2022 Farmland Values

2022 Farmland Values

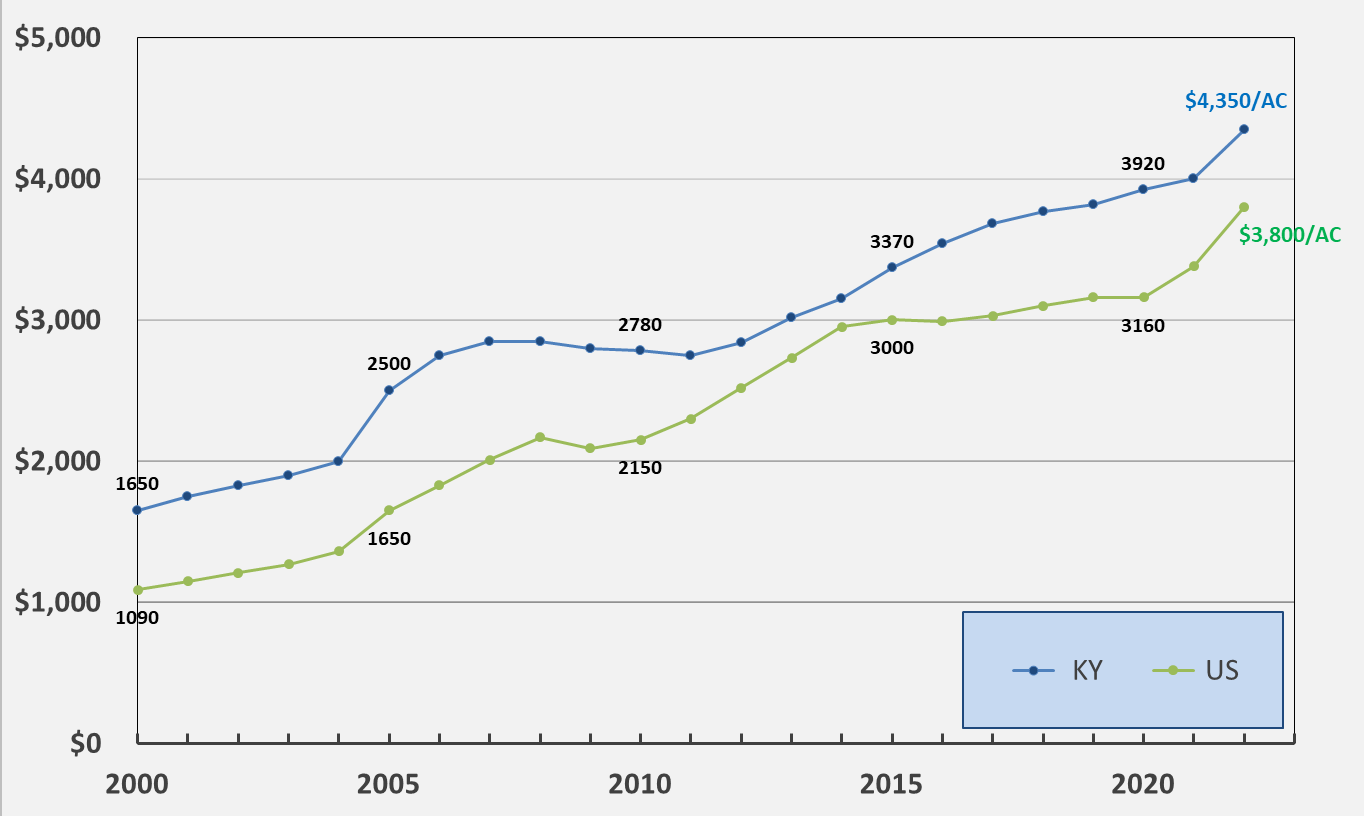

Kentucky’s farm real estate values increased 8.8% according to the annual Land Values Summary released by USDA in August. Average real estate value in the Commonwealth increased to $4,350 per acre, up from the $4,000 per acre reported in 2021. Average cropland values increased from $4,350/ac to $5,000/ac (10.1%) while Kentucky’s pasture land value was up 6.9% from $3,620/ac to $3,870/ac.

Nationally average farm real estate values increased 12.4% to $3,800/ac from $3,380 a year earlier. Every state in the continental U.S. (Alaska and Hawaii are not included in the report) recorded increases in land values. Nineteen states realized double-digit percentage increases in land values including most states in the grain-producing states in the Midwest.

The complete Land Values 2022 Summary is available from the National Agricultural Statistics Service of USDA.

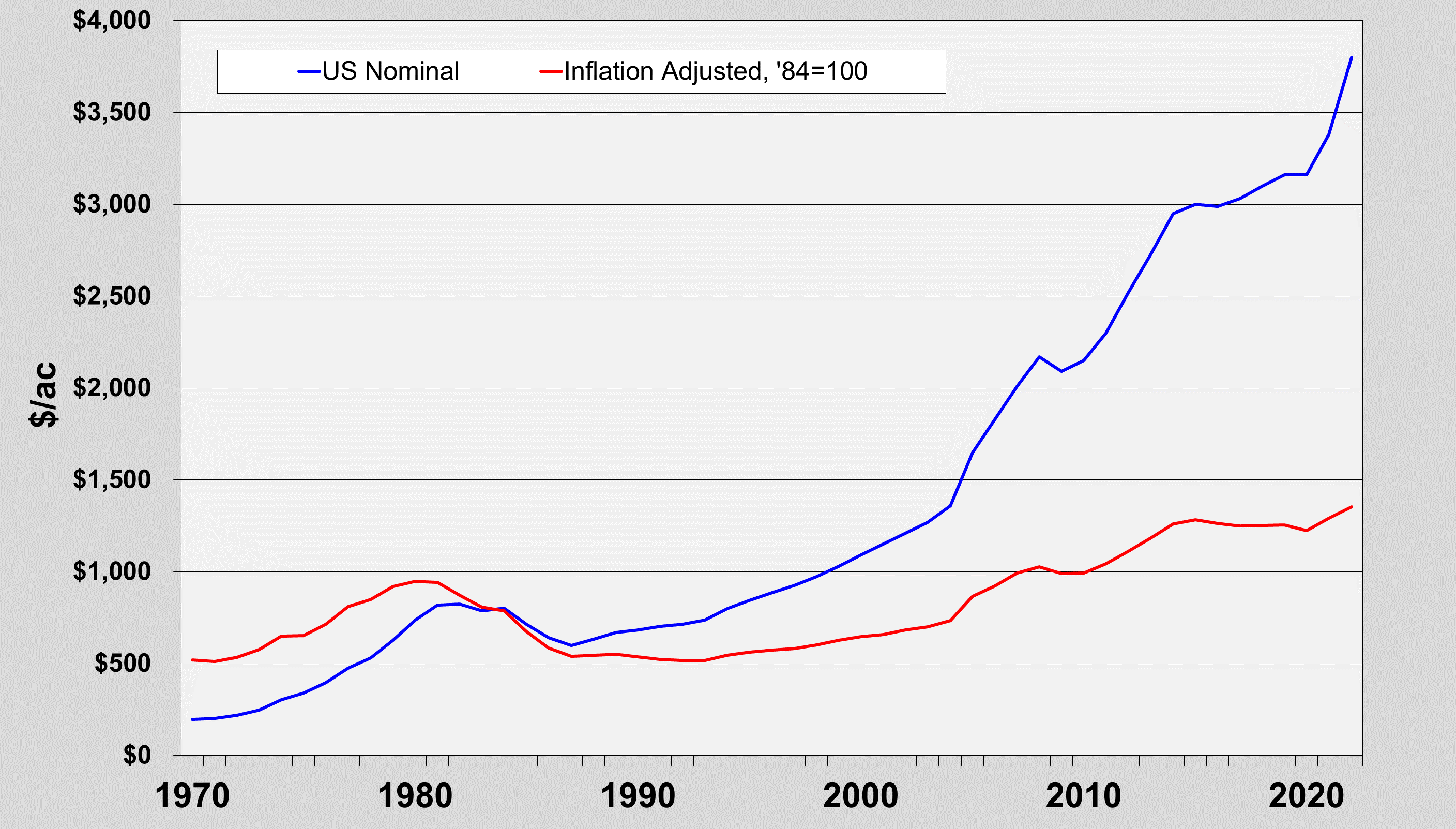

Land value changes are widely reported in the farm literature, usually in the format of Figure 1. This version represents the past fifty years and includes nominal as well as inflation-adjusted values. The length of this time series captures the farm financial crisis of the 80s when land values in many states dropped by fifty percent. In inflation-adjusted terms, the high of $947/ac in 1980 was not surpassed until 2007.

Figure 1: United States Farm Real Estate Values 1970-2022

Figure 2 is a comparison of Kentucky land values with the national trend since 2000. Kentucky’s values trend generally with national values but exceed the national average while trailing most Midwestern states.

Figure 2: Kentucky & U.S. Farm Real Estate Values 2000-2022

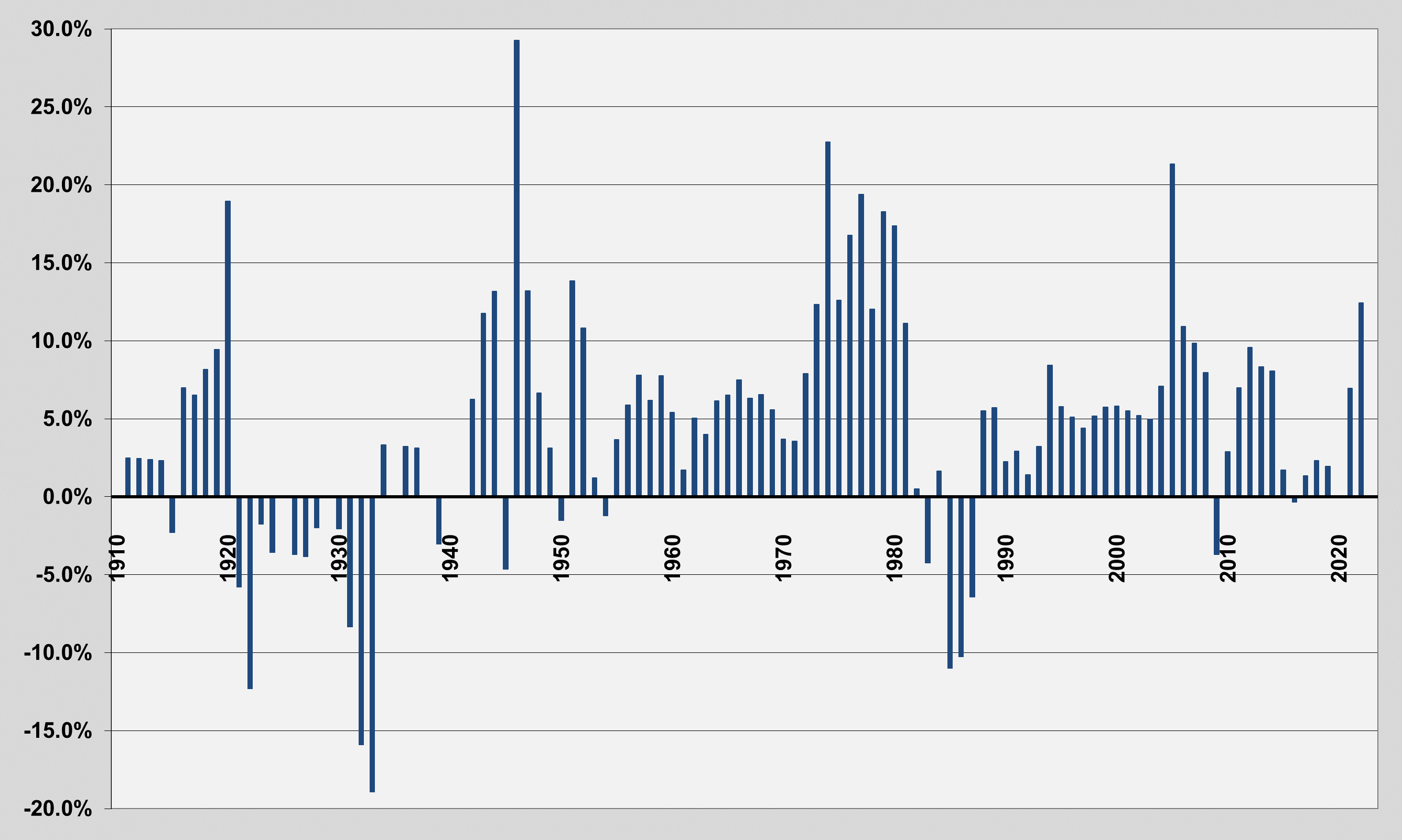

Land values are a good indicator of profitability in agriculture. Profits tend to accrue to the land and are reflected in sale prices and rental values. Broader economic events are also reflected in changes in land values. Year-to-year percentage changes are reflected in Figure 3. Major events like the Great Depression, World Wars, and the 80s farm financial crisis are apparent in increases or decreases in land values. The notion that land values always increase because “they don’t make any more of it” is generally the case; however, there have been years (most recently 2009) when land values decreased.

Figure 3: Annual Percentage Change in U.S. Farm Real Estate Values 1910-2022

Recommended Citation Format:

Isaacs, S. "2022 Farmland Values." Economic and Policy Update (22):9, Department of Agricultural Economics, University of Kentucky, September 29th, 2022.

Author(s) Contact Information: