Spring 2024 Farm Observations Across Kentucky

Spring 2024 Farm Observations Across Kentucky

Published on April 29, 2024

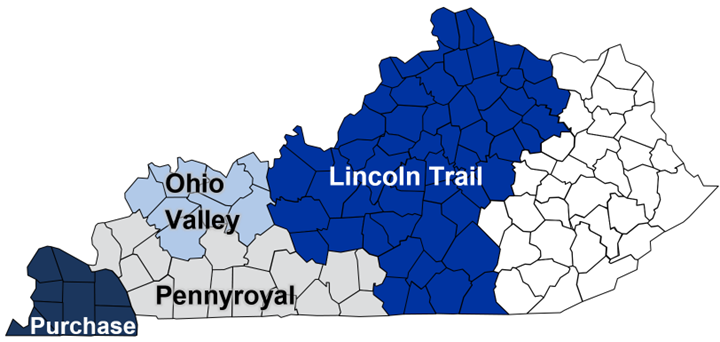

The Kentucky Farm Business Management Program is a program of the Department of Agricultural Economics at the University of Kentucky. Extension Specialists serve four Farm Analysis Associations working with cooperating members to improve farm management techniques and decisions through recordkeeping and analysis. Currently, KFBM serves 355 farms that are representatives of 49 counties. KFBM specialists work very closely with a diversity of farms and this article will share some of the real-time observations that they have seen this spring.

Lincoln Trail Association

Spring is here and producers are taking advantage of the dry weather between rain showers to spread fertilizer. It is still early but wheat looks good after getting much-needed fertilizer applied. One concern for most is commodity prices. Producers are not confident that current commodity price levels will result in positive gains for the year. The decline in farm incomes in 2023, coupled with low commodity prices will make for a challenging 2024. Input costs have backed off some to help with profitability, but producers are still considering ways to lower expenses. Another concern is interest rates and if rates will come down in 2024. Interest expense on operating notes has become a larger percentage of the farm operating budget, and this was not there in the past years. After 2022 and 2023, cash is no longer there for producers to utilize so finding the right lending products will be beneficial to most.

Ohio Valley Association

Field operations and planting continue in the Ohio Valley area. Several acres of soybeans have been planted as of mid-April. A small amount of corn has been planted. We received much-needed rain about a week ago. Talk in the area indicates producers will continue their usual rotation despite the outlook of the budgets. Some adjustments to the amount of fertilizer may occur to stem some of the costs. In addition, the market for used equipment has decreased.

There was a broad range in Net Farm Incomes and Management Returns for 2023. A lot depended on when the fertilizer was purchased, but there was also a variation in yields across the Ohio Valley. Some had excellent yields and some were on the verge of a crop insurance claim. However, overall, we expect a large drop in management returns. Poultry producers had another strong year, and cattle producers saw profits last year since cattle prices were strong most of the year.

Interest rates were a topic of nearly every visit this winter as we have been experiencing higher rates for over a year. Interest on the line of credit was the biggest concern, but equipment rates have increased significantly as well, and many are factoring that in when discussing trades. Higher equipment costs and higher interest rates really add up.

Concerns are growing for the 2024 crop year. Fertilizer prices have come down some, but not in proportion to grain prices. Current market prices look to be below break-even levels for the 2024 crop using average yields.

There have been several land sales in the last month and land is not coming down. Rents are also holding strong, despite the negative incomes last year.

Wheat and rapeseed crops in the Ohio Valley area look outstanding, despite being very dry over the winter. Rapeseed is in full bloom and those producers should make a profit since their price was locked in. The wheat producers need another year of outstanding yields to make a profit since wheat prices have also dropped. The early April rains provided much-needed moisture. To put into perspective the dryness, one producer has a pond that they water cattle out of dried up in March; it usually doesn’t go dry until August.

The Ohio River is very high now and some crop ground is under water that was planted in early beans. As soon as the fields dry up, most of the crop will be planted quickly. Most everyone had anhydrous and fertilizer applied by the end of March and was sitting on go when the cold temperatures came back for a week.

Cattle producers are all pretty positive right now. Cattle prices have held strong and most producers selling feeders now are surprisingly getting better prices than they did in 2023. If we can continue to get rain to help the hay crop this summer, it is looking like cattle may see another profitable year.

Pennyroyal Farm Analysis Group

In the Pennyroyal area, winter wheat is looking good, and some fields have started to head out. Each day that passes relieves a bit of fear of a late freeze and encourages the idea of a strong wheat crop like the last three years. Some farms are reporting a bit of freeze damage because of the mid-March freeze, but the 2023 wheat crop also showed some freeze damage at a similar growth stage and farms still reported near-record yields.

Corn planting has begun in the region but has been slowed in some areas due to wet weather. A few farms are finished planting, and some have not begun as they are waiting for soil temperatures to moderate. There are a few farms that have planted some soybeans. However, with the recent rains, the need for replanting is becoming a concern. Tobacco plants are growing in greenhouses, and a few tobacco farmers in the area are starting to welcome back the first round of H2A workers that will help with seeding, prepping equipment, and greenhouse work. There have been reports of cutworms appearing in the tobacco seedlings much earlier than usual.

Many tobacco farmers took a hit over the winter, as several tobacco companies cut contracts by anywhere from 20-60%. Coupled with large cuts in 2022, 2021, and 2020, several tobacco farmers are facing major operation shrinkage. There are some growers whose contracts were eliminated and others who chose to exit tobacco production altogether. Continued increasing wages in the H2A program and a decline in H2A worker productivity have frustrated some growers beyond the point that they are willing to continue in the industry.

Farmers are fully feeling the impact of lower grain prices and higher interest rates. We have now had a full operating cycle of higher interest rates, and many farmers are feeling the impact on their cash flow. The volume of unpriced old crop grain, not just in Kentucky but across the country, has farmers concerned about the prospect of market rallies. The decision to sell grain and lock in prices to stop storage and interest costs versus holding onto it for a market increase is a tough one that many farmers are still struggling with. Reports of bankers either not renewing operating lines or putting farms on notice are unfortunately on the rise.

Purchase Area Association

Spring planting is underway. This spring has been relatively dry, with mostly favorable weather, although slightly cool at times. This has allowed many producers to start spring planting preparations. Producers were able to do some early tillage and fertilization, which will make actual planting go much faster and smoother. Conditions allowed for both hog and chicken manure applications to be made this spring ahead of planting. Several producers have opted to plant early soybeans ahead of corn, waiting for the ground temperatures to warm just a little more before planting much corn. Over the last couple of years, there has been a greater interest in planting early soybeans and so far, yields have been favorable. Planting soybeans this early does require some extra seed treatments to protect the seed as it stays in the ground a little longer before germinating than later planted soybeans.

Crop prices for the 2024 crop are not where most producers or lenders would like them to be. Despite the lower prices, there does not appear to be many producers who are changing their crop rotations. There does seem to be less wheat across the area this spring, as June wheat prices were around $5.00 last fall, not providing much incentive to plant the crop. Several producers are still holding onto a little bit of the 2023 crop, hoping for some marketing gains. However, more and more are being forced to sell the crop, as they need to generate revenue to help start the 2024 crop. Most producers have been disappointed after putting the 2023 crop in storage, as there have not been many opportunities to sell above the harvest price.

Tobacco producers are struggling this year, as contracted pounds were cut by tobacco companies over the winter. Several producers experienced reductions in the number of pounds they have contracted of more than 30%. For many, this causes questions about whether they can afford to bring in their H2A workers. Tobacco has typically been a profitable enterprise for Kentucky producers. Without the revenue from tobacco sales, these producers will likely experience decreased profitability.

The profitability outlook for the 2024 crop is questionable. While input prices on fertilizer are much lower than in the last couple of years, the output prices are significantly lower as well. Producers will be looking for any rally in the market and will hopefully take advantage of any opportunities to lock in some higher prices. Several producers burned through some of the cash reserves they had from the 2021 and 2022 crops in 2023. This reduction in available cash will make the 2024 crop year feel much tighter. Lenders are also looking very closely at cash flow projections for the 2024 crop. With higher interest rates, the options of doing a refinance to help with cash flow are off the table. The increase in interest costs makes the refinanced payments just as high or higher than existing payments in many cases.

Recommended Citation Format:

Kentucky Farm Business Management. "Spring 2024 Farm Observations Across Kentucky." Economic and Policy Update (24):4, Department of Agricultural Economics, University of Kentucky, April 29th, 2024.

Author(s) Contact Information: