2023 Farm Bill Overview and Update

Author(s): Will Snell

Published: April 28th, 2023

Shareable PDF

The 2023 Farm Bill debate continues to evolve in our nation’s capital amidst a lot of political challenges. The farm bill is a massive comprehensive piece of legislation covering everything from farm programs, conservation, rural development, forestry, trade promotion, nutrition, and even ag research and education. Generally, the farm bill comes before Congress every 5 years, with the current (2018) farm bill set to expire on September 30, 2023. Every farm bill is challenging, but this one will be a doozy to get to the finish line on time.

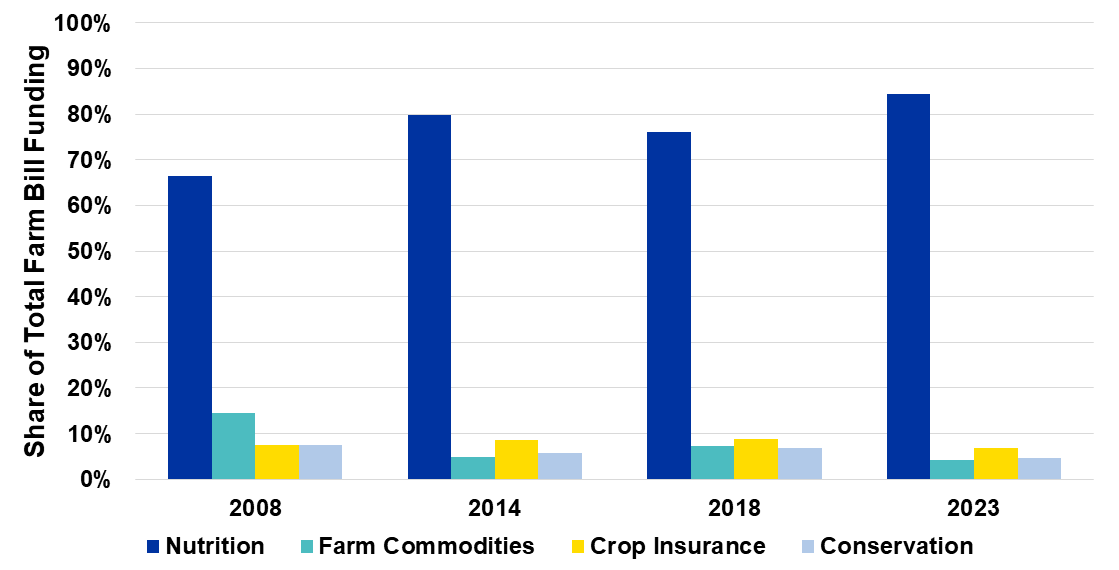

Initially, when the first farm bill originated as part of the New Deal programs of the 1930s, the focus was on programs to jump-start the depressed farm economy. Over time, additional topics, interest groups, and impacted participants have joined the farm bill debate. In reality, the farm bill has turned into a “food” bill as the Congressional Budget Office (CBO) has projected that nutrition expenditures are projected to exceed 80% of the farm bill budget over the next ten years, with farm commodities, crop insurance, and conservation programs in aggregate comprising less than 15% of the farm bill pie (Figure 1).

Figure 1: Distribution of Farm Bill Funding

1/ 2008, 2014, 2018, Farm Bills Based on CBO Estimates on Date of Enactment, 2023 Based on CBO Score February 2023

The challenging issue for this farm bill will be funding. This will be the first trillion-dollar farm bill with the budget set by an established CBO baseline of available dollars which cannot be increased without the approval of Congress. Nutrition supporters argue that the nation is still reeling from the effects of Covid, a potential emerging recession, and escalating grocery prices that are significantly impacting low-income consumers. Opponents argue that in the midst of a tight labor supply, stronger work requirements for able-bodied adults are needed for low-income citizens to be eligible for food assistance within the Supplemental Nutrition Assistance Program (SNAP, i.e., food stamps). Farm group leaders contend that net farm income in the coming years will likely decline in response to continued inflated input costs amidst anticipated lower commodity prices. Others participating in the farm bill debate are looking at reducing spending within this piece of legislation given concerns over the pending debt ceiling issue and the overall growing national debt facing the U.S. government and taxpayers.

The number one goal of most of the farm sector amidst the farm bill debate is protecting crop insurance. Other items that various farm organizations support are increasing the farm safety net amid inflated input prices, along with increased support for specialty crops, trade promotion programs, conservation programs, research, and rural development (yes, broadband again). Updating base acres or determining payments on planted acres has been discussed, along with the usual debate over means testing (based on income levels) for various farm programs benefits. These asks will require new dollars, which without additional funds becoming authorized by this divided Congress (a challenge) will require taking dollars from nutrition programs (another challenge) or other programs (again, a major challenge). Another big hurdle in passing a major piece of legislation like a farm bill is that almost ½ of the 118th Congress has NEVER been part of a farm bill debate.

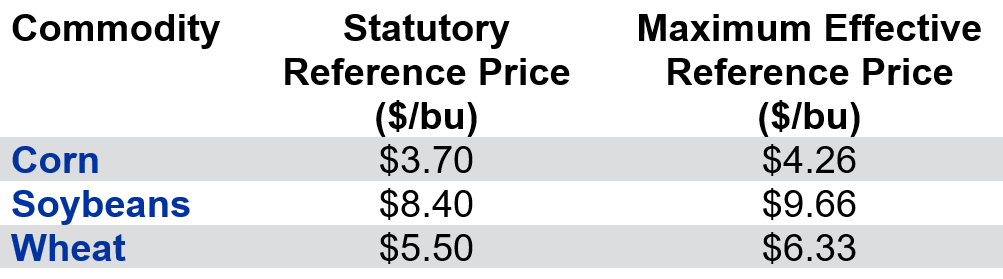

The primary farm bill safety net component for crop farmers (primarily corn, wheat and soybeans for Kentucky) in the current farm bill are the Agricultural Risk Coverage (ARC) and the Price Loss Coverage (PLC) programs. These programs were established in the 2014 Farm Bill with eligible farmers having the option of selecting one of these two safety net programs. ARC-CO triggers payments on 85% of historical base acres if the county revenue for a given crop year falls below 86% of the benchmark revenue for the county-based program. [1] PLC triggers payments on 85% of historical base acres if the marketing year average price falls below an established price floor labeled as a reference price. The statutory reference price was established in the 2014 farm bill (see Table below for Kentucky program crops). The 2018 Farm Bill introduced an escalator clause that allows a higher “effective” reference price up to a maximum of 115% of the statutory reference price. For 2023 corn, soybean, and wheat crops, the statutory reference price will remain the effective price floor. Relatively high commodity prices have resulted in no payments under these two programs in recent years and are projected to not come into play for 2023 grain crops. Some farm organizations are calling for a stronger safety net under these programs (either by increasing the statutory reference prices or the escalator percentage) as part of the 2023 Farm Bill debate, arguing that the price/revenue protection provided by these programs was established almost ten years ago when input prices were significantly lower and when farmers didn’t face the geopolitical issues causing much uncertainty and volatility in ag markets as they do today.

The ag policy focus by President Biden/Secretary Vilsack has somewhat shifted away from traditional farm bill safety net programs to new programs supporting sustainability, climate change, and additional non-traditional sources of farm revenues (e.g., local foods, value-added, expanded meat processing, climate-smart ag practices, biobased economy products) which the administration argues will provide increased opportunities for small to medium-sized farmers. Given that most of the traditional farm bill dollars go to large-scale producers of program crops (primarily corn, soybeans, and wheat) Secretary Vilsack has been on tour this year claiming that U.S. ag policy needs to diversify income support. He wants to change the mindset of “you have to get big or get out.” He constantly points out that while U.S. agriculture established a record high net farm income in 2022, the majority of farms lost money and depend primarily on off-farm income to support their farming operation.

Currently, there is a lot of focus amidst the farm bill debate about emerging climate-smart agriculture programs as part of the Inflation Reduction Act (IRA) passed in December which contained nearly $20 billion to assist with carbon sequestration/conservation programs. USDA is rolling out funding opportunities for these funds, but some members of Congress and farm organizations support targeting these funds to support other farm bill initiatives.

Importance of Government Payments to Farm Income

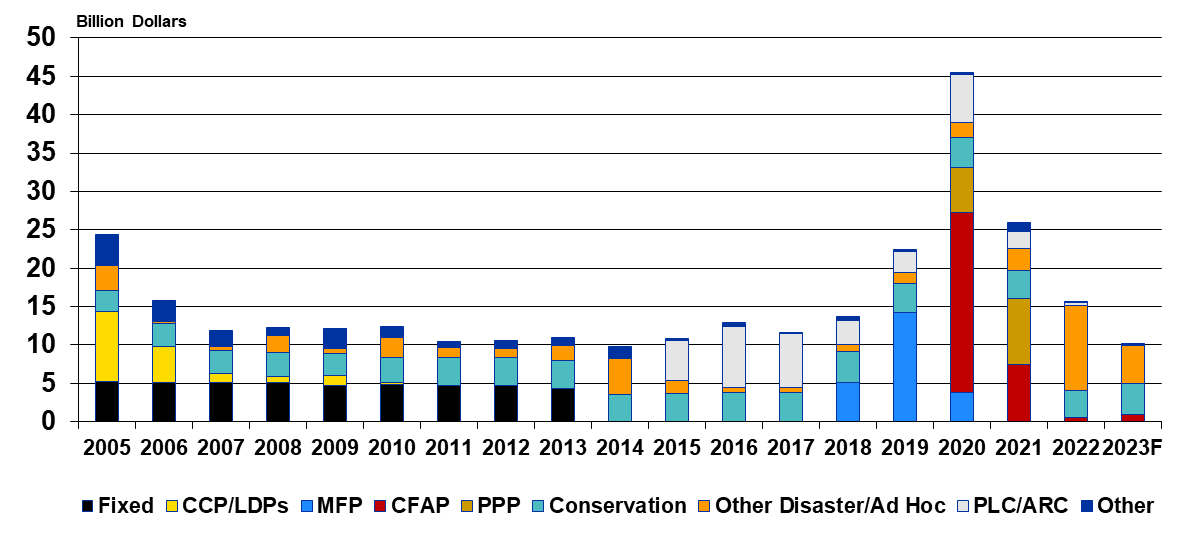

Government payments to support agriculture has varied over the years in response to the farm economy and the strength of the farm lobby. Federal government direct payments for U.S. farm programs were fairly stable from 2007-2017 (averaging $11.4 billion dollars or 13.5% of U.S. net farm income), after establishing a record high level of nearly $25 billion in 2005. Government payments for farm programs increased considerably during the 2018-2021 period primarily in response to supplemental/ad hoc funds that were authorized outside the farm bill that provided the ag economy dollars to offset the adverse impacts of trade conflicts, Covid, and various natural disasters. As a result, government payments to the ag sector swelled to a record $45.6 billion in 2020 accounting for 45% of net U.S. farm income before falling in 2021-2022 (and projected for 2023) as ag prices/markets recovered.

Figure 2: Federal Government Direct Farm Program Payments

Source: ERS/USDA

Specifically, the trade war with China prompted the Trump administration to issue Market Facilitation Program (MFP) payments to U.S. farmers during 2018-2020, totaling $23.1 billion. Pandemic support for U.S. farmers was provided by the Coronavirus Food Assistance Program (CFAP) totaling over $31 billion in 2020 and 2021, along with more than $14 billion for the Paycheck Protection Program (PPP) to support payroll for small businesses (including agriculture) with forgivable loans during the COVID-19 pandemic. Collectively non-farm bill programs accounted for over 70% of government support for agriculture from 2018-2022, prompting some ag lobbyists to support incorporating a more permanent disaster program within the 2023 Farm Bill.

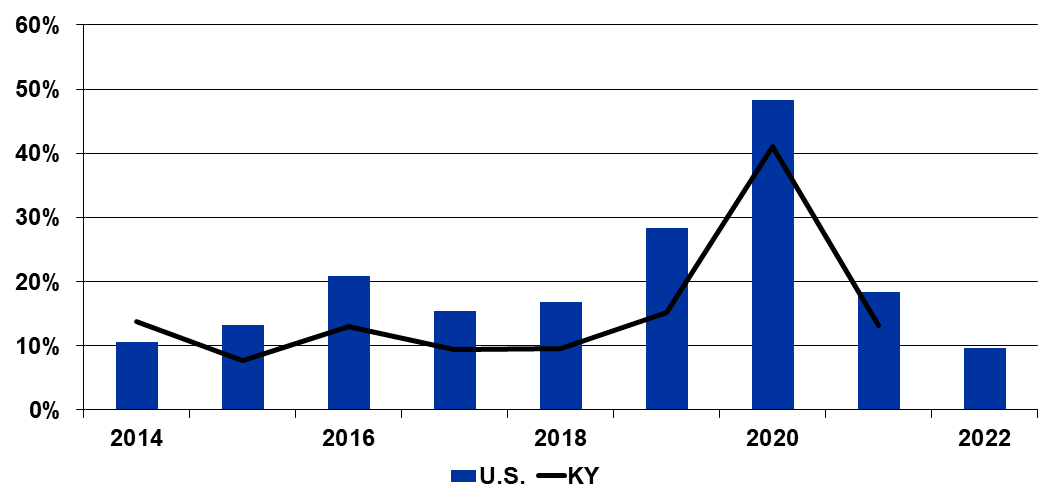

Excluding the Tobacco “buyout” years (2005-2014), Kentucky’s farm economy has generally been less dependent on government payments compared to the United States as a whole (see Figure 3). This observation rests upon the relative importance of livestock in our state which (outside of conservation dollars) typically does not receive direct government support. Over the past two farm bills, Kentucky ranks 35th in terms of dependence on direct government farm payments (measured as the level of government farm payments as a percentage of net farm income) and 25th in terms of total government farm payments.

Figure 3: Direct Government Payments as a % of Net Farm Income

United States vs Kentucky

Source: ERS/USDA: February 2023

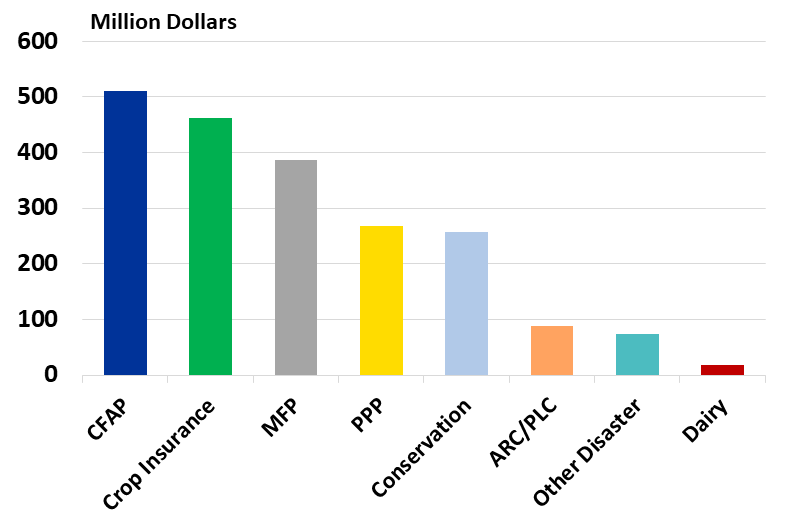

Government payments exceeded 40% of Kentucky net farm income in 2020 and were over 30% of net farm income for our Kentucky Farm Business Analysis farms (primarily large grain farms in western Kentucky) during the 2018-2021 period. Similar to the U.S. data, the majority of government dollars received by Kentucky farmers since the adoption of the 2018 Farm Bill has been outside the traditional farm bill safety net programs. Figure 4 shows the distribution of payments that Kentucky farmers have received from 2018-2021 (2022 data will become available in August 2023). One-quarter of the government payments during this time frame originated from the Coronavirus Food Assistance Program (CFAP -- $511 million), 19% from Market Facilitation Program payments (MFP -- $386 million), and 13% from Paycheck Protection Program payments ($267 million) versus only 4% from the farm bill income/price support programs (PLC/ARC).

Figure 4: Various Government Farm Payments for Kentucky (2018-2021)

Source: ERS/USDA: February 2023

Stronger commodity prices and reduced supplemental/ad hoc assistance will likely result in Kentucky government payments being less than 10% of net farm income in 2022, comprised primarily of around $60 million for conservation and over $50 million for the first round of Emergency Relief Program (ERP) payments which provided assistance for natural disasters in 2020 and 2021.

Looking ahead it will be a real challenge for Congress to continue to support U.S./Kentucky agriculture with continued significant funding for a wide variety of supplemental/ad hoc funds which increases the need for a farm bill that strengthens/expands existing markets, creates new markets, provides effective risk management programs and tools to counter weather risks and volatile markets and provides economic support for rural communities. While the ag community will continue to examine farm bill programs to support ag prices and incomes, one out of every eight Kentucky households receives nutrition assistance which elevates food insecurity and food access as important issues for Kentuckians as part of this farm bill/ag policy debate.

[1] ARC also has an individual farm revenue-based program but has yet to be selected by many farms.

Recommended Citation Format:

Snell, W. “2023 Farm Bill Overview and Update." Economic and Policy Update (23):4, Department of Agricultural Economics, University of Kentucky, April 28th, 2023.

Author(s) Contact Information:

Will Snell | Extension Professor | wsnell@uky.edu

Recent Extension Articles

Tobacco Economics Update

Will Snell | April 6th, 2023

This tobacco update includes 2023 tobacco budgets for burley, dark air-cured, dark fire-cured, cigar wrapper tobaccos, a summary of USDA’s 2023 Prospective Plantings report, and an overview of recent prices and market factors.

Projected Plantings and Historical Accuracy

Grant Gardner | April 28th, 2023

In this article, I discuss the Prospective Planting report for 2023, which provides the first survey-based estimates of farmers' 2023 planting intentions. I first discuss the projections for the United States and Kentucky. I then look at how accurate the United States estimates have been in recent history and how the information could affect marketing year prices.