Cow-Calf Profitability Estimates for 2023 and 2024 (Spring Calving Herd)

Author(s): Greg Halich, Kenny Burdine, and Jonathan Shepherd

Published: February 28th, 2024

Shareable PDF

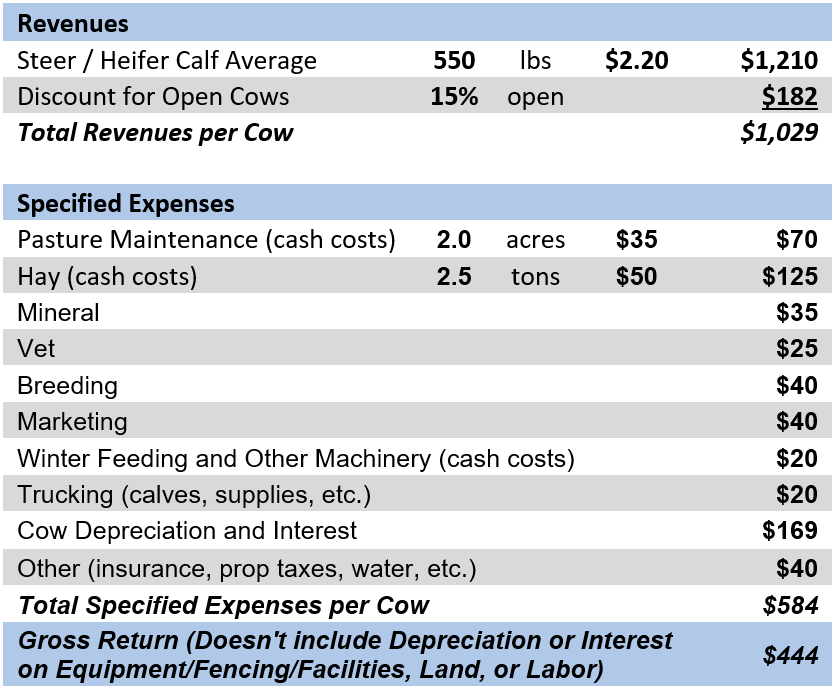

The purpose of this article is to examine cow-calf profitability for a spring calving herd that sold weaned calves in the fall of 2023 and provide an estimate of profitability for the upcoming year, 2024. Table 1 summarizes estimated costs for a well-managed spring-calving cowherd for 2023. Every operation is different, so producers should evaluate and modify these estimates to fit their situation. Note that in Table 1 we are not including depreciation or interest on equipment/fencing/facilities, as well as labor and land costs. These will be brought into the analysis and discussed later on.

Calves are assumed to be weaned and sold at an average weight of 550 lbs. In the fourth quarter of 2023, steers in this weight range were selling for prices in the $230’s per cwt and heifers in the $200’s, on a state average basis. Therefore, a steer/heifer average price of $2.20 per lb is used for the analysis, which was $0.65 per lb higher than last year. As we write this in February, calf prices have increased from these levels, but this analysis assumes that spring-born calves were sold in the fall of 2023. Weaning rate was estimated at 85%, meaning that it is expected that a calf will be weaned and sold from 85% of the cows that were exposed to the bull. Based on these assumptions and adjusted for the weaning rate, the average calf revenue is $1029 per cow.

Cost-wise, there were not any major changes for 2023, other than marketing costs due to the higher calf prices. Pasture maintenance costs are assumed to be relatively low at $35 per acre and would include only basic cash costs of pasture clipping (fuel, maintenance, repairs), and a limited amount of reseeding, fertilizer, and fencing repairs. Cattle farmers who consistently apply large amounts of fertilizer to pasture ground would see higher pasture maintenance costs. The pasture stocking rate is assumed to be 2.0 acres per cow, but this will vary greatly. Stocking rate impacts the number of grazing days and winter feeding days for the operation (i.e. high stocking rates will mean more hay feeding days), which has large implications for costs on a per-cow basis.

These spring-calving cows were assumed to use 2.5 tons of hay per cow, and the estimated cash cost of making this hay (fuel, maintenance, repairs, supplies, fertilizer, etc.) was $50 per ton. Mineral cost is $35 per cow, veterinary / medicine costs $25, trucking costs $20, machinery cash costs for winter feeding and other miscellaneous jobs is $20, and other costs (insurance, property taxes, water, etc.) are $40. Breeding costs are $40 per cow and should include annual depreciation of the bull and bull maintenance costs, spread across the number of cows he services. Marketing costs are assumed to be $40 per cow (adjusted for the 85% calf crop) for average-sized farms selling in smaller lots. Larger operations would likely market cattle in larger groups and pay lower commission rates.

Breeding stock depreciation and interest are major costs that are often overlooked. They are generally not cash costs that need to be paid on a yearly basis, unless you have a loan on the cattle, but they are real costs that need to be paid at some point. As an example, assume that in a typical year bred heifers are valued at $1800, have eight productive years, and have a cull cow value of $1000. For clarity, this is not meant to reflect the current value of bred heifers and cull cows, but rather the average value of all females currently in the herd (cows enter the herd at different times and in different markets). The average yearly depreciation is calculated as follows:

$1800 bred heifer value

–$950 cull-cow value (adjusted for a 5% death loss)

$850 total depreciation

$850 total depreciation / 8 productive years = $106 cow depreciation per year. The actual depreciation will vary across farms. When buying bred replacement heifers, the initial heifer value is clear. With farm-raised replacements, this cost should be the revenue foregone had the heifer been sold with the other calves, plus all expenses incurred (feed, breeding, pasture rent, etc.) to reach the same reproductive stage as a purchased bred heifer. At an average value of $1400 (halfway between bred heifer and cull value) over her lifespan on your farm, and assuming a 4.5% interest rate results in a $63/cow/year interest cost, or a total of $169/cow/year in combined depreciation and interest.

Table 1: Estimated Gross Return to Spring Calving Cow-calf Operation 2023

Note that based on the assumptions in our example, total specified expenses per cow are $584 and revenues per cow are $1029. Thus, the estimated gross return is $444 per cow. At first glance, this positive return looks impressive but is also misleading. A number of costs were intentionally excluded because they vary greatly across operations. Notice that no depreciation or interest on equipment/fencing/facilities was included. Notice also that labor and land costs were also not included. Thus, the gross return needs to be adjusted by these costs to come up with a true return to the farm.

Since these costs vary so much from one operation to the next, it may be helpful to pick a specific-sized farm and provide estimates for these costs: a 40-cow operation that is producing its own hay and has all farming operations on its own land (80 acres of pasture and 30 acres of hay).

Assume this farm has on average $50,000 in equipment which depreciates roughly $1000 every year, or $25/cow/year in depreciation. At 4% interest, an additional cost of $2000 in interest per year, or $50/cow/year, would be realized. Assume also this farm has fencing, barns, working facilities, etc., with an initial value of $50,000 and a lifespan of 25 years. That would amount to $50/cow/year in depreciation and $25/cow/year in interest.

Assume we have 2.0 acres of pasture and .75 acres of hay per cow, and value that at a land rent of $45/acre, that would be $125/cow/year in land rent. Assume also that we have determined we have $125/cow/year in labor, which would amount to $5000 total labor cost per year for the entire herd.

Summary of Additional Non-Cash Costs (40-Cow Example Farm)

Equipment Depreciation $25/cow/year

Equipment Interest $50/cow/year

Fencing-Facilities Depreciation $50/cow/year

Fencing-Facilities Interest $25/cow/year

Land Rent $125/cow/year

Labor $125/cow/year

Total Additional Non-Cash Costs $400/cow/year

These non-cash costs add up to $400/cow/year on our example farm: $150 per cow in depreciation/interest on equipment/fencing/facilities and $250 per cow in land rent and labor. We encourage you to estimate these for your own operation, but the unfortunate reality is that they quickly add up on most farms. The $444/cow/year gross return over cash costs and cow depreciation does not look quite as good now. After adjusting for these other costs, the net return (all costs included) is +$44 per cow per year ($444 – $400), or $1760 net return for the 40-cow farm.

Another way to look at this is to just include the depreciation and interest for equipment/fencing/facilities ($150/cow/year), and not include land and labor ($250/cow/year). In this case, the return would increase to +$294 per cow ($11,760 for the farm) and would represent the farm's return to land and labor. Was this $294 per cow a real profit? No, because it does not include any costs for land and labor. But we are showing it here because this is the approach many farmers use.

These numbers will vary across operations, so estimating your own cost structure is extremely important. Our guess is that compared to our example farm, there are far more cow-calf operations of similar size with a higher cost structure than there are operations with a lower cost structure in Kentucky. Put simply, well-managed spring calving herds were likely generating a true profit in 2023.

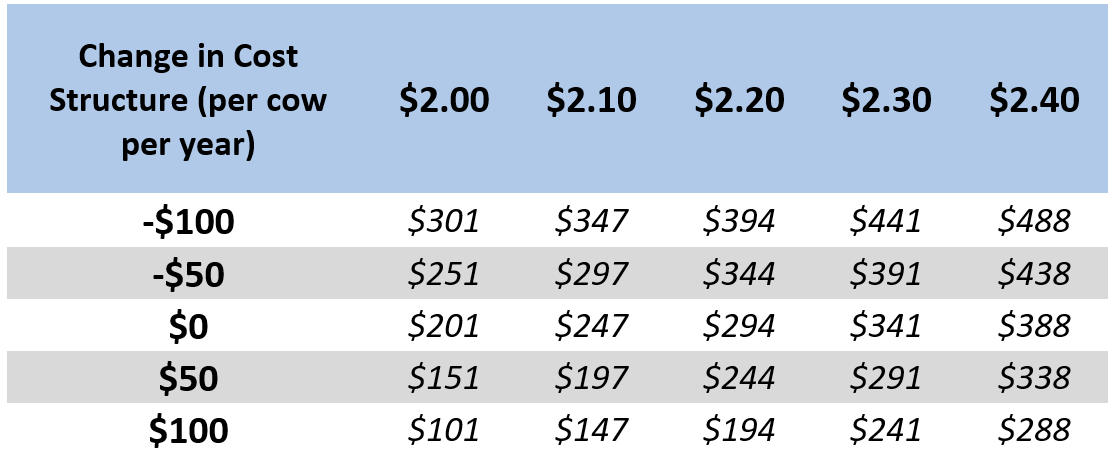

Readers can use Table 2 to modify the analysis based on their cost structure and calf prices for 2023. It uses all costs except for land and labor, so the table shows a return to land and labor using the cost structure in our example. As an example, we used $2.20/lb in our base scenario as the steer/heifer price for 2023. Given the cost structure we used ($0 change on the left hand side of the table), the expected return to land and labor is $294 per cow, just as was previously described. If a cattle farmer sold their calves for an average price of $2.20/lb but had a $50/cow/year higher cost structure (+$50 change on the left hand side of the table), their expected return to land and management would decrease to $244 per cow. If another cattle farmer sold their calves for an average price of $2.30/lb calf, and had a $50/cow/year higher cost structure (+$50 on the left hand side), their expected return to land and management would decrease to $291 per cow.

Table 2: Estimated Return to Land and Labor (per cow) to Spring Calving Cow-calf Operation in 2023 Given Changes in Cost Structure and Calf Prices

Note: Returns are based on costs shown in Table 1, plus $150 per cow in depreciation/interest on equipment/fencing/faciltiies.

Discussion

Cow-calf profitability for 2023 was well above the long-run average. Significantly higher calf prices occurred in a year where costs increased only slightly, resulting in a substantial increase in profitability compared to 2022.

We assumed an average-sized cattle farm that would sell at the higher commission rate and would likely get a lower sales price for calves compared to larger operations. Larger operations that can sell at the lower commission rate and generally get better calf prices for selling in larger lots would have had better profitability than what we show here.

Finally, one important assumption that we made that would change on some farms relates to culling open cows. Our assumption for an average-sized farm was that they would not pregnancy-check cows in the fall and would thus not cull open cows at that time. Farms that are able to cull open cows in the fall at weaning time and avoid the expense of wintering them would have had better profitability than what we show here. These open cows would be replaced with bred heifers that would incur wintering costs, but would be very likely to produce a calf the following spring.

2024 Outlook

Calf prices were high in 2023, but supply fundamentals paint the picture of an even stronger market for 2024. The size of the US cowherd decreased by about 2.5% over the last year which means the 2024 calf crop will be smaller. Should we start to see heifer retention in 2024, the feeder cattle supply will become even tighter. While geopolitical and macroeconomic uncertainties have the potential to impact demand, the 2024 calf market has the potential to exceed levels seen in 2023.

For the purposes of the analysis, we will assume fall 2024 prices for that same 550 lb steer/heifer are in the $2.30-2.50/lb range, or $2.40/lb average. This will be an increase of about $0.20 per lb from the fall of 2023. Spring prices are likely to be much higher than this, but we are building in a seasonal price decrease. 2024 costs are likely to be similar to the estimates for 2023. Using the same costs from 2023 with this higher calf price for 2024 would result in an increase in profitability of $94 per cow compared to 2023. The return to land and labor for 2024 would thus be projected to be $388 per cow. Recall that in our example we had estimated $200 per cow in land rent and labor. Thus we would be making a true profit of $138 per cow using the cost estimates in our example.

Fertilizer prices have come down in 2024 compared to the unprecedented high levels in 2022. However, they are still roughly 30-50% higher than pre-2022 levels. In this analysis, we assumed a below-average fertilizer dependency to sustain a beef-cow unit. Farms that use higher levels of fertilizer will have lower profits than we show here. Thus managing around these high fertilizer prices is still of paramount importance. For practical strategies to reduce or eliminate fertilizer use on cattle farms see the February 2023 video “Strategies to Reduce Fertilizer Use on Cattle Farms” available to watch.

Market fundamentals suggest that calf prices should be at very high levels in 2023 and the same should largely hold in 2024. Still, calf prices are only part of the story, and we hope this article highlights the importance of cost control. Ideally, costs for a given operation would be structured such that attractive profits can be had at these high calf prices. However, there will be farms that will still struggle to cover all their costs, even with the higher calf revenues.

Many farms will be tempted to increase the size of their cow herds in response to these high calf prices. However, two cautionary red flags should be waved at this point: 1) During the last time of extremely high calf prices (2014-2015), bred heifer prices got bid up to the point where they would only pencil out with continued high calf prices. Those calf prices collapsed quickly leaving those that expanded with low revenues to support paying for those high-priced breeding stock. 2) Concentrating on high-priced calves and ways to produce more of them takes away focus from reducing costs that are out of control on many farms. If you are not generating a significant true profit (above what would give you and your land a fair return) in the current market, you are almost certain to be in the red when calf prices come back down to more normal levels. Most farms would be better served to concentrate on reducing their cost structure to better position themselves for the lean times that are almost sure to follow. Purchasing equipment that is not really needed to reduce current tax liabilities will only inflate this cost structure in the long run.

Greg Halich is an Associate Extension Professor in Farm Management Economics for both cattle and grain production and can be reached at Greg.Halich@uky.edu or 859-257-8841. Kenny Burdine is an Extension Professor in Livestock Marketing and Management and can be reached at kburdine@uky.edu or 859-257-7273. Jonathan Shepherd is an Extension Specialist in Farm Management and can be reached at jdshepherd@uky.edu or (859) 218-4395.

Recommended Citation Format:

Halich, G., K. Burdine, and J. Shepherd. "Cow-Calf Profitability Estimates for 2023 and 2024 (Spring Calving Herd)." Economic and Policy Update (24):2, Department of Agricultural Economics, University of Kentucky, February 28th, 2024.

Author(s) Contact Information:

Greg Halich | Associate Extension Professor | greg.halich@uky.edu

Kenny Burdine | Extension Professor | kburdine@uky.edu

Jonathan Shepherd | Extension Specialist | jdshepherd@uky.edu

Recent Extension Articles

U.S. Beef Cow Inventory Continues to Decline

Kenny Burdine

USDA-NASS released their January 2024 cattle inventory estimates on the afternoon of January 31st. Estimates came in pretty close to expectations and confirmed that the cowherd had continued getting smaller during the course of 2023. It was really a question of how much contraction had occurred. At the national level, inventory of all cattle and calves came in little less than 2% lower than January of 2023

Grain Profitability Outlook 2024

Greg Halich

Grain prices have dropped dramatically in the last year. Current prices for 2024 new crop delivery are around $4.15/bu for corn, $11.00/bu for soybeans (2/23/23). This is a decrease of around $1.00/bu for corn and $1.75/bu for soybeans compared to what these prices were expected one year ago.