2023 May WASDE Update: Yield is King

Author(s): Grant Gardner

Published: May 30th, 2023

Shareable PDF

Summary

Current projections predict a record U.S. corn and soybean crop during the 2023/24 marketing year. Although yield estimates can change drastically with growing season weather, the projections indicate a smaller gross revenue per acre in 2023/24 compared to 2022/23 due to lower price expectations. As winter wheat is approaching the end of the growing season, more information is known. Despite the drought in the west and lower yields, total production is still expected to be larger than last year due to increased wheat acreage. Wheat markets are still fluctuating due to geopolitical conflicts, but current projections indicate that the average gross revenue per acre of wheat will also decline compared to 2022/23.

Introduction

The USDA released its latest World Agricultural Supply and Demand Estimates (WASDE) on May 12th. The May WASDE report gives the first projections for the 2023/24 marketing year outside of February’s Agricultural Outlook Forum (AOF). One large addition to the May projections compared to February is that the May projections are based on the acreage reported in the March 31st Prospective Planting report, which I covered in last month’s Economic and Policy Update article, "Projected Plantings and Historical Accuracy."

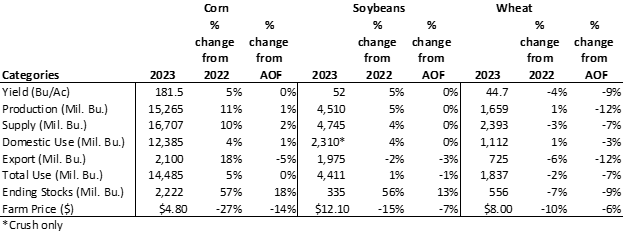

The February forum numbers indicated a record production year driven largely by yield increases estimated by a trendline. In this article, I point out changes in the supply and demand estimates from the previous marketing years and AOF (Table 1). It is worth noting that the marketing year for wheat begins on June 1st, and the marketing year for corn and soybeans begins on September 1st. Initially, trend yield is utilized until more information is available. As the start of the marketing year gets closer, the WASDE reports will incorporate planted acreage and specific yield estimates.

Commodity Breakdown

Corn

Trend would suggest a U.S. corn yield of 181.5 bu/acre for the 2023/24 marketing year, which is unchanged from the estimates at the AOF. Using data from the prospective planting report, total U.S. corn production estimates have increased by 1% since February, an increase of 11% from last year as the U.S. rebounds from drought. On the demand side, domestic use is projected to increase by 4% and exports by 18%. The current projection for production exceeds that of total use, which would result in a 57% increase in ending stocks. The increased carry results in a 14% lower price forecast of $4.80/bushel. If the projections are accurate, an acre of corn this year will gross $272.58 less than last year. One factor which will partially offset lower gross revenues is dramatically lower fertilizer prices in 2023 compared to last year.

Soybeans

The same method to project yield in corn is used for soybeans in the May WASDE report. Current projections indicate a soybean yield of 52 bu/acre, up 5% from last year. As acreage is projected to remain unchanged, production also increases by 5%. Exports are estimated to decrease by 2% from last year. The average marketing year price is projected to be $12.10/bu, down 15% from last year and 7% from the February AOF projections, driven by the expected decrease in exports. Current projections indicate an average gross revenue of $73.70 per acre less than last year. One factor which could increase soybean demand, and thus price, is crush expansion. Crush capacity is projected to increase by nearly 65 million bushels in 2023 and 185 million bushels in 2024 (Gert, 2024). If crush capacity is obtained early and there is enough meal or oil demand, the price of soybeans could increase.

Wheat

The USDA has more information on wheat yields as winter wheat harvest quickly approaches. The current yield estimates suggest a 4% decrease from last year and a 9% decrease since the February projections due to drought in the Western U.S. However, due to an expansion in wheat acres, total production is still expected to be up 1% from last year. As exports and use are set to decrease, and markets are still trying to correct after the Russia-Ukraine invasion, the season average price is projected to be 10% lower than last year at $8.00/bu. Both lower yields and prices cause the average projected gross revenue to fall by $53.93 per acre. Geopolitical events such as the Black Seas Grain deal are still impacting world wheat markets, and the price will likely be volatile in the 2023/24 growing season.

Table 1: May 2023 WASDE Projections Compared to 2022/23 Marketing Year AOF Projections

Sources: Mapes, William E. | Southern Ag Today, USDA WASDE, USDA AOF

Recommended Citation Format:

Gardner, G. "2023 May WASDE Update: Yield is King." Economic and Policy Update (23):5, Department of Agricultural Economics, University of Kentucky, May 30th, 2023.

Author(s) Contact Information:

Grant Gardner | Assistant Extension Professor | grant.gardner@uky.edu

Recent Extension Articles

Current State of Carbon Market Policies

Jordan Shockley

There are now policies that have passed or are currently being considered pertaining to carbon markets in the agricultural sector. Two important policies in the carbon market space are the Growing Climate Solutions Act (passed) and the proposed rule by the Securities and Exchange Commission (SEC) titled “The Enhancement and Standardization of Climate-Related Disclosures for Investors.”

Land Rental Agreements

Jennifer Rogers

Land rental agreements can come in many shapes, sizes, parameters, and stipulations. Typically, we see three basic land rent types: cash rent, share rent, and the increasingly popular, flex rent. Each rental agreement is likely to be different. This article will just touch on the basics, realizing that each landlord and renter can develop their own individual agreement.