Mississippi River Level Impacts on Basis: 2022 Vs. 2023

Author(s): Grant Gardner

Published: October 30th, 2023

Shareable PDF

In 2022 and 2023, the river levels on the Mississippi slowed barge freight and, thus, crop exports out of Kentucky. When river levels decline, barge transportation slows, which causes barge freight rates to increase. Local commodity basis, defined as the difference between the futures price and the local cash price, is a function of transportation cost. Thus, higher barge freight rates cause the basis to widen. When the basis widens, producers selling at the cash price, utilizing hedge-to-arrive (HTA) contracts, or hedging through futures typically receive lower crop prices than expected. When river levels are normal in Kentucky, the average October basis is near -$0.20 for corn or -$0.30 for soybeans. This year, producers that had to deliver when the basis was at its worst could have lost $0.30- $0.60/bushel on corn and $0.50-$0.70/bushel on soybeans.

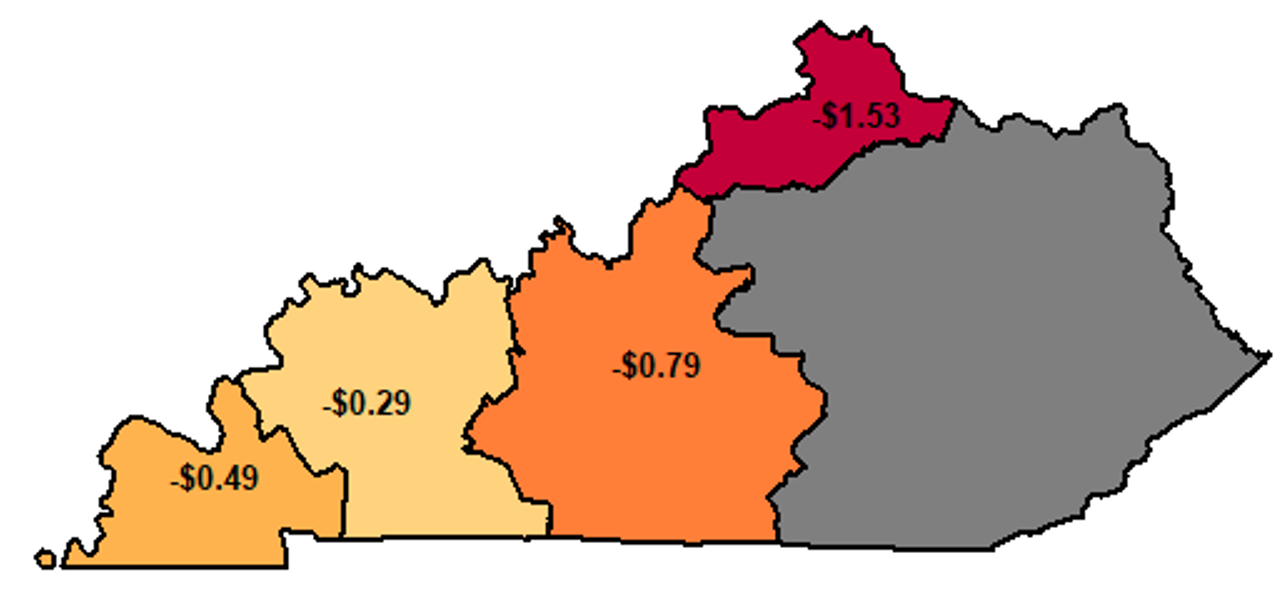

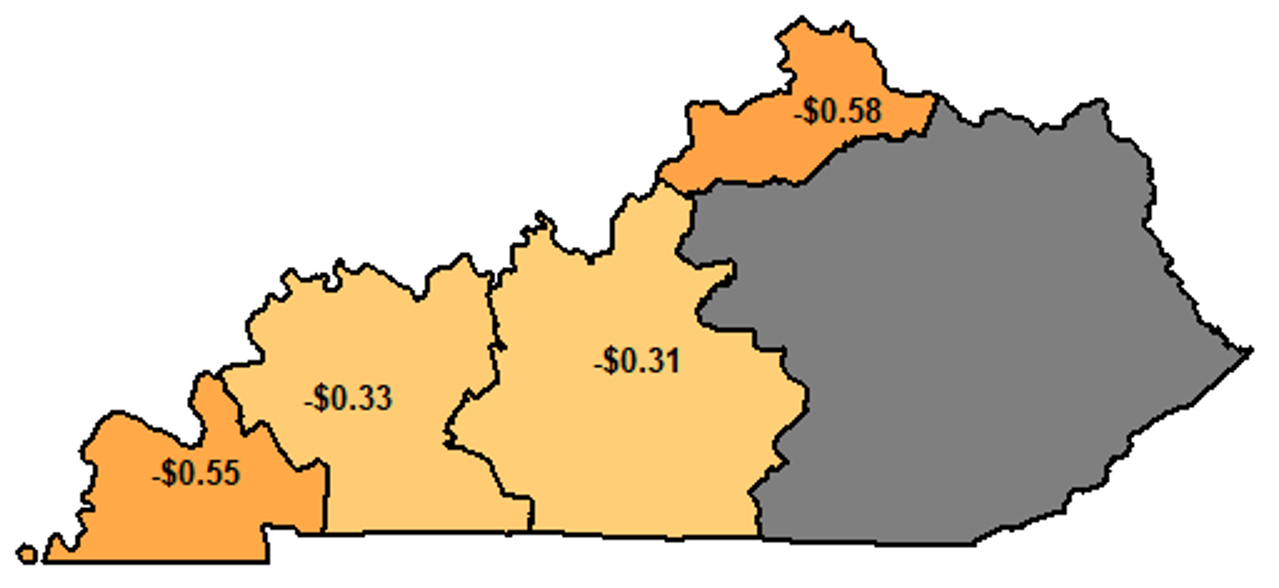

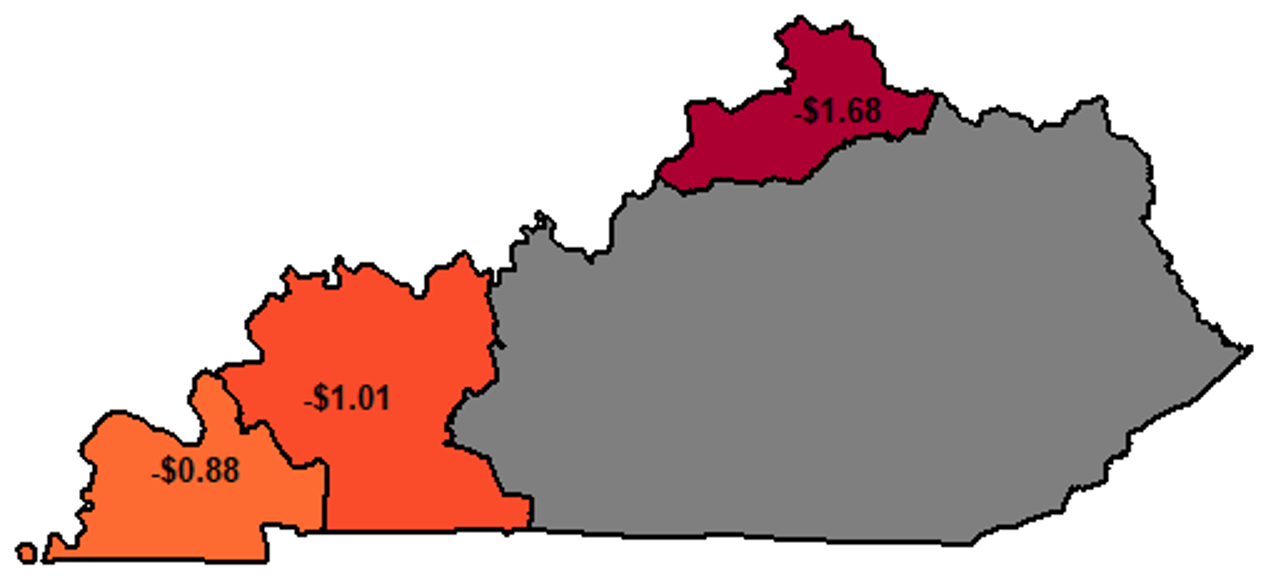

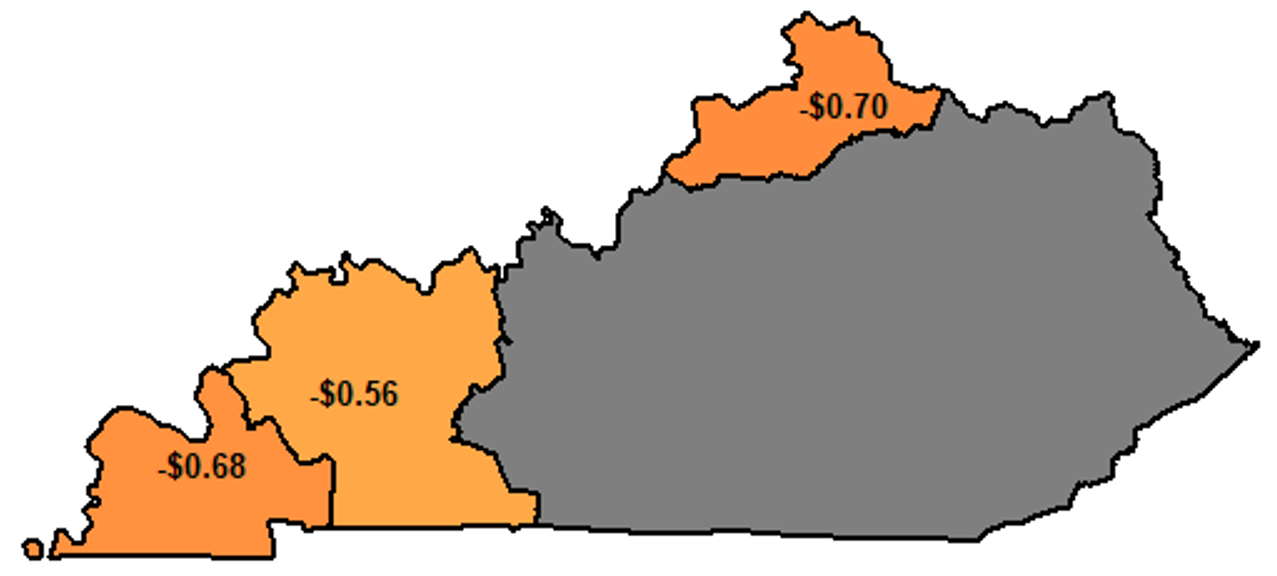

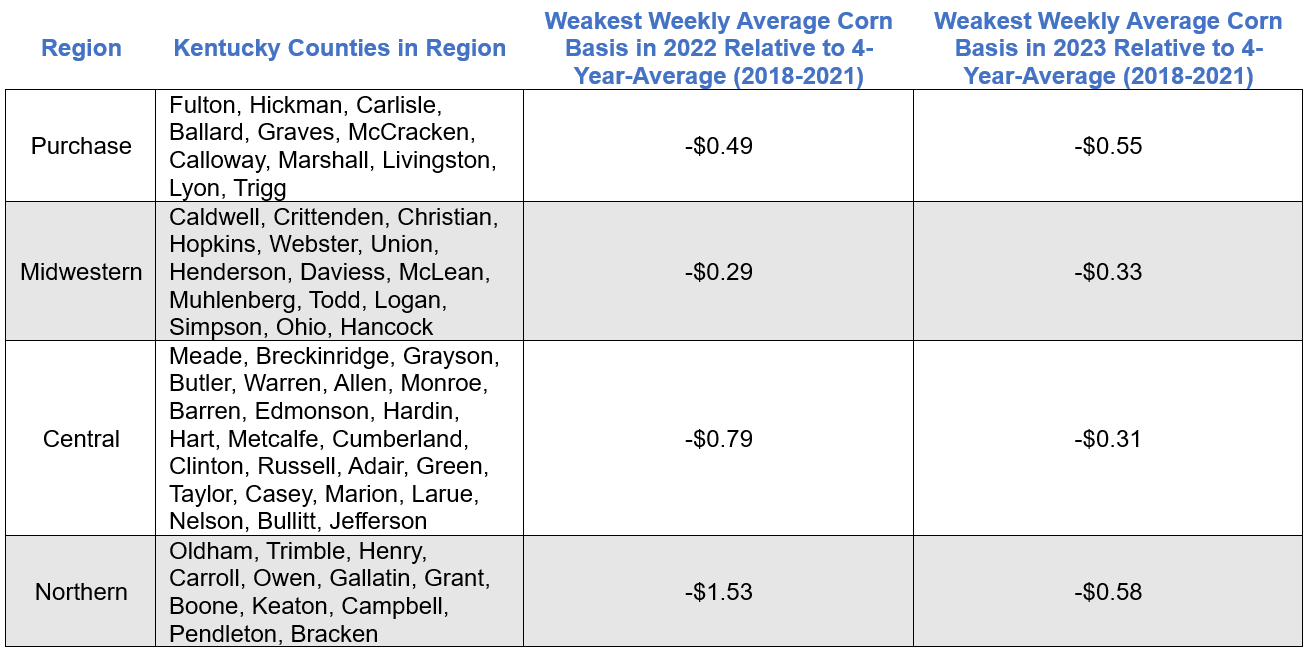

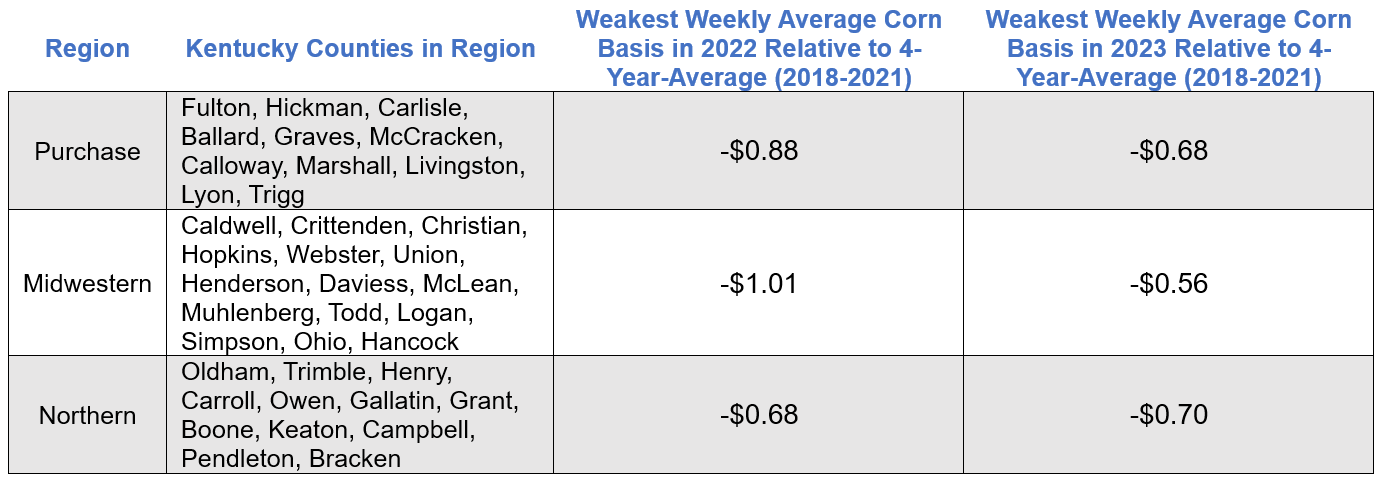

As river levels have hit record lows in 2023, it is unsurprising that corn basis dropped lower than last year in the western regions. Interestingly, the corn basis is better in the central and northern regions than last year, which could be driven by 2022 barge freight from Cincinnati being two and a half times 2023 prices (USDA-AMS Grain Transportation Reports, 2023). The USDA only reports soybean basis for three Kentucky regions; however, soybean basis is better in 2023 than in 2022. Elevators likely have a higher demand for soybeans when river levels are low because they are higher priced and allow smaller quantities of grain with higher dollar volume to be shipped downriver. Overall, the impact of river levels on Kentucky basis has been less detrimental than last year; however, many producers are still taking a large hit to their bottom line.

Looking at risk management strategies, producers should utilize on-farm storage to store corn and soybeans until river levels are normal. Off-farm storage could also be a viable option; however, less storage supply and higher storage demand have caused off-farm storage costs to increase. Higher storage cost needs to be accounted for before making a decision. Last year, the basis improved drastically by mid-November, surpassing the 2018-2021 average by December/January. We will likely see similar but less drastic patterns occur this year. Although barge transportation has been less costly, river levels are lower than last year and could moderate basis recovery.

Typical methods for producers to manage price risk include hedging through futures or HTA Contracts that minimize price risk but leave the producer susceptible to basis risk. Minimizing price risk is typically the preferred strategy because the basis is more predictable than price under normal circumstances. However, river-level issues have caused unpredictable basis patterns. If we continue to experience dry summers, Kentucky producers without on-farm storage may need to rely on forward or basis contracts that lock basis before river levels decline. A downfall to these strategies is that they limit where crops can be delivered and leave the producer susceptible to production risk, which may result in producers taking a lower spot price or elevator fees.

Figure 1: Weakest Weekly Average Corn Basis in 2022 Relative to 4-Year-Average (2018-2021)

Source: DTN (2023)

Figure 2: Weakest Weekly Average Corn Basis in 2023 Relative to 4-Year-Average (2018-2021)

Source: DTN (2023)

Figure 3: Weakest Weekly Average Soybean Basis in 2022 Relative to 4-Year-Average (2018-2021)

Source: DTN (2023)

Figure 4: Weakest Weekly Average Soybean Basis in 2023 Relative to 4-Year-Average (2018-2021)

Source: DTN (2023)

Table 1: 2022 and 2023 Weakest Weekly Average Corn Basis Relative to 4-Year-Average by USDA Region and Corresponding Kentucky Counties

Table 2: 2022 and 2023 Weakest Weekly Average Soybean Basis Relative to 4-Year-Average by USDA Region and Corresponding Kentucky Counties

Recommended Citation Format:

Gardner, G. "Mississippi River Level Impacts on Basis: 2022 Vs. 2023." Economic and Policy Update (23):10, Department of Agricultural Economics, University of Kentucky, October 30th, 2023.

Author(s) Contact Information:

Grant Gardner | Assistant Extension Professor | grant.gardner@uky.edu

Recent Extension Articles

2023 Kentucky Vegetable & Fruit Input Costs: Changes and Trends

Tim Woods, Emily Spencer & Matt Ernst

Prices for many crop inputs have increased steadily since 2016. This report updates 2023 Kentucky price trends for key vegetable and fruit crop inputs: fuel and fertilizer, labor, plant protection products, and seed. These representative data may be used to help producers identify input costs and trends and update production budget estimates for 2024.

Prospects for Winter Backgrounding 2023-2024

Greg Halich & Kenny Burdine

After several years of cattle selling at frustratingly low price levels, continued herd liquidation has led to tight supplies and much higher calf prices in 2023. While markets have pulled back in recent weeks, calves and heavy feeders are moving at prices $50 to $70 per cwt above what was seen a year ago. Feed prices have also decreased over the last several months and most feeds will cost less this winter than last. All of these factors should be taken into consideration when one considers placement of calves into backgrounding programs this fall.