U.S. Beef Cow Inventory Continues to Decline

U.S. Beef Cow Inventory Continues to Decline

USDA-NASS released their January 2024 cattle inventory estimates on the afternoon of January 31st. Estimates came in pretty close to expectations and confirmed that the cowherd had continued getting smaller during the course of 2023. It was really a question of how much contraction had occurred. At the national level, inventory of all cattle and calves came in little less than 2% lower than January of 2023. It is also worth mentioning that this decrease is in addition to a downward revision to the January 2023 number of about 0.5%. While this large, aggregated number likely has the highest accuracy, it includes all types and classes of beef and dairy cattle, so I tend to focus on a few of the more specific estimates from this report each year.

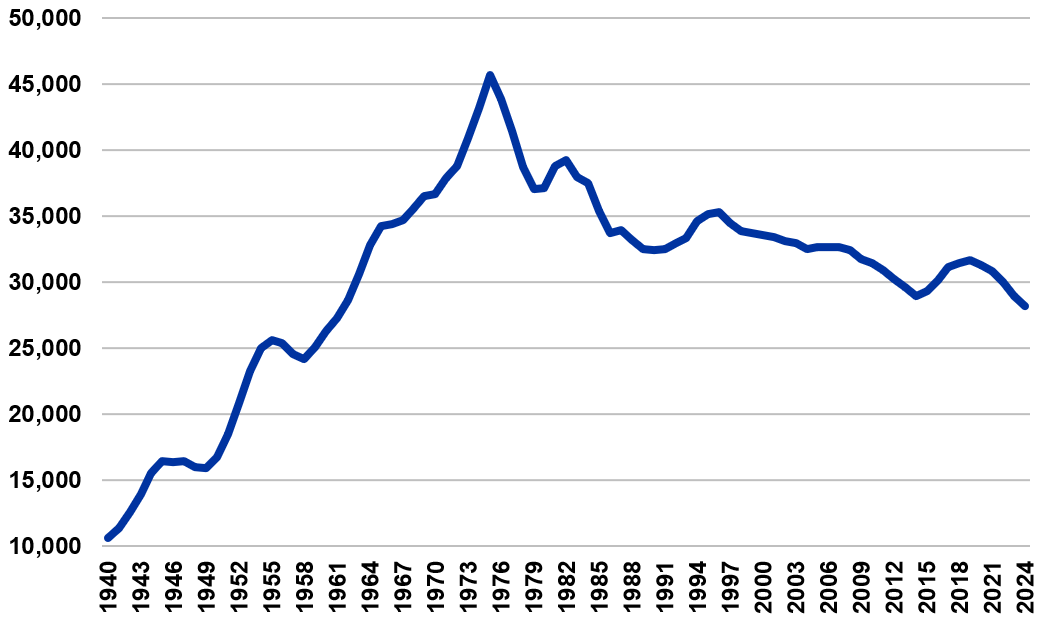

The first number I always look at is the number of beef cows in production, which speaks to the likely size of the calf crop in the new year. Beef cow inventory was down 2.5% from 2023, which puts the beef cow herd at the smallest level seen since 1961. This was not a surprise given cow slaughter levels and heifer retention over the course of last year. This places the US beef cowherd down 11% (3.4 million cows) from its recent high in 2019. The chart below tracks US beef cow inventory since 1940.

Figure 1: January 1 U.S. Beef Cow Inventory (1940 to 2024) (1,000 head)

Source: USDA-NASS and Livestock Marketing Information Center

USDA also estimated that the number of heifers held for beef cow replacement was down by roughly 1.5%. This was also after a significant reduction to beef heifer retention from a year ago. On a percentage basis, this is a smaller decrease than what was seen from 2022 to 2023, but still suggests that beef cow numbers are likely to decline again during 2024. Of course, things can change quickly, and beef cow slaughter will have an impact as well. Historically, calf prices at levels seen in 2023 have brought heifer retention, but higher input costs, limited hay supply in some regions, and high interest rates are limiting producer desires to expand.

The report also provided some perspective on the number of cattle on feed in the US. On a monthly basis, USDA estimates on-feed inventory for feedlots with one-time capacity exceeding 1,000 head. Despite a smaller supply of feeder cattle, on-feed inventories have been running above year-ago levels since October of last year. This was likely due to some early domestic placements, an increase in live cattle imports, more heifers on feed, and a longer number of days on feed in the latter part of 2023. Consistent with these monthly estimates, the annual cattle inventory report that came out on January 31st, placed total cattle on feed in the US 1.6% higher than January of last year. Comparing January 1 on-feed estimates in these two reports is always interesting and suggests that nearly 83% of total cattle on feed are being fed at these larger feedlots. That proportion has been increasing for some time and it is a trend that I suspect will continue.

The Kentucky inventory estimates were not what I expected. After a 7% decrease during 2022, this most recent report estimated the size of the KY beef cow herd at 907 thousand head, a slight increase from January of 2023. Given the number of cows moving through auctions last year and observations from my Extension travels, I expected beef cow numbers in the Commonwealth to be lower. Kentucky was the only top 10 beef cow inventory state that saw an increase in cow numbers. While the Kentucky beef cow herd was estimated to be slightly larger in the new year, beef heifer retention was lower.

From a longer-term perspective, this most recent USDA report paints a picture of continued tight cattle supplies. The smaller beef cow herd means the 2024 calf crop is going to be smaller. Even if we did start seeing heifer retention occurring in the new year, those heifers would not wean calves 2025. From my perspective, the only way that we could see an increase in beef cow numbers next year would be from sharp reductions in cow culling. There are macroeconomic and geopolitical uncertainties that can impact these markets, but it appears that the supply picture will remain pretty bullish.

The USDA report is summarized in the table below and the full report can be accessed at: https://downloads.usda.library.cornell.edu/usda-esmis/files/h702q636h/6108x003v/kk91h696g/catl0124.pdf

Table 1: USDA January 1, 2024 Cattle Inventory Estimates

| 2023 (1,000 head) | 2024 (1,000 head) | 2024 as % of 2023 | |

|---|---|---|---|

| All Cattle and Calves | 88,841.0 | 87,157.4 | 98 |

| Cows and Heifers that have Calved | 38,336.8 | 37,579.8 | 98 |

| Beef Cows | 28,939.3 | 28,223.0 | 98 |

| Milk Cows | 9,397.5 | 9,356.8 | 100 |

| Heifers 500 Pounds and Over | 18,760.7 | 18,483.0 | 99 |

| For Beef Cow Replacement | 4,929.6 | 4,858.3 | 99 |

| For Milk Cow Replacement | 4,073.6 | 4,059.2 | 100 |

| Other Hiefers | 9,757.5 | 9,565.5 | 98 |

| Steers 500 Pounds and Over | 16,056.5 | 15,789.2 | 98 |

| Bulls 500 Pounds and Over | 2,029.0 | 2,020.7 | 100 |

| Calves Under 500 Pounds | 13,658.0 | 13,284.7 | 97 |

| Cattle on Feed | 14,195.8 | 14,423.3 | 102 |

| 2022 (1,000 head) | 2023 (1,000 head) | 2023 as % of 2022 | |

| Calf Crop | 34,439.5 | 33,593.0 | 98 |

Source: NASS, USDA

Recommended Citation Format:

Burdine, K. "U.S. Beef Cow Inventory Continues to Decline." Economic and Policy Update (24):2, Department of Agricultural Economics, University of Kentucky, February 2, 2024.

Author(s) Contact Information:

Kenny Burdine | kburdine@uky.edu