The Steer-Bull Price Differential: A Historical Perspective

The Steer-Bull Price Differential: A Historical Perspective

In extension settings, I am often asked whether I think it pays for a cow-calf operator to castrate bulls and sell steers. Castration is not without cost as it requires time and facilities and does stress calves for a period of time. Like so many management decisions, there are numerous ways that one can look at this decision and there is more to be considered than economics alone. But, it had been about three years since I wrote an article on this topic, so I thought it was likely a good time to revisit it.

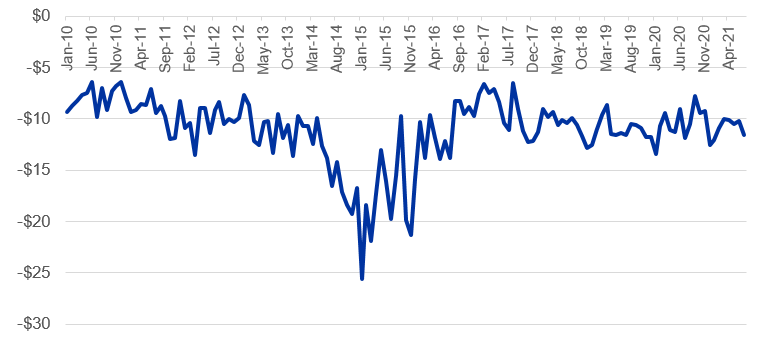

When examining historical prices, it is difficult to argue that there is not a price advantage to selling steers. Sure, there will be times when a group of bulls will outsell a group of steers, but I view those times as the exceptions, rather than the norm. Sometimes those exceptions may be due to quality or lot size differences. Other times it may be as simple as a buyer needing to fill out a load of bulls and bidding the price of a group up beyond what would have been expected. But, going back to January of 2010, there has not been a single month when the average price of 550 lb bulls exceeded that of 550 lb steers. The figure below plots this data by month from January 2010 to July 2021. The bull discount got very wide at times during 2014 and 2015 but otherwise has been running in a range of $7 to $14 per cwt. Over that entire time period, the bull discount averaged $11.12 per cwt.

Figure 1: Bull Minus Steer Price at KY Auctions: January 2010 to July 2021

550 lb M/L #1-2's ($'s per cwt)

A logical follow-up question would involve the likely weaning weight differences between steers and bulls. In the figure above, I tracked the price differential at the same sale weight. On a 550 lb calf, that $11.12 per cwt historical price difference amounts to a little more than $60 per head but also ignores potential weight differences between the two. I like to frame this discussion by asking how much more a bull calf would have to weigh at weaning to make up for that difference. To answer this question, we have to understand the value of additional lbs (value of gain) and not confuse this with the sale price. Price slide refers to the decrease in price per cwt that occurs as the weight of cattle increases. Because of the price slide, the value of additional lbs is typically less than the sale price. This is a key concept in cattle marketing that impacts almost all decisions that producers make. I will walk through a quick illustration.

The average price of a 550 lb bull calf from 2010 to 2020 in Kentucky auction markets was $150 per cwt or $825 per head. If the price slide in the market were $10 per cwt, for each 100 lb increase in the bull’s weight, his price would decrease by $10 per cwt. So, if a bull weighed 600 lbs, rather than 550 lbs, his price would have been $145 per cwt ($5 per cwt less) and his total value would be $870. This is $45 more dollars than the 550 lb bull, which means that those additional pounds were worth roughly $0.90 each. At that rate, the bull’s weight would need to exceed the weight of the steer by 67 lbs to make up for the roughly $60 difference in value from the price discount. As price slide increases, the value of additional lbs decreases. Using a larger price slide of $15 per cwt would make the value of those additional lbs worth only about $0.60, which would mean that the bull would need to outweigh the steer by roughly 100 lbs for his value to be comparable. Similarly, a smaller price slide would result in higher values of gain and fewer additional lbs needed to offset the price differential.

This discussion is quickly summarized in the table below. In the table, I work through these calculations for price slides of $5, $10, and $15 per cwt. Ordinarily, I would not include a price slide as low as $5 per cwt for calves, but we are in a unique market right now with relatively high feed costs. Generally speaking, high feed prices tend to result in smaller price slides as preference shifts towards the placement of heavier feeder cattle into feedlots. Conversely, price slides for calves will typically be larger in the spring when grass demand supports lighter calf prices. Price slides also tend to increase as overall price levels increase. For example, we saw price slides exceed $20 per cwt during 2014 and 2015 when calf prices exceeded $2 per lb. So, the table below is largely for illustration purposes but provides a framework from which producers can make similar calculations based on calf prices and price slides in any market.

Table 1: Price Slides and Value of Additional Weight

| $5 / cwt price | $10 / cwt price slide | $15 / cwt price slide | |

|---|---|---|---|

| Value of 550 lb bull, initial price of $150 per cwt | $825 per head | $825 per head | $825 per head |

| Value of 600 lb bull | $885 per head | $870 per head | $855 per head |

| Value of each additional lb | $1.20 | $0.90 per lb | $0.60 per lb |

| Lbs needed to add $60 of value per head | 50 lbs | 67 lbs | 100 lbs |

Finally, I would mention that implants likely need to be considered as part of this discussion too. While I leave implant specifics to my animal science colleagues, implanted steers have the potential to see much better rates of gain and narrow that weight difference considerably. So, unless a producer is selling into a market that does not allow implants, they may offer the potential to receive steer prices, but also see improved rates of gain.

Every producer has to decide for themselves whether castrating bulls makes sense for their operation. I am fully aware that there is a cost to working calves and some producers may choose not to do this due to facility or time limitations. I have not attempted to delve into those additional costs in this article, but rather have focused on the value differences so that producers can weigh those against the additional costs they would incur. There is pretty consistent evidence that bulls will sell at a discount to steers in the marketplace and the additional lbs needed for bulls to offset that discount can be significant. I would also point out that there are individuals in the marketplace who make money by purchasing bulls, castrating them, backgrounding them for a period of time, and re-selling them. I just mention this as evidence that this is a way that value is commonly added to cattle in the market. So, producers who typically sell bulls may want to consider the potential value that can be added to their calves through this practice as they look for ways to increase profitability in the future.

Recommended Citation Format:

Burdine, K. "The Steer-Bull Price Differential: A Historical Perspective." Economic and Policy Update (21):8, Department of Agricultural Economics, University of Kentucky, August 31st, 2021.

Author(s) Contact Information: