Grain Profitability Outlook 2023

Author(s): Greg Halich

Published: February 28th, 2023

Shareable PDF

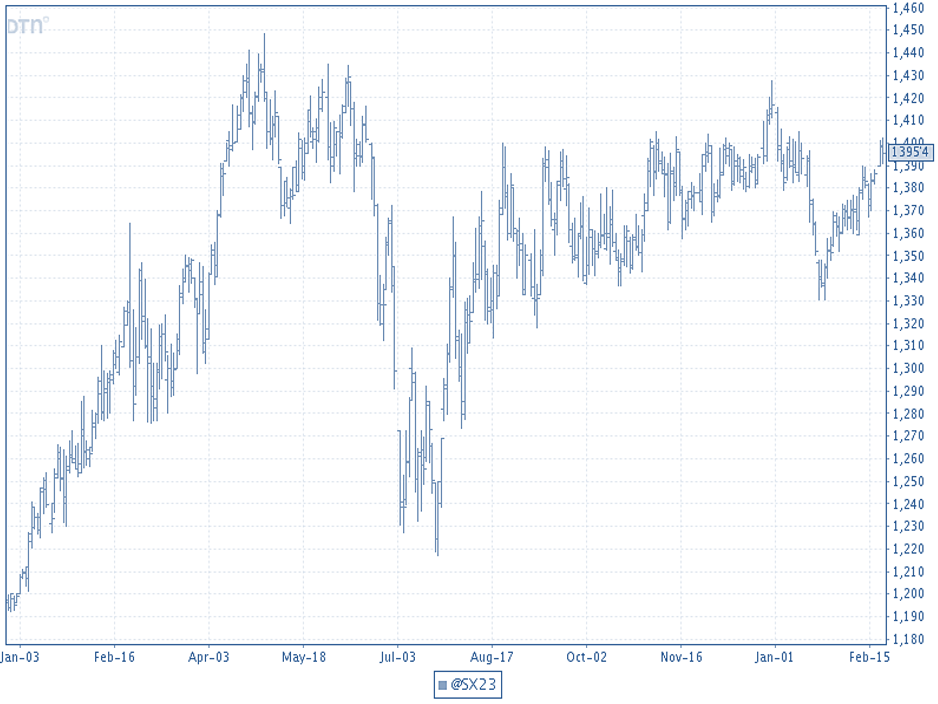

The grain markets surged to a new level after Russia’s invasion of Ukraine in late February 24, 2022. Prices have come down since their peak last spring, but they are still extremely high. Current prices for 2023 new-crop delivery are around $5.60/bu for corn, $14/bu for soybeans (2/22/23). This is an increase of around $.30/bu for corn and $.75/bu for soybeans compared to what these prices were expected one year ago (see Figure 1).

Figure 1: November 2023 Soybean Futures (2/22/2023)

Continuing to temper the increased revenue from higher grain prices are steep increases in fertilizer and fuel prices over the last two years. Fertilizer prices rose steadily during the winter of 2021-22 and reached all-time highs by spring 2022. These prices have come down quite a bit in the last few months but are still 50% higher than 2020-21 levels. Fuel prices were also up significantly and were roughly $4.25/gallon level one year ago. They also have dropped over the last few months and are currently around $3.50/gallon. Other input costs have increased as well, albeit at lower levels than seen with fertilizer and fuel. This article will evaluate the overall effect of these changes, and estimates the expected profitability for the 2023 crop.

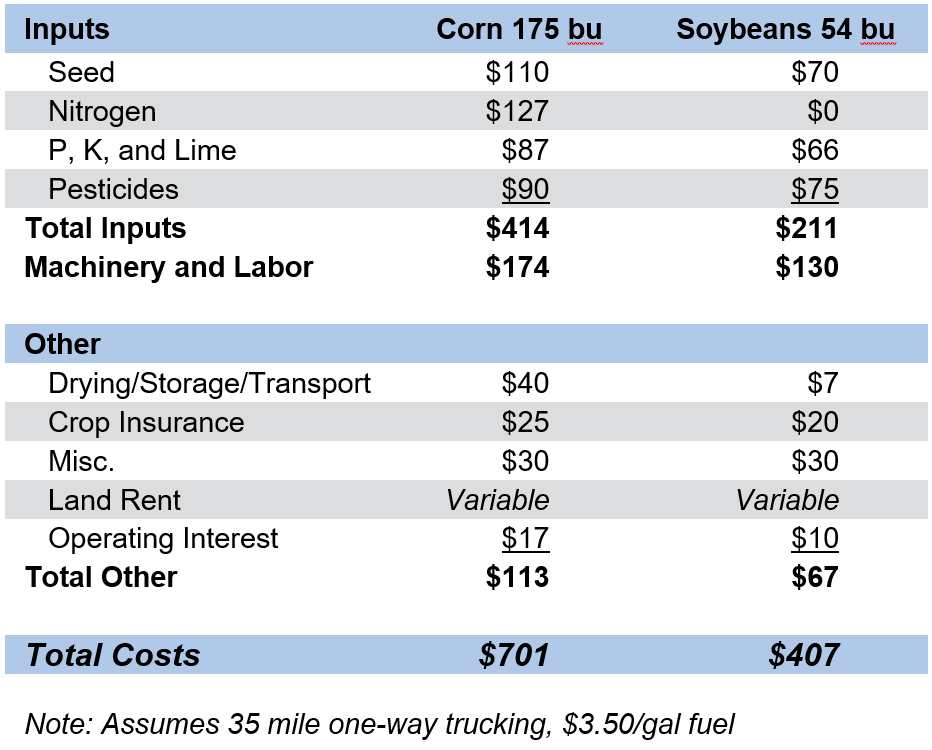

Costs for an efficient western Kentucky grain farm are estimated in Table 1 on soil that averages 175 bushels corn and 54 bushels soybeans per acre. Machinery and labor costs include depreciation and overhead costs, as well as an opportunity cost for operator labor. Fuel costs are based on $3.50/gallon diesel and 35-mile one-way trucking to the elevator.

Table 1: Projected Costs (per acre) Western Kentucky 2023

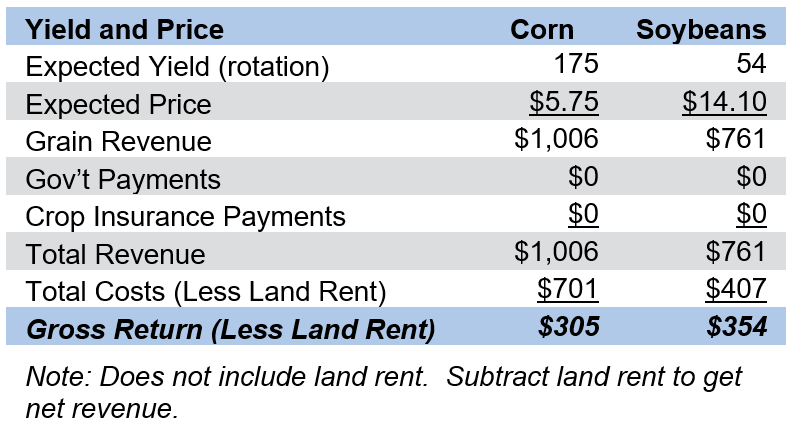

Corn and soybean prices used in this analysis are based on forward contracting prices (as of late March) for an average of fall and winter delivery: $14.10/bu for soybeans and $5.75/bu for corn. Table 2 shows the expected gross return (does not include land rent) given the costs in Table 1 and expected commodity prices and yields.

Table 2: Summary Gross Return West Kentucky 2023 (per acre)

The expected gross profit for this productivity soil is $305/acre for corn and $354/acre for soybeans. Assuming a 50-50 rotation the average gross return would be $330/acre. Net return would be calculated by subtracting out the land rent. In western Kentucky, much of the ground with this type of productivity is being rented for $175-300/acre. As an example, if we use a $225 land rent, the net return (return to management and risk) would be a $105/acre.

Table 3: West Kentucky 2023 (per acre)

$14.10 Soybeans (elevator) $5.75 Corn (elevator)

$.67-N, $.63-P, $.54-K

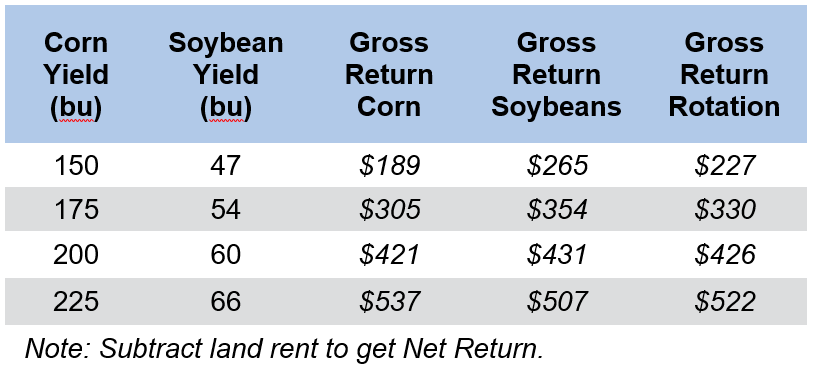

Table 3 shows a summary of the estimated gross returns for various soil productivities. Think of these yields as the long-run expected yields for a particular farm, not year-to-year variability. Costs are adjusted to account for different expected yields. The biggest change in costs is for trucking which adjusts on a 1-1 basis, but other costs such as fertilizer are adjusted at a lower rate. Looking at Table 3, it is easy to see how quickly gross profitability changes with expected yield.

Note: Central Kentucky has a higher cost structure due to its use of urea as the primary nitrogen source and longer trucking distances to key markets on average. Thus gross returns in this region are likely to be $10-50 per acre lower than those shown in Table 3.

Observations

1) Potential profitability looks great for 2023, even after accounting for the drop in expected commodity prices from 2022, and the still-significant input cost increases that have occurred over the last two years. We have not seen these magnitudes in gross returns since the peak of the ethanol boom.

2) There are rumors of significant land rent increases, and this would not be surprising given the profitability of the 2022 crop and the projected profitability of the 2023 crop. The only question is how high will these rents go and what percent of the overall crop acres will be at these increased levels. I was in south-central Indiana this past week and spoke with a landowner (retired grain farmer) that rented out his entire farm for $340/acre. I have heard reports of cash rents in the most competitive areas in Kentucky approaching $400/acre.

3) Soybean profitability has increased relative to corn profitability in the last month. Up to that point, corn returns held an advantage compared to soybean returns on the better ground in Kentucky. The current relative price levels have brought the profit spread between these two crops to more normal levels. Currently, there doesn’t seem to be much opportunity to deviate from the typical 50-50 rotation.

Marketing

Remember the old adage “a bird-in-the-hand is worth two in the bush”. If you haven’t marketed much of your 2023 crop now would be a good time to start getting serious about it. While most farmers are reluctant to market very much of their future crop this far out, the current prices offered for the 2023 new crops are screaming for attention, and at least worth considering given the great market conditions. There is much volatility and uncertainty in the grain markets right now and risk management is paramount. What would happen to grain prices if China, our biggest importer of both corn and soybeans, starts supplying military aid to Russia in its “Special Operation” against Ukraine? Remember the other old adage: what the market giveth, the market can taketh.

Don’t believe my numbers? I appreciate skepticism. Here is a link to corn-soybean budgets so that you can come up with your own estimates: https://agecon.ca.uky.edu/budgets

Recommended Citation Format:

Halich, G. "Grain Profitability Outlook 2023." Economic and Policy Update (23):2, Department of Agricultural Economics, University of Kentucky, February 28th, 2023.

Author(s) Contact Information:

Greg Halich | Associate Extension Professor | greg.halich@uky.edu

Recent Extension Articles

Cow-Calf Profitability Estimates for 2022 and 2023 (Spring Calving Herd)

Greg Halich, Kenny Burdine, and Jonathan Shepherd | February 28th, 2023

The purpose of this article is to examine cow-calf profitability for a spring calving herd that sold weaned calves in the fall of 2022 and provide an estimate of profitability for the upcoming year, 2023. Even though calf prices were better in 2022 compared to 2021 (+$.15/lb), projected profitability is lower due to increases in cash costs ($94/cow higher in 2022).

Changes in Kentucky Sales Tax That Apply to Farming

Jerry Pierce | February 28th, 2023

Legislation went into effect on the first of 2023 that made many services subject to Kentucky’s 6% sales tax. One change was to the qualifications for residential use exemption from sales tax on utilities. As a result, Kentucky sales tax will be charged for utility services furnished to any location that is not your place of domicile, even if it was formally classified as residential. There are other changes that apply to farming.