Could Bourbon Help Kentucky Producers Survive Another Tradewar?

Could Bourbon Help Kentucky Producers Survive Another Tradewar?

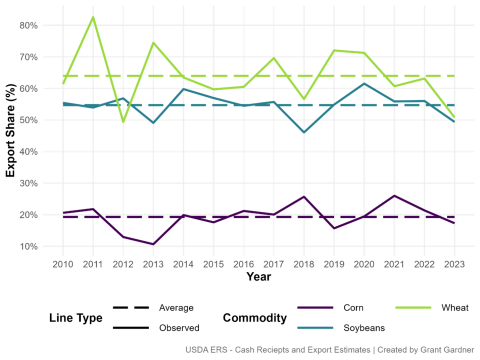

International markets support U.S. agriculture, particularly in Kentucky, which benefits from its proximity to the Mississippi River, enabling quick and low-cost transportation to Louisiana ports. From 2010 to 2023, an average of 63% of wheat receipts and 55% of soybean receipts were derived from exports, underscoring the reliance of these crops on global trade (Figure 1). In contrast, corn is less export-oriented, with just 19% of receipts linked to foreign buyers. This level of exposure makes Kentucky agriculture particularly sensitive to tariff changes and shifts in trade policy. During times of slow exports, strong local demand becomes essential.

In terms of ethanol, Kentucky produces 55 million gallons per year compared to Iowa’s nearly 5000 gallons (EIA, 2024). Kentucky can additionally crush nearly 45% of its soybean supply (Gerlt, 2025). Use of grain crops for feed and milling also plays a role, but likely the most distinctive source of Kentucky demand is bourbon and whiskey production.

Recent research by Murphy (2024) indicates that Kentucky distilleries demand over 30 million bushels of corn and 2 million bushels of wheat annually. If sourced entirely within the state, whiskey production would consume nearly 13% of Kentucky's corn crop and 7% of its wheat. This level of demand provides a significant cushion for corn producers, especially when international markets are uncertain.

Corn prices are less likely to be affected by trade disputes due to this domestic demand, but Kentucky’s other major cash crops—wheat and soybeans—remain highly export-dependent. Distilleries contribute some demand for wheat, especially as “wheated” bourbons gain popularity, but wheat still makes up only about 2% of the total grain used for whiskey distillation (Murphy, 2024). Soybeans, which are not used in whiskey at all, are the most exposed to price risks from retaliatory tariffs and global supply disruptions.

While grain demand from distilleries makes up sizeable portions of local use and helps support prices—especially for corn—Kentucky grain producers remain vulnerable to trade disruptions. Corn is partially shielded from global market volatility thanks to strong in-state demand from whiskey production. However, wheat and soybeans, which are more dependent on exports and have fewer local industrial uses, remain exposed to global price shocks and retaliatory tariffs.

Although Kentucky’s distilling industry provides a valuable buffer for local corn and some wheat, it is not a silver bullet. The state's broader agricultural outlook remains closely tied to the ebb and flow of international markets. Future investments in soybean crushing, wheat milling, or other regional processing infrastructure could improve resilience by expanding local demand and lessening dependence on volatile export channels.

Figure 1. Export Contribution to Kentucky Ag Receipts: Observed vs. Long-Run Average Share by Commodity

Table 1: Kentucky Distillery Demand and Average Production

| Distillery Demand (Bushels) | Average Kentucky Production (Bushels) | Distillery Demand | |

|---|---|---|---|

| Corn | 32,063,769 | 247,291,667 | 13% |

| Wheat | 2,181,502 | 29,446,667 | 7% |

Sources:

Gerlt, S. (2025). Soybean Crush Expansion, 2025 Update. American Soybean Association. Retrieved May 8, 2025, from https://soygrowers.com/news-releases/soybean-crush-expansion-2025-update/

Murphy, R. (2024). From Bushels to Barrels: A Descriptive Analysis of the U.S. Whiskey Industry. Theses and Dissertations--Agricultural Economics. https://doi.org/10.13023/etd.2024.489

U.S. Energy Information Administration (EIA). (2024). U.S. Fuel Ethanol Plant Production Capacity. https://www.eia.gov/petroleum/ethanolcapacity/

Recommended Citation Format:

Gardner, G. and T. Mark. "Could Bourbon Help Kentucky Producers Survive Another Tradewar?" Economic and Policy Update (25):5, Department of Agricultural Economics, University of Kentucky, May 30, 2025.

Author(s) Contact Information: