Farm Bill Update – January 2024

Author(s): Will Snell

Published: January 30th, 2024

Shareable PDF

Following the expiration of the 2018 Farm Bill on September 30, 2023, Congress extended the 2018 Farm Bill late last year until September 30, 2024. Congress has been forced to address budget issues during the early weeks in 2024, with a continuing resolution passed in mid-January to prevent a government shutdown. However, ongoing budget discussions to keep the government open beyond early March, along with a major tax reform bill, border security, and foreign aid packages will continue to monopolize floor debate in the coming weeks, leaving minimal, if any floor time to address reauthorizing a new farm bill. Farm organizations and other farm bill participants are reorganizing their strategies moving forward in 2024, but as always, politics and dollars will battle to determine if this massive piece of legislation makes it across the finish line this year.

The two primary safety net programs for major crops remain the Price Loss Coverage (PLC) and the Agricultural Risk Coverage (ARC) programs. In general, PLC program payments are triggered when the average market price for the covered crop in any given year falls below the “effective reference price” for that crop. Farmers have two options within the ARC program – a county revenue-based program (ARC-CO) and an individual farm revenue program (ARC-IC). Historically most farmers selecting the ARC program have chosen the county-based revenue program. ARC-CO program payments are triggered when the actual county crop revenue of a covered commodity is less than the ARC-CO revenue guarantee for the crop.

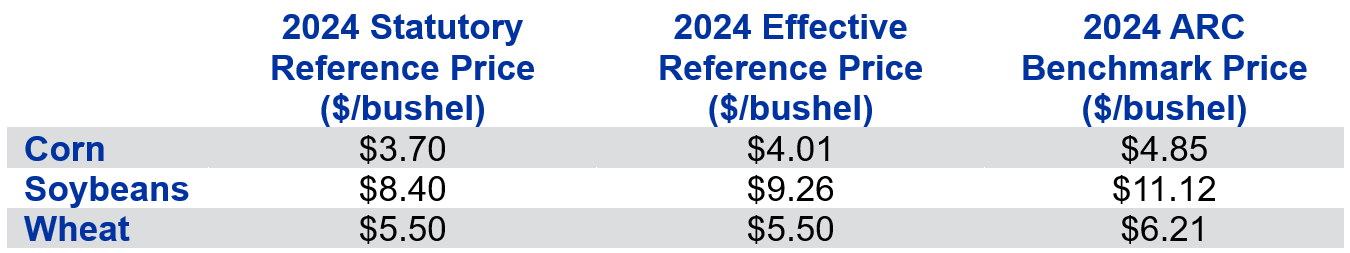

Several major farm organizations have endorsed increasing the reference prices for the major crops, arguing that input costs have increased significantly since these safety net levels were originally authorized in the 2014 Farm Bill. The 2018 Farm Bill provided a mechanism to increase reference prices based on historical trends in crop prices. However, these adjustments face a cap of 115% of the statutory reference price. The table below presents the reference prices for major Kentucky crops for the 2024 crop year, indicating that the corn and soybean effective reference prices will increase marginally from their statutory level, while wheat will remain at the level established under the 2014 Farm Bill. Currently, these “safety net” prices remain below projected prices for the upcoming crop year. Relatively higher grain prices in recent years also led to greater price protection under the ARC programs by increasing the price component used to calculate the ARC revenue guarantee (Click here for more program details.)

Table 1: Reference Prices for Kentucky Crops

Farmers will have until March 15, 2024 to select either the PLC or ARC programs to protect their crops from major adverse market fluctuations for the upcoming crop year (click here for details). In recent years of relatively high commodity prices, most grain farmers have not received any PLC or ARC payments. Without significant declines in market prices (which could trigger PLC payments) or significant localized yield reductions (which could trigger ARC payments), analysts are generally not projecting payments for many of the major program crops in 2024, inducing many farm organizations to argue for higher reference prices in future years to protect against diminishing and vulnerable crop profit margins.

Besides higher reference prices, the farm community continues to lobby for protecting the critical piece of the farm safety net – crop insurance. In addition, in lieu of uncertain future disaster/ad hoc payments, there is growing support of expanding crop insurance coverage/subsidies to more crop and livestock producers, along with increasing funds for trade promotion, conservation, rural infrastructure programs, and ag research. However, additional funding remains a huge hurdle in this farm bill debate given rising concerns over federal debt levels. Maintaining the existing farm bill under its current structure is projected to cost nearly $1.5 trillion over the next ten years, compared to $867 billion for the 2018 farm bill at the time of its enactment.

Without additional new funding sources, lawmakers seeking increased farm bill funding will require finding dollars from other parts of the farm bill pie. Pulling dollars from the Supplemental Nutrition Assistance Program (SNAP – over 80% of the current farm bill budget), is off-limits for many lawmakers who likely will be critical to its passage. Others are looking at acquiring funds from the climate change/carbon-smart agriculture conservation programs funded in the Inflation Reduction Act of 2022 to provide for a stronger farm safety net in this farm bill and to boost available baseline spending in future farm bills. Again, opposition exists to redirect these funds. Others are looking at the Commodity Credit Corporation (CCC), USDA’s line of credit at the Treasury, for additional dollars to fund expanded farm bill initiatives which is meeting resistance from some lawmakers who claim these funds should only be used in emergencies beyond paying for traditional farm safety net programs.

The bottom line is that passage of a new farm bill will be a huge challenge this year with 2024 being an election year determining who is in the White House and which political party controls majority status in the House and Senate. Floor time debate in the coming months for a farm bill could be challenged in this political environment. Furthermore, despite two years of debate, major differences still exist among farm bill participants relative to the distribution of farm bill dollars among farm safety net programs, conservation, and nutrition. If we don’t see farm bill movement prior to the August recess, perhaps the next opportunity will be during the lame-duck session after the November election, with another extension of the 2018 farm bill into 2025 certainly a possibility. Stay tuned!

Recommended Citation Format:

Snell, W. “Farm Bill Update – January 2024." Economic and Policy Update (24):1, Department of Agricultural Economics, University of Kentucky, January 30th 2024.

Author(s) Contact Information:

Will Snell | Extension Professor | wsnell@uky.edu

Recent Extension Articles

Kentucky’s Agricultural Districts Program

Jerry Pierce

Someone asked about Agricultural Districts recently. It sounded like a farm tax program, but I had to admit that I knew nothing about them, and that I would look into it. The program was created by the Kentucky Legislature in 1982. The purpose of the legislation is “to provide a means by which agricultural land may be protected and enhanced as a viable segment of the state's economy and as an important resource.”

5 Commandments for Bale Grazing in the East

Greg Halich

I have had many people tell me they tried bale grazing and that it will not work under in conditions such as those found in Kentucky. In just about every case where they explained how they were implementing bale grazing, they were not adhering to one or more of the following fundamental concepts, which I will frame as the “Five commandments for bale grazing in the East.”