Average KFBM Net Farm Income Dips Negative for the First Time in Decades

Average KFBM Net Farm Income Dips Negative for the First Time in Decades

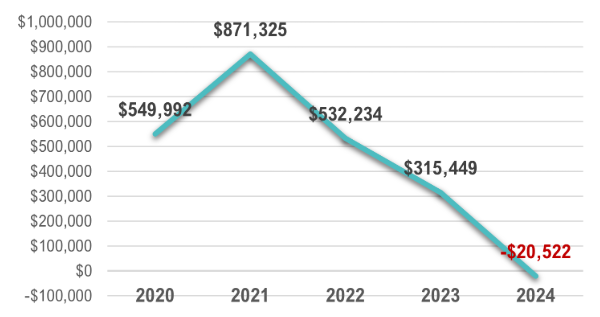

For the first time since the 1980s, the average Net Farm Income (NFI) among Kentucky Farm Business Management (KFBM) cooperators has fallen below zero, closing the production year at an average of ($20,522). This dramatic shift is a sharp reversal from the record high NFI in 2021 of $871,325. The most recent KFBM data highlights the mounting financial pressure on KFBM farms.

Figure 1. KFBM Grain Net Farm Income 2020-2024

Table 1. KFBM Grain Net Farm Income by Area

| Kentucky | Pennyroyal | Ohio Valley | Purchase | Central Kentucky | |

|---|---|---|---|---|---|

| 2020 | $549,992 | $700,163 | $378,222 | $492,649 | $183,259 |

| 2021 | $871,325 | $995,086 | $787,955 | $734,801 | $528,467 |

| 2022 | $532,234 | $647,664 | $518,603 | $114,600 | $296,915 |

| 2023 | $315,449 | $457,361 | $122,168 | $223,136 | $79,108 |

| 2024 | -$20,522 | -$20,202 | $21,177 | -$70,041 | -$19,094 |

The 2024 production year was a challenging one for KFBM farmers due to a combination of lower commodity prices, climbing interest rates, and weather-related production issues. Grain markets saw significant softening due to larger global inventories and reduced export demand. For row crop farmers, this meant stable or even increased yields could not offset the decline in market prices.

Adding to the financial burden, producers faced higher interest costs as the Federal Reserve maintained elevated interest rates to combat inflation. Operating loan rates commonly fell within the 7-9% range, and long-term financing rates remained steady, posing a challenge for those looking to refinance.

KFBM producers also endured a difficult spring planting season in 2024 (and 2025) characterized by persistent rainfall and flooding. Spring 2024 was one of the wettest springs on record, causing delayed planting. Several KFBM producers were unable to plant entire fields and had preventive plant crop insurance claims. Late planting not only reduced yield potential but also increased input costs due to the need for replanting and additional fieldwork.

Accrued government payments, in the form of the Emergency Commodity Assistance Program (ECAP), injected much needed liquidity into struggling operations, even though funds were not received until April 2025. Without these payments, the average NFI would have fallen even further. Despite this assistance, cash flow strain for KFBM farms was significant. The average KFBM operation experienced a nearly 50% decline in cash available for term debt repayment. After accounting for key expenditures, such as income taxes, term debt payments, and family living, the average KFBM ended the year with a cash flow shortfall of over $35,000.

Farms with strong liquidity positions were able to draw down cash reserves to manage these shortfalls. Many farms were forced to make difficult decisions, including selling assets, rolling stale operating debt, or refinancing term debt at a higher interest rate. These strategies, while necessary, have long-term implications, eroding equity and pushing out repayment timelines.

Looking into the 2025 production year, KFBM Specialists caution that many of these challenges remain firmly in place. Commodity markets continue to trend downward, input costs remain high, elevated interest rates persist, and 2025 spring and summer were extremely wet, once again delaying planting and summer small grain harvest. These factors place immense pressure on profitability, an alarm for all producers, but especially those with weak-to-moderate solvency positions. In mid-July, enrollment for the Supplemental Disaster Relief Program (SDRP) was opened. This program is part of government farm support derived from the American Relief Act passed in December 2024. While this program is much anticipated relief for many farms, Stage 1 is limited to those with existing Federal Crop Insurance or Noninsured Crop Disaster Assistance Program (NAP) losses from 2023 and 2024. Details for Stage 2, which will provide assistance to those with uncovered losses, have not been announced.

KFBM and the University of Kentucky remain committed to providing analysis and management tools to help producers adapt. Specialists emphasize the importance of proactive financial planning during these downturns. Tools such as detailed cash flow projections, financial analysis, and benchmarking through programs like KFBM remain crucial resources to help producers navigate periods of economic stress. As Kentucky agriculture faces one of its most challenging periods in decades, the importance of sound financial management and strategic decision-making has never been greater.

Recommended Citation Format:

Brashears, K. "Average KFBM Net Farm Income Dips Negative for the First Time in Decades." Economic and Policy Update (25):7, Department of Agricultural Economics, University of Kentucky, July 30, 2025.

Author(s) Contact Information: