Grain Profitability Outlook 2024

Author(s): Greg Halich

Published: February 28th, 2024

Shareable PDF

Grain prices have dropped dramatically in the last year. Current prices for 2024 new crop delivery are around $4.15/bu for corn, $11.00/bu for soybeans (2/23/23). This is a decrease of around $1.00/bu for corn and $1.75/bu for soybeans compared to what these prices were expected one year ago (see Figure 1).

Figure 1: December 2024 Corn Futures (2/22/2024)

Helping to temper the significant decrease in expected revenue from lower grain prices are small decreases in fertilizer and fuel prices over the last years. Fertilizer prices rose steadily during the winter of 2021-22 and reached all-time highs by spring 2022. These prices have come down significantly in 2023 and have continued with a slight downward trend over the last year. Fuel prices have also dropped over the last two years and are currently around $3.25/gallon. This article will evaluate the overall effect of these changes, and estimate the expected profitability for the 2024 crop.

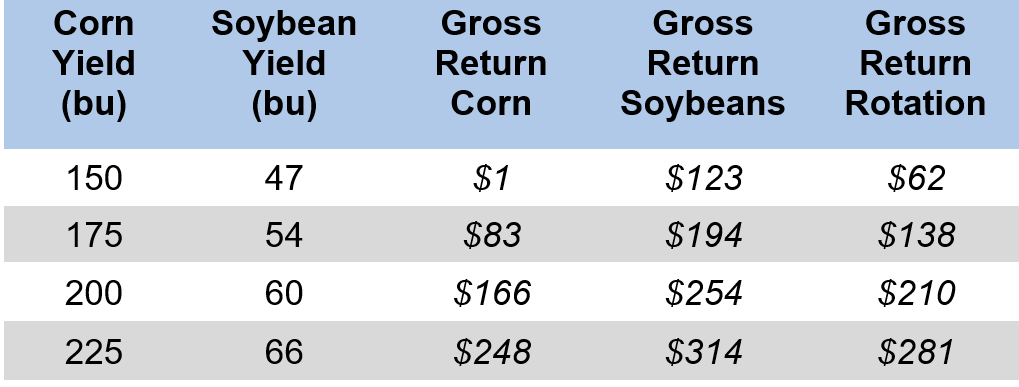

Costs for an efficient western Kentucky grain farm are estimated in Table 1 on soil that averages 175 bushels corn and 54 bushels of soybeans per acre. Machinery and labor costs include depreciation and overhead costs, as well as an opportunity cost for operator labor. Fuel costs are based on $3.25/gallon on-farm diesel and 40 mile one-way trucking to the elevator. Fertilizer prices are assumed $.46/unit for N, $.62/unit for P, and $.42/unit for K.

Table 1: Projected Costs (per acre) Western Kentucky 2024

Notes: Assumes 40 mile one-way trucking, $3.25/gal fuel

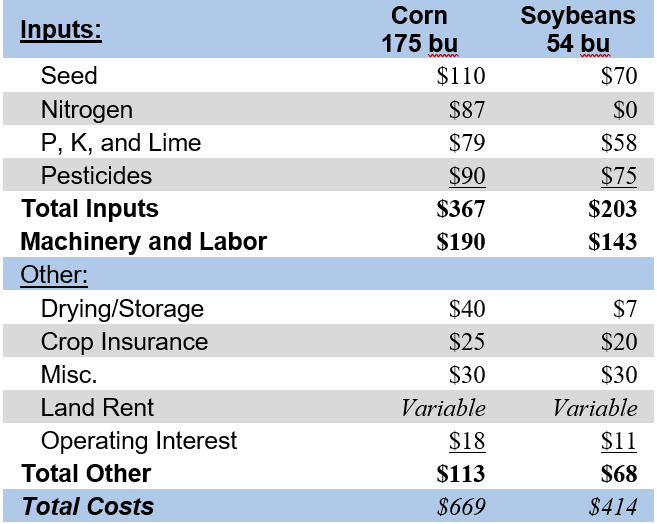

Corn and soybean prices used in this analysis are based on forward contracting prices (as of 2/23/24) for an average of fall and winter delivery: $11.25/bu for soybeans and $4.30/bu for corn. Table 2 shows the expected gross return (does not include land rent) given the costs in Table 1 and expected commodity prices and yields.

Table 2: Summary Gross Return Western Kentucky 2024 (per acre)

Note: Does not include land rent. Subtract land rent to get net revenue.

The expected gross profit for this productivity soil is $83/acre for corn and $194/acre for soybeans. Assuming a 50-50 rotation the average gross return would be $138/acre. Net return would be calculated by subtracting out the land rent. In western Kentucky, much of the ground with this type of productivity is being rented for $175-250/acre. As an example, if we use a $200 land rent, the net return (return to management and risk) for a 50-50 rotation would be a –$62/acre.

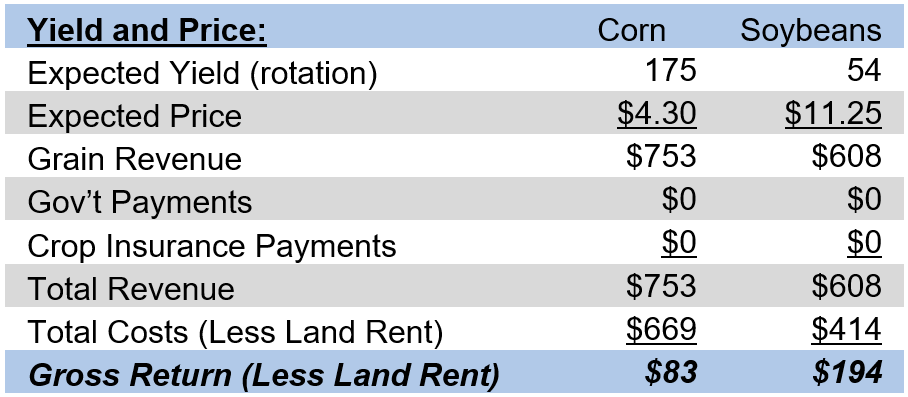

Table 3 shows a summary of the estimated gross returns for various soil productivities. Think of these yields as the long-run expected yields for a particular farm, not year-to-year variability. Costs are adjusted to account for different expected yields. The biggest change in costs is for trucking which adjusts on a 1-1 basis, but other costs such as fertilizer are adjusted at a lower rate. Looking at Table 3, it is easy to see how quickly gross profitability changes with expected yield.

Table 3: Western Kentucky Projected Returns 2024 (per acre) at $11.25/bu Soybeans, $4.30/bu Corn, $0.46-N, $0.62-P, $0.42-K

Note: Subtract land rent to get Net Return

Note: Central Kentucky has a higher cost structure due to their use of urea as the primary nitrogen source and longer trucking distances to key markets on average. Thus gross returns in this region are likely to be $10-50 per acre lower than those shown in Table 3.

Observations

1) The profitability of corn and soybeans has dropped dramatically in the last few months for the 2024 new crop. The price drop is reminiscent of what happened in 2014 at the end of the ethanol boom. As with 2014, I suspect it will take time for grain farmers to psychologically, accept the reality of the market situation that has unfolded over the last several months.

2) While the overall profitability of a 50-50 corn-soybean rotation for the 2024 new crop looks fair at best, the individual stories for corn and soybean profitability are very different. Profitability for corn looks poor, while profitability for soybeans looks decent. With the current relative prices, I’m not sure why anyone except on the very best ground would plant corn in 2024. Unless relative prices change, we should see a significant increase in soybean acres compared to corn acres in both Kentucky and nationwide.

Marketing

Hopefully, most grain farmers are ahead of the curve and have marketed a significant portion of the 2024 new crop before prices started sliding at the end of December. At the current low prices, it may be difficult psychologically to forward contract grain, but the odds are just as good that prices could drop further as they are that prices increase.

While most farmers are reluctant to market much of their future crop this far out, the current prices offered for 2024 soybeans offer at least decent returns given typical land rents. Profitability for corn, on the other hand, looks terrible with current prices for the 2024 new crop. One marketing option is to forward contract soybeans only at this time, and hope that the market will correct itself in terms of the lopsided profitability between the two crops. Either corn prices will need to increase, soybean prices will need to decrease, or some combination of the two will need to happen to avoid a flood of soybean acres and a death of corn acres this spring.

Don’t believe my numbers? I appreciate skepticism. Here is a link to corn-soybean budgets so that you can come up with your own estimates: https://agecon.ca.uky.edu/budgets.

Recommended Citation Format:

Halich, G. "Grain Profitability Outlook 2024." Economic and Policy Update (24):2, Department of Agricultural Economics, University of Kentucky, February 28th, 2024.

Author(s) Contact Information:

Greg Halich | Associate Extension Professor | greg.halich@uky.edu

Recent Extension Articles

Weathering The Storm

Jerry Pierce

“Agriculture is by nature a cyclical industry.” So said the Federal Deposit Insurance Corporation (FDIC) in History of the Eighties - Lessons for the Future published in 1987. It still is, with net incomes cycling up and down over the decades. So how can farms “weather the storm” when farm income is cycling down? Long-term success in farming depends greatly on the ability of the farm business to meet obligations in the long term and short term. And it might be said that every business must meet its obligations this year to have a chance to meet the longer-term obligations.

Cow-Calf Profitability Estimates for 2023 and 2024 (Spring Calving Herd)

Greg Halich, Kenny Burdine, and Jonathan Shepherd

The purpose of this article is to examine cow-calf profitability for a spring calving herd that sold weaned calves in the fall of 2023 and provide an estimate of profitability for the upcoming year, 2024. Every operation is different, so producers should evaluate and modify these estimates to fit their situation.