2022 Tobacco Census Data for Kentucky

Author(s): Will Snell

Published: February 28th, 2024

Shareable PDF

The USDA conducts an agricultural census every five years with the latest released on February 13, 2024, reflecting data compiled from farm operations in 2022. Below are some highlights from the 2022 Ag Census pertaining to Kentucky’s tobacco sector which arguably has experienced the largest structural change of any sector and state in U.S. agriculture over the past two decades.

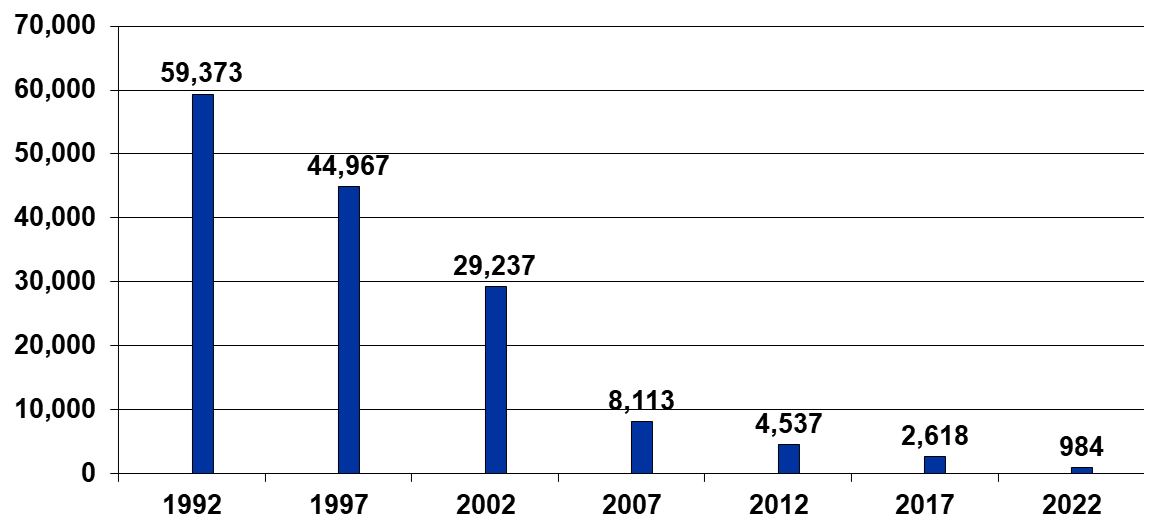

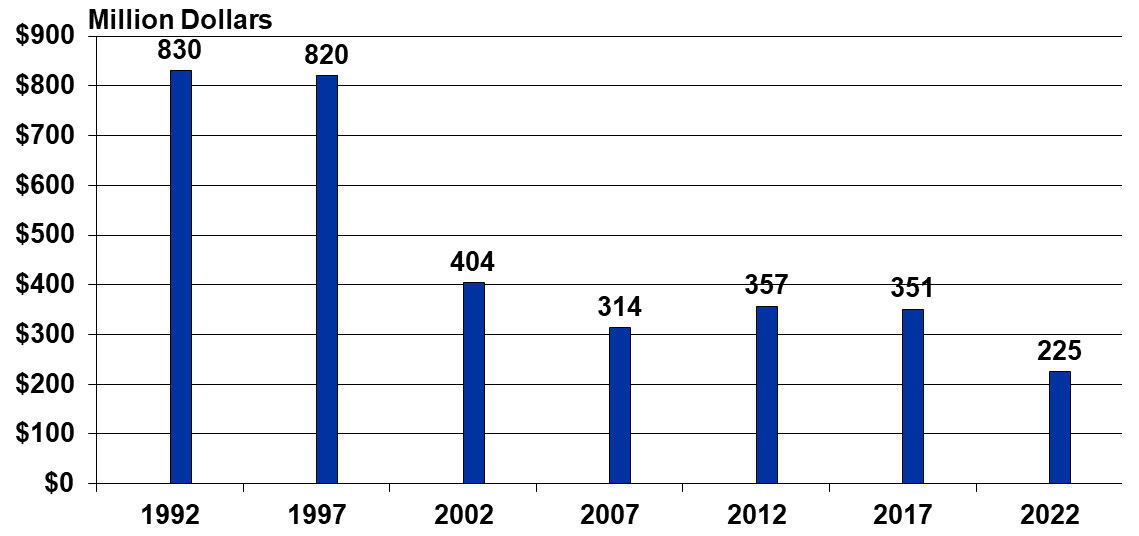

- Kentucky farms with tobacco acres in 2022 totaled 984, down from 2,618 farms in 2017 and nearly 60,000 farms back in the early 1990s. The value of Kentucky's tobacco production totaled $225 million in 2022, compared to $351 million in 2017 and a reduction of more than 70% from record levels exceeding $800 million in the 1990s.

Figure 1: Number of Farms Growing Tobacco in Kentucky (Census Years)

Source: USDA Ag Census

Figure 2: Value of Kentucky Tobacco Production

Source: USDA Ag Census

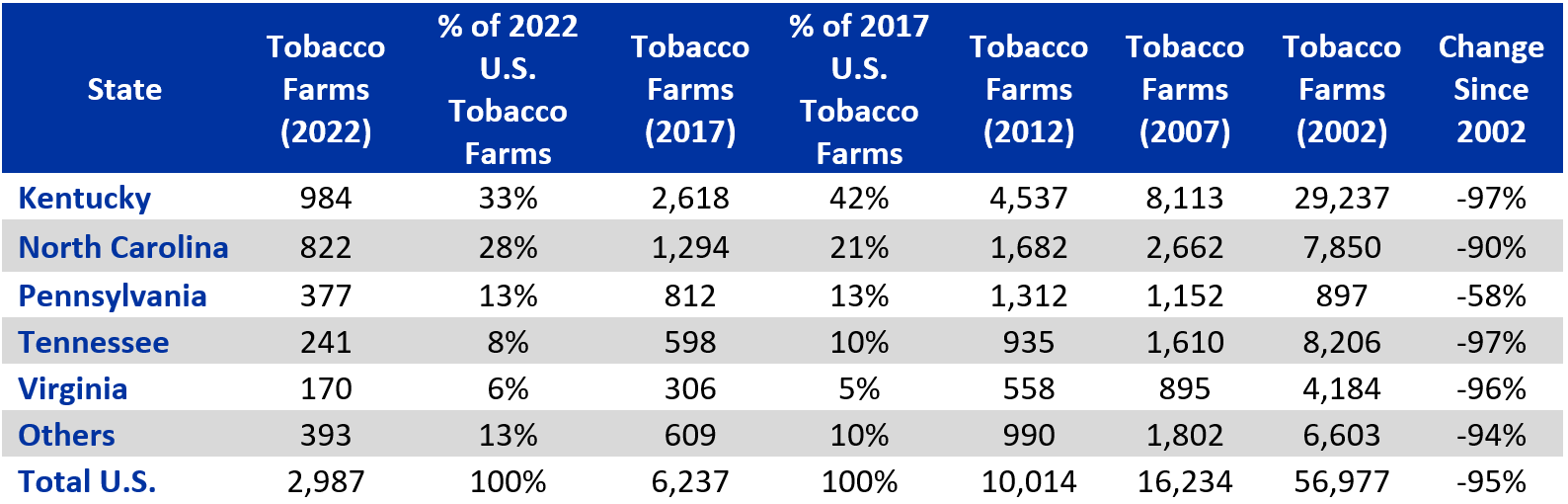

- Kentucky remains the U.S. state with the largest number of tobacco farms, but its share has declined from 42% of U.S tobacco farms in 2017 to 33% in 2022. North Carolina remains number two in tobacco farms with 822 farms, followed by Pennsylvania (377), Tennessee (241), and Virginia (170).

Table 1: Number of Tobacco Farms by State

- The average size of tobacco production per farm in Kentucky was 44.9 acres in 2022, compared to 30.8 acres in 2017, 19.4 acres in 2012, 10.8 acres in 2007 and 3.8 acres in 2002.

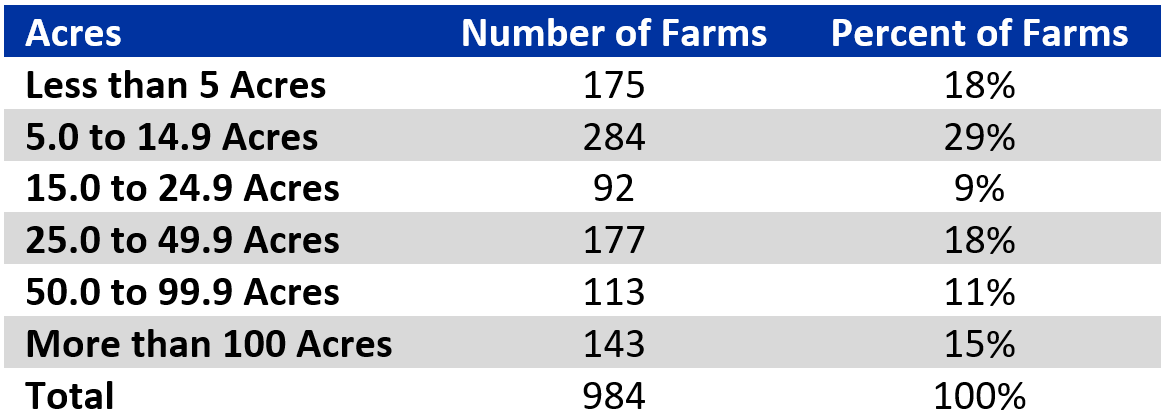

- In 2022, 143 (or 15%) of Kentucky tobacco farms grew more than 100 acres of tobacco, while 47% had less than 15 acres.

- Christian County remained the Kentucky county with the largest number of farms growing tobacco in 2022 with 77 farms, followed by Daviess and Todd with 50 farms, Graves with 49 farms and Todd with 42 farms.

- Not a single Kentucky county showed an increase in the number of farms growing tobacco in 2022 vs 2017, compared to 12 counties increasing the number of farms growing tobacco in the 2017 Census.

- Breckinridge County lost the greatest number of tobacco farms in the 2022 Census with a reduction of 76 farms, followed by Todd (-75), Christian (-60), Barren (-56) and Daviess (-56).

- Christian County remained the #1 Kentucky tobacco county by value of production in 2022 with $44.2 million of sales followed by Calloway County ($15.4 million), Barren County ($13.9 million), Todd County ($13.3 million) and Graves County ($8.4 million).

Table 2: Kentucky Tobacco Farms by Acres

USDA Ag Census data regarding tobacco farms is also broken down by county and market value in a downloadable spreadsheet, Ag Census Tobacco Farms (2022-2022).

Recommended Citation Format:

Snell, W. “2022 Tobacco Census Data for Kentucky." Economic and Policy Update (24):2, Department of Agricultural Economics, University of Kentucky, February 28th 2024.

Author(s) Contact Information:

Will Snell | Extension Professor | wsnell@uky.edu

Recent Extension Articles

Grain Profitability Outlook 2024

Greg Halich

Grain prices have dropped dramatically in the last year. Current prices for 2024 new crop delivery are around $4.15/bu for corn, $11.00/bu for soybeans (2/23/23). This is a decrease of around $1.00/bu for corn and $1.75/bu for soybeans compared to what these prices were expected one year ago.

Weathering The Storm

Jerry Pierce

“Agriculture is by nature a cyclical industry.” So said the Federal Deposit Insurance Corporation (FDIC) in History of the Eighties - Lessons for the Future published in 1987. It still is, with net incomes cycling up and down over the decades. So how can farms “weather the storm” when farm income is cycling down? Long-term success in farming depends greatly on the ability of the farm business to meet obligations in the long term and short term. And it might be said that every business must meet its obligations this year to have a chance to meet the longer-term obligations.