Historical Review of “Government” Payments to Kentucky Farmers

Historical Review of “Government” Payments to Kentucky Farmers

Currently, there are a plethora of policy actions being discussed in our nation’s capital affecting agriculture, ranging from the farm bill debate to tax policy modifications, and of course, the on-going trade policy developments. Following two extensions of the 2018 farm bill, lawmakers are attempting to pass some form of a farm bill this session to address a slumping, volatile, and uncertain farm economy. At the center of this debate has been the tradeoff of funding for nutrition programs versus farm programs. Lawmakers are presently attempting to incorporate certain provisions of the farm bill into a budget reconciliation package as a means to increase chances of passing legislation in this session that will improve the overall future safety net for U.S. agriculture. Among the topics being proposed are increasing reference (safety net) prices for farm bill crops, boosting crop insurance subsidies, raising payment limitations, pulling in more conservation funding into the farm bill funding baseline, along with expanding base acres that are eligible for farm program payments. Click here and here for summaries of recent developments surrounding the current political strategy and specific provisions in moving various components of the farm bill forward.

Despite tightening crop profit margins, USDA is actually projecting an actual increase in net farm income for 2025, but only on the heels of $30.8 billion of additional government farm support evolving from the American Relief Act of 2025 passed last December. Ten billion dollars of this amount was designated to the Emergency Commodity Assistance Program (ECAP) to compensate producers for increased input costs and falling commodity prices. To date, USDA through the Farm Service Agency (FSA), has distributed nearly $110 million dollars of ECAP funding to Kentucky farmers, with the potential to increase to more than $130 million in a likely second round of funding. For more details on ECAP, click here. U.S. Ag Secretary Brooke Rollins has indicated that the remaining $20 billion evolving from the American Relief Act will become available soon in the form of a disaster fund declaration.

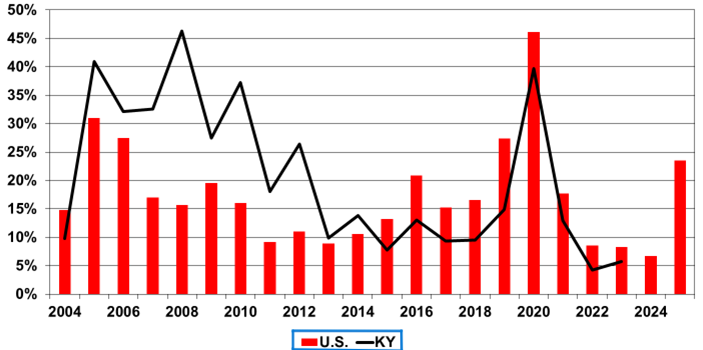

While Washington DC devotes considerable attention to farm bill programs to support agriculture, which have been important to certain sectors of Kentucky agriculture (primarily grain and dairy farms) in reality, outside of conservation funding, farm bill programs have not accounted for a significant amount of Kentucky farm income in recent years and arguably over the past two decades. The bulk of government payments to Kentucky farmers in recent years have come outside of the farm bill in the form of disaster and ad hoc payments in response to crises such as trade wars, weather events, and COVID.

As part of an $8 billion farm economy, Kentucky farmers received $512.5 million from two rounds of Coronavirus Food Assistance Program (CFAP) pandemic payments from the federal government (in 2020 and 2021), along with $386.2 million in Market Facilitation Program (MFP) trade war assistance payments which were authorized by USDA in 2019. In fact, during the life of the 2018 farm bill, only about a quarter of Kentucky’s direct government payments for agriculture have evolved from farm bill programs.

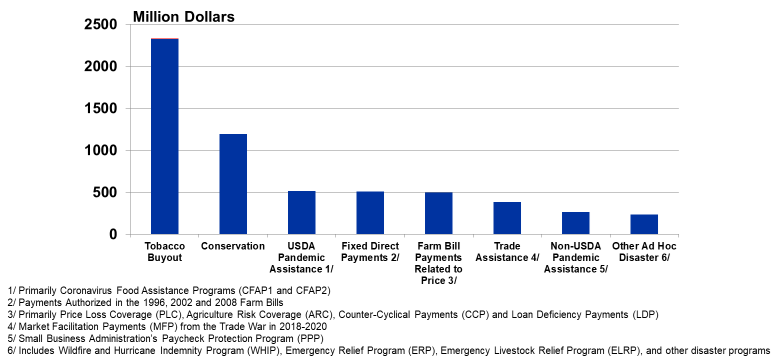

Given our diversity of agriculture in Kentucky, farmers have generally been less dependent on farm bill programs compared to the U.S. as whole, with exception of the years when Kentucky farmers received tobacco buyout payments (2005-2014). Unlike other direct government payments to farmers which were provided by taxpayer dollars, the tobacco buyout, while administrated by USDA, was funded by assessments on domestic tobacco companies selling cigarettes in the U.S. market. In reality, despite significant ad hoc and funding for other government farm programs, tobacco buyout payments totaling more than $2.3 billion are by far the largest single source of “government” payments received over the past two decades, accounting for over 1/3 of Kentucky’s direct government payments for agriculture and roughly the equivalent to the payments that Kentucky has received from all farm bill program payments combined from 2004-2023.

Figure 1. Kentucky Direct Government Farm Payments (2004-2023)

Source: ERS/USDA

Figure 2. Government Payments as a Percent of Net Farm Income: KY vs US

Source: ERS/USDA

Note: KY Data Only Available Through 2023, US Data Forecast for 2024 and 2025

Recommended Citation Format:

Snell, W. “Historical Review of “Government” Payments to Kentucky Farmers." Economic and Policy Update (25):5, Department of Agricultural Economics, University of Kentucky, May 30, 2025.

Author(s) Contact Information: