Kentucky Farm Observations From Across the State

Author(s): Kentucky Farm Business Management (KFBM) Program

Published: October 30th, 2023

Shareable PDF

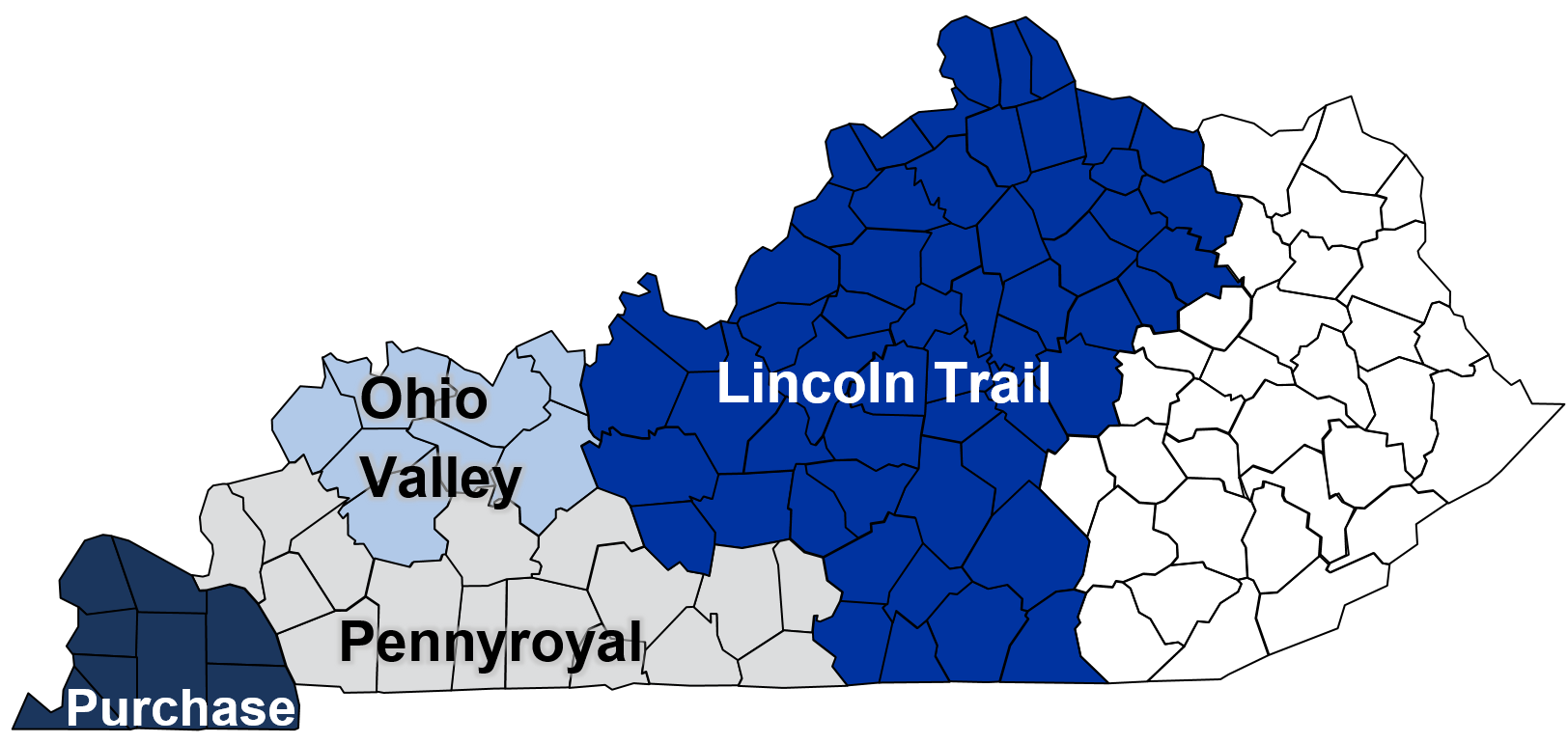

The Kentucky Farm Business Management Program is a program of the Department of Agricultural Economics at the University of Kentucky. Extension Specialists serve four Farm Analysis Associations working with cooperating members to improve farm management techniques and decisions through recordkeeping and analysis. Currently, KFBM serves 355 farms that are representatives of 49 counties. KFBM specialists work very closely with a diversity of farms and this article will share some of the real-time observations that they have seen this fall.

Purchase Area

The Purchase area includes farms in the farthest western counties of the state, west of Kentucky Lake and bordered by the Ohio and Mississippi Rivers.

Crop production observations in the Purchase Area seem positive. There have been reports of very encouraging yields for both corn and full-season soybeans. If the yields remain where they are now, everyone should be able to weather the lower price points. However, that is yet to be seen, as typically the best crop is harvested first. Tobacco has been dismal as plants were heavily damaged by wind and rain. To add to the destruction, several cases of Angular Leaf Spot, a bacterial infection of the tobacco leaves, have been found. This decreases the quality of the leaves significantly and reduces the price to around $1 a pound: hardly worth harvesting. A few producers have talked with crop insurance and opted not to harvest the tobacco. This creates some labor issues with guaranteed hours for the migrant workers, but all of that is being negotiated and worked out.

A big issue that is building and causing the most uncertainty is the river. The Mississippi River is once again at almost record lows, only a few feet from shutting down barge traffic. This is causing a very wide basis locally, as barges are not able to be loaded as heavy due to the low water levels and thus transporting the grain costs more. Basis affects the cash price received by the producer. There were reports a couple of weeks ago of a $-1.30 basis for soybeans, this means that if the market price for soybeans is $11.00, the cash price the producer receives is $9.70. If on-farm grain storage is available, it will likely be used for this harvest season, hoping that some rain will come for areas north of us and increase the river levels, bringing the basis back into a more normal range. Within the area, several grain bins are being built. Much of this is from the Disaster Relief payments that provided grain storage construction grants for those affected by the closure of Mayfield Grain due to the December 2021 tornado.

Pennyroyal Area

The Pennyroyal Area encompasses 17 counties, ranging on the southwestern border from Mammoth Cave to Kentucky Lake and north to the Western Kentucky Parkway.

Harvest is full speed ahead, with many finished or almost finished with corn within the first week of October. Yields will, once again, vary significantly across the region, depending on who got rain, how much and when. Some farms anticipate record-breaking corn yields this fall, while others describe the crop as “good to slightly above average.”

Price is a concern. More than one farm mentioned their first batch of 2023 wheat sold for $8-$9 bushel, while the last batch sold in the $4-$5 range. It seems most farms are only 0-40% priced for the 2023 crop year, the average is around 30%. Since beans also appear to be strong, there is hope that good yields will help offset lower grain prices. Many farms wanted to take advantage of pricing opportunities earlier this year, but with the weather in the area, there were serious concerns about overselling.

There are a number of farmers that do not expect tobacco to be a good crop this year. Many tobacco farmers in the area have reported wind, hail, and water damage, along with disease. West Christian and East Trigg counties had a severe hailstorm in late September that destroyed a lot of what had not been cut. Before and after pictures of the same field below:

Financially, KFBM specialists have noticed a couple of trends this summer and fall. Interest rates are a top focus for many. For those with excess cash, there have been questions about how to best manage accounts to capture high depository rates. Many utilize stair-step CDs or high-yield money market accounts. For those using an operating line, they have explored their financing options, and have been paying much closer attention to any floating income. The decision to purchase land this year has been complicated by higher interest rates.

It seems equipment purchasing has slowed as well, or it seems farms are struggling with the decision more. Equipment costs had been trending upward quickly for many years. Those who have had leases come up for renewal this year have been surprised by renewal costs 30-60% higher for the same equipment. Those who have purchased equipment have encountered dramatically higher purchase prices, higher interest rates, and less favorable terms, like an adjusting rate after twelve months.

One interesting thing happening in this area is drone applications. Application of chemical by drone has been used in the area for tobacco, corn, and beans. Feedback for this method is positive. Especially for tobacco, as leaf damage is significantly reduced. A couple of farms have mentioned that they will sow cover crops with a drone this year over standing beans. The main downside to drone application is the battery life of the drones makes large fields a bit more difficult to cover. The cost is slightly lower than helicopter application, and most farms report that the application is more precise.

There are concerns regarding tax planning this year. As producers begin to prepare for tax planning, they should consider if there are deferred 2022 crop insurance proceeds that will be taxed in 2023. Deferring crop insurance proceeds is a viable tax management strategy, but forgetting about that deferred income can sometimes cause large swings in taxable income in the following year. Producers can refer to their 2022 Schedule F if they are unsure about whether there was a deferral. With the value of the grain per bushel being less than in previous years, there could be cause for cash flow concerns. It will take more bushels to produce the same level of revenue.

Ohio Valley Area

The Ohio Valley Area includes farms in 8 northwestern counties bordering or adjoining counties along the Ohio River.

Yields are surprisingly better than anticipated in the Ohio Valley area considering the weather challenges faced throughout the year. There was a dry stretch in June. In July there was too much rain resulting in river levels flooding out bottom areas. There was even hail damage in parts of the area. Thankfully, only small areas were impacted as yields were significantly lower in these damaged crops. Despite the weather, yields for both corn and soybeans are expected to be near 5-year averages of 196 bushels per acre for corn and 60 bushels per acre for soybeans.

River levels are once again becoming an issue this year. The Ohio River is already lower than it was last year at this time. Low river levels cause issues with grain elevators shipping out grain as they receive it from producers. Traffic at the grain elevators is not backing up yet and they are not closing yet due to no storage capacity, but they are already starting to build their ground piles of corn, not even a full month into harvest. There have also been reports of fertilizer availability issues due to low river levels and the inability to ship the fertilizer up the river to local markets.

Earlier this year, several producers in the area were interested in growing wheat because wheat prices were high. Expected wheat prices for June 2024 have dropped, and wheat planting interest dropped right along with that. Most producers have reduced their wheat acreage for the 2024 crop. Most wheat was planted in early October in the Ohio Valley area.

Cattle demand is high now. There are some producers in the area looking to increase the size of their herd by purchasing cow-calf pairs. This decision is motivated by the thought that if they can buy cow-calf pairs at a decent price, they will make their money back on selling the calf. It is unlikely that this trend will continue once pastures dry up, as hay availability is expected to be tight for everyone. The dry fall conditions have been good for corn and soybean harvest; however, the pastures are suffering from the lack of rain. Conditions during the summer months did not provide for a large hay crop either.

Several producers in the area have also been interested in starting tax planning early. The large crop carryover from 2022 brought significant income into the 2023 tax year. Extra income at the beginning of the year will impact the decision of when to sell the current year's crop. Tax management is an important part of the overall farm management decisions.

Lincoln Trail Area

The Lincoln Trail area includes most of the central part of the state. This area includes the I-65 and I-75 corridors north to south and reaches as far east as Winchester. This area is diverse in its agricultural production.

Harvest has started and is rolling fast with everything being so dry. If it stays dry, harvest might be a quick one. Corn yields are excellent, even with the extended periods of no rain during the growing season. Producers in the area have indicated elevated levels of taxable income due to increased yields. At the time of drafting this article, there had not been many soybeans harvested yet. Therefore, it is too early to say anything about soybean yields, but the plants are loaded with pods, providing an optimistic outlook of what the yields could be.

From the livestock side of things, pasture conditions are not good. There was a little rain shower in early October, which was welcomed, but much more moisture is needed to help with pasture conditions. Most producers in the area started feeding hay a few weeks ago. Hay inventories may not be enough to provide feed until next spring if pasture conditions do not improve. A few producers who have started looking to purchase a few extra bales of hay have quickly found prices to be higher than expected.

Overall, Kentucky producers are experiencing good yields for both corn and soybeans. Prices are lower than what has been experienced in recent years. The elevated yields will help producers maintain cash flow, despite these lower prices. Tobacco quality and yields will be down this year due to weather events that caused damage and disease. The Mississippi and Ohio Rivers are vital thoroughfares for both moving the produced crops to end users and for bringing necessary inputs like fertilizer into the state. Decreased water levels in these rivers disrupt that traffic and have been the cause of lower local grain prices and could cause increased fertilizer prices for the 2024 crop. Dry weather conditions have provided for a quick harvest, however, livestock producers that depend on grass to feed their animals may struggle with feeding costs this winter. Despite the struggles, our Kentucky producers are resilient and will use their expert management skills to make the decisions that they feel are best for their operation. Actual yields, income, and other financial measures will be summarized by KFBM personnel in early 2024.

Recommended Citation Format:

Kentucky Farm Business Management. "Kentucky Farm Observations From Across the State." Economic and Policy Update (23):10, Department of Agricultural Economics, University of Kentucky, October 30th, 2023.

Author(s) Contact Information:

Kentucky Farm Business Management (KFBM) Program

Recent Extension Articles

Mississippi River Level Impacts on Basis: 2022 Vs. 2023

Grant Gardner

In 2022 and 2023, the river levels on the Mississippi slowed barge freight and, thus, crop exports out of Kentucky. When river levels decline, barge transportation slows, which causes barge freight rates to increase. When river levels are normal in Kentucky, the average October basis is near -$0.20 for corn or -$0.30 for soybeans. This year, producers that had to deliver when the basis was at its worst could have lost $0.30- $0.60/bushel on corn and $0.50-$0.70/bushel on soybeans.

Prospects for Winter Backgrounding 2023-2024

Greg Halich & Kenny Burdine

After several years of cattle selling at frustratingly low price levels, continued herd liquidation has led to tight supplies and much higher calf prices in 2023. While markets have pulled back in recent weeks, calves and heavy feeders are moving at prices $50 to $70 per cwt above what was seen a year ago. Feed prices have also decreased over the last several months and most feeds will cost less this winter than last. All of these factors should be taken into consideration when one considers placement of calves into backgrounding programs this fall.