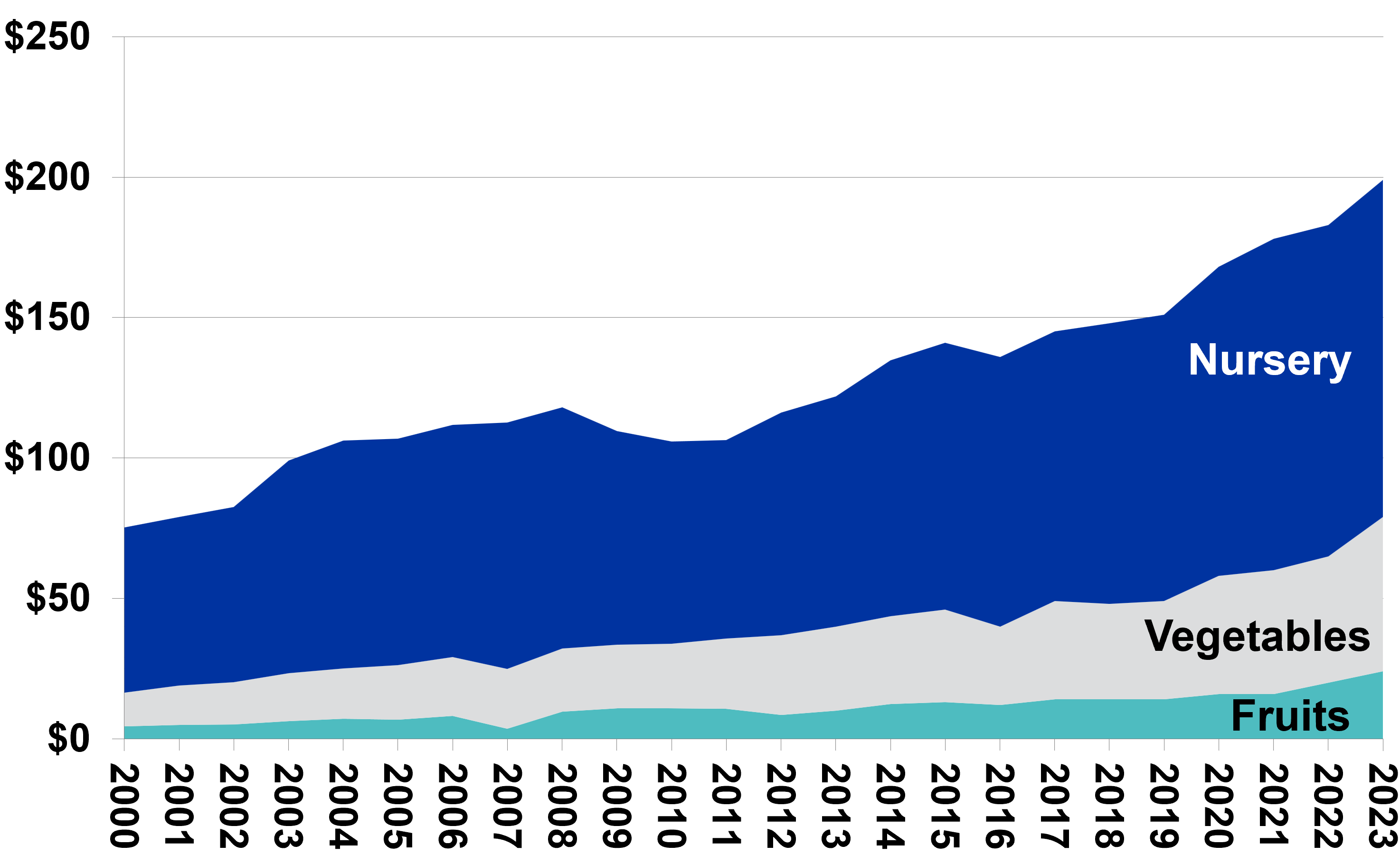

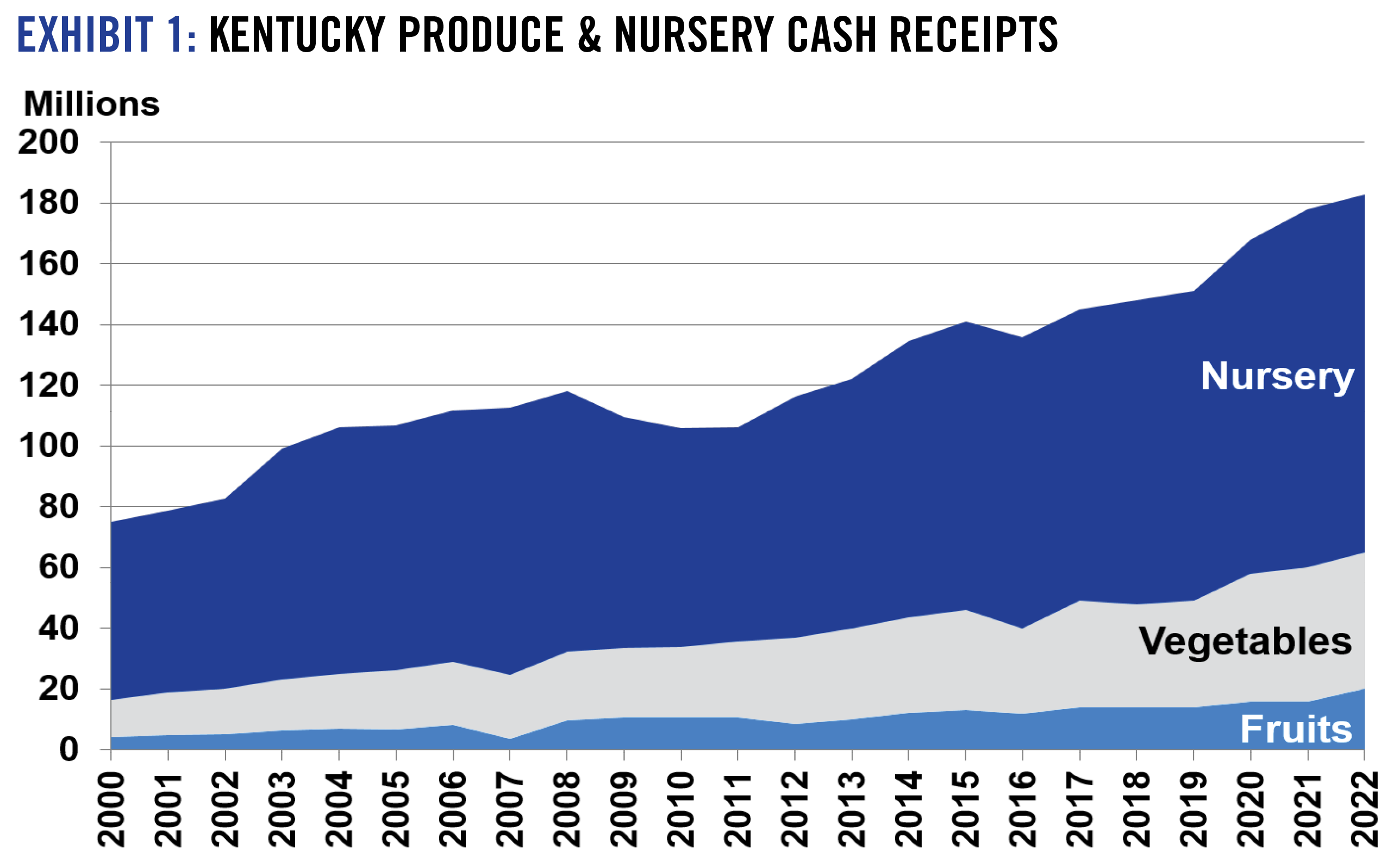

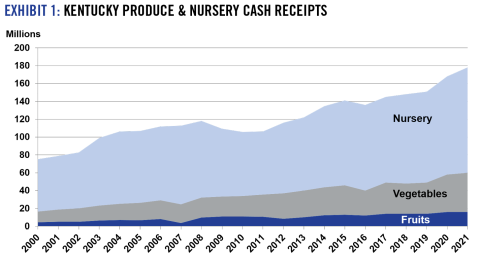

Specialty crop sales overall for 2024 should wind up at or above record levels of $200 million in Kentucky. A challenging growing season for open-field production was countered by continued strong demand in local and retail markets. Produce auction sales appear to be on pace to see modest overall growth. Direct market channels, especially important to Kentucky specialty crop producers, have all seen substantial and steady expansion over the past five years – farm markets, agritourism/on-farm retail, and community supported ag programs, as well as farm-to-institution, and food banks.

Fruit ($23 million) and vegetable ($54 million) cash receipts for Kentucky are estimated at $77 million, which does not include additional sales through controlled environment greenhouses and vertical farms. Those could add an additional $20-40 million in additional revenues based on historical sales.

The nursery and ornamental sector in Kentucky continues to ride the coattails of strong national markets. Although housing starts and interest rates may have slowed some of the commercial and wholesale installation demand, Kentucky leans heavily on sales through retail garden centers. This industry has been generating approximately $120 million in farm gate cash receipts and, with strong retail emphasis, will reflect the strong profitability reported by nursery and garden centers nationally.

Future markets for Kentucky will continue to be shaped by local growing conditions and local/regional demand. Labor costs continue to rise, including H2A rates ($15.87 in 2025, up 4.8% from 2024). But a stronger economy, including expected lower interest rates, will help the Kentucky industry to grow overall. Uncertainty about tariffs, extremely important to produce, remains, with the expectation that such policies will strengthen market opportunities in the short run.

Kentucky Produce& Nursery Cash Receipts

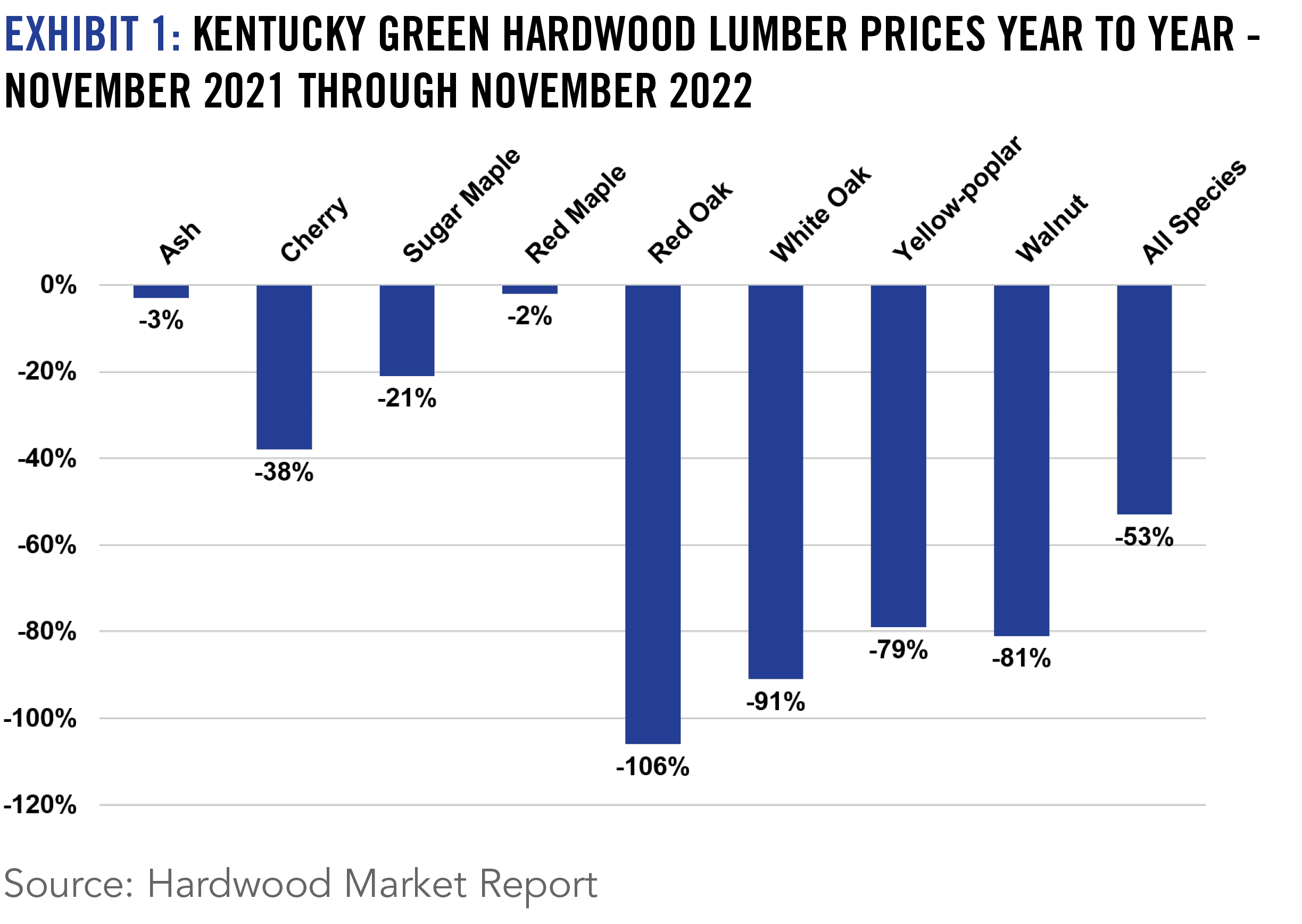

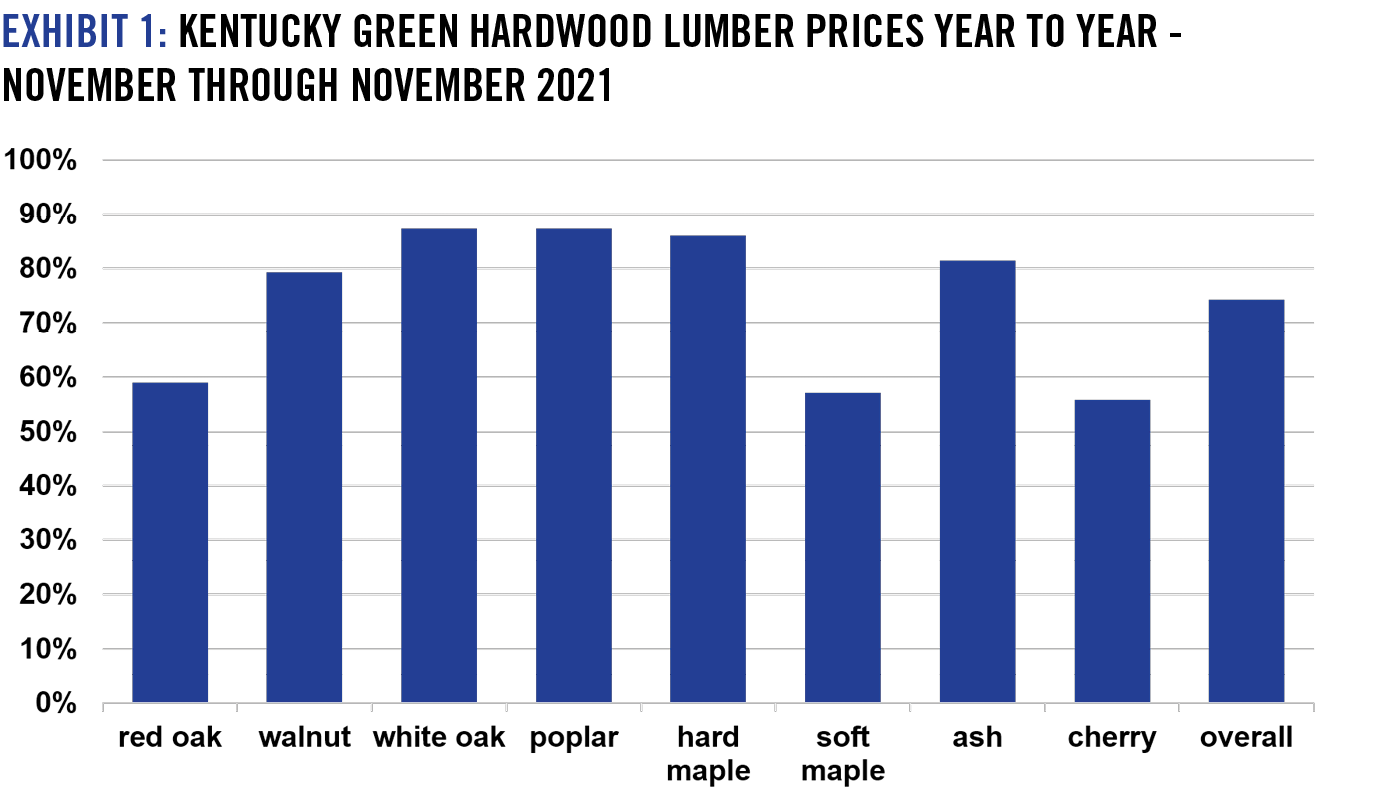

The forest sector is experiencing significant issues across the eastern U.S., especially in the hardwood region that encompasses Kentucky. While there are a few species and commodities where prices have remained relatively stable in 2024 the majority have decreased in value. Continued inflation, lack of movement in new home construction, and fears over future demand have resulted in a number of mills closing, the latter including the second largest mill located in eastern Kentucky. These closings and the overall decrease in demand for hardwood products has resulted in a reduction in the forest sectors economic contribution to Kentucky. While the total industry contribution is estimated to stay above $18 billion, direct contributions dropped from $13.9 billion last year to $12.3 billion this year. However, this down-trend was not evenly distributed across sub-sectors with primary and secondary industries and wood residues experiencing significant decreases. Pulp and paper and paper converters saw only minor reductions. There is also significant concern within the industry over the fragility of the logging sector including a work force shortage. This concern is because the majority of the forest industries require a consistent supply of wood from Kentucky’s forests that the logging sector provides. To address the work force issue, forestry partners in Kentucky are instituting a “ForestryWorks” program aimed at introducing high school students to forest industries to help bolster the work force, but this shortage will be one that continues to plague the industry for some time. Another indicator of the down-trend in the forest sector is the value contributed by an acre of harvested timber. Last year and acre of harvested timber yielded a total of $22,308 dollars to Kentucky’s economy, this year the value fell to $19,468. Log and lumber prices have remained low throughout the majority of 2024 compared to the highs experienced in 2021 and the first half of 2022. Examples are red oak logs, gaining 2 to 3 percent in value year to year in 2024, but are 30% less than 2021/22, or yellow-poplar losing 11% in value this year but are 36% lower than 2021/22. Even white oak and black walnut, that are experiencing historically high prices, have still lost value since 2021/22. Industry sources indicate significant softening of demand in the fourth quarter of 2024 that is expected to continue into 2025. Unfortunately, this does not bode well for harvesting, stumpage values, and landowners needing to sell timber. However, there is stability in pricing for some commodities. The price of tie logs overall has remained constant through 2024 with the losses in non-oak tie log prices balanced by and similar increase in oak tie log prices. While white oak stave logs, used for whiskey barrel production fell $15% in 2024 from a high of $2,700 per thousand board feet in the first quarter of 2023, the average price of stave logs in Kentucky is still above the $1,800 value of 2022 and 2023. Stave and tie log demand and prices should remain flat in 2025. However, there is significant concern that a continued down-trend in prices for species other than white oak will continue well into 2025. Continued soft markets for species other than white oak are to be expected and could easily be exasperated by trade wars and wood tariffs. The current soft pricing of a number of timber products, high cost of parts and supplies, flat or down-trending housing starts and global trade and economic concerns have the potential to do long-term harm to the regions logging capacity that cannot be easily or quickly repaired. A decrease in logging capacity and lower timber values also can harm the economic viability of Kentucky’s forests, 80% of which are non-industrial family ownerships, and the landowner’s ability to conduct valuable forest management practices.

Income Implications for Kentucky Farms and Farm Households

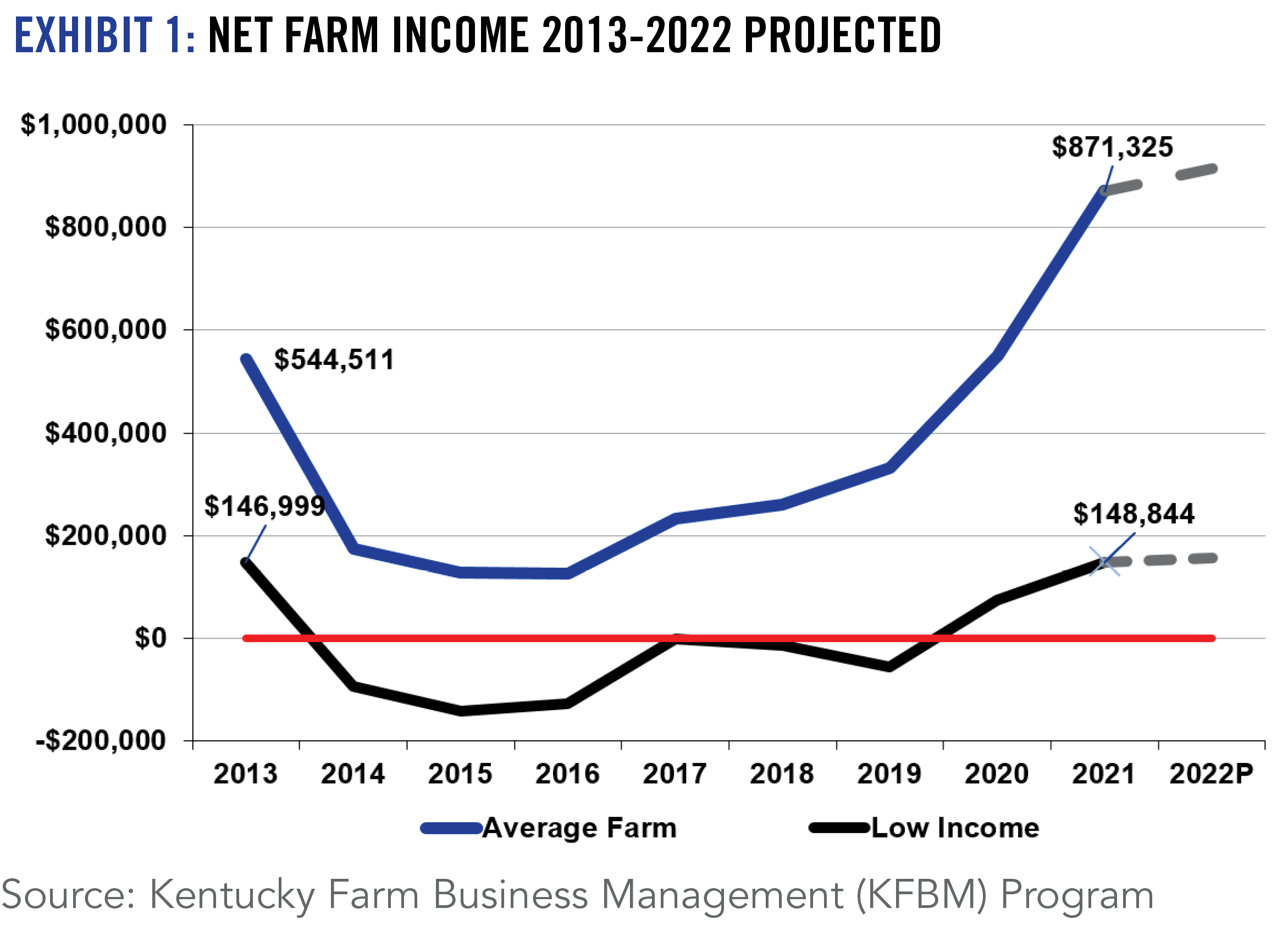

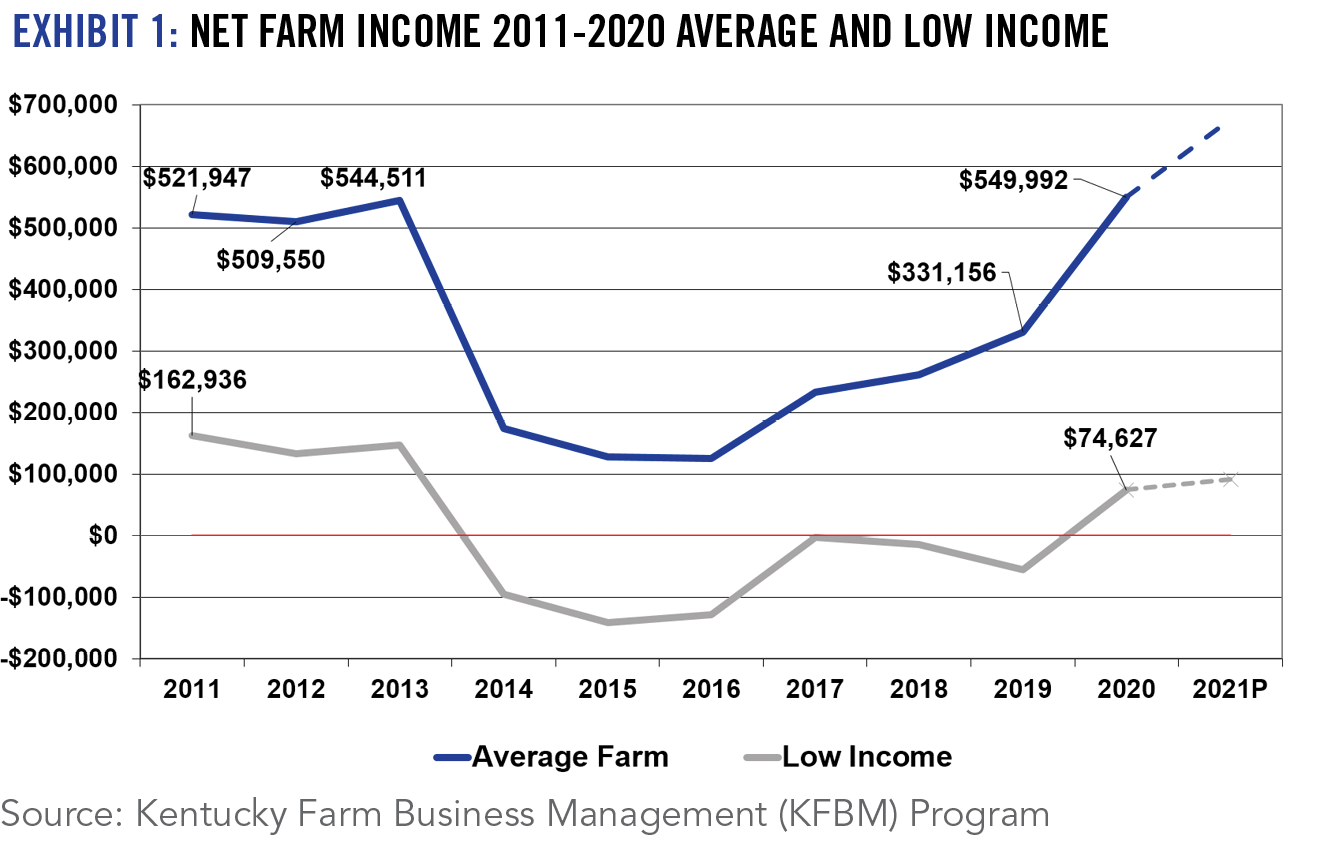

Farm profitability and current outlooks have strong implications for Kentucky farms and families. Data from commercial grain farms participating in the Kentucky Farm Business Management program (KFBM) to illustrate the impacts.

The key to a farm’s long-term financial survival is profitability. Profitability affects the farm’s ability to secure and service debt for operation, replacement, and ownership. It also provides income for the families that operate the farms.

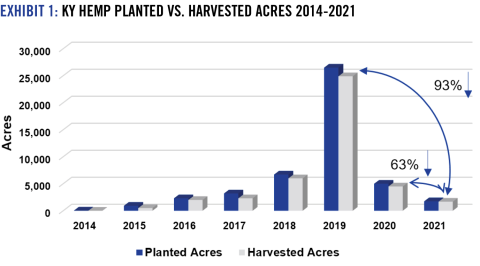

Agricultural profitability has always been cyclical. The current cycle began with a recovery for KFBM grain farms beginning in 2017 that peaked in 2021, with a steady decline over the last two years as commodity prices have softened and costs have surged. The downward trend will continue in 2024 and into the foreseeable future.

Two factors have influenced the current cycle: 1) government payments and 2) commodity prices and cost of production.

Unusually large government payments contributed substantially to the recovery from 2017 through 2021. Government payments have been significantly lower since.

By 2021 commodity prices drove gross returns per acre about 43% above 2017 levels. Total costs per acre increased only about 17% during that time, then shot up 23% in 2022. Commodity prices have now begun to decline while costs have continued to rise, resulting in lower Net Farm Income (NFI). As a result, NFI is projected to decline for 2024 toward 2018 levels.

Net Farm Income directly affects farm financial condition by providing the means to meet obligations in long-term and short-term. The farm balance sheet shows the ability of the farm to meet its obligations in the long run (solvency) and to pay principal due in the next 12 months (liquidity).

A Debt-to-Asset Ratio (D/A) of 30% or less is considered good for a commercial crop farm solvency. Strong land values and good management decisions helped the average farm to maintain a D/A ratio under 30% for the last seven years, demonstrating long-term stability.

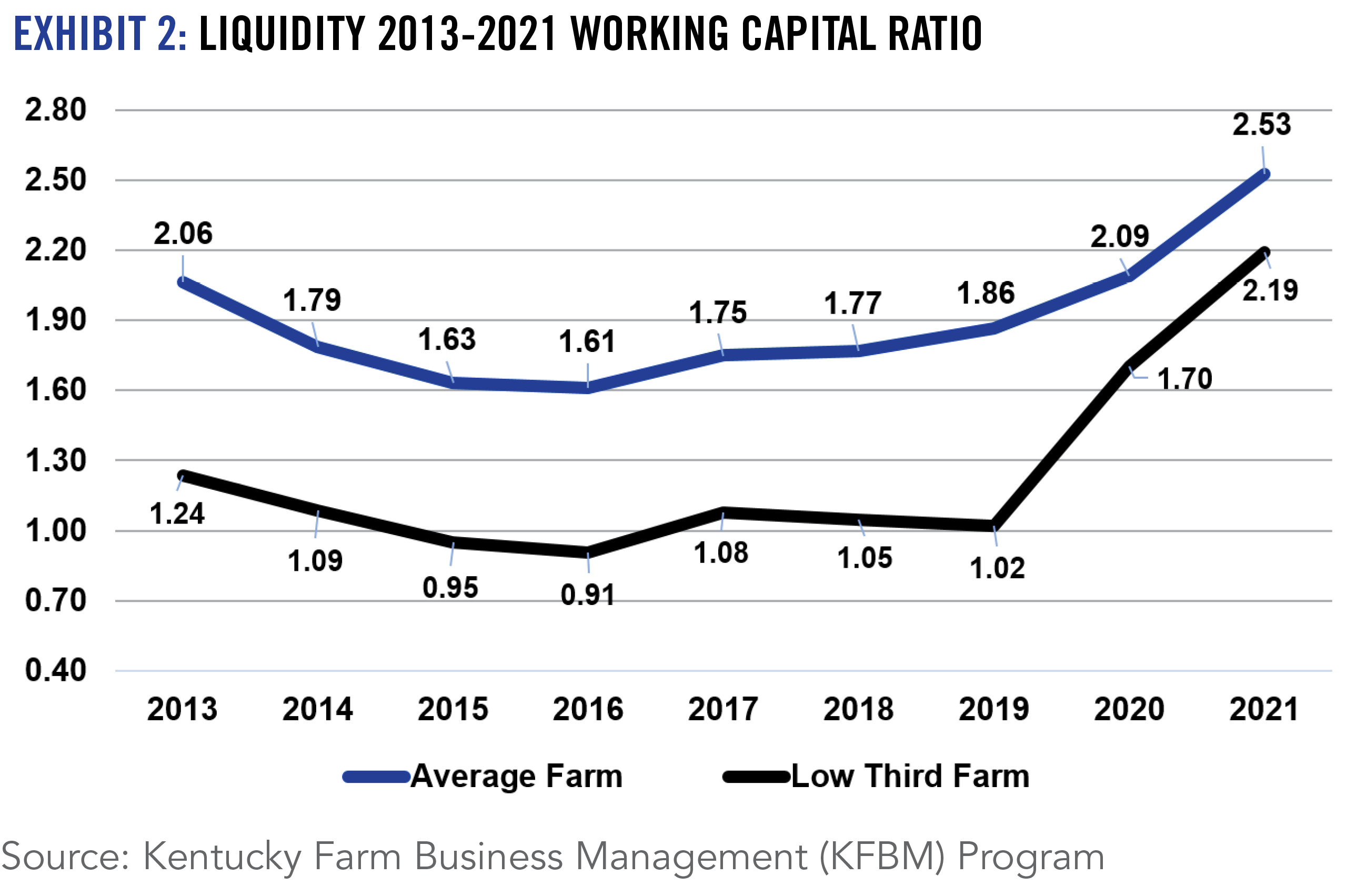

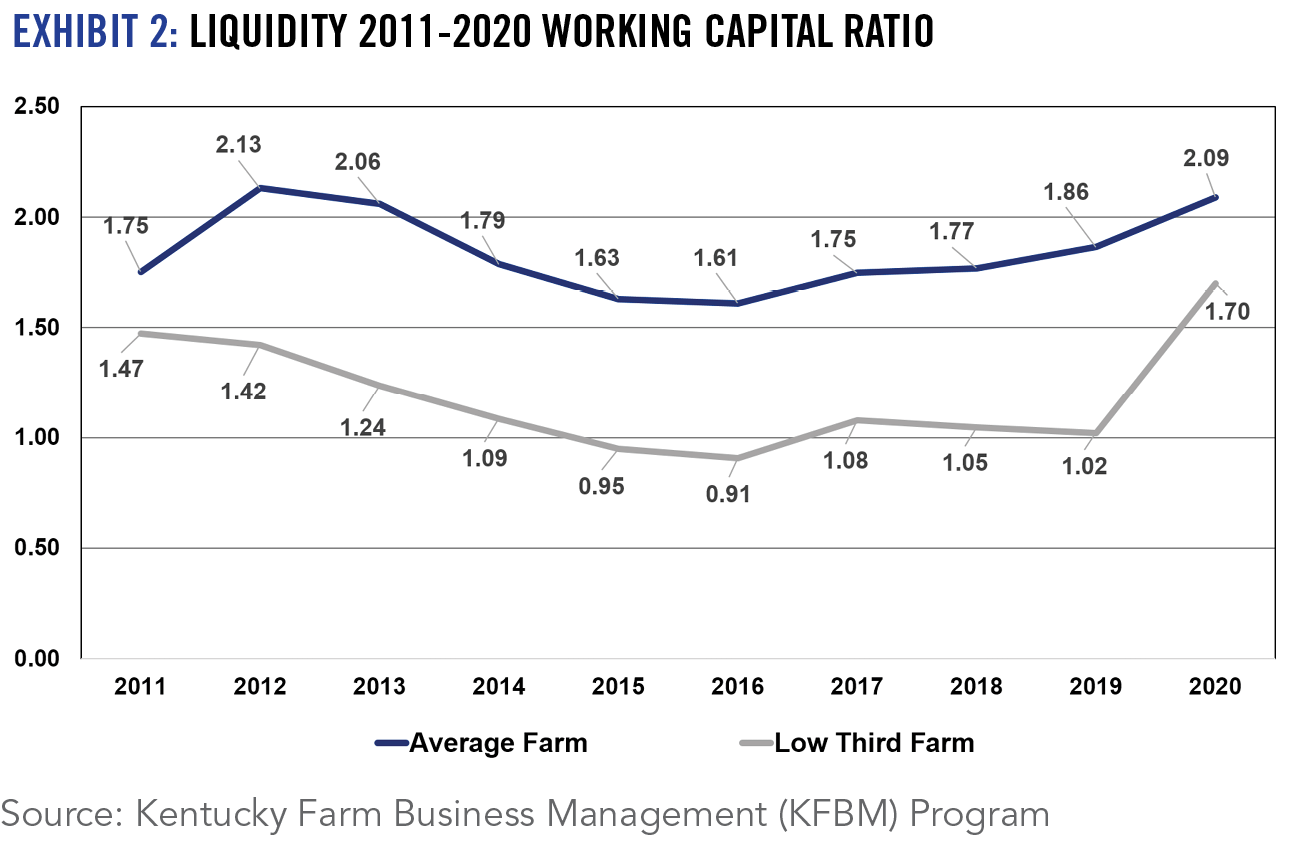

Liquidity is measured by farm’s ability to more-than-cover the principal due in 12 months. A crop farm should have a minimum 2:1 ratio of unobligated current assets to principal due in 12 months.

The average KFBM farm had about $1.5 million in working capital at the beginning of 2024 and a working capital ratio of 2:21. This was a strong liquidity position, especially given the sharp downturn in profitability. Working capital ratio should remain above 2:1 going into 2025.

Note that all types of liabilities increased in 2023: long term, current, and intermediate. Average current liability was $1.2 million at the beginning of 2024. The increase in liabilities will likely continue into 2025, and is a concerning trend.

Capital Replacement & Term Debt and Replacement Margin reflects how much NFI remains after paying farm expenses, family living, taxes, and debt payments. This is available to make extra debt payments, purchase land or equipment, take out for personal use, or leave invested in the farm. The margin dropped from $348,702 in 2022 to $99,643 at the end of 2023. This sharp decline indicates real challenges in meeting obligations while maintaining operations.

Total family spending reflects the pressure on NFI. KFBM farm families cut spending by 9% compared to 2022, even with rising medical and insurance costs. Cuts were primarily for durable goods, personal vehicles, and other big-ticket personal items.

Expectations for 2024 and beyond:

- Continued decrease in profitability.

- Tighter cash flow, creating competition between liabilities, farming, family living, and balance sheet.

- Challenge to adequately cover obligations in the short-run.

Ag Economic Outlook Archives

2023 Situation

Following an amazing run in 2021 and 2022, the agricultural economy is expected to retreat in 2023. Prices for most major farm commodities were lower in 2023 as the global producers responded to price incentives induced by tight global stocks and trade opportunities. In addition to increased global competition, the U.S. ag economy was adversely affected by slumping exports, interest rate hikes, labor challenges, unfavorable weather patterns impacting crop yields and pasture conditions, along with the volatility caused by ongoing global geopolitical issues.

The lone bright spot in the ag economy in 2023 was cattle markets where farm-level prices soared in response to tight cattle supplies and a resilient beef consumer base even amidst relatively high retail beef prices.

While inflation moderated in the second half of the year, the ag sector continues to be adversely impacted by inflationary pressures on the economy. Despite lower fertilizer and feed expenses, overall farm production expenses were higher in 2023, primarily due to higher interest expenses (with farm loan rates exceeding 8%) and labor costs. In addition, government farm payments receded to pre-trade war/pandemic levels. In aggregate, USDA is forecasting that U.S. net farm income will decline by 17% in 2023, following record-high levels in 2021 and 2022. Despite a significant decline, the projected 2023 U.S. net farm income level adjusted for inflation will still be the fourth-highest real net farm income realized in the past 75 years.

A significant portion of the growth in farm income in recent years has been a strong international market for U.S. farm commodities and ag products. However, U.S. ag exports, which generally account for over 20% of U.S. ag production, declined in 2023 in response to a stronger U.S. dollar, a weakening global economy, and rebounding world stocks. The biggest decline occurred in our largest ag export market – China which faces a lot of economic challenges as its economy continues to try to recover from COVID and other financial stressors. The decline in U.S. ag exports, coupled with continued growth in ag imports will likely cause the U.S. ag industry to experience its third trade deficit in the past five years – very uncharacteristic given that the U.S. ag sector historically has recorded relatively large trade surpluses.

The Kentucky agricultural economy has not escaped many of these national macroeconomic issues and trends, but our diverse farm economy, better-than-expected grain yields amidst weather challenges, and carryover grain sales from the 2022 crop helped cushion some of the downfall. As a result, University of Kentucky agricultural economists are projecting that 2023 Kentucky ag cash receipts will decline modestly from its record high level of $8.3 billion in 2023 to $8.1 billion as the significant increase in cattle (+22%) and wheat receipts (+30%) are just slightly offset by lower receipts for corn (-18%), soybeans (-6%), dairy (-15%) and tobacco (-10%). Poultry will likely remain Kentucky’s number one commodity in terms of cash receipts, but strong cattle prices vaulted cattle receipts over corn, soybeans, and equine receipts in 2023. Similar to national trends, production expenses will be higher for most Kentucky farmers this past year while government payments will fall leading to net farm income for Kentucky agriculture declining in 2023 from record highs of $3.1 billion in 2021 and $3.9 billion in 2022. While the outcomes will vary across enterprises and farmers, overall net farm income adjusted for inflation for Kentucky this past year is expected to remain above the $2.5 billion average recorded over the past ten years.

Exhibit 1: U.S. Net Farm Income

Source: USDA-ERS, December 2023 Estimates

Exhibit 2: Kentucky Farm Cash Receipts

Source: KY Ag States/USDA-NASS, UK Ag Economics Estimates for 2023

2024 Outlook

Looking ahead to 2024, commodity prices, except for cattle, will continue to face headwinds amidst global competition, higher stock levels, and a slowing global economy. Despite challenges, Kentucky ag cash receipts may still remain above $8 billion on the heels of expanding livestock receipts and anticipated stable crop receipts. While inflation has eased in recent months, the current macroeconomic environment does not indicate that interest rates will likely fall dramatically in the coming year. Labor costs will continue to rise as the H2A wage rate is bumped up 6% to $15.14 per hour. Feed and fertilizer costs have moderated from recent highs, but remain above historical levels. Despite political drama in DC, we will have some sort of farm bill in place, but one that will likely deliver very little changes in price/income protection leading to lower government payments with conservation funding being the wild card. After trending up the past few years, the value of the dollar could soften some in 2024 if the Federal Reserve begins to ease its recent restrictive monetary policy. However, a slowing global economy along with export market competition will continue to challenge U.S. ag export growth.

Collectively, lower/stable crop prices, intense export competition, higher interest and labor expenses, and limited government payments will challenge potentially higher livestock receipts in the coming year. Even accounting for narrowing profit margins, the ag balance sheet remains relatively strong heading into 2024. Ag loan portfolios have benefited in recent years from the ability of farmers to utilize excess cash to pay for operating expenses, land, and equipment holding down increasing debt levels. However, higher interest rates and the depletion of cash/working capital in a lower net farm income environment may cause lenders to be more cautious in the coming year in evaluating loans. Despite these economic challenges, the farm economy outlook remains relatively positive heading into 2024. However, as usual, extreme/unpredictable weather events and uncertain geopolitical actions could quickly disrupt markets and forecasts emphasizing the need to incorporate various risk management tools to counter potential market volatility.

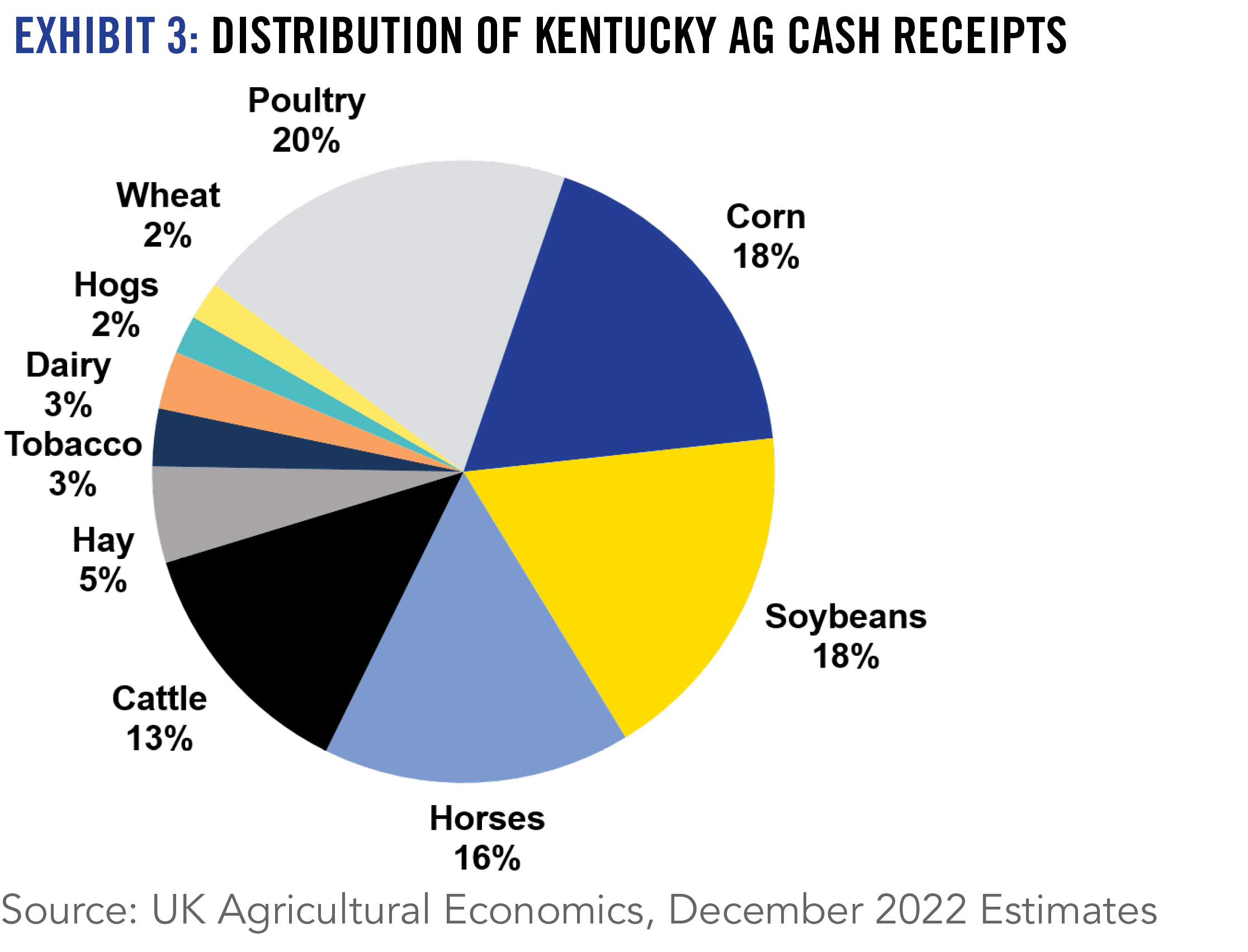

Exhibit 3: Distribution of Projected 2023 Kentucky Ag Cash Receipts

Source: K Agricultural Economics, December 2023 Estimates

2023 Situation

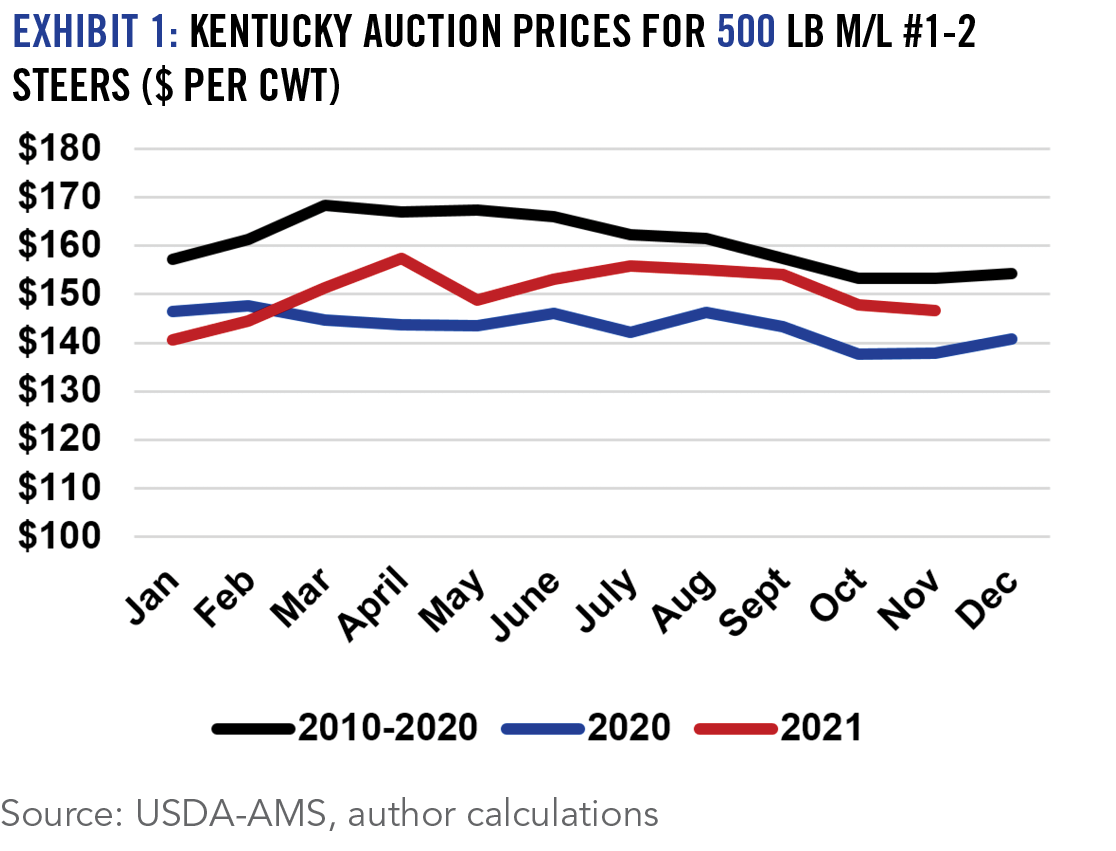

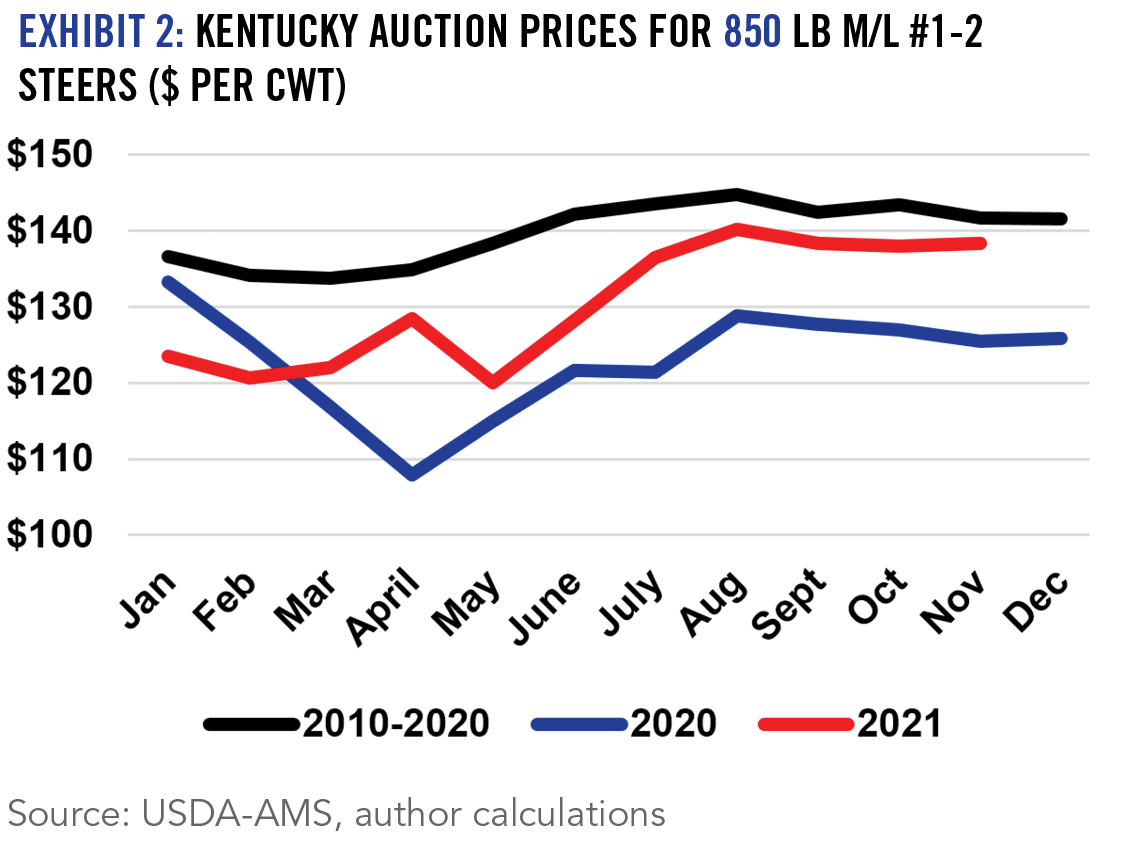

We came into 2023 with the smallest beef cow herd on record in over sixty years. At the same time, US beef production saw its first year-over-year decline since 2015 and will be down nearly 5% for the year. Tight supplies were the story for the vast majority of the year and were reflected in feeder cattle and calf prices. Beginning in mid-September, futures market prices saw major declines that persisted into December. The drops were driven by a combination of markets moving too high, too quickly over the summer and larger than expected fall feedlot placements. While cash feeder cattle prices were impacted, they did not drop as drastically as the futures market did. Despite the fall market frustration, both calf and heavy feeder prices averaged $40-$60 per cwt higher than 2022, as can be seen in the charts below.

Exhibit 1: Kentucky Auction Prices for 550 lb M/L #1-2 Steers ($ per cwt)

Source: USDA-AMS, author calculations

Exhibit 2: Kentucky Auction Prices for 850 lb M/L #1-2 Steers ($ per cwt)

Source: USDA-AMS, author calculations

2024 Outlook

Dry weather in much of Kentucky during 2023 impacted hay supplies and prices going into 2024. Despite relatively high calf prices, there is no indication that cattle producers have started to expand. Cow slaughter and heifers on feed point to another year of contraction. The 2024 cow herd will likely be more than 2% smaller than 2023, which means feeder cattle supplies will only get tighter. While inflation, interest rates, and macroeconomic questions have the potential to impact the market, supply fundamentals should support cattle prices such that calf prices increase again year-over-year. While cow-calf operators are typically the primary beneficiaries of tight cattle supplies, the outlook for margin operators is also encouraging. Feed prices have moderated somewhat from last year, but the value of gain should remain relatively high, creating opportunity for stocker and backgrounding operations. One lesson of fall 2023 was how quickly markets can swing, so price risk management should be a component of marketing plans.

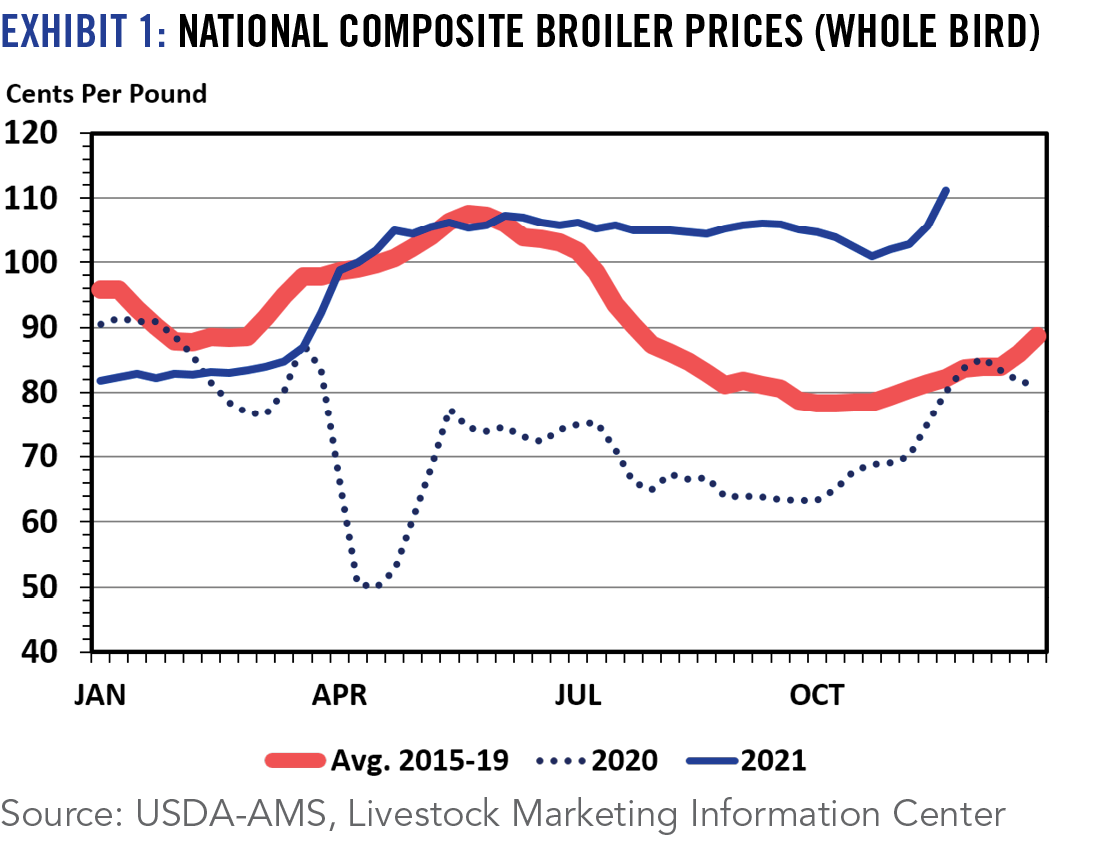

2023 Situation

Kentucky poultry production will be higher in 2023 as post-tornado impacts were at play in early 2022. However, out times remain an issue for growers, as do operating costs. The two largest poultry narratives centered around plant closures and Avian Influenza (AI) this year. The announced closure of the Tyson plant in Corydon, Indiana impacts more than 20 growers in Kentucky and the future of those operations is certainly in flux. At the same time, a significant increase in cases of AI was seen in the fall across the U.S. As of early December, a case had not been confirmed in Kentucky, but the situation should be monitored. At the national level, broiler production is expected to be up by less than one percent in 2023 and broiler prices are down by roughly 13% from last year.

Exhibit 1: National Composite Broiler Prices (Whole Bird)

Source: USDA-AMS, Livestock Marketing Information Center

2024 Outlook

While feed costs have trended lower, labor challenges continue to impact integrators. It is very possible that this was a major factor behind the closure of the Corydon, IN Tyson plant and certainly bears watching going forward as additional plant closures would significantly impact the industry. Construction and material costs, combined with much higher interest rates, are creating entry challenges for growers into the poultry sector and those upgrading existing operations. While the sector remains stable, significant growth seems unlikely. The recent increase in cases of AI serves as a crucial reminder that growers need to manage that risk to the extent possible and the December 2021 tornado drives home the linkage between infrastructure, markets, and grower profits.

2023 Situation

After two solid years in the hog sector, things shifted drastically in 2023 as farrow-to-finish margins turned negative. The lone bright spot in the hog markets has been exports, which have been higher in 2023, despite the fact that China has continued to import less pork from the U.S. The increased export levels seen in the pork market are counter to what has generally been seen in other protein markets and Mexico has been a major driver of this export strength. Closer to home, Kentucky came into 2023 with a steady breeding hog inventory and larger market hog numbers. Eastern corn belt hog prices fell by 15% when compared to 2022, which was only partially offset by cheaper feed.

Exhibit 1: Direct Eastern Corn Belt Hog Prices - Market Formula ($ per cwt carcass weight basis)

Source: USDA-AMS, USDA-NASS, author calculations

2024 Outlook

Productivity gains continue to be a double-edged sword for the industry. Gains in pigs per litter are a major reason why USDA-ERS is predicting nearly a 2% increase in pork production next year. Hopefully, continued export strength can keep increases in per capita availability at a minimum. Kentucky’s hog sector is a healthy mix of independent and contract-integrated operations and both segments of the market are impacted by different things. For independents, margins should improve in 2024, but that is most likely to be driven by lower feed prices. Indications are that growth is continuing among integrated operations, but construction costs and interest rates are having an impact there as well.

2023 Situation

Following two years of post-Covid improvement, equine markets seemed to cool somewhat in 2023. After sizable year-over-year increases in 2021 (+38%) and 2022 (+13%), Keeneland sales revenues were down by 6% in 2023, in part due to a 3.6% decline in the number sold. While the pullback is significant, perspective is likely valuable as the sales levels of 2023 are still the second highest annual sales level since 2007 (second only to 2022). While the number of mares bred in North America continued to decline, Kentucky actually bucked the national trend and saw an increase in the number of mares bred in 2023 (The Jockey Club). Stud fees paid on these mares are another significant contributor to equine receipts in the Commonwealth.

Exhibit 1: Annual Keeneland Sales, 2000-2023

Source: Keeneland

2024 Outlook

Despite the decrease in sales for 2023, the equine sector remains relatively strong. Gaming revenues from historical horse racing continue to impact purses, which has the potential to impact sales and stud fees. It is unclear how broader sports betting in Kentucky may impact this going forward but it certainly bears watching. It will also be interesting to watch how inflationary pressure impacts equine markets, especially the non-racing markets. Despite the 1.6% increase in number of mares bred in Kentucky during 2023, it is difficult to forecast another increase for 2024. And one would have to expect stud feeds to flatten, at best, for the upcoming year. An expectation of steady equine receipt levels in Kentucky would seem most likely for 2024.

The most recent Kentucky Equine Survey was released in the summer of 2023 and provides a comprehensive look at Kentucky’s equine sector and its impact on the state.

2023 Situation

Coming off a reasonably good year for the dairy sector in 2022, Kentucky came into 2023 with slightly more dairy cows than last year. This was the first statewide increase since the 1980’s. Unfortunately, the values of cheese, non-dry milk, and whey pulled farm-level milk prices lower. U.S. all milk price decreased by $4-5 per cwt in 2023 and Dairy Margin Coverage (DMC) margins reached levels this summer not seen since 2012. By fall, farm-level milk prices showed some improvement and were accompanied by decreases in feed costs. Still, dairy cow numbers have been decreasing at the national level since the spring of 2023.

Exhibit 1: U.S. All Milk Price vs. DMC Feed Cost ($ per cwt)

Source: USDA-AMS, USDA-NASS, author calculations

2024 Outlook

While the dairy herd should enter 2024 a bit smaller than last year, this will likely be largely offset by productivity increases. The second half of 2023 provided some optimism that dairy product prices will improve going forward and USDA-ERS is projecting an increase in dairy exports. This should be somewhat supportive of prices and producers will further benefit from lower feed costs. Profitability challenges will continue to be felt by smaller-scale dairies, which make up a significant portion of Kentucky’s dairy sector. Dairy producers should continue to utilize the DMC program and other risk management tools available to them.

2023 Situation

A record year of U.S. corn production widened the gap in supply and demand, pushing corn prices down close to $1.40 per bushel in 2023. For example, the 2023 December corn futures were around $6.00/bu on December 1, 2022, and $4.60/bu on December 1, 2023. Thankfully, volatility throughout the marketing year offered ample opportunities for producers to lock in higher prices. Harvest time futures were above $6.20 in June due to weather conditions, which caused a supply scare in major production states like Indiana, Illinois, and Iowa.

2023 was an atypical year, as corn prices mostly trended downward, correcting for a tight stock and high price situation that has lingered since COVID. The marketing year typically runs September-September, and we generally expect prices to increase until June or July when end-users and elevators start accounting for the next season’s crop. Kentucky producers likely faired the drop in prices better than other states, as 2023 yields were much higher than the lower drought-induced yields of 2022.

Exhibit 1: Corn Supply and Demand by Marketing Year

Source: USDA Feed Grains Yearbook

2024 Outlook

As we move into 2024, I expect corn prices to return to typical cyclicality, meaning prices should increase as the marketing year progresses. Questions remain on the demand side of the equation, especially concerning export markets. Brazil surpassed the United States as the world’s largest corn exporter in 2023, and the United States will need to make up for the lost demand in 2024 to induce a meaningful increase in corn prices. Of late, China has avoided U.S. corn exports, but as prices have dropped, the United States’ export price is on par with Brazil’s. Next year’s corn supply will also have a large impact on prices. If soybeans follow corn on all the U.S. acres planted in corn in 2023, we could easily be in another tight stock situation in 2024; however, I do not expect this to occur as fertilizer prices have lowered dramatically, incentivizing corn. Current harvest time futures are above $5.00, a lower but profitable corn price.

Exhibit 2: Monthly Export Price by Country

Source:FAO FPMA Tool

2023 Situation

Near-record corn planting led to the lowest soybean supply since 2019. 2024 January corn futures began the year close to $14.00 and followed the downward trajectory of corn to nearly $11.40 before the June/July weather scares. Unlike corn, which quickly declined in price after the scare, soybeans stayed relatively high due to the small U.S. projected production and relatively strong exports. Since June, soybean futures have mostly been above $13.00, indicating multiple opportunities for producers to lock in $13.80/bu beans in 2023.

Due to tight supplies, soybean prices were highly volatile in 2023. Adding to this pressure, Argentina, a major contributor of soybeans, has been reported to be out of beans after a poor production year. Tight stocks have led to continually elevated prices since June instead of prices falling in June/July as expected.

2024 Outlook

Soybean prices still look strong in 2024 due to projected U.S. crush expansion and smaller stocks. Unlike corn, we have not seen a widening gap in supply and demand post-COVID. I expect soybean prices to stay elevated but highly volatile for years. Between 2023 and 2026, soybean crush capacity is expected to increase by over 500 million bushels. Questions remain on whether supply and demand will meet capacity, but the U.S. will likely need soybean expansion as we look to the future. I do not see a surplus of beans on the horizon unless most of the 2023 corn acres are planted to soybeans in 2024. Harvest time futures prices are close to $12.75, a lower but profitable soybean price.

Exhibit 1: Soybean Supply and Demand by Marketing Year with Projected Crush Expansion (Bushels/Year)

2023 Situation

Russia’s invasion of Ukraine pushed the wheat price to a record level and pressed U.S. wheat supplies to new levels in 2023. Supply outpaced demand by nearly 60 million bushels, driving the 2023 December SRW wheat futures contract from close to $8.20 on December 1, 2022, to $5.60 on December 1, 2023, a decline in price of nearly $2.60. Thankfully, futures shot above $7.60 in June and July due to a weather scare combined with geopolitical tensions, specifically the cancellation of the “Black Seas Grain Deal.” These price movements likely allowed some marketers to lock-in higher than higher-than-average wheat prices.

2023 wheat markets experienced price movements that were similar but more volatile than those of corn markets. Short price spikes due to geopolitical tensions gave ample marketing opportunities to lock in prices before the winter wheat harvest. Since the winter wheat harvest, prices have remained low.

Exhibit 1: Wheat Supply and Demand by Marketing Year (Bushels/Year)

Source: USDA Wheat Data

2024 Outlook

U.S. wheat prices are dictated more by world supplies than U.S. corn or soybean prices, and thus, the declining stocks held by major exporters add price volatility to wheat markets. Geopolitical tensions between Russia, the largest wheat exporter, and Ukraine, the seventh largest export since 2019, exacerbate these effects. As prices return to normal levels, capturing volatile price spikes will become increasingly important for the U.S. producer. Harvest time futures are still profitable at close to $6.00, but producers should pay attention to short-term increases to maximize profitability. From a supply perspective, the large number of corn acres in 2023 primes producers for double-crop wheat/soybeans. Production could increase in Kentucky, a key double-crop state, but I look for similar numbers nationally due to current pricing mechanisms.

2023 Situation

Kentucky’s tobacco sector continues to contract amidst declining consumer demand for tobacco products, international competition, and labor/yield challenges adversely impacting profit margins. The situation and outlook have reversed among tobacco types.

While U.S. burley use continues to fall amidst an accelerating decline in domestic cigarette sales, and import leaf substitution, burley growers were encouraged to grow more pounds in 2023 with increased contract volume offers coupled with higher contract price incentives. However, increased burley acres planted did not materialize (off 3%). Overall U.S. burley demand may have been around 70 million pounds, but it is likely that the 2023 crop will not total much more than 50-55 million pounds. Accounting for all the additional price adjustments, U.S. burley prices for the 2023 crop may average around $2.40 - $2.50/lb, compared to $2.21/lb in 2022.

Given the demand challenges facing burley, Kentucky’s dark tobacco sector has been the bright spot over the past decade as snuff sales increased and growers faced virtually no international competition. The situation has reversed as competition in the form of product competition has unfolded for the dark tobacco sector with nicotine pouches (which do not use dark tobacco) cutting into the snuff market (the primary use of dark tobacco). Consequently, dark tobacco contract volume was reduced significantly in 2023 with acreage harvested down by more than 20%. In addition, the 2023 dark tobacco crop was hurt dramatically by excessive rain leading to very poor yields and quality. As a result, the value of the Kentucky tobacco crop (burley + dark) may just barely exceed $200 million in 2023 compared to averaging around $250 million in recent years.

Exhibit 1: Value of Kentucky Tobacco Production

Source: USDA, UK Projections for 2023

2024 Outlook

U.S./Kentucky burley growers will once again have an opportunity to grow more pounds in 2024 given extremely tight global burley supplies. However, acreage responses will hinge critically on contract prices offered for the 2024 crop. U.S./Kentucky dark tobacco growers are expected to experience additional cuts in contract volume as the nicotine market adjusts to a changing consumer base. Wage rates for the labor-intensive crop are expected to surpass $15.00/hour which will continue to challenge profit margins at existing yields. Profit opportunities for cattle and grains may also impact the number of tobacco growers remaining in the industry. Consequently, the value of the 2024 Kentucky crop may be challenged to surpass much above $200 million unless price incentives are significantly higher, and growers experience a much better growing/curing season compared to this past year.

2023 Situation

Input costs remained up sharply during 2023 for most specialty crops, especially labor, pesticides, and capital items. Strong local retail markets helped strengthen demand and prices for both produce and nursery/greenhouse crops. Some significant business failures associated with controlled environment production were experienced, however, the scale of production remains significant and, despite the difficulties of transition, sales continue to expand significantly. Farm gate cash receipts for fruit are estimated at $24 million, vegetables at $55 million, and nursery and greenhouse crops at $120 million – all at or near record levels of sales for Kentucky. Controlled environment greenhouse production will contribute another $30-$50 million above that level.

Exhibit 1: Kentucky Produce & Nursey Cash Receipts

2024 Outlook

Strong competitive pressures will continue from outside of the U.S. in the produce market, challenging many of the wholesale market outlets for Kentucky farms. While Kentucky growers benefit from strong local demand, and strong local prices may remain in direct markets, import supply will continue to rise. Labor costs are a big constraint in this sector, accounting generally for 30-40% of production costs for most produce. Labor cost projections for 2024 are sharply higher and will put pressure on grower margins. New capital-intensive greenhouses and vertical farming systems continue to expand in Kentucky, primarily with a view toward regional wholesale markets.

The outlook for 2024 in Kentucky will continue to hinge on strong local demand for specialty crops as markets for many specialty crops trend downward nationally. Recovering restaurants and other wholesale channels, including the produce auctions, will help support continued strong markets in direct-to-consumer platforms. Garden center demand in Kentucky will be expected to keep pace with the strong growth nationally, helping the retail-oriented farms.

2023 Situation

While the overall economic contribution for the forest sector remained steady, approximately $13 billion, for 2023 there were significant discrepancies in market strength among sub-sectors. Lumber prices, to a large extent, drive average timber and log pricing. The last two quarters of 2022 encountered significant downturns in lumber prices across all species, with white and red oak dropping 91% and 106%respectively. Only a portion of these losses were recovered in 2023, for example, white and red oak recovered only 37% and 44%, respectively. Other species responded with modest gains in 2023, but only partially recovering from losses in 2022 with the exception of hard and soft maples that lost over 40% of their value in 2023. The sluggish oak lumber market was also felt in the railway tie log market especially for oak, with oak prices retreating to values paid for non-oak tie logs. Pulpwood demand in eastern Kentucky has suffered with the loss of markets thus further depressing timber markets and limiting forest management opportunities in that region. While western Kentucky pulpwood markets have rebounded since the re-opening of the Wickliffe pulp mill, overall prices are static. In total, the lackluster lumber, tie, and pulpwood markets have led to anemic timber values for woodland owners that have average-quality timber. The one bright spot continues to be white oak stave log prices. While flattening somewhat in 2023 prices have remained relatively high and there continues to be a strong demand to support a seller’s market throughout 2023.

Along with demand issues, overall the forest sector is plagued by a worker shortage, three smaller mills closed in 2023 and many mills are keeping log inventories low, which is unusual going into the winter. The latter shows a short-term fear of continuing soft markets and results in a lack of demand and reduced prices for average logs for many species. Part of this positioning is based on housing starts which are down.

2024 Outlook

However, there is some optimism in the sector that there will be a balance in supply and demand in 2024. This balance will be needed before we see a rebound in overall timber pricing for a large number of our species. The exception being white oak stave logs where demand will remain high enough to maintain prices throughout 2024.

Impact of Net Farm Incomes on Kentucky Commercial Crop Farms

Farm profitability affects farms and farm families in tax liability, the net farm income that enables the business to meet its financial obligations, and in farm family income. Data from the Kentucky Farm Business Management (KFBM) program illustrates how farm profitability has affected participating commercial crop farms.

Most farmers pay income tax on a cash basis: income received minus expenses paid and depreciation taken. Average 2022 Farm Profit or Loss for this group was $161,591. Crop farmers can expect high income tax liability again this year.

Net farm income (NFI) is a more accurate measure of profitability. It is gross income produced in the year minus cost of production regardless of when expenses are paid or income is received. The highest NFI yet seen in KFBM was $871,325 in 2021. Last year it dropped back to the 2020 level. Two reasons for the drop: 1) Total Cost Per Acre rose 21%, cutting the net by $184/ac. 2) Government Payments, a huge factor in farm recovery starting in 2017, fell to nearly nothing in 2022. Farmers can expect the same for 2023 and 2024.

USDA projects substantially lower 2023 NFI for all farms nationwide. For Kentucky crop farms, corn and soybean yields may offset lower prices, and the increase in cost of production has slowed, which could result in a less severe drop in NFI.

Net farm income directly affects farm financial condition by providing the means to meet obligations in long-term and short-term.

Solvency is the ability of the farm to meet its obligations in the long-term. A debt/asset ratio of less than 30% is healthy for a crop farm. Debt/asset ratio for these farms has been below 30% and falling for the past 6 years, due to increased NFI, good management decisions, and stable land prices.

Liquidity is the ability of the farm to meet its obligations in the short-term. Working capital is used to measure liquidity. It is current assets minus principal due in the next 12 months. The remainder is available to pay operating expenses, take advantage of opportunities, and meet challenges. Comparing working capital to principal due in the next 12 months gives the working capital ratio. A 2:1 or more ratio is healthy for a crop farm. These farms have had a healthy working capital ratio for the past three years due to management planning to keep current assets in the farm.

These farms are all owned and operated by families. They depend on NFI to contribute to Family Living. Total spending in 2022 was $95,988, a $24,000 increase over 2020 and earlier, led by increases in medical & general expenses.

2022 Situation

Agriculture continues to be on a wild ride with a multitude of factors impacting prices, income, and the overall outlook for the ag economy. Spiraling inflation topped the headlines in 2022, but other factors such as major weather events, continued supply chain disruptions, soaring input prices, labor challenges, and trade disruptions continued to offer challenges for most businesses this past year, including agriculture. On top of these factors, the war between two major global ag markets, Russia and Ukraine, generated significant impacts on commodity prices and the availability of both farm inputs, ag trade flows, and global food supplies. Despite these extreme events, the U.S. farm economy remained relatively strong in 2022. Even with record increases in input expenses and considerably lower government payments, USDA is projecting that U.S. net farm income will be higher in 2022.

The ag economy continues to depend heavily on trade outcomes. Despite several adverse trade headwinds such as a much stronger U.S. dollar (up more than 10% in 2022) and global economic growth cut in half, the value of U.S. agricultural exports will end up the year at record high levels, with gains across most ag commodities and major food products.

Leading the list of the largest export gains for ag products important to Kentucky (through September 2022) are U.S. soybean exports (+49%), dairy (+26%), beef (+ 21%) and poultry (+18%). U.S. distilled spirit exports are 25% higher, while forestry products are up 10%, both rebounding from dismal 2020- 2021 export levels. Pork exports are down 10%, and tobacco exports continue to plummet.

Certainly, higher commodity prices are responsible for the growth in export value as export volume was constrained by tight supplies for several ag commodities/products, not by a lack of demand. China remains the U.S. largest foreign customer for U.S. agricultural products, but U.S. ag sales to other major foreign markets, including Canada, Mexico, Japan, and the European Union all experienced double digit percentage increases through September 2022 compared to the same period last year.

U.S. ag production expenses are projected to increase by nearly 20% in 2022, which would be the highest annual dollar increase on record. While prices for some inputs such as fuel and fertilizer have moderated in recent months from their levels earlier in the year, they remain relatively high and volatile. Even with higher input prices, ag commodity prices have generally increased by a larger percentage as tight global supplies amidst strong export demand are keeping prices well above levels observed in recent years.

Interest rates have steadily increased in recent months in response to the Federal Reserve’s actions to fight inflation. Operating and real estate loans are now above 7% and will likely inch up more by the end of the year. Higher interest rates and tightening profit margins may soften the surge the growth in land values observed during the past years, but farm asset values remain strong. Consequently, even in the midst of some emerging concerns (higher interest rates, increasing debt loads, and uncertainty over the future value of farm prices, income, and assets), the balance sheet for U.S. agriculture remains solid heading into 2023, especially compared to the 2016-2020 period.

Kentucky

After a string of great years, mother nature was not kind to Kentucky farmers in 2022. Extensive periods of excess rain early in the growing season, followed by drought conditions during critical growing periods led to lower crop yields plus a poor curing season for tobacco. The December 2021 tornado in west Kentucky and the July 2022 floods destroyed ag infrastructure and likely affected 2022 farm marketings/income in these areas. While Kentucky farmers benefitted from relatively high national commodity prices, local grain prices were adversely impacted during the harvest season by the effects of low water levels on the Mississippi River limiting grain flow to domestic and export markets and inducing significant carryover of grain into 2023.

Despite these challenges, Kentucky ag cash receipts may approach a record high $8 billion for 2022, well surpassing last year’s record high of $6.9 billion. Adjusted for inflation, our 2022 receipt estimate if achieved, will be 19% higher than the inflation-adjusted average over the previous ten years. Overall, farm-level prices received by Kentucky farmers will likely exceed lower yields/marketings for most Kentucky ag enterprises. Despite challenges evolving from the tornado and avian influenza, poultry is expected to regain the top spot in Kentucky agriculture with a 20% market share of receipts, followed by soybeans and corn (both at 18%), horses (16%) and cattle (13%).

Kentucky farmers established a record net farm income in 2021 with exceptional yields and growing export markets. Inflated input prices and limited direct government farm payments for this year will partially offset Kentucky’s expected record level of farm cash receipts for 2022, but crop insurance payments should cushion the blow for Kentucky farmers impacted by natural disasters, leading to another year of relatively strong net farm income levels for Kentucky agriculture.

2023 Outlook

Historically, periods of high global ag prices often lead to a global production response which typically results in commodity prices falling more than sticky ag input prices. However, agriculture will enter 2023 with continued tight global supplies of most agricultural commodities and thus continued relatively high commodity prices. However, the upcoming year is filled with much uncertainty over issues such as the war in Ukraine, South American crop production response, economic challenges in China, the effects of inflation on interest rates and the cost and availability of ag inputs. U.S. ag export demand could be dampened by a slowing global economy and an anticipated higher valued U.S. dollar. Most ag economists expect commodity prices and margins to moderate in 2023, but still maintaining relatively high cash receipts and net income levels. But the outlook is very vulnerable to radicle changes in global economic, geopolitical events, weather and disease factors which could easy lead to extremely volatile farm prices and incomes. Consequently, producers must continue to monitor to changing conditions, and be ready to adjust marketing strategies often amidst this extreme uncertain marketplace.

2022 Situation

In a year when production was expected to be lower, beef production was actually higher in 2022. Wide spread drought and a relatively strong cull cow market resulted in a lot of cattle being pulled forward and a large proportion of females entering in the beef system. In fact, the size of the US cowherd has been decreasing since 2019, but we have not yet seen an annual decrease in beef production. While USDA estimates won’t be released until early 2023, it is likely that the size of the US beef cow herd decreased by another 3-4% for the year, which would put the herd near the levels seen in 2015.

2023 Outlook

While there is uncertainty about demand and weather going forward, the fundamentals look very strong in the beef cattle sector. A decrease in beef production of more than 5% is very likely for 2023 and the supply of feeder cattle and calves will continue to get tighter. The spring calf market should be extremely high, with 550 lb medium / large frame #1-2 steers averaging more than $2 per lb on a state average basis. Tight supplies and high feed prices will support heavy feeder prices, which should trend upward throughout the year. Value of gain will remain strong and opportunities to add weight to Kentucky cattle should exist, despite high feed costs. High value of gain should also lead to attractive margins for stocker operations that add lbs via forage from spring to fall.

2022 Situation

Avian Influenza (AI) was the primary story of poultry markets this year at the national level. While AI was found in Kentucky, it was largely contained and the impacts were limited. National broiler production was higher in 2022, but production was down considerably in the Commonwealth. Several operations were impacted by the tornadoes that ripped through much of Kentucky in December of 2021 and a processing plant in the Western part of the state operated at reduced capacity for a period of time. This, combined with an increase in time between flocks, worked to decrease production at the state level. Much was made of decreasing broiler prices through summer and fall, but wholesale price levels have remained above last year’s levels.

2023 Outlook

Feed and labor costs will again impact integrator margins and may continue to result in increased time between flocks in 2023, but Kentucky production levels should return to near normal levels. Poultry producers will continue to feel the impact of high energy costs on their returns per flock. Construction costs and higher interest rates will also limit growth in the sector and may impact upgrades to existing houses. While the industry remains stable, the last couple of years have driven home the importance of risk factors such as disease outbreak and natural disasters, both of which should be on the minds of Kentucky’s poultry producers.

2022 Situation

The year 2021 was a banner year for hog markets as prices reached their highest levels since 2014. Eastern Corn Belt hog prices actually exceeded those levels in 2022, but significantly higher feed prices ate into margins somewhat. Still, farrow-to-finish returns were positive for most of the year. Surprisingly, hog inventory has been decreasing since 2020, despite relatively attractive return levels. Export levels have decreased from their recent highs as China appears to have rebuilt its hog inventory, but remain well over 20% of domestic pork production.

2023 Outlook

USDA-ERS is predicting a slight increase in pork production in 2023, but that will primarily be a function in increasing productivity. Exports are also likely to face continued headwinds going forward. Hog prices will likely decrease from 2022 levels, but remain historically strong. As with all livestock species, feed prices for the coming year will impact profitability. However, farrow-to-finish returns are likely to be in the black for most of 2023.

2022 Situation

Equine markets have continued their very impressive recovery from the depressed market brought on by COVID-19. After seeing an increase of 38% from 2020 to 2021, Keeneland sales increased by another 9% in 2022. This was the highest sales level since 2007. A continued return to normal likely had a positive impact on markets for competition horses. Coming out of the pandemic, excess disposable income, an increase in remote work arrangements, and a possible change in priorities likely had a positive impact on the demand for horses of all types.

2023 Outlook

While there are risk factors that can impact equine markets, the general strength of the sector is likely to remain. Revenues generated from historical horse racing (HHR) continue to increase purses and attract quality horses to the state. This trend is also undoubtedly feeding into sale values and possibly stud fees, the two main components of equine farm level receipts in the Commonwealth. While the number of mares bred may continue to decline slightly, it is also possible that trend will be offset by strength in the markets. So, another increase in equine receipts at the state level seems very likely for 2023.

2022 Situation

Dairy cow inventory steadily increased for the first several months of 2022 as farm level milk prices improved, then largely flattened through summer and into fall. The U.S. All Milk price will average around $25 per cwt for the year, which will be more than $6 per cwt higher than 2021, despite the fact that milk price levels have retreated from their spring highs. This price improvement was partially offset by increased feed costs as the estimated feed cost included in the Dairy Margin Coverage (DMC) program ration increased by about $3 per cwt of milk produced from 2021 to 2022.

2023 Outlook