Ag Export Growth Subsides Amidst a Changing Global Economy

Author(s): Will Snell

Published: June 29th, 2023

Shareable PDF

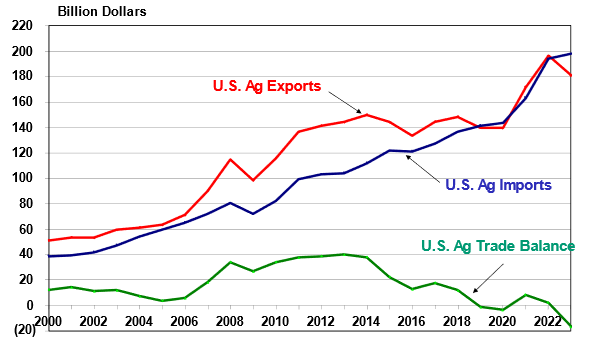

After achieving a record high of $196.4 billion in FY 2022 (October 1, 2021- September 30, 2022), USDA has for the second time reduced its 2023 FY forecast for U.S. agricultural trade – down to $181 billion compared to $184.5 billion estimate in February and its initial estimate of $190 billion last November. Increasing crop supplies, lower commodity prices, a relatively higher valued dollar, and a sluggish and a slowing global economy are putting downward pressure on U.S. ag export sales.

Figure 1: U.S. Ag Exports, Imports, and Trade Balance

source: ERS/USDA

The latest trade data (through April 2023) reveals that since the beginning of the year, the value of U.S. ag exports are off 6%, with U.S. corn exports down 35%, beef exports are off 21%, and wheat exports 11% lower compared to the same period last year. While slumping so far in 2023, both corn and beef are coming off record high export levels in recent years. Alternatively, U.S. soybeans export growth continues along with higher dairy and pork exports so far in 2023. Important to Kentucky, bourbon exports continue to soar, while forest exports are trending lower. Tobacco exports are rebounding from record lows as tight supplies of burley worldwide are inducing foreign buyers to purchase limited stocks of U.S. burley.

China is forecast to remain the largest foreign buyer of U.S. agriculture, staying relatively stable in 2023 with U.S. soybean import demand remaining strong despite reportedly attempts from the Chinese government to diversify its import sources. Economic growth in China is forecast to increase from 3% to 5.2% this year as the nation continues to rebound from its COVID-19 challenges. While China’s economy will likely rebound this year, economic growth is expected to decline in most other major U.S. markets. Despite its sluggish economy and the on-going U.S./Mexico GMO trade debate, U.S. ag exports to Mexico are expected to grow this year with Mexico surpassing Canada as the United States’ second leading export customer. Collectively, the United States’ three largest customers – China, Mexico, and Canada will account for nearly one half of U.S. ag exports in 2023.

Future export market trends for U.S. agriculture will hinge critically on the size of the 2023 U.S. grain crops, future developments of moving grain out of Ukraine amidst the current war with Russia, meat supplies, recovery in global economic growth, and the strength of the U.S. dollar versus major training partners. While the U.S. dollar has softened a little so far in 2023, higher U.S. interest rates will likely keep the dollar relatively high and thus constrain potential export growth. A lot depends on future actions by the Federal Reserve in its attempts to reduce inflationary pressures on the U.S. economy.

Agricultural imports into the United States continue to grow leading to an anticipated record trade deficit for U.S. agriculture for FY 2023 forecast at $14.5 billion. In fact, after recording annual trade surpluses for decades, U.S. agriculture has recorded trade deficits 3 out of the past 5 fiscal years. While U.S. food companies purchase foreign goods that compete with U.S. ag commodities/products and to address seasonality issues, food import demand has been increasing given the diversity of a changing demographic consumer base. Hispanic and Asian residents represent the fastest growing consumer bases in the United States who bring much different food preferences to the traditional American food basket. As Americans have become more diverse, wealthier, and travel abroad, the composition of the American diet reflects a larger share of ethnic foods, tropical products, spices, and imported gourmet food items and beverages. Foreigners traveling in the United States also discover many unique foods/beverages (e.g., country ham, bourbon) which create export opportunities for U.S. food and ag-related companies. However, enhanced international competition for U.S. ag exporters coupled with the anticipated growing demand for imported ag/food product trends will likely challenge the existence of future large U.S. ag trade surpluses.

Recommended Citation Format:

Snell, W. “Ag Export Growth Subsides Amidst a Changing Global Economy." Economic and Policy Update (23):6, Department of Agricultural Economics, University of Kentucky, June 29th 2023.

Author(s) Contact Information:

Will Snell | Extension Professor | wsnell@uky.edu

Recent Extension Articles

Kentucky Dairy Product Shoppers: Perceptions of Local Sourcing and the Environment

Tim Woods, Shuoli Zhao, Azita Varziri, and Camille Dant

A significant survey was completed during the early part of 2023, exploring the values and demand perceptions of Kentucky consumers of dairy products. This survey of 827 individuals explored a wide range of attitudes and behaviors connected with a range of food sourcing and impact considerations.

2022 Financial Overview of Kentucky Farms

Tarrah Hardin

After coming off a record high Net farm income (NFI) in 2021, grain farms in Kentucky Farm Business Management (KFBM) program saw their net farm income decrease to levels below pre-pandemic. The main cause of the downturn in NFI, comes from the increase in operating expenses.