What is the Driving Force behind Carbon Programs in the U.S. and Why Agriculture?

Author(s): Jordan Shockley

Published: April 28th, 2022

Shareable PDF

As new carbon programs continue to become available to row crop farmers across the country, understanding the driving force behind why these programs exist in the first place is key to determining their longevity. Last year, we provided an overview of carbon markets in the article "Carbon Markets 101," highlighting the Food and Agriculture Climate Alliance, carbon pricing, differences between carbon programs, and the importance of seeking legal advice before entering any contractual arrangement. This article goes in-depth to address the question of why? Why do these carbon programs currently exist, and why are they focused on the agriculture sector?

The foundation for the existence of carbon programs globally is The Paris Agreement. The Paris Agreement is a legally binding international treaty on climate change adopted by over 200 countries. The goal of the agreement is to limit global warming to below two degrees Celsius compared to pre-industrial levels. Since each country’s emissions of greenhouse gases differ (e.g., the U.S. contributes 15% of global carbon dioxide emissions, while Japan contributes 4%), each country sets emission-reduction targets, known as National Determined Contributions (NDCs).

Two types of carbon markets have developed across the globe to meet the goals of The Paris Agreement by reducing greenhouse gas emissions, compliance markets, and voluntary markets. Compliance markets are governmentally imposed limits on greenhouse gas emissions at the federal or state level. Globally, most carbon markets are compliance-based markets. However, carbon programs in the U.S. are driven mostly by voluntary markets. These markets are driven by companies voluntarily committing to reduce their greenhouse gas emissions. Many have seen popular press articles where a company has pledged to be net-zero in greenhouse gas emissions by a specific date in the future. So why are companies voluntarily making these pledges, which inherently will cost money? Some of these companies are driven by their mission and business goals, where environmental stewardship plays an important role. Other companies are driven by consumers and investors that demand environmental accountability. Field to Market reports that more than eight in ten Americans consider sustainability when buying food and nearly ¾ of consumers want companies to do a better job explaining how their purchases impact the planet.

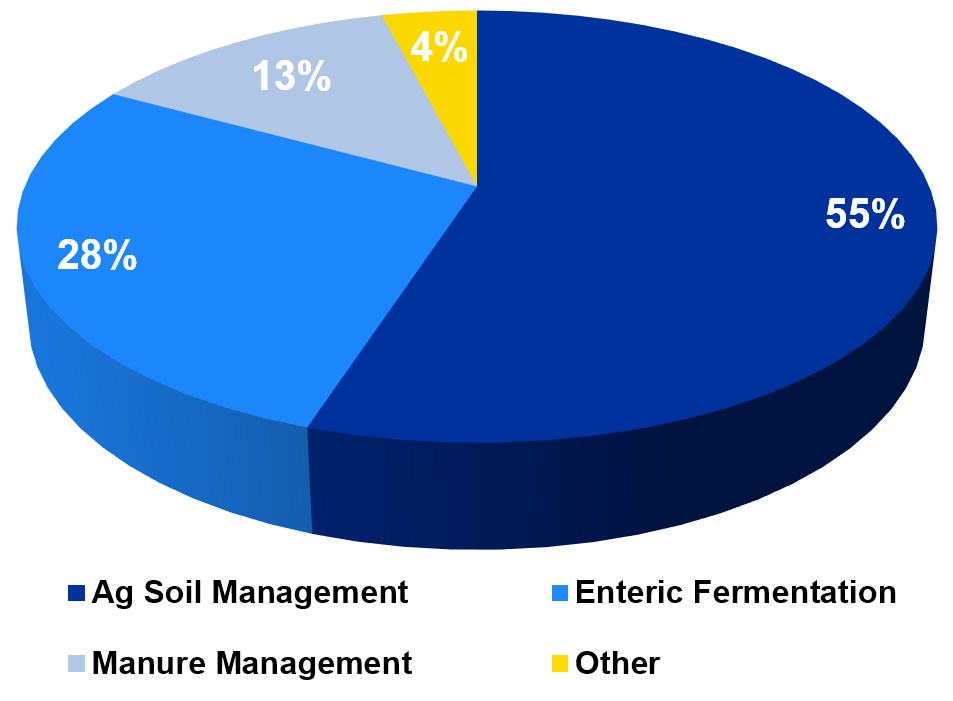

Given the demand for environmental stewardship, companies are voluntarily pledging to reduce their emissions by a specific time in the future. While some companies may reach this goal internally by improving operating efficiencies and converting to green energy, many companies need to purchase carbon credits from other sources to offset their emissions. Creating carbon credits is where agriculture plays a role, specifically row crop producers. According to the U.S. Environmental Protection Agency, 55% of U.S. greenhouse gas emissions from agricultural activities are from ag soil management practices. In short, this is from common tillage practices. Row crop producers can sequester carbon in the soil and generate carbon credits by adopting management practices like cover crops and switching from conventional tillage to no-till or other conservation tillage practices. However, the concept of additionality is important. Additionality means that a farmer must adopt a different and new management practice that sequesters additional carbon compared to their “baseline” or current practice. Therefore, if you have adopted no-till or cover crops as a common management practice, you are not eligible to enroll in most carbon programs offered today. If you qualify and enroll in a carbon program, the carbon credits generated by the adoption of no-till or cover crops are purchased from the producer by a third-party aggregator with which you signed an agreement to enroll your acres in their carbon program. Those credits are verified and then sold to companies who need to offset their emissions to meet greenhouse gas pledges. Therefore, as of today, the carbon programs we see offered in agriculture are based on voluntary markets driven by corporate promises. If interested in carbon programs in your area, you must ask questions, read the fine print, and seek legal advice before enrolling.

Figure 1: U.S. Greenhouse Gas Emission from Agricultural Activities, 2019.

Source: U.S. Environmental Protection Agency Inventory of Greenhouse Gas Emissions.

Additional information on Sources of Greenhouse Gas Emissions is available through the United States Environmental Protection Agency.

Recommended Citation Format:

Shockley, J. "What is the Driving Force behind Carbon Programs in the U.S. and Why Agriculture?" Economic and Policy Update (22):4, Department of Agricultural Economics, University of Kentucky, April 28th, 2022.

Author(s) Contact Information:

Jordan Shockley | Associate Extension Professor | jordan.shockley@uky.edu

Recent Extension Articles

The Importance of Agriculture for Kentucky: March 2022 Report Update Now Available

Sarah Bowker | April 28th, 2022

Our unit, the Community and Economic Development Initiative of Kentucky (CEDIK), recently updated the 2015 report, The Importance of Agriculture for Kentucky. The report defines the economic impact of the Agricultural sector on the Kentucky economy. In our March 2022 update, the primary finding is that the total economic impact of agriculture in Kentucky in 2019 equaled $49.6 billion, representing an 8.8% increase from the economic impact of $45.6 billion in 2012.

3 Tips for Farm Management During Rising Inflation

Jennifer Rogers | April 28th, 2022

With input prices on the increase and so many things changing with our economy, it is important that producers think about how to manage during rising inflation. There is nothing that we can do to control the prices that we have to pay for products, we can only make sound management decisions about what we purchase and how we manage cash, and the cost of money that is borrowed.