Projected Plantings and Historical Accuracy

Projected Plantings and Historical Accuracy

In this article, I discuss the Prospective Planting report for 2023, which provides the first survey-based estimates of farmers' 2023 planting intentions. I first discuss the projections for the United States and Kentucky. I then look at how accurate the United States estimates have been in recent history and how the information could affect marketing year prices. Findings indicate that planted acres closely follow prospective plantings. The report and current events could point to lower corn prices and volatile soybean and wheat prices compared to last year.

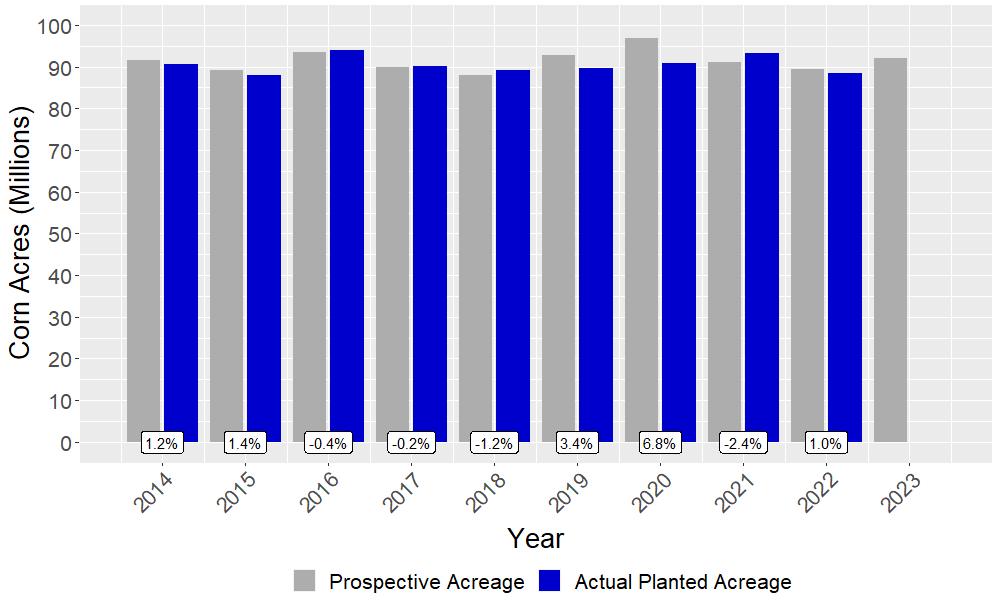

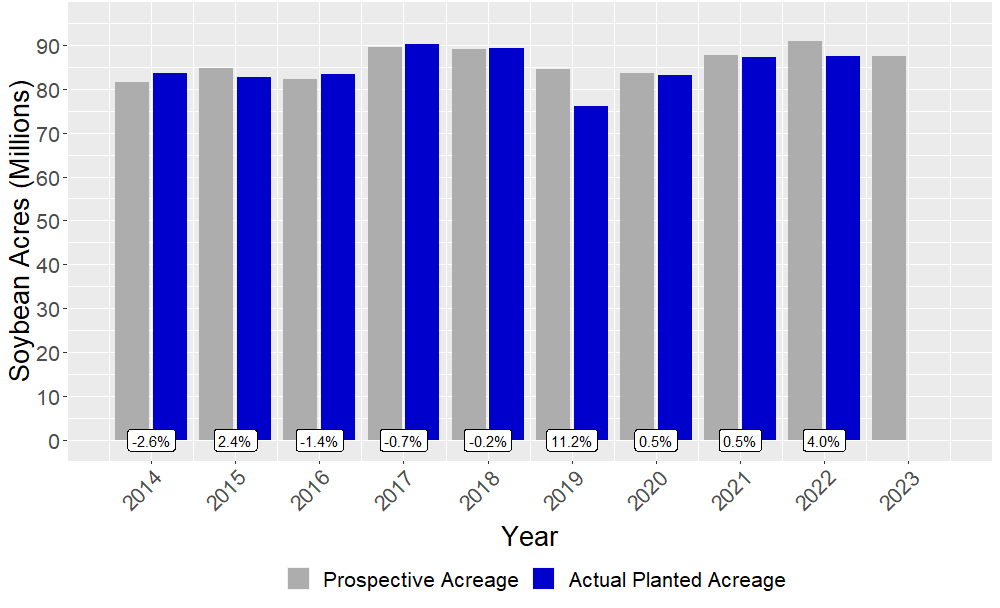

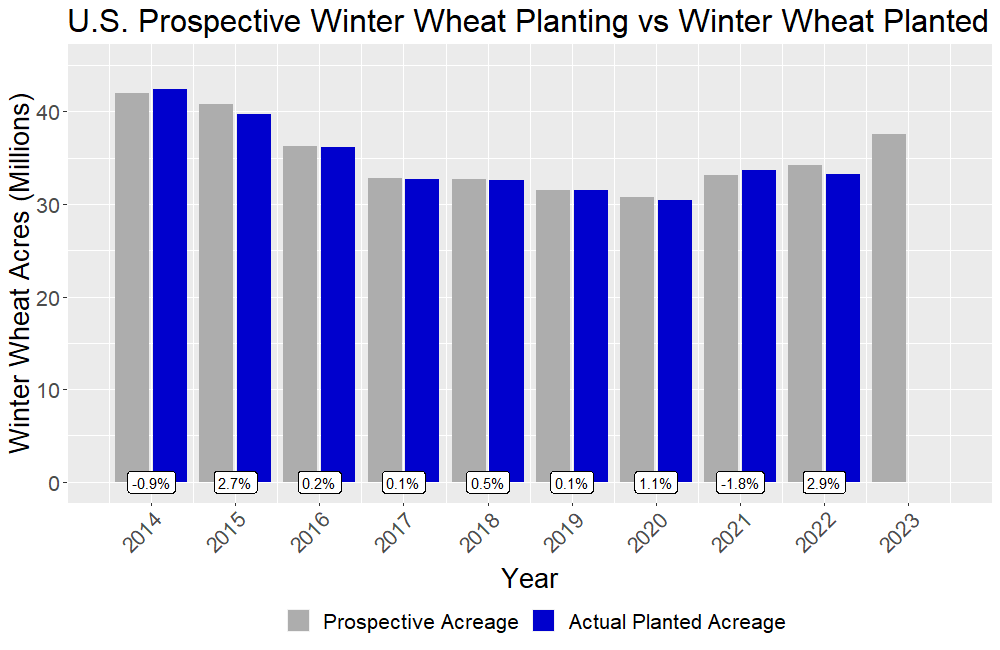

To look at how accurate prospective planting estimates are, I graph the prospective planting projections and the more precise end-of-year acreage estimates for the United States in Figure 1. The label above each year indicates how close prospective acre projections were to actual planted acres for each crop as a percentage. For example, the worst miss-projection in the past ten years occurred in the 2019 soybean acreage estimate when the report overestimated soybean acreage by 11.2%. On average, prospective plantings for the United States have been off by 2.21% for corn, 3.65% for soybeans, and 0.94% for wheat. It is worth noting that winter wheat planting indicates an estimate of already planted winter wheat, which causes the U.S. winter wheat prospective planting estimates to miss by less than 1% on average.

The final column of each panel in Figure 1 indicates the prospective planting estimates for corn, soybeans, and wheat, respectively. Corn production is projected to be up by close to 3.4 million acres as high fertilizer prices likely restrained 2022 acres. Soybean acreage is expected to be similar to 2022, and wheat acres are projected to increase by over 4 million compared to last year.

Looking specifically at Kentucky, soybean acreage is projected to decline by half a million acres to 1.9 million. Kentucky corn acres are projected to increase from 1.44 million in 2022 to 1.6 million. Kentucky winter wheat acres are projected to increase by 8,000 acres to 610,000 acres in 2023.

Since the report's release, December corn futures have dropped close to $0.23, from $5.67 to $5.44. After a sharp increase at the time of the report, soybean futures fell $0.58 from $13.22 to $12.62. and July Chicago SRW futures dropped close to $0.59 from $7.04 to $6.45. The drop in December corn futures is likely caused by the near-record prospective plantings in 2023. Soybean futures are experiencing volatility due to increases in crush capacity and low soybean stocks. Wheat futures are experiencing similar volatility due to questions over the Black Seas Grain Deal and drought in the West, which could cause supply shortages.

Overall, the Prospective Planting projections have a small margin of error. Although Kentucky has slightly more variability, I expect the number of acres of each crop to follow prospective plantings closely, should the weather cooperate. Current prospective acreage projections, in combination with the crop balance sheets, point towards a lower corn price due to excess supply and more volatile soybean and wheat prices. Producers may want to leverage forward contracting to avoid price volatility, specifically in the wheat and soybean markets.

Figure 1: United States Prospective and Planted Acres

U.S. Prospective Corn Planting vs Corn Planted

U.S. Prospective Soybean Planting vs Soybean Planted

U.S. Prospective Winter Wheat Planting vs Winter Wheat Planted

Recommended Citation Format:

Gardner, G. "Projected Plantings and Historical Accuracy." Economic and Policy Update (23):4, Department of Agricultural Economics, University of Kentucky, April 28th, 2023.

Author(s) Contact Information: