2023 Kentucky Vegetable & Fruit Input Costs: Changes and Trends

Author(s): Tim Woods, Emily Spencer, and Matt Ernst

Published: October 30th, 2023

Shareable PDF

Summary

Prices for many crop inputs have increased steadily since 2016. This report updates 2023 Kentucky price trends for key vegetable and fruit crop inputs: fuel and fertilizer, labor, plant protection products, and seed. These representative data may be used to help producers identify input costs and trends and update production budget estimates for 2024.

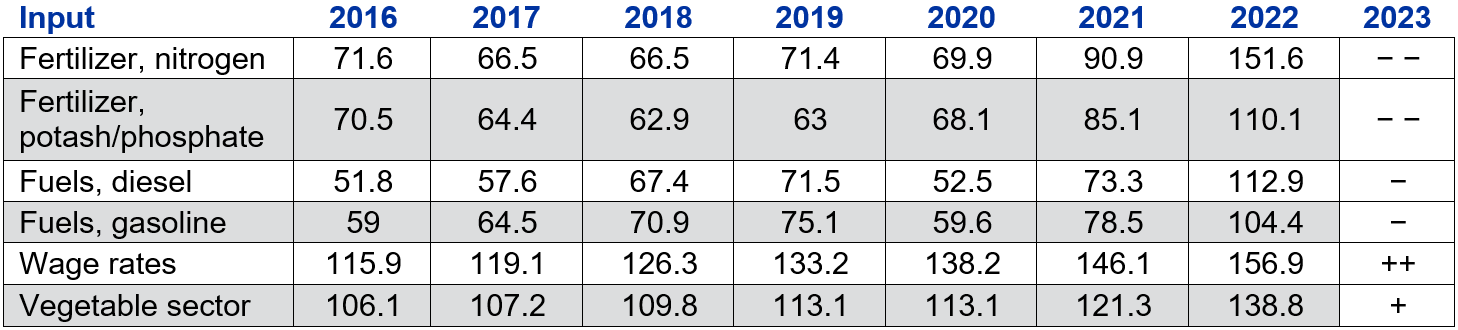

Nationally, there has been a sharp increase in many farm inputs connected with the vegetable sector, especially over the past 3 years. Table 1 below details average price increases for several key inputs, including the vegetable sector overall.

Table 1: Index of Selected Prices Paid by U.S. Farmers Related to Vegetable Production

Index, 2011 = 100

Source (2016-2019): USDA, National Agricultural Statistics Service except first quarter 2022 projections by USDA, Economic Research Service

Source (2020-2022): Vegetables and Pulses Outlook: April 2023, VGS-370, April 27, 2023, USDA, Economic Research Service

Source (2023): decreases from 2022 levels based on sources in the footnotes below[1][2][3][4]

Source Vegetable sector[5]

Key variable input costs such as those related to fertilizers and fuel were down in 2023 compared to the previous year, but still remained relatively high. Wage rates have moved up sharply since 2016 and appear to be up again based on AEWR figures, especially in California.

Kentucky farmers have similarly seen significant increases in some inputs, while others have stayed relatively steady or even dropped since last year. In the summer and fall of 2023, we completed a regional summary of input prices for Kentucky producers for both conventional and organic inputs on vegetable farms.

For John Bell at Elmwood Stock Farm, a certified organic farm in Georgetown, KY, three inputs have been significantly over budget in the fall of 2023: cardboard and plastics, seed, and interest expense. Bell further noted that, “drip irrigation supplies are around 20% more than what we had expected.” This article details some of the farm inputs that are affecting Kentucky growers in 2023 and will likely continue to affect Kentucky growers into 2024.

Plant protection products

Plant protection expenses vary across different crops and by season. An input price survey was conducted with regional suppliers, agricultural organizations, and leading farmers in summer 2023, confirming higher prices for many inputs for Kentucky specialty crop growers. However, prices reported by major suppliers for Kentucky growers in the 2022 and 2023 seasons showed relative stability across synthetic products. Price ranges for selected major products are reported here.

Inputs for certified organic production may be more difficult to obtain locally, depending on the crop and the region. Generally speaking, product prices for OMRI-approved materials showed less variability in 2022 and 2023 than in previous years. Availability and shipping costs are often more significant factors for obtaining plant protection products for certified organic production.

For a list of plant protection products and their respective costs, see the CCD website.

Labor

Kentucky H2A wages were $11.63/hour in 2019, climbing 23% to $14.26 in 2023. Labor comprises 30-40% for typical produce enterprises, so this is a significant figure. Labor is also a significant portion of post-harvest costs related to packing, grading, and shipping. These costs have increased throughout the supply chain.

Seed

Seed costs, as reported by USDA for vegetable farms on a national basis, increased slightly from 2020 to 2022. The USDA survey reported no year-on-year increase in seed costs for the first quarter of 2023, as compared to 2022.

Kentucky vegetable producers reported only modest, if any, increases in seed prices for 2023. The vegetable seed cost category is similar to the plant protection category: some increases to be expected over time, but large percentage increases continue to be unusual.

Plant material for perennial crops (asparagus, berries, tree fruit, nuts) has increased more significantly since 2020. This is tied to robust demand and producers passing along higher costs (e.g., labor and fertilizer) to buyers. In some cases, higher freight costs have an outsized impact on the cost of acquiring plant stock for perennial crops.

2024 Outlook

Nationally, prices for many crop inputs have increased since 2020 and we see the same for Kentucky growers. International market trends, trade and geopolitics have an outsized impact on the prices that Kentucky farmers pay for fuel. Producers with the storage and/or financial capacity to pre-purchase fuels may be able to guard against some of the risks of price increases. Price uncertainty will likely remain in 2024.

Prices for nitrogen fertilizers were still very high in 2023. Going into fall 2023, “fundamental factors suggest an easing in nitrogen fertilizer prices,” according to the University of Illinois (Schnitkey)[6]. However, as the Illinois report acknowledges, this is an easing from very high nitrogen prices. Price relief for synthetic nitrogen sources in 2024 is unlikely to reach back to price levels seen in 2021, let alone 2020.

Global factors in the phosphate industry supply chain portend that 2024 phosphate fertilizer prices could remain at 2023 levels (Jasinski)[7]. Potash prices are also likely to remain similar to 2023 prices because of similar supply and demand.

In short: Input prices rose sharply across the board for specialty crop producers through the pandemic both in Kentucky and nationally. Some costs have moderated in 2023, even come down sharply relative to peak costs in 2022. Labor costs remain a challenge and the era of higher fuel, fertilizer, chemical, and seed prices is likely to persist for Kentucky fruit and vegetable growers in 2024, though there is evidence to suggest that the prices will stabilize at their current high price point, rather than see more sharp increases.

[1] https://www.dtnpf.com/agriculture/web/ag/crops/article/2023/08/09/fertilizers-see-large-price-move

[2]https://www.dtnpf.com/agriculture/web/ag/crops/article/2023/08/09/fertilizers-see-large-price-move

[5] Input items common to vegetable production weighted by 2006 vegetable farm expenses derived from the 2006 Agricultural Resource Management Survey.

[6] Schnitkey, G., N. Paulson, C. Zulauf, and J. Baltz. “Nitrogen Fertilizer

Prices Stabilize at High Levels in Spring 2023.” farmdoc daily (13): 108, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 13, 2023.

[7] Jasinski, Stephen. “Phosphate Rock” and “Potash.” In Mineral Commodity Summaries 2023, U.S. Department of the Interior U.S. Geological Survey. https://pubs.usgs.gov/periodicals/mcs2023/mcs2023.pdf

Recommended Citation Format:

Woods, T., E. Spencer, and M. Ernst. "2023 Kentucky Vegetable & Fruit Input Costs: Changes and Trends." Economic and Policy Update (23):10, Department of Agricultural Economics, University of Kentucky, October 30, 2023.

Author(s) Contact Information:

Tim Woods | Extension Professor | tim.woods@uky.edu

Emily Spencer | Extension Associate | emilyspencer@uky.edu

Matt Ernst | Writer | Center for Crop Diversification

Recent Extension Articles

What to Consider When Renting Out Your Farm

Michael Forsythe

According to 2022 KFBM data, only 27% of land farmed by Kentucky farmers is owned by the farmer. The remaining 73% is typically comprised of landowners that may or may not have a background in farming. In some cases, the landowner inherited the farm and may not even live in the same state as the farmland. There are several factors the landowners need to be aware of and consider when renting their farm.

Mississippi River Level Impacts on Basis: 2022 Vs. 2023

Grant Gardner

In 2022 and 2023, the river levels on the Mississippi slowed barge freight and, thus, crop exports out of Kentucky. When river levels decline, barge transportation slows, which causes barge freight rates to increase. When river levels are normal in Kentucky, the average October basis is near -$0.20 for corn or -$0.30 for soybeans. This year, producers that had to deliver when the basis was at its worst could have lost $0.30- $0.60/bushel on corn and $0.50-$0.70/bushel on soybeans.